Hudson's Bay's Future: A Toronto Firm's Bid And The Road Ahead

Table of Contents

The Toronto Firm's Bid: Details and Implications

The future of HBC hinges on the details of this significant acquisition attempt. Understanding the bidding firm, its motivations, and the specifics of the offer is crucial to predicting the outcome.

Who is the Bidding Firm?

[Insert the name of the Toronto-based bidding firm here]. While specific details may be limited due to ongoing negotiations, we know this company is [describe the company's background - e.g., a private equity firm, a real estate investment trust, a competitor in the retail sector]. Their financial strength is evident in [mention any publicly available financial data or significant previous investments]. Their interest in HBC likely stems from [explain their potential motives – e.g., acquiring valuable real estate assets, leveraging HBC's brand recognition, or expanding their retail portfolio].

- Specifics of the Bid: The bid reportedly values HBC at [insert the bid amount, if available] and is contingent upon [mention key conditions, such as regulatory approvals or financing]. The timeline for completion is currently [mention the estimated timeline].

- Acquisition History and Strategy: This firm has a history of [describe their acquisition history, focusing on similar transactions and their post-acquisition strategies]. This suggests a potential approach for HBC that may involve [predict potential strategies based on their past behaviour – e.g., restructuring, asset sales, brand repositioning].

- Synergies: Potential synergies between the bidding firm and HBC could include [mention possible synergies – e.g., cost-saving measures through merged operations, leveraging shared distribution networks, or cross-marketing opportunities].

- Expert Opinion: [Insert quotes or summaries from industry experts regarding the likelihood of the bid's success, highlighting potential challenges and opportunities].

Assessing HBC's Current State: Challenges and Opportunities

Analyzing HBC's current financial health and market position is essential to understanding the attractiveness of this takeover bid.

HBC's Financial Performance

HBC's recent financial performance has been [describe HBC's financial performance – e.g., mixed, challenging, showing signs of recovery]. Revenue figures for the past [specify time period] show [insert relevant data], while profit margins have been [insert data]. The company's debt levels are currently at [insert data, if available].

- Market Position: HBC faces stiff competition from [mention key competitors and their market share].

- Strengths: HBC retains significant strengths, including its iconic brand recognition and its extensive portfolio of prime real estate locations across Canada.

- Weaknesses: Declining sales in recent years and an outdated business model have presented substantial challenges.

- Past Successes and Areas for Improvement: HBC's past success with [mention successful strategies] can inform future improvement strategies focused on [mention areas for improvement – e.g., e-commerce development, customer experience enhancements, brand revitalization].

Potential Outcomes and Scenarios for Hudson's Bay's Future

The success or failure of the Toronto firm's bid will significantly shape HBC's future trajectory.

Scenario 1: Successful Acquisition

A successful acquisition could lead to significant changes within HBC. The new ownership might implement a restructuring plan, potentially including store closures or expansions depending on their strategic vision. We could see a repositioning of the brand, targeting a new demographic or emphasizing different product lines. This would inevitably impact employees, with potential job losses or reassignments.

Scenario 2: Unsuccessful Acquisition

If the bid fails, HBC might explore alternative acquisition opportunities or undertake a major internal restructuring. Failure to secure a buyer could lead to financial distress and potentially bankruptcy.

- Impact on Shareholders: Shareholders will see significant gains in a successful acquisition, while an unsuccessful bid might result in devaluation of their shares.

- Impact on Consumers: Consumers could experience changes in pricing, product offerings, store locations, or the overall shopping experience, depending on the outcome.

- Long-Term Implications for the Canadian Retail Landscape: This bid's outcome will significantly affect the Canadian retail sector, influencing competition, employment, and consumer choices.

- Alternative Buyers or Strategies: Other potential buyers for HBC could include [mention possible alternative buyers] or the company may adopt a strategy focused on [mention potential internal restructuring strategies].

The Role of Real Estate in Hudson's Bay's Future

HBC's extensive real estate holdings represent a significant asset that will influence the bid's success and future plans.

HBC's Real Estate Holdings

The value of HBC's prime real estate across Canada is substantial. These properties are located in [mention key locations and their strategic value].

- Real Estate Development or Sales: The bidding firm might decide to develop the properties, lease them to other businesses, or sell them to generate capital.

- Real Estate in Financial Strategy: Real estate plays a crucial role in HBC's overall financial strategy, providing a safety net against operational losses.

- Impact on Bidding Process and Valuation: The value of this real estate significantly impacts the overall valuation of HBC and influences the bidding process.

