IMF Review Of Pakistan's $1.3 Billion Loan Package: Latest Updates

Table of Contents

Key Conditions of the IMF Loan Package

The IMF's loan package for Pakistan comes with a set of stringent conditions designed to address the country's economic vulnerabilities and ensure the loan's effectiveness. These conditions aim to foster sustainable economic growth and prevent future crises. The conditions are far-reaching, impacting various aspects of the Pakistani economy.

- Stricter tax collection measures: The IMF demands significant improvements in tax revenue collection to broaden the tax base and increase government revenue. This includes measures to combat tax evasion and improve tax administration.

- Reduction in government spending: The government is under pressure to reduce its expenditure, particularly in non-essential areas, to control the budget deficit and free up resources for debt servicing and essential public services. This often involves difficult choices regarding social programs and infrastructure projects.

- Increased energy prices: Subsidies on energy prices are a major drain on public finances. The IMF insists on gradual increases in energy prices to reflect their true cost, though this can be politically challenging due to potential social unrest.

- Market-determined exchange rate policy: The IMF advocates for a more flexible and market-determined exchange rate for the Pakistani Rupee to reflect the country's economic realities and improve the competitiveness of its exports. This often leads to currency fluctuations.

- Reforms in state-owned enterprises (SOEs): Many state-owned enterprises in Pakistan are inefficient and loss-making. The IMF pushes for reforms to improve their efficiency, profitability, or privatization to reduce the government's financial burden.

Pakistan's Progress on IMF Conditions

Pakistan's progress in fulfilling the IMF's conditions has been a mixed bag. While some progress has been made, significant challenges remain. The political climate and the complexity of implementing reforms have created hurdles.

- Progress on tax revenue generation: While there have been efforts to improve tax collection, the target remains ambitious, and significant revenue gaps persist. Challenges include informal economic activity and limited capacity within the tax administration.

- Implementation of fiscal reforms: The government has implemented some fiscal reforms, but the pace has been slow, hampered by political considerations and resistance to austerity measures.

- Successes and setbacks in energy sector reforms: Some progress has been made in energy sector reforms, but the full implementation of the required price adjustments remains a significant challenge. This is often a point of contention between the government and the IMF.

- Challenges in managing the exchange rate: Maintaining a market-determined exchange rate has been difficult, requiring delicate balancing between currency stability and macroeconomic management. The Pakistani Rupee's value remains volatile.

- Status of structural reforms: Progress on structural reforms varies across sectors. Some reforms are progressing well, while others face considerable resistance and require further action.

Potential Outcomes of the IMF Review

The outcome of the IMF review remains uncertain. Several scenarios are possible, each with significant implications for Pakistan's economy.

- Successful completion of the review and release of funds: This scenario would provide much-needed relief to Pakistan's economy, allowing it to address its immediate financial needs and potentially stabilize the currency.

- Delayed disbursement due to unmet conditions: If Pakistan fails to meet the required conditions, the IMF may delay the disbursement of the next tranche of funds, creating further economic instability.

- Potential renegotiation of the loan terms: The IMF may agree to renegotiate the loan terms to reflect the challenges faced by Pakistan, potentially extending the repayment period or adjusting some conditions.

- Impact on Pakistan's credit rating: The outcome of the review will significantly impact Pakistan's credit rating, affecting its ability to borrow money internationally in the future.

- Economic consequences for Pakistan, both positive and negative: A successful review could lead to economic stabilization and recovery. Conversely, a failure could lead to a deeper economic crisis and potential default.

Impact on the Pakistani Rupee and Inflation

The IMF review and its potential outcomes will have a significant impact on both the Pakistani Rupee and inflation. The interplay between these factors is complex and deserves careful consideration.

- Impact of IMF conditions on currency stability: IMF-mandated policies aimed at fiscal consolidation and exchange rate adjustments can affect the Rupee's value, causing volatility.

- Inflationary pressures resulting from IMF-mandated policies: Measures such as energy price increases can contribute to inflationary pressures, requiring careful management to mitigate negative impacts on the population.

- Possible strategies to mitigate inflation: The government may need to implement measures to control inflation, such as targeted subsidies or monetary policy adjustments.

- Analysis of the interplay between the IMF loan and the Rupee's value: The success of the IMF loan program is directly linked to the stability of the Pakistani Rupee, impacting Pakistan's ability to import essential goods and services.

- Long-term implications for economic stability: The long-term success of the IMF program and its impact on the Rupee and inflation will determine Pakistan's economic trajectory for years to come.

Conclusion

The IMF review of Pakistan's $1.3 billion loan package is a critical juncture for the nation's economic future. The successful completion of the review hinges on Pakistan's ability to meet the stringent conditions imposed by the IMF. While progress has been made in certain areas, significant challenges remain. The outcome of the review will have far-reaching implications for Pakistan's economy, including its currency, inflation, and overall stability. Stay informed on the latest developments regarding the IMF Pakistan Loan to understand the potential economic trajectory of the country. Regularly check back for further updates and analysis on this crucial issue. Understanding the intricacies of the IMF loan to Pakistan is crucial for navigating the country's economic future.

