Impact Of G-7 De Minimis Tariff Talks On Chinese Exports

Table of Contents

Current De Minimis Thresholds and Their Impact on Chinese Exports

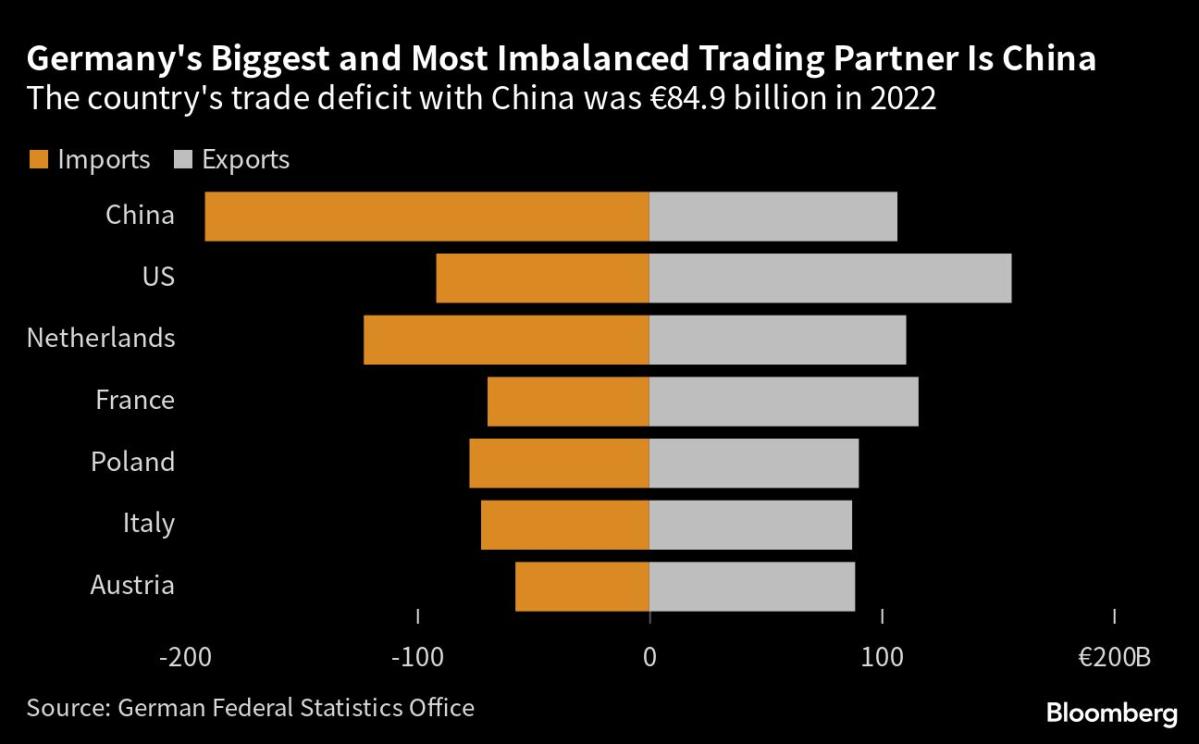

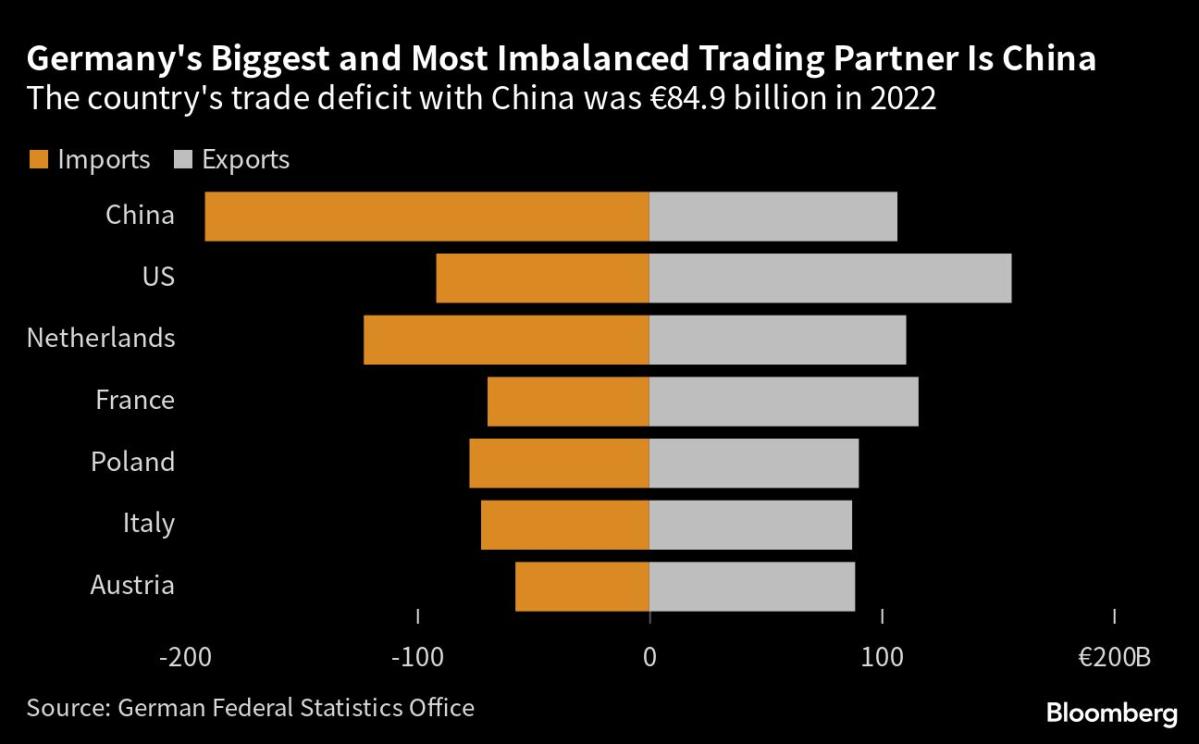

De minimis thresholds represent the value below which imported goods are exempt from import duty and other customs procedures. These thresholds vary significantly across G-7 nations. For example, the US currently has a relatively low threshold, while some European countries have higher limits. This disparity has provided a competitive advantage to Chinese exporters, particularly those dealing in low-value goods shipped via e-commerce platforms.

-

Examples of how current thresholds affect Chinese small businesses and e-commerce platforms: Chinese small and medium-sized enterprises (SMEs) selling goods on platforms like Alibaba and AliExpress heavily rely on these lower thresholds to remain competitive. Lower tariffs allow for lower prices, attracting more buyers internationally.

-

Statistics on the volume of Chinese goods currently benefiting from low de minimis thresholds: A significant portion of Chinese exports, especially in consumer goods and electronics, fall below existing de minimis thresholds in key G-7 markets. Precise figures are difficult to obtain due to data limitations, but anecdotal evidence and industry reports suggest a substantial volume.

-

Cost implications of shipping low-value goods under current thresholds: The current system favors low-value shipments from China, as the cost of customs clearance is avoided. This significantly reduces the overall cost of exporting small items, making them more affordable for international consumers.

Proposed Changes to De Minimis Thresholds by the G-7

The G-7 is currently discussing a harmonization of de minimis thresholds, proposing a significant increase across member nations. This move aims to level the playing field for domestic businesses and address concerns about unfair competition and revenue losses.

-

Specific examples of proposed changes and their potential impact on various product categories: Proposals vary, but a common theme is a significant upward adjustment. This would affect a broad range of products, from clothing and electronics to small household goods. For example, a higher threshold could substantially impact the profitability of exporting smaller, low-cost items.