Conclusion: Securing Hudson's Bay's Future

The Toronto firm's bid presents a pivotal moment for HBC. The company's future depends on the bid's success, the buyer's strategic vision, and HBC's ability to adapt to the ever-evolving retail landscape. While the outcome remains uncertain, the potential for positive transformation exists. This analysis highlights the critical role of the bid, the challenges facing HBC, and the various potential scenarios that could unfold. To stay informed about further developments regarding Hudson's Bay's future and the Toronto firm's bid, follow reputable news sources and HBC's investor relations page. Continued monitoring of these developments will provide valuable insights into the future of Canadian retail and the impact of this significant bid on the industry.

Featured Posts

-

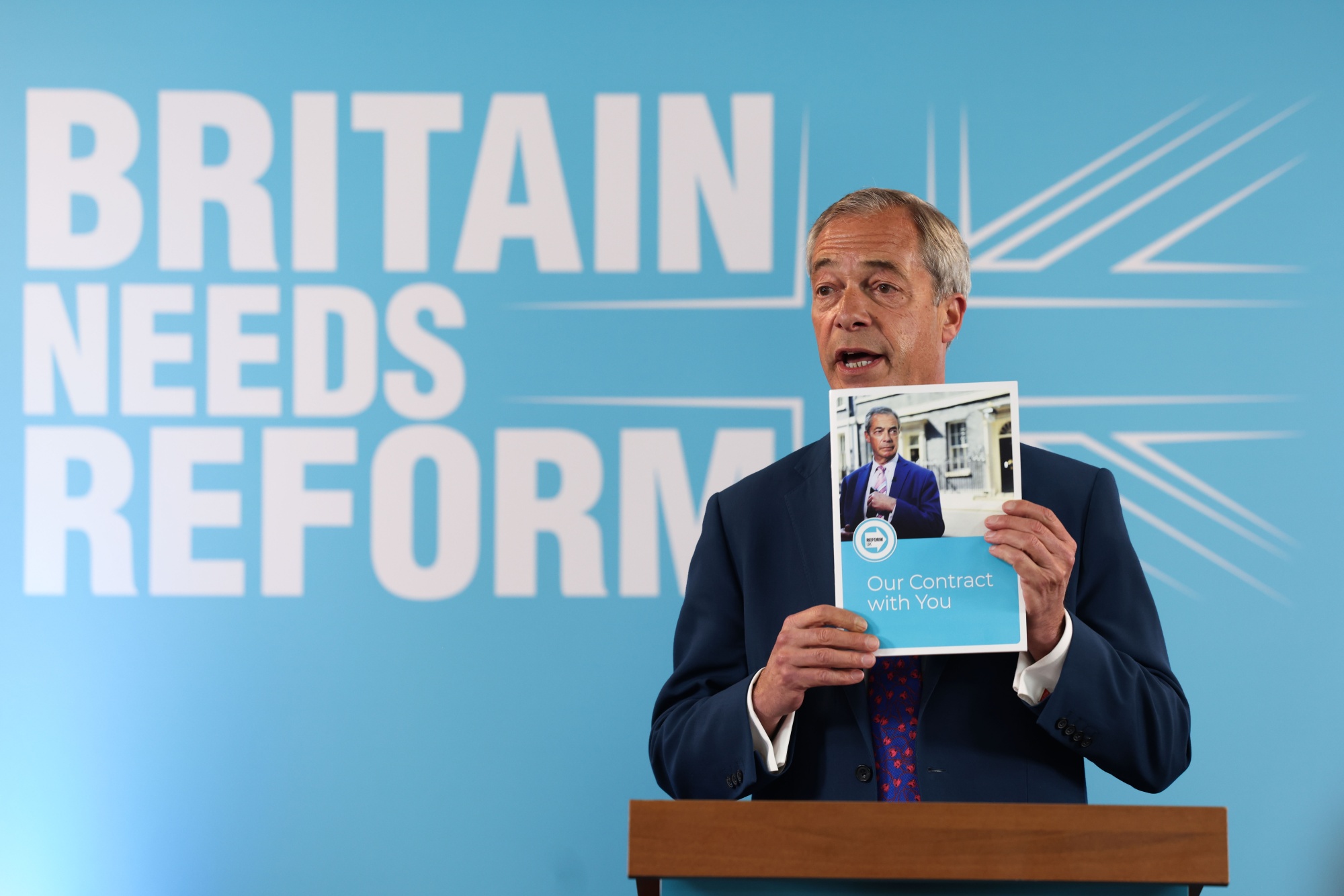

Farage Backs Snp Reform Partys Holyrood Election Strategy Unveiled

May 03, 2025

Farage Backs Snp Reform Partys Holyrood Election Strategy Unveiled

May 03, 2025 -

The Mental Health Crisis In Ghana Insufficient Psychiatrists And The Path Forward

May 03, 2025

The Mental Health Crisis In Ghana Insufficient Psychiatrists And The Path Forward