Featured Posts

-

Suncor Production Record High Output Sales Slowdown Explained

May 10, 2025

Suncor Production Record High Output Sales Slowdown Explained

May 10, 2025 -

Inside The Reimagined Queen Elizabeth 2 A Cruise Ship Transformed

May 10, 2025

Inside The Reimagined Queen Elizabeth 2 A Cruise Ship Transformed

May 10, 2025 -

2025 A Good Year For Stephen King Despite A Potential Monkey Movie Flop

May 10, 2025

2025 A Good Year For Stephen King Despite A Potential Monkey Movie Flop

May 10, 2025 -

Secret Service Ends Probe Into Cocaine Found At White House

May 10, 2025

Secret Service Ends Probe Into Cocaine Found At White House

May 10, 2025 -

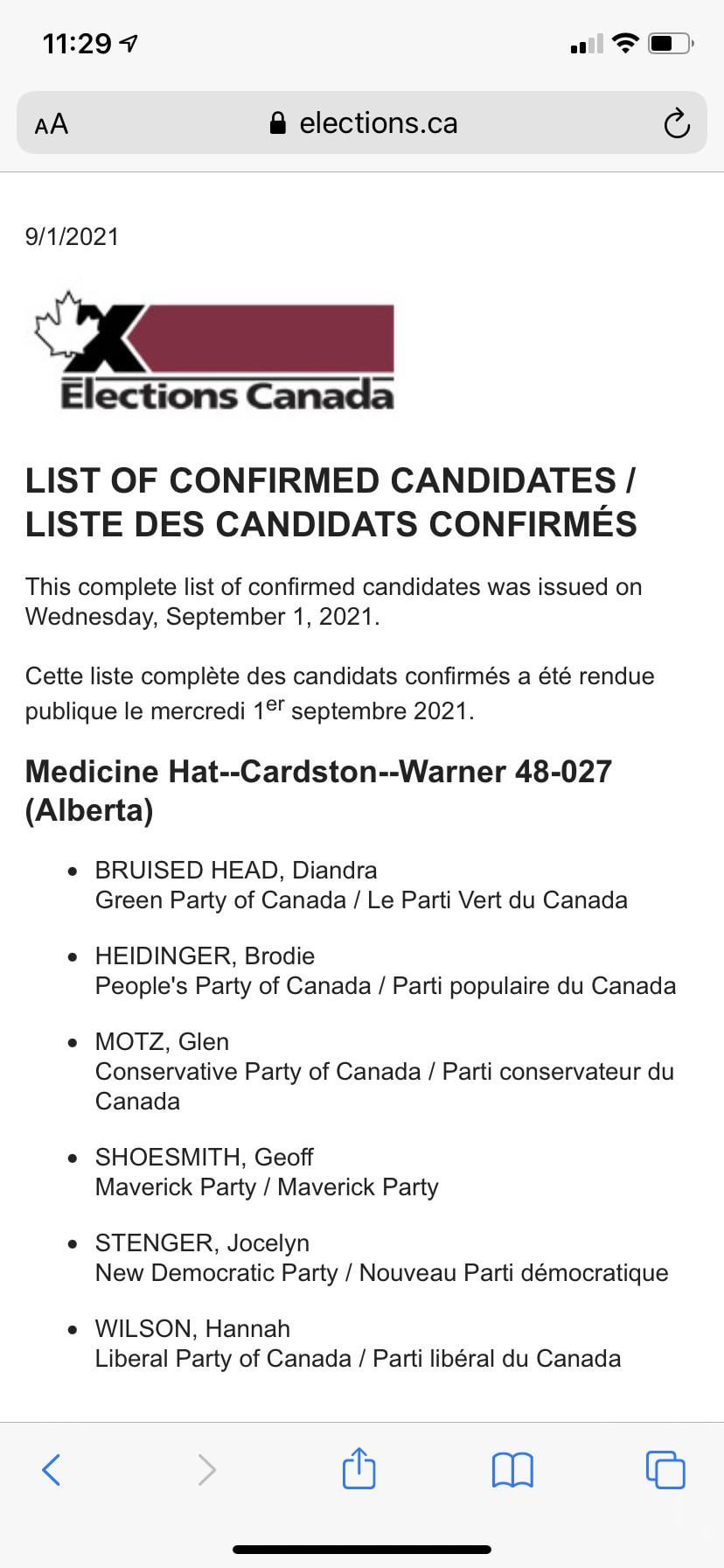

Everything You Need To Know About Your Nl Federal Candidates

May 10, 2025

Everything You Need To Know About Your Nl Federal Candidates

May 10, 2025