IBM Software Fuels Deutsche Bank's Digital Acceleration

Table of Contents

Enhanced Risk Management and Compliance through IBM Technology

Effective risk management and regulatory compliance are paramount in the financial industry. Deutsche Bank has significantly enhanced its capabilities in this area by implementing IBM technology. Keywords like risk management, compliance, regulatory technology (RegTech), and IBM Cloud Pak for Data are central to this success.

-

Centralized Data for Enhanced Risk Assessment: The implementation of IBM Cloud Pak for Data has been instrumental in centralizing and analyzing vast datasets. This consolidated view provides a comprehensive understanding of risk profiles, allowing for more accurate and timely risk assessments. The improved data visibility enables proactive identification and mitigation of potential threats.

-

AI-Powered Compliance Automation: Deutsche Bank leverages AI-powered solutions from IBM to automate compliance checks. This automation reduces the manual effort involved in regulatory reporting, minimizing human error and freeing up valuable resources for other critical tasks. This automation significantly improves efficiency and accuracy in regulatory reporting.

-

Streamlined Regulatory Reporting: Streamlined data processing, a direct result of IBM's solutions, has led to more accurate and timely regulatory reporting. This ensures Deutsche Bank remains compliant with evolving regulations and minimizes the risk of penalties. The accuracy and speed of reporting are critical components of maintaining a strong regulatory standing.

-

Robust Security Measures: Protecting sensitive financial data is crucial. IBM security solutions are integrated into Deutsche Bank's infrastructure, providing robust protection against cyber threats and ensuring data privacy and compliance with data protection regulations. This comprehensive security approach is a cornerstone of maintaining customer trust and operational integrity.

Streamlining Operations with IBM Cloud and Automation Solutions

Deutsche Bank's digital acceleration is significantly driven by the adoption of IBM Cloud and automation solutions. This section highlights the role of cloud computing, hybrid cloud, automation, DevOps, and cost optimization in their transformation.

-

Increased Scalability and Flexibility with IBM Cloud: Migration to IBM Cloud has provided Deutsche Bank with increased scalability and flexibility. This allows them to adapt quickly to changing business demands and easily scale resources up or down as needed. The cloud infrastructure provides the agility to respond to market fluctuations and technological advancements.

-

Optimizing Infrastructure with a Hybrid Cloud Strategy: The adoption of a hybrid cloud strategy allows Deutsche Bank to effectively leverage both on-premises and cloud-based resources. This optimizes existing infrastructure investments while benefiting from the scalability and flexibility of the cloud. The hybrid approach offers a balanced and cost-effective solution.

-

Automation for Enhanced Efficiency: IBM's automation tools have streamlined workflows throughout Deutsche Bank's operations, resulting in significant cost reductions and improved efficiency. This automation frees up employees to focus on higher-value tasks, improving overall productivity. Automation also reduces the risk of human error in repetitive tasks.

-

Faster Deployment with DevOps: DevOps practices, powered by IBM, have enabled Deutsche Bank to achieve faster deployment of new applications and services. This increased agility allows them to respond more quickly to market opportunities and customer needs. Faster deployments provide a competitive advantage in the fast-paced financial market.

Improving Customer Experience with IBM AI and Analytics

Improving customer experience is a key driver of Deutsche Bank's digital transformation. This section focuses on the role of customer experience, AI, artificial intelligence, machine learning, personalization, IBM Watson, and chatbots.

-

AI-Powered Customer Service with IBM Watson: IBM Watson is used to power AI-driven chatbots and provide personalized recommendations to customers. This enhances customer service by providing instant support and tailored advice. The personalized approach fosters customer loyalty and improves satisfaction.

-

Data-Driven Insights into Customer Behavior: Data analytics provide Deutsche Bank with deeper insights into customer behavior and preferences. This understanding informs the development of more effective products, services, and marketing campaigns. Data analysis allows for more targeted and effective engagement.

-

Modern Digital Banking Platforms: Deutsche Bank is developing more efficient and user-friendly digital banking platforms based on insights gleaned from data analysis and AI capabilities. This improved user experience leads to increased customer satisfaction and engagement. Modern, intuitive platforms are crucial for competing in the digital age.

-

Proactive and Personalized Services: Through personalized and proactive services, Deutsche Bank is improving customer engagement and satisfaction. This approach demonstrates a customer-centric focus and fosters strong customer relationships. Proactive service helps to anticipate customer needs and resolve issues before they escalate.

The Role of IBM Services and Expertise in Deutsche Bank's Success

The success of Deutsche Bank's digital transformation is not solely dependent on technology, but also on the expertise and support provided by IBM. This section emphasizes the importance of IBM consulting, digital strategy, implementation, support, partnership, and expertise.

-

Strategic Guidance from IBM Consulting: IBM's consulting services provided crucial strategic guidance throughout Deutsche Bank's digital transformation journey, helping to navigate complex challenges and define a clear path forward. This strategic partnership ensured alignment with business goals.

-

Seamless Implementation and Dedicated Support: The seamless implementation of IBM solutions was facilitated by dedicated support from IBM experts. This ensured a smooth transition and minimized disruption to Deutsche Bank's operations. Expert support is crucial for successful technology adoption.

-

Ongoing Partnership for Continuous Optimization: The ongoing partnership with IBM ensures continuous optimization and innovation. This collaborative approach ensures that Deutsche Bank's technology remains cutting-edge and aligned with evolving business needs. Continuous improvement is critical for long-term success.

-

Access to a Broad Ecosystem: Deutsche Bank benefits from access to IBM's extensive ecosystem of partners and technologies. This broad ecosystem provides a rich source of innovation and solutions, further enhancing their digital transformation efforts. A robust ecosystem provides access to a wider range of expertise and resources.

