Hudson Bay's Creditor Protection Extended: Court Approves July 31st Deadline

Table of Contents

Court Approval and the Extended Deadline

The court's decision to extend Hudson Bay's creditor protection provides the company with additional time to negotiate with creditors and finalize a comprehensive restructuring plan. The original deadline, [insert original deadline here], proved insufficient to address the complexities of the situation. The extended deadline of July 31st offers a crucial window for Hudson Bay to solidify its financial future. The court cited the need for further negotiations with various creditor groups and the complexity of developing a robust restructuring strategy as key reasons for granting the extension. This highlights the significant challenges faced by the company and the importance of a well-structured plan for successful reorganization under Hudson Bay creditor protection.

- Date of original creditor protection filing: [Insert date]

- Specific reasoning behind the extension as stated by the court: [Insert verbatim quote or accurate paraphrase of the court's reasoning, emphasizing the need for more time for negotiations and restructuring].

- Impact on ongoing negotiations with creditors: The extension allows for more meaningful discussions with creditors, potentially leading to more favorable terms and a higher likelihood of a successful restructuring.

Implications for Creditors

The extension of Hudson Bay creditor protection has significant implications for various creditor groups. Secured lenders may see a delay in recovering their investments, while unsecured creditors might face uncertainty regarding the ultimate recovery rate. Suppliers could experience disruptions in payments and potentially face challenges maintaining their relationship with Hudson Bay. The potential outcomes vary greatly depending on the specifics of the restructuring plan and the company's performance in the coming weeks. Open communication and transparency between Hudson Bay and its creditors are crucial during this period.

- Potential scenarios for different creditor classes: [Discuss potential scenarios for each creditor class: best-case, worst-case, and most likely scenarios]

- Impact on interest payments and principal repayments: The extension may affect interest payments and principal repayments depending on the terms negotiated with creditors within the Hudson Bay creditor protection framework.

- Timeline for future creditor meetings and updates: [Outline expected timeline for creditor meetings, reports, and other communication].

Hudson Bay's Restructuring Plan

Details of Hudson Bay's proposed restructuring plan are still emerging. However, the plan is expected to address the company's debt burden, improve operational efficiency, and strengthen its competitive position within the retail market. The plan may involve a combination of strategies such as asset sales, cost-cutting measures, and a potential shift in its retail strategy. While specifics remain confidential, it is likely the plan will focus on stabilizing the company's finances and paving the way for long-term sustainability.

- Key components of the restructuring strategy: [Outline potential components based on available information, e.g., store closures, cost reductions, debt refinancing].

- Potential changes to the company's operations: [Discuss potential changes, including store closures, layoffs, or changes to the product assortment].

- Expected outcome of the restructuring process: [Discuss the hoped-for outcomes, such as reduced debt, improved profitability, and enhanced competitiveness].

Market Reaction and Future Outlook

The market's reaction to the court's decision extending Hudson Bay creditor protection has been mixed. While some analysts view the extension as a positive sign indicating a potential path towards recovery, others remain cautious, emphasizing the ongoing risks and challenges facing the company. The stock price has [Insert description of stock price movement following the announcement], reflecting the uncertainty surrounding the restructuring process and its ultimate success.

- Stock market performance following the announcement: [Detailed description of stock performance]

- Analyst predictions on the success of the restructuring plan: [Summary of analyst opinions and predictions]

- Potential long-term effects on Hudson Bay's competitiveness: [Analysis of long-term impact on market share and competitiveness]

Conclusion

The extension of Hudson Bay's creditor protection to July 31st provides crucial breathing room for the company to finalize its restructuring plan. While the extended deadline offers a pathway towards recovery, significant challenges remain for both the company and its creditors. The coming weeks will be critical in determining the ultimate success of the restructuring efforts. For continued updates and analysis on the ongoing Hudson Bay creditor protection proceedings, stay tuned for further developments. Keep checking back for more information on this evolving situation and the impact of the Hudson Bay creditor protection extension on the company's future. Understanding the implications of this Hudson Bay creditor protection process is vital for all stakeholders.

Featured Posts

-

Bvg Streik Wie Die Fahrgaeste Betroffen Sind

May 16, 2025

Bvg Streik Wie Die Fahrgaeste Betroffen Sind

May 16, 2025 -

Addressing Water Contamination Concerns In The Township

May 16, 2025

Addressing Water Contamination Concerns In The Township

May 16, 2025 -

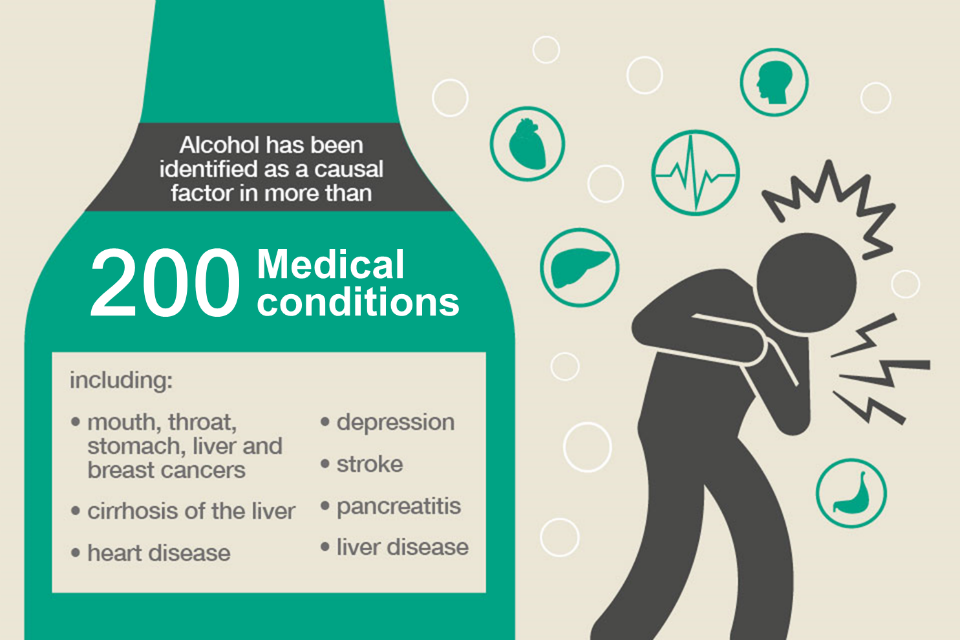

Women And Alcohol A Rise In Consumption And Associated Health Risks

May 16, 2025

Women And Alcohol A Rise In Consumption And Associated Health Risks

May 16, 2025 -

Stock Market Valuation Concerns Bof As Assessment And Recommendations

May 16, 2025

Stock Market Valuation Concerns Bof As Assessment And Recommendations

May 16, 2025 -

Is Jalen Brunson The New Face Of Liberty A Knicks Fans Unusual Petition

May 16, 2025

Is Jalen Brunson The New Face Of Liberty A Knicks Fans Unusual Petition

May 16, 2025