Impact Of Income Tax Elimination On Hernando, Mississippi

Table of Contents

Economic Growth and Investment

Eliminating income tax in Hernando could significantly boost the local economy. This would have a ripple effect, impacting various sectors and potentially transforming the town's economic landscape.

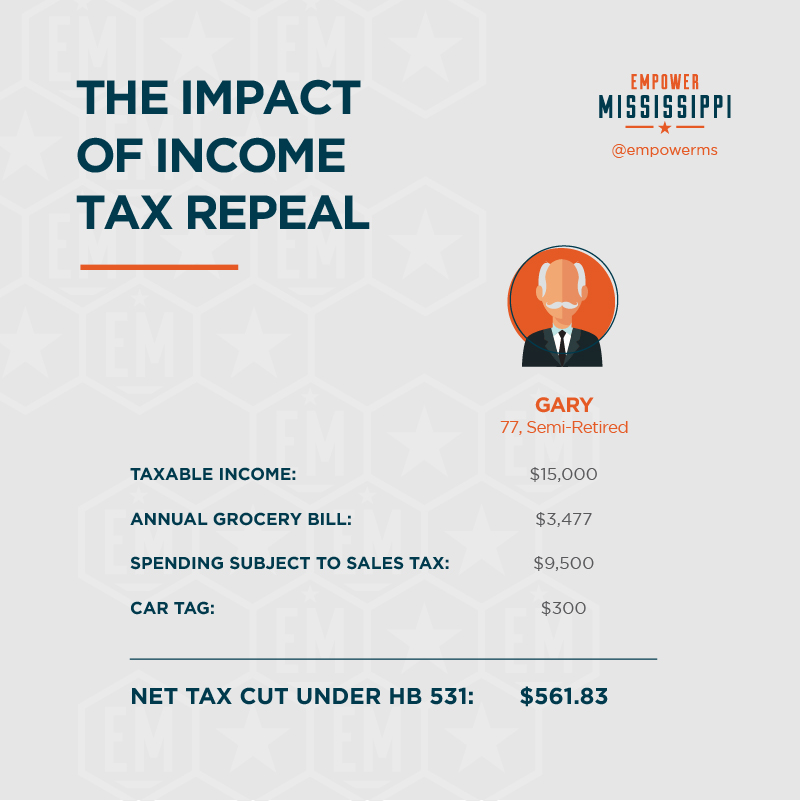

Increased Disposable Income and Spending

- Higher Disposable Income: The most immediate impact would be an increase in disposable income for Hernando residents. This means more money in their pockets to spend on local goods and services.

- Boosted Consumer Spending: Increased disposable income translates directly into increased consumer spending. Local businesses, from restaurants and retail shops to service providers, would likely see a significant rise in sales. This increased revenue could lead to business expansion and job creation.

- Property Value Appreciation: A thriving local economy often leads to increased property values. Higher property values would benefit homeowners and generate increased property tax revenue for the town.

- Increased Sales Tax Revenue: While income tax revenue would be lost, the increase in consumer spending could potentially offset this loss, at least partially, through increased sales tax revenue. This is a key aspect of the economic impact analysis.

Attracting New Businesses and Investment

- Business Attraction: A lower tax burden makes Hernando a more attractive location for new businesses. Companies looking to establish themselves or relocate would find Hernando a more competitive option compared to areas with higher income taxes.

- Job Creation: New businesses mean new job opportunities for Hernando residents. This could lead to a reduction in unemployment and a more diversified local economy.

- Investment Influx: The prospect of economic growth often attracts further investment from both domestic and foreign sources. This investment could fuel further economic expansion and development.

Potential Challenges and Drawbacks

While income tax elimination promises economic benefits, it's crucial to acknowledge potential challenges. A comprehensive analysis must address these potential drawbacks.

Reduced Government Revenue and Public Services

- Significant Revenue Loss: The most significant challenge is the substantial reduction in government revenue. Income tax is a major source of funding for public services.

