How To Find Funding For Sustainability Projects In Your SME

Table of Contents

Identifying Funding Opportunities for Sustainable Initiatives

Securing funding for your eco-conscious endeavors requires a multi-pronged approach. Let's explore the key avenues available to SMEs:

Grants and Subsidies

Grants and subsidies are essentially free money awarded to businesses that meet specific criteria, often related to environmental sustainability. Many governmental and non-governmental organizations offer these, focusing on projects that promote renewable energy, waste reduction, and resource efficiency.

- Examples: The European Union offers various grants under its Horizon Europe program, focusing on green technologies and sustainable development. Many national and local governments also provide subsidies for energy-efficient upgrades or renewable energy installations. Numerous foundations, like the Ellen MacArthur Foundation, also offer grants for circular economy projects.

- Tips for Research and Application:

- Utilize keywords like "SME sustainability grants," "green business funding," and "environmental grants" when searching grant databases.

- Carefully review eligibility criteria to ensure your project qualifies.

- Craft a compelling application that clearly outlines your project's objectives, impact, and alignment with the funder's priorities.

Green Loans and Financing

Green loans and financing specifically target environmentally friendly projects. These options often come with attractive terms, such as lower interest rates compared to traditional loans, incentivizing sustainable investments.

- Green Loans vs. Traditional Loans: Green loans usually have specific conditions, requiring the funds to be used for pre-approved sustainable initiatives, like energy efficiency upgrades or the adoption of renewable energy sources. This often translates to more favorable interest rates and potentially longer repayment periods.

- Accessing Green Loans:

- Research banks and financial institutions known for their commitment to sustainable finance. Many major banks now offer dedicated green loan products.

- Prepare the necessary documentation, including a detailed business plan, financial projections, and an environmental impact assessment.

- Explore alternative lenders, such as community development financial institutions (CDFIs), which often focus on supporting environmentally and socially responsible businesses.

Impact Investing and Venture Capital

Impact investing and venture capital represent a more equity-focused approach to funding. Investors in this space prioritize both financial returns and positive social and environmental impact. This is particularly suitable for scalable and innovative sustainability projects.

- Attracting Impact Investors:

- Develop a strong business plan that clearly articulates your project's measurable environmental and social impact. Quantifiable metrics are crucial.

- Demonstrate the project's scalability and potential for significant positive impact.

- Network with impact investors and venture capitalists specializing in sustainability. Attend industry events and conferences to build relationships.

- Preparing a Compelling Pitch:

- Highlight the potential for strong financial returns alongside significant environmental and social benefits.

- Clearly communicate the risks and mitigation strategies involved in your project.

Developing a Compelling Funding Proposal

Securing funding requires a well-structured and persuasive proposal. Let's break down the essential components:

Defining Your Sustainability Project

Clearly defining your project's objectives, scope, and measurable impact is paramount. A strong sustainability strategy should be deeply integrated into your overall business goals.

- Key Elements of a Strong Project Definition:

- SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound).

- Detailed project timeline with clear milestones.

- Quantifiable results, such as expected reduction in carbon emissions or waste.

Crafting a Persuasive Business Plan

A comprehensive business plan is your roadmap to success. It must clearly demonstrate the viability and potential of your sustainability initiative.

- Crucial Sections for Funding:

- Detailed financial projections, including revenue forecasts and expense budgets.

- Thorough market analysis demonstrating demand for your sustainable products or services.

- Comprehensive risk assessment and mitigation strategies.

- A robust environmental impact assessment demonstrating the project's positive environmental outcomes.

Demonstrating Environmental and Social Impact

Quantifying the positive environmental and social impact of your project is critical for attracting funding. Potential funders need to see the value proposition beyond just financial returns.

- Measuring and Reporting Impact:

- Calculate your project's carbon footprint reduction.

- Track waste minimization and resource efficiency improvements.

- Document community engagement and positive social contributions.

Conclusion: Securing Funding for Your SME's Sustainability Journey

Finding funding for sustainability projects in your SME requires a structured approach. Thorough research into available grants, loans, and investment opportunities, combined with a well-crafted funding proposal that showcases the positive environmental and social impact of your project, is crucial. By clearly defining your sustainability goals, demonstrating your project's viability through a strong business plan, and effectively communicating its impact, you can significantly increase your chances of securing the necessary financial resources to achieve your green ambitions. Start your search today by researching available grants, exploring green loan options, and connecting with impact investors. Find sustainable funding for your SME, secure funding for your green initiative, and access sustainability grants for SMEs to propel your business towards a more sustainable future.

Further Resources: [Insert links to relevant government websites, grant databases, and impact investor networks here.]

Featured Posts

-

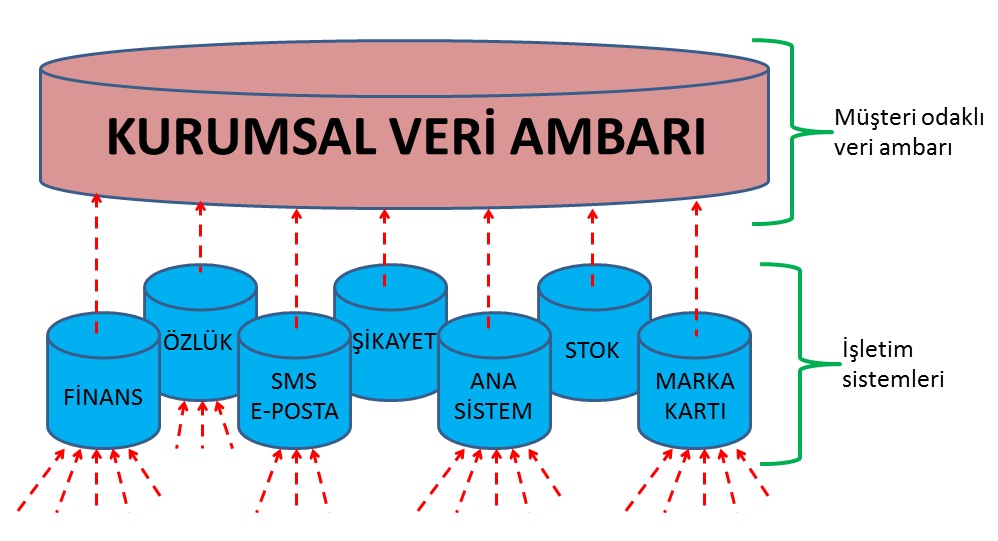

Carsamba Guenue Ledra Pal Da Dijital Veri Tabani Odakli Isguecue Piyasasi Rehberi

May 19, 2025

Carsamba Guenue Ledra Pal Da Dijital Veri Tabani Odakli Isguecue Piyasasi Rehberi

May 19, 2025 -

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Developer Conference

May 19, 2025

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Developer Conference

May 19, 2025 -

Ny Mets Schedule 3 Crucial May Series

May 19, 2025

Ny Mets Schedule 3 Crucial May Series

May 19, 2025 -

Eurovision 2025 Haennis Contribution To The Swiss Entry

May 19, 2025

Eurovision 2025 Haennis Contribution To The Swiss Entry

May 19, 2025 -

Eurovision 2025 Speculation Mounts Over Jamalas Involvement

May 19, 2025

Eurovision 2025 Speculation Mounts Over Jamalas Involvement

May 19, 2025