How To Get The Best Value For Your Money

Table of Contents

Planning and Budgeting: The Foundation of Smart Spending

Before you even think about shopping, you need a solid financial foundation. Creating a realistic budget and setting clear financial goals are the cornerstones of smart spending and achieving the best value for your money.

Creating a Realistic Budget:

Understanding your income and expenses is crucial to effective budgeting. Here's how to get started:

- Track your spending: For at least a month, meticulously track every penny you spend. Use budgeting apps like Mint or YNAB (You Need a Budget), or a simple spreadsheet. This will reveal spending patterns and areas where you can cut back.

- Categorize your expenses: Group your expenses into categories like housing, transportation, food, entertainment, and debt payments. This allows you to see where your money is going.

- Allocate funds: Based on your tracked spending and income, allocate funds to essential expenses (necessities), savings, and discretionary spending (wants). The 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment) is a popular guideline.

- Regularly review: Your budget isn't set in stone. Review it monthly to ensure it aligns with your financial goals and adjust as needed.

Setting Financial Goals:

Clear financial goals provide direction for your spending and help you prioritize value.

- Define your priorities: What are your short-term and long-term financial goals? Examples include saving for a down payment on a house, paying off debt, or funding a child's education.

- Break down large goals: Large goals can seem overwhelming. Break them down into smaller, more manageable steps to stay motivated and track progress. For example, saving $20,000 for a down payment can be broken down into monthly savings targets.

- Regularly review and adjust: Life changes, and so should your goals. Regularly review your financial goals to ensure they still align with your priorities and adjust as needed.

Smart Shopping Strategies: Finding the Best Deals

Once you have a budget, you can start implementing smart shopping strategies to find the best value for money products and maximize your spending power.

Comparing Prices and Products:

Don't settle for the first option you find. Take the time to compare prices and product features.

- Use price comparison websites: Websites like Google Shopping, PriceGrabber, and others allow you to compare prices from multiple retailers at once.

- Read reviews: Check online reviews on sites like Amazon, Yelp, and others to gauge product quality, reliability, and overall customer satisfaction.

- Consider long-term value: Think beyond the initial price. Factor in things like warranty, maintenance costs, and the product's lifespan when evaluating value. A slightly more expensive item with a longer lifespan might be more cost-effective in the long run.

Utilizing Sales and Discounts:

Timing your purchases strategically can lead to significant savings.

- Seasonal sales: Take advantage of seasonal sales and clearance events. Retailers often heavily discount items at the end of a season to make room for new inventory.

- Holiday promotions: Many retailers offer significant discounts during major holidays like Black Friday and Cyber Monday.

- Email newsletters: Sign up for email newsletters from your favorite retailers to receive exclusive discounts and early access to sales.

- Coupon codes and cashback: Use coupon codes and cashback rewards programs to further reduce your spending.

The Art of Bargain Hunting:

Explore options beyond mainstream retailers to uncover hidden bargains and get the best value for your money.

- Refurbished or used items: Consider buying refurbished or gently used items in good condition. You can often find significant savings on electronics, furniture, and other items.

- Discount stores and outlet malls: Shop at discount stores, outlet malls, and thrift shops for affordable options.

- Negotiate prices: Don't be afraid to negotiate prices, especially for larger purchases. A little polite negotiation can sometimes lead to significant savings.

Beyond Price: Considering Long-Term Value

While price is a factor, focusing solely on the lowest price can be short-sighted. Consider the long-term value and cost-effectiveness of your purchases.

Investing in Quality:

Investing in quality items can save you money in the long run, even if the initial cost is higher.

- Durability and lifespan: Consider the product's durability and lifespan. A higher-quality item may last longer, reducing the need for frequent replacements.

- Warranty and repair options: Look for products with warranties and readily available repair options.

- Brand reputation: Research brands known for their reliability and customer support.

The Value of Experiences:

Don't forget the value of experiences! These can bring significant happiness and fulfillment.

- Prioritize meaningful experiences: Budget for experiences that align with your values and create lasting memories.

- Balance material possessions and experiences: Find a balance between acquiring material possessions and investing in enriching experiences.

