Impact Of Expanded Manufacturing Tax Credits On Ontario Businesses

Table of Contents

Enhanced Competitiveness and Investment

The expanded Ontario Manufacturing Tax Credits are designed to enhance the competitiveness of Ontario's manufacturing businesses and encourage further investment. This is achieved through two primary mechanisms: increased profitability and attracting both domestic and foreign investment.

Increased Profitability and Return on Investment (ROI)

Tax credits directly translate to increased profitability, leading to a higher return on investment (ROI) for manufacturing-related expenditures. This allows businesses to allocate more resources towards growth initiatives.

- Reinvest in Modernization: Tax savings can be used to purchase new, more efficient equipment, upgrading outdated machinery and streamlining production processes.

- Expand Operations: The increased profitability can fund expansion projects, allowing businesses to increase production capacity and meet growing demand.

- Attract and Retain Top Talent: The financial flexibility provided by the credits enables businesses to offer competitive salaries and benefits, attracting and retaining skilled workers crucial to the manufacturing sector.

- Research and Development: Tax savings can be reinvested in research and development, fostering innovation and the creation of new products and processes.

While precise ROI figures vary greatly depending on the specifics of each business and investment, studies show that tax credits significantly improve the financial outlook for manufacturing projects, making them more attractive and financially viable.

Attracting Foreign and Domestic Investment

The Ontario Manufacturing Tax Credits provide a significant competitive advantage, making Ontario a more attractive location for manufacturing investment compared to other provinces and even countries.

- Competitive Landscape: These tax incentives directly address the challenges faced by Ontario manufacturers in competing with jurisdictions offering similar support.

- Global Reach: The program attracts foreign direct investment (FDI), bringing in capital, expertise, and creating a more dynamic economic environment.

- Growth Opportunities: Domestic businesses are also incentivized to expand their operations within Ontario, fostering intra-provincial growth and development.

Many businesses cite the availability of these tax credits as a key factor in their decision to locate or expand in Ontario, underlining their importance in attracting investment.

Job Creation and Economic Growth

The economic impact of the Ontario Manufacturing Tax Credits extends far beyond individual businesses; it stimulates significant job creation and broader economic growth throughout the province.

Stimulating Employment in the Manufacturing Sector

The increased profitability and investment spurred by the tax credits directly lead to higher employment rates within the manufacturing sector.

- Direct Employment: Expansion projects and modernization initiatives require additional personnel, resulting in a direct increase in manufacturing jobs.

- Indirect Employment: Increased manufacturing activity boosts related sectors like logistics, transportation, and supply chain management, creating additional jobs indirectly.

- Skilled Labor Demand: Modernization efforts often require skilled labor, leading to a greater demand for specialized technicians and engineers.

While precise job creation numbers are subject to ongoing economic factors, initial reports suggest a positive correlation between the tax credits and employment growth in the manufacturing sector.

Boosting the Provincial Economy

The expanded manufacturing activity fueled by the Ontario Manufacturing Tax Credits has a ripple effect, significantly boosting the provincial economy as a whole.

- Increased Tax Revenue: The resulting economic activity generates increased tax revenue for the government, contributing to the overall fiscal health of the province.

- Supporting Industries: The growth in the manufacturing sector stimulates demand in supporting industries, such as transportation, logistics, and materials supply, generating further economic activity.

- GDP Growth: The combined effect of increased manufacturing output and related economic activity contributes to a higher overall Gross Domestic Product (GDP) for Ontario.

The economic impact of these credits is a complex issue that requires ongoing evaluation, but early indicators suggest a positive contribution to Ontario's GDP growth.

Challenges and Considerations

While the Ontario Manufacturing Tax Credits offer significant benefits, there are challenges and considerations that must be addressed to maximize their effectiveness.

Administrative Complexity and Application Process

Navigating the application process and managing the associated administrative tasks can be challenging for some businesses, particularly smaller ones.

- Paperwork Burden: The application process may involve significant paperwork and documentation requirements, creating a burden on businesses with limited resources.

- Time Constraints: The application deadlines and processing times can be a source of stress and uncertainty for businesses.

- Lack of Clarity: Some businesses may find the program guidelines and eligibility criteria unclear or difficult to understand.

The government should strive to simplify the application process, offering clear and concise guidelines and providing adequate support to businesses navigating the system.

Ensuring Equitable Access for Businesses of All Sizes

It's crucial to ensure that the benefits of the Ontario Manufacturing Tax Credits are accessible to businesses of all sizes, preventing larger corporations from disproportionately benefiting.

- SME Support: Small and medium-sized enterprises (SMEs) may lack the resources to fully leverage the tax credits, requiring tailored support and guidance.

- Regional Disparities: Ensuring equitable distribution across different regions of Ontario is vital to prevent economic imbalances.

- Program Adjustments: Ongoing monitoring and evaluation are necessary to identify and address any potential inequities in access to the program.

The program's design should actively promote inclusivity and encourage participation from businesses of all sizes and locations.

Conclusion

The expanded Ontario Manufacturing Tax Credits represent a significant opportunity to revitalize and modernize Ontario's manufacturing sector. These incentives have the potential to stimulate substantial investment, create numerous jobs, and bolster the provincial economy. While administrative complexities and ensuring equitable access remain important challenges, the overall positive impacts of the program are undeniable. Addressing these challenges through process simplification and targeted support for SMEs will ensure that the full potential of the Ontario Manufacturing Tax Credits is realized.