-

Rationale behind these proposed changes: The primary drivers are increased government revenue, a more level playing field for domestic businesses competing with cheaper imports, and a more effective fight against undervaluation of imported goods to avoid tariffs.

-

Arguments for and against the proposed changes: Supporters argue the changes will create a fairer trading environment and increase government revenue. Critics, however, warn of increased costs for consumers and potential negative impacts on small businesses and cross-border e-commerce. Studies on the potential economic impact are ongoing and often yield conflicting results.

Potential Impact on Chinese Export Businesses

Higher de minimis thresholds would significantly impact Chinese export businesses. The effect will vary across sectors.

-

Specific examples of businesses that would be disproportionately affected: E-commerce businesses reliant on low-value shipments will be most affected. Manufacturers of inexpensive consumer goods will also face challenges. Conversely, larger exporters of high-value goods may see less impact.

-

Potential strategies Chinese exporters might employ to mitigate the impact: Strategies include consolidating smaller shipments into larger ones to minimize the impact of higher thresholds, adjusting pricing models to account for increased tariffs, and potentially restructuring supply chains to better manage costs.

-

Potential shifts in export destinations: Chinese businesses might redirect exports to countries with more favorable de minimis thresholds, potentially impacting trade relationships with G-7 nations.

Wider Geopolitical Implications of the G-7 De Minimis Tariff Talks

The G-7 de minimis tariff talks have broader geopolitical implications, affecting global trade balances and international relationships.

-

Analysis of the implications for trade relationships between China and G-7 nations: Increased tariffs could strain relations between China and G-7 countries, leading to potential trade disputes and retaliatory measures.

-

Potential for retaliatory measures from China: China might respond with its own trade restrictions, escalating tensions and impacting global trade flows.

-

Discussion on potential trade disputes and their impact on the global economy: The potential for increased trade disputes and economic uncertainty could negatively impact global economic growth and investor confidence.

Conclusion

The G-7 de minimis tariff talks present both opportunities and challenges for Chinese exporters. While a harmonized system could lead to greater fairness and transparency, it will undoubtedly increase costs for many Chinese businesses, particularly those specializing in low-value goods. Adapting to these changes will require strategic planning and proactive measures. Businesses involved in exporting from China should closely monitor these G-7 de minimis tariff talks and proactively assess potential impacts on their operations. Proactive adaptation and strategic planning regarding G-7 de minimis tariff changes are crucial for maintaining competitiveness in the global marketplace. Stay informed on the latest developments in G-7 de minimis tariff negotiations to effectively adapt your export strategies.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