Conclusion: Maximize Your Value Today

Getting the best value for your money is a journey, not a destination. By implementing the strategies outlined above – from creating a realistic budget and comparing prices to considering quality and investing in experiences – you can significantly improve your financial well-being. Start maximizing your value today by adopting these smart spending habits and learning how to get the best value for your money. Remember that finding the best value for your money isn't just about saving; it's about making informed decisions that align with your financial goals and priorities. So start planning, start comparing, and start enjoying the fruits of your wise spending!

Featured Posts

-

Stiven King Novaya Ataka Na Trampa I Maska

May 06, 2025

Stiven King Novaya Ataka Na Trampa I Maska

May 06, 2025 -

Top Performing Vs Underperforming Teaser Trailers A Case Study

May 06, 2025

Top Performing Vs Underperforming Teaser Trailers A Case Study

May 06, 2025 -

The Best Affordable Items Quality And Value Combined

May 06, 2025

The Best Affordable Items Quality And Value Combined

May 06, 2025 -

I Nch Yenq Zijyel Adrbyejanin 2020 I Nvoyyembyeri 9 Ic Hyetvo Pastyer Yev Vyerlvo Tsvo Tyvo N

May 06, 2025

I Nch Yenq Zijyel Adrbyejanin 2020 I Nvoyyembyeri 9 Ic Hyetvo Pastyer Yev Vyerlvo Tsvo Tyvo N

May 06, 2025 -

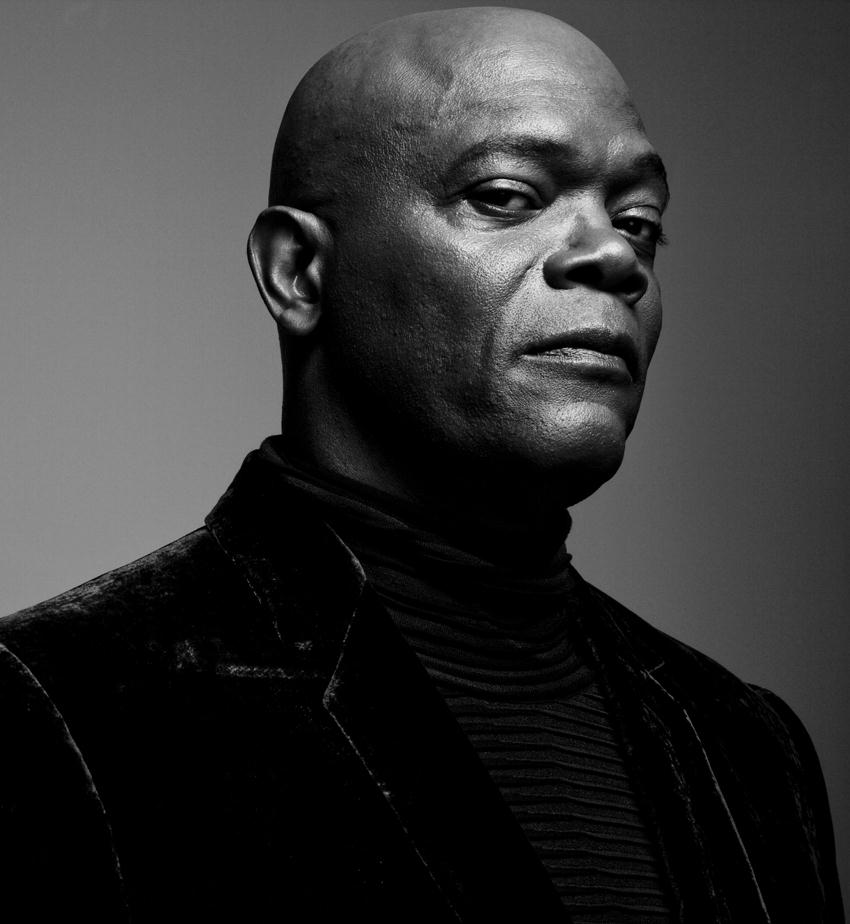

Samuel L Jacksons 10 Year Old Narration Spike Lees Super Bowl Recognition

May 06, 2025

Samuel L Jacksons 10 Year Old Narration Spike Lees Super Bowl Recognition

May 06, 2025