Call to Action: Learn more about how the Ontario Manufacturing Tax Credits can benefit your business and explore the application process. Contact the Ontario Ministry of Economic Development, Job Creation and Trade today to maximize your access to these valuable Ontario Manufacturing Tax Credits.

Featured Posts

-

The Anthony Edwards Baby Mama Controversy Understanding The Online Chaos

May 07, 2025

The Anthony Edwards Baby Mama Controversy Understanding The Online Chaos

May 07, 2025 -

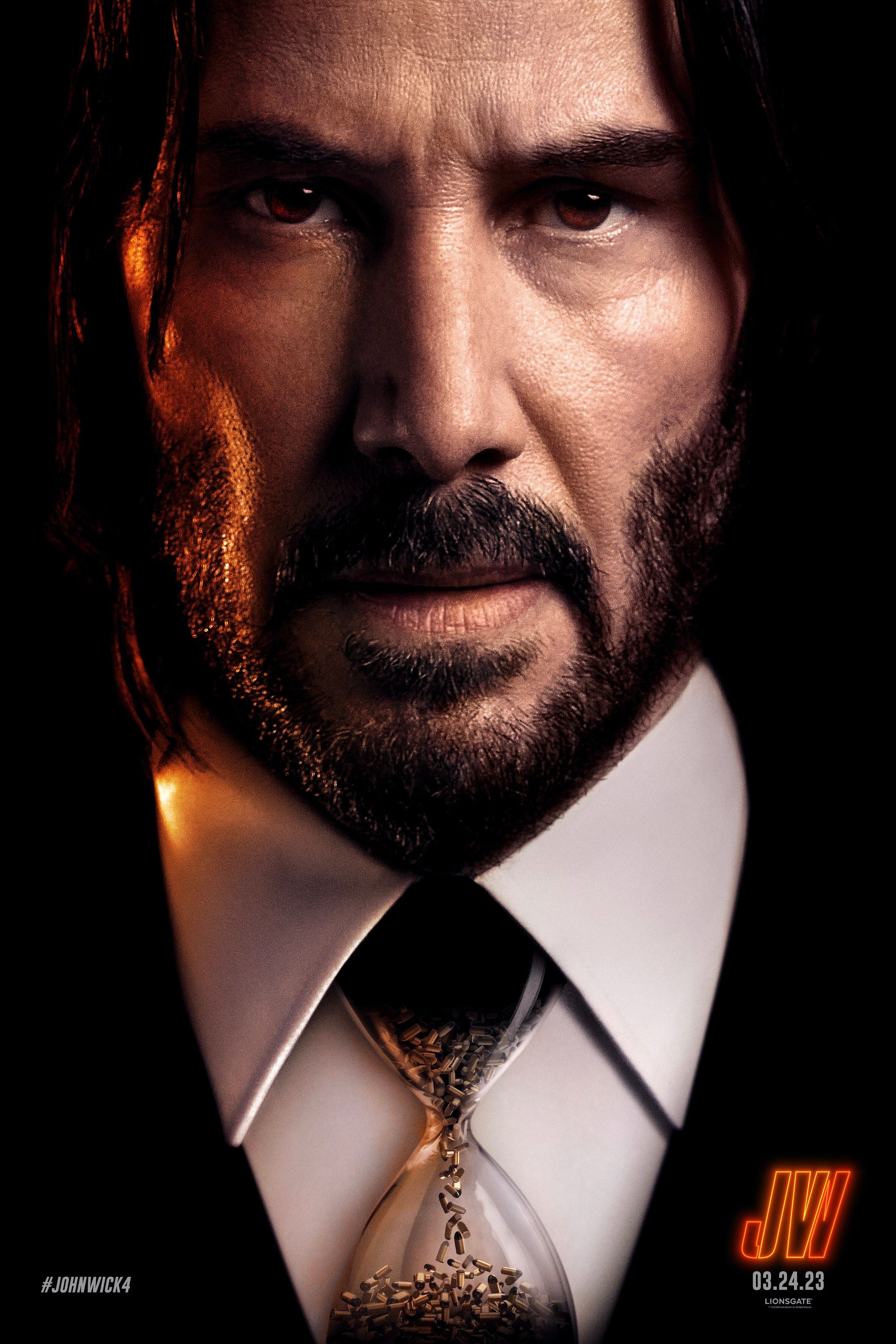

John Wick 5 A Premature Sequel The Arguments Against

May 07, 2025

John Wick 5 A Premature Sequel The Arguments Against

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Edition Analyzing The Famous Faces And Their Fortunes

May 07, 2025

Who Wants To Be A Millionaire Celebrity Edition Analyzing The Famous Faces And Their Fortunes

May 07, 2025 -

The Importance Of Middle Management Benefits For Businesses And Employees

May 07, 2025

The Importance Of Middle Management Benefits For Businesses And Employees

May 07, 2025 -

Should You Invest In Xrp Ripple Now A Comprehensive Analysis

May 07, 2025

Should You Invest In Xrp Ripple Now A Comprehensive Analysis

May 07, 2025

Latest Posts

-

Champions League Final Preview Hargreaves Insight On Arsenal Vs Psg

May 08, 2025

Champions League Final Preview Hargreaves Insight On Arsenal Vs Psg

May 08, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 08, 2025 -

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025 -

Psg Nice Macini Kacirmayin Canli Izleme Rehberi

May 08, 2025

Psg Nice Macini Kacirmayin Canli Izleme Rehberi

May 08, 2025 -

Nereden Izlenir Psg Nice Macini Canli Yayinla Takip Edin

May 08, 2025

Nereden Izlenir Psg Nice Macini Canli Yayinla Takip Edin

May 08, 2025