Conclusion

Deutsche Bank's successful digital acceleration is a testament to the power of IBM software and services in driving transformation within the financial sector. By leveraging IBM's cloud solutions, AI capabilities, and automation tools, Deutsche Bank has significantly improved risk management, streamlined operations, and enhanced customer experience. This case study underscores the importance of strategic partnerships and the transformative power of innovative technology in achieving significant business benefits.

Call to Action: Learn how IBM software can fuel your digital acceleration. Explore IBM's solutions for financial institutions and discover how to modernize your operations and achieve significant business benefits. Contact us today to discuss your digital transformation strategy and see how IBM can help you leverage the power of IBM software for your own digital transformation journey.

Featured Posts

-

Bill Gates Accuses Elon Musk Millions Of Poor Children Affected Musk Responds

May 30, 2025

Bill Gates Accuses Elon Musk Millions Of Poor Children Affected Musk Responds

May 30, 2025 -

Novo Nordisks Strategic Missteps With Ozempic In The Booming Weight Loss Market

May 30, 2025

Novo Nordisks Strategic Missteps With Ozempic In The Booming Weight Loss Market

May 30, 2025 -

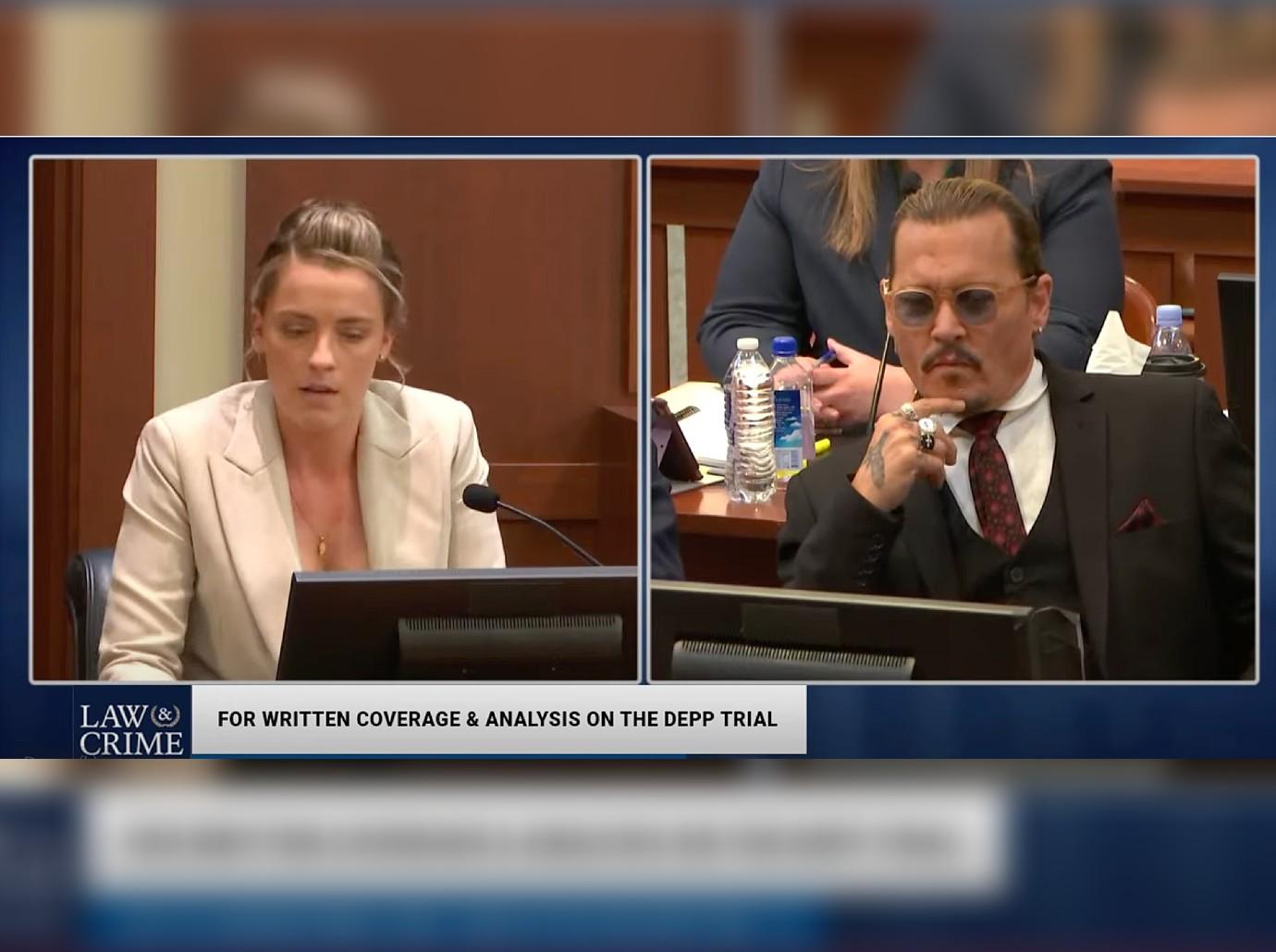

Elon Musk Fathered Amber Heards Twins Examining The Claims

May 30, 2025

Elon Musk Fathered Amber Heards Twins Examining The Claims

May 30, 2025 -

Programma Tileorasis Savvatoy 3 5 Odigos Gia Tis Kalyteres Ekpompes

May 30, 2025

Programma Tileorasis Savvatoy 3 5 Odigos Gia Tis Kalyteres Ekpompes

May 30, 2025 -

Legenda Tenisului Andre Agassi Juca Pickleball

May 30, 2025

Legenda Tenisului Andre Agassi Juca Pickleball

May 30, 2025