Crystal Palace Target Kyle Walker Peters On A Bosman

May 24, 2025

Crystal Palace Target Kyle Walker Peters On A Bosman

May 24, 2025 -

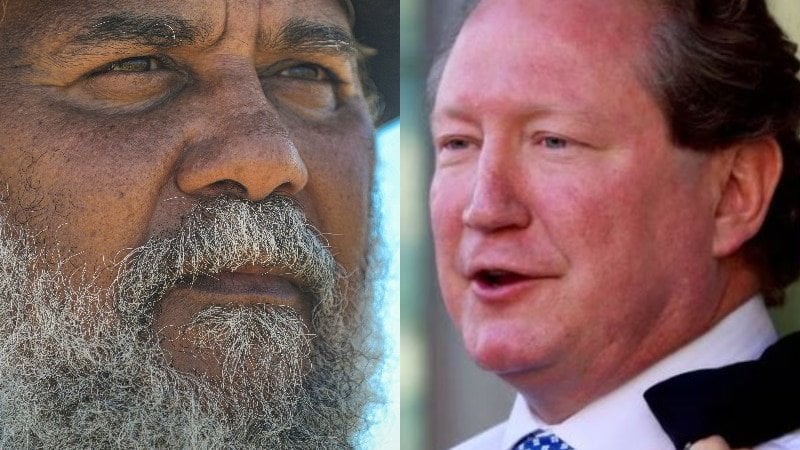

Andrew Forrests Pilbara Concerns Rio Tintos Counterarguments

May 24, 2025

Andrew Forrests Pilbara Concerns Rio Tintos Counterarguments

May 24, 2025 -

Live M56 Traffic Updates Motorway Closed Following Serious Accident

May 24, 2025

Live M56 Traffic Updates Motorway Closed Following Serious Accident

May 24, 2025 -

2 Lvmh Share Drop After Disappointing First Quarter Results

May 24, 2025

2 Lvmh Share Drop After Disappointing First Quarter Results

May 24, 2025

Latest Posts

-

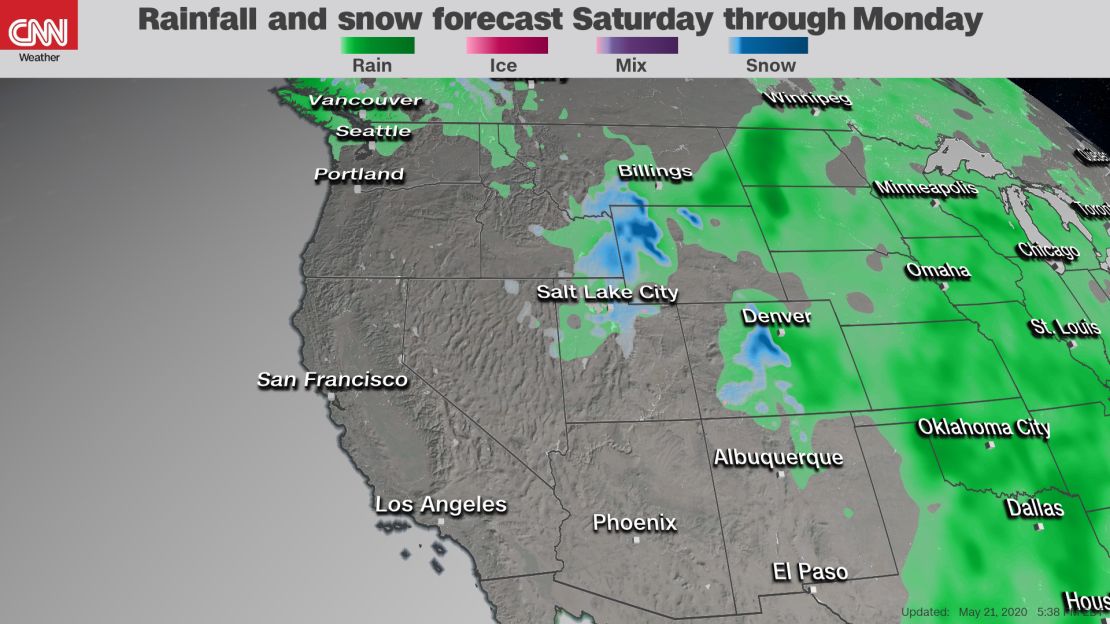

New York City Memorial Day Weekend Weather Prediction And Rain Outlook

May 24, 2025

New York City Memorial Day Weekend Weather Prediction And Rain Outlook

May 24, 2025 -

Stitchpossibles Weekend Success A Look At The Potential For A Historic 2025 Box Office

May 24, 2025

Stitchpossibles Weekend Success A Look At The Potential For A Historic 2025 Box Office

May 24, 2025 -

Best Memorial Day 2025 Sales Laptops Beauty And More

May 24, 2025

Best Memorial Day 2025 Sales Laptops Beauty And More

May 24, 2025 -

Memorial Day Weekend Rain Forecast For New York City

May 24, 2025

Memorial Day Weekend Rain Forecast For New York City

May 24, 2025 -

Box Office Battle Brewing Stitchpossible Weekend And The Potential For 2025 Records

May 24, 2025

Box Office Battle Brewing Stitchpossible Weekend And The Potential For 2025 Records

May 24, 2025