IMF To Review Pakistan's $1.3 Billion Package Amidst India Tensions

Table of Contents

The IMF's Conditions for Disbursing the Loan

The IMF's disbursement of the loan is contingent upon Pakistan meeting a series of stringent conditions designed to address the country's deep-seated economic challenges. These conditions are broadly categorized into fiscal and structural reforms.

Strict Fiscal Reforms

The IMF is expected to demand significant adjustments to Pakistan's fiscal policies. These demands aim to improve revenue generation and control government spending. Key aspects include:

- Significant tax revenue increases: This involves broadening the tax base, improving tax collection efficiency, and potentially increasing existing tax rates. The IMF will likely scrutinize Pakistan's tax collection mechanisms to identify areas for improvement and plug loopholes.

- Further cuts in government spending: Pakistan will likely need to further reduce government expenditure, prioritizing essential services while minimizing non-essential spending. This could involve cuts in various government programs and subsidies.

- Implementation of effective measures to curb energy subsidies: Energy subsidies have long been a drain on Pakistan's resources. The IMF will likely push for reforms to rationalize these subsidies, potentially leading to price increases for consumers. This is a politically sensitive issue, but crucial for fiscal sustainability.

- Addressing circular debt issues within the energy sector: Circular debt, where one entity owes money to another within the energy sector, has created a major financial burden. The IMF will insist on reforms to resolve these issues and improve the financial health of the energy sector.

Structural Economic Reforms

Beyond fiscal measures, the IMF will likely demand broader structural reforms to address underlying weaknesses in the Pakistani economy. These reforms aim to create a more stable and investor-friendly environment. This includes:

- Improving governance and tackling corruption: Transparency and accountability in government operations are crucial for attracting foreign investment. The IMF will likely pressure Pakistan to strengthen its anti-corruption institutions and improve governance mechanisms.

- Boosting investor confidence through policy predictability: Consistent and predictable economic policies are essential for attracting long-term investments. The IMF will likely urge Pakistan to create a stable policy environment that reassures investors.

- Strengthening the independence of central bank operations: A strong and independent central bank is crucial for managing monetary policy and maintaining macroeconomic stability. The IMF may recommend reforms to enhance the autonomy of the State Bank of Pakistan.

- Promoting sustainable and inclusive economic growth: The IMF will likely stress the need for sustainable economic growth that benefits all segments of society. This would involve investments in education, healthcare, and infrastructure.

The Impact of India-Pakistan Tensions on the Review

The escalating tensions between India and Pakistan add a layer of complexity to the already challenging IMF Pakistan Loan Review. This geopolitical uncertainty introduces significant risks to Pakistan's economic outlook.

Geopolitical Uncertainty

The heightened tensions can negatively impact several key areas:

- Foreign investment inflows into Pakistan: Geopolitical instability can deter foreign investors, reducing crucial capital inflows needed for economic recovery.

- The stability of the Pakistani Rupee: Increased uncertainty can lead to capital flight and put downward pressure on the Pakistani Rupee, increasing inflation.

- The overall economic outlook, making it harder to meet IMF targets: The uncertainty created by the India-Pakistan tensions can make it more difficult for Pakistan to achieve the economic targets set by the IMF, potentially jeopardizing the loan disbursement.

Resource Allocation

The ongoing tension may force Pakistan to divert resources from crucial economic reforms towards defense spending. This diversion of resources can hinder the implementation of the IMF-mandated reforms, further complicating the review process.

Pakistan's Economic Situation and the Loan's Importance

Pakistan's economy is facing significant challenges, making the IMF loan crucial for its survival.

Critical Funding

The $1.3 billion loan tranche is vital for Pakistan to:

- Avoid a potential default on its international debt obligations: The loan provides crucial funding to meet its debt obligations and prevent a default, which could have devastating consequences.

- Stabilize its currency and prevent further inflation: The loan can help stabilize the Pakistani Rupee and mitigate the impact of inflation on the cost of living.

- Access crucial foreign exchange reserves needed for essential imports: The reserves will allow Pakistan to import essential goods, preventing shortages and further economic instability.

Challenges Facing Pakistan

Pakistan grapples with several severe economic challenges:

- High inflation rates impacting the cost of living: High inflation erodes purchasing power and increases poverty.

- A widening current account deficit: A large current account deficit indicates that Pakistan is importing more than it is exporting, placing strain on its foreign exchange reserves.

- Persistent reliance on external financing: Pakistan's continued dependence on external financing highlights its vulnerability to global economic shocks and the need for sustainable economic reforms.

Potential Outcomes and Implications

The outcome of the IMF Pakistan Loan Review will have significant consequences for Pakistan's economy.

Successful Review

A successful review would provide much-needed financial relief and bolster Pakistan's efforts to stabilize its economy. It would signal a renewed confidence in the country's economic prospects and potentially unlock further international funding.

Failed Review

Failure to meet the IMF's conditions could have severe repercussions:

- A deeper economic crisis: A failed review could trigger a deeper economic crisis, potentially leading to social unrest.

- Further devaluation of the Pakistani Rupee: A failed review could lead to further devaluation of the currency, increasing inflation and the cost of imports.

- Increased risk of sovereign debt default: Failure to secure the loan increases the risk of Pakistan defaulting on its sovereign debt, isolating it from international financial markets.

- Reduced access to international financial markets: A failed review could further limit Pakistan's access to international financial markets, making it more difficult to secure future funding.

Conclusion

The IMF's review of Pakistan's $1.3 billion loan package is a critical juncture for the country's economic future. The success of the review hinges on Pakistan's ability to implement stringent fiscal and structural reforms while navigating the complexities of its relationship with India. The outcome will have profound implications for Pakistan's economic stability and its ability to address its mounting challenges. Stay informed about the latest developments concerning the IMF Pakistan Loan Review to understand the potential ramifications for this crucial South Asian nation. Understanding the intricacies of this IMF Pakistan Loan Review is crucial for investors and policymakers alike.

Featured Posts

-

Four Mind Bending Randall Flagg Theories That Reinterpret Stephen Kings Works

May 10, 2025

Four Mind Bending Randall Flagg Theories That Reinterpret Stephen Kings Works

May 10, 2025 -

Family Shattered The Brutal Unprovoked Racist Murder

May 10, 2025

Family Shattered The Brutal Unprovoked Racist Murder

May 10, 2025 -

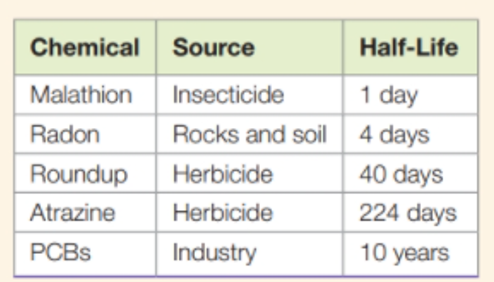

Months Long Persistence Of Toxic Chemicals From Ohio Derailment

May 10, 2025

Months Long Persistence Of Toxic Chemicals From Ohio Derailment

May 10, 2025 -

Reaktsiya Kinga Na Diyi Maska Ta Trampa Zvinuvachennya U Zradi

May 10, 2025

Reaktsiya Kinga Na Diyi Maska Ta Trampa Zvinuvachennya U Zradi

May 10, 2025 -

Canadian Homeownership Dreams Dashed By High Down Payments

May 10, 2025

Canadian Homeownership Dreams Dashed By High Down Payments

May 10, 2025