- Impact on Public Services: Reduced revenue could lead to cuts in essential services such as schools, infrastructure maintenance (roads, bridges, etc.), public safety (police and fire departments), and other crucial programs.

- Finding Alternative Funding: Addressing this shortfall requires careful planning and exploration of alternative funding sources. This might include increased property taxes, sales taxes, or exploring grants and other forms of external funding.

Impact on Low-Income Households and Inequality

- Unequal Benefits: While tax cuts benefit most residents, low-income households may not see proportional gains. They may spend a larger portion of their income on essentials, leaving less room to benefit from tax savings.

- Increased Inequality: This disparity could potentially exacerbate existing income inequality within the community.

- Mitigation Strategies: Addressing this requires proactive measures, such as targeted social programs or investments in affordable housing and job training initiatives.

Comparative Analysis of Similar Initiatives

To understand the potential outcome of income tax elimination in Hernando, it's beneficial to examine similar initiatives in other locations. Case studies of towns or states that have implemented similar tax reforms can offer valuable insights. Analyzing both the successes and failures of these policies can help predict the potential consequences in Hernando. Data-driven analysis from these case studies is crucial for informed decision-making. For example, analyzing the effects of similar tax reforms in other Mississippi towns or nearby states can offer valuable lessons and inform projections for Hernando's unique situation.

Long-Term Sustainability and Planning

The long-term success of income tax elimination in Hernando requires comprehensive planning and proactive management.

- Long-Term Sustainability: The town needs a robust economic diversification strategy to ensure its long-term financial stability. Over-reliance on sales tax revenue alone is risky.

- Economic Planning: A well-defined economic plan is vital, including diversification strategies to reduce dependence on a single economic sector. This will ensure resilience in the face of economic downturns.

- Fiscal Management: Proactive fiscal management and careful budgeting are essential to navigate potential financial challenges.

- Contingency Planning: A comprehensive contingency plan is crucial to address unforeseen circumstances or economic downturns. This would ensure the town's financial stability and continued provision of essential services.

Conclusion: Weighing the Impact of Income Tax Elimination on Hernando, Mississippi

Eliminating income tax in Hernando, Mississippi, presents a complex dilemma with both significant potential benefits and considerable challenges. While increased disposable income, consumer spending, and business attraction are promising prospects for economic growth, the potential loss of government revenue and the impact on public services require careful consideration. Further, the potential for increased income inequality highlights the need for mitigation strategies. A thorough analysis of comparable initiatives and proactive long-term planning are crucial to ensure the sustainability of such a policy. The decision to eliminate income tax in Hernando should be driven by data, community engagement, and a commitment to fiscal responsibility. We urge residents of Hernando, Mississippi to actively participate in the ongoing discussion and contribute to informed decision-making regarding income tax elimination and its potential impact on their community's future. The future economic development of Hernando hinges on careful consideration of all aspects of income tax elimination.

Featured Posts

-

25 Killed Hundreds Affected Central Us Tornado Outbreak

May 19, 2025

25 Killed Hundreds Affected Central Us Tornado Outbreak

May 19, 2025 -

Final Destination Bloodline Trailer Tony Todds Last Performance And A Reason For Optimism

May 19, 2025

Final Destination Bloodline Trailer Tony Todds Last Performance And A Reason For Optimism

May 19, 2025 -

Impugnacion De Correismo Prohibicion De Celulares En La Segunda Vuelta

May 19, 2025

Impugnacion De Correismo Prohibicion De Celulares En La Segunda Vuelta

May 19, 2025 -

Sauver Notre Dame De Poitiers Le Role Du Departement

May 19, 2025

Sauver Notre Dame De Poitiers Le Role Du Departement

May 19, 2025 -

Ufc Fight Night Burns Vs Morales Live Fight Blog And Results

May 19, 2025

Ufc Fight Night Burns Vs Morales Live Fight Blog And Results

May 19, 2025