May 03, 2025 -

Nigel Farage Takes On Conservatives In Shrewsbury Relief Road Debate And Local Observations

May 03, 2025

Nigel Farage Takes On Conservatives In Shrewsbury Relief Road Debate And Local Observations

May 03, 2025 -

Situatsiya Vokrug Makronov Reaktsiya Zakharovoy

May 03, 2025

Situatsiya Vokrug Makronov Reaktsiya Zakharovoy

May 03, 2025 -

Sc Election Integrity Survey Shows 93 Public Trust

May 03, 2025

Sc Election Integrity Survey Shows 93 Public Trust

May 03, 2025

Latest Posts

-

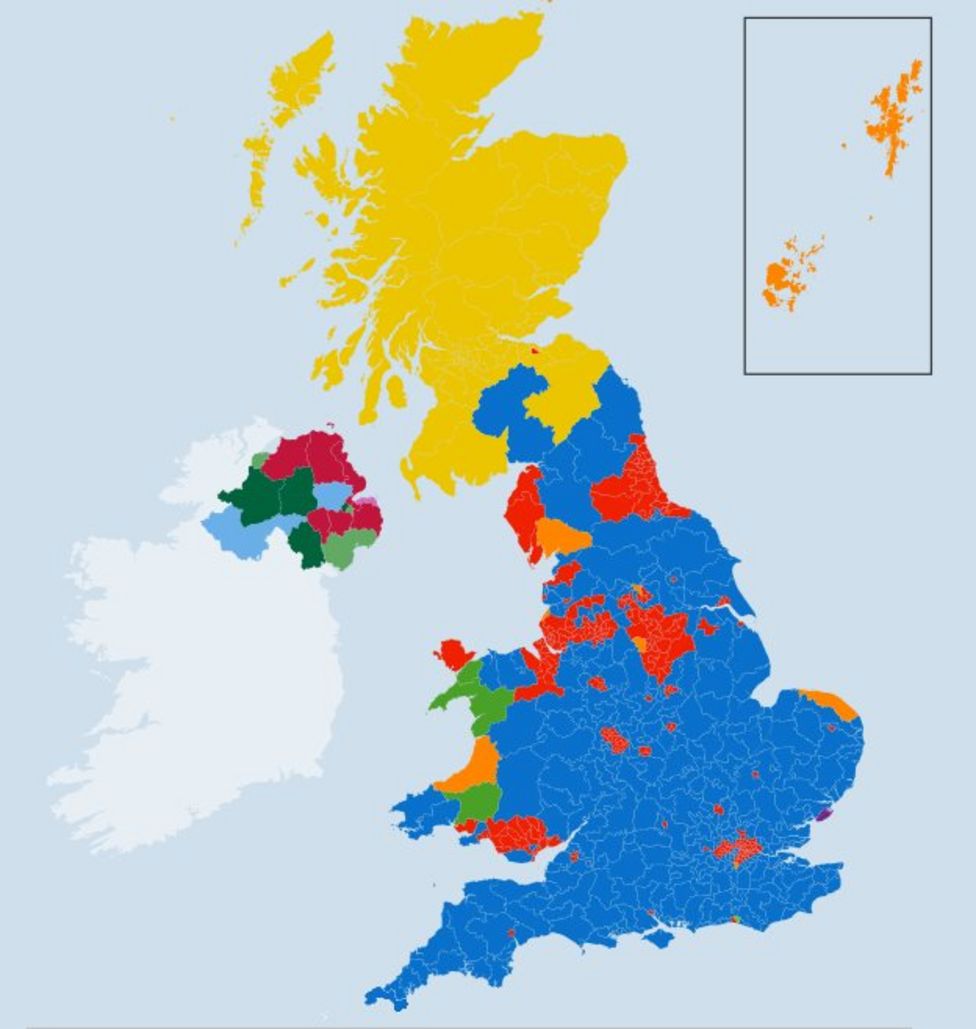

Local Elections 2024 Assessing The Reform Partys Impact Under Farage

May 03, 2025

Local Elections 2024 Assessing The Reform Partys Impact Under Farage

May 03, 2025 -

Farages Reform Party Faces The Verdict Uk Local Election Results

May 03, 2025

Farages Reform Party Faces The Verdict Uk Local Election Results

May 03, 2025 -

Uk Local Elections Can The Reform Party Under Farage Make Gains

May 03, 2025

Uk Local Elections Can The Reform Party Under Farage Make Gains

May 03, 2025 -

Reform Partys Local Election Performance A Key Test For Farage

May 03, 2025

Reform Partys Local Election Performance A Key Test For Farage

May 03, 2025 -

Councillors Defection A Major Blow To Labour Boost To Reform

May 03, 2025

Councillors Defection A Major Blow To Labour Boost To Reform

May 03, 2025