Impact Of Recent Saudi Regulatory Changes On The ABS Market

Table of Contents

New Regulations and Their Implications for ABS Issuance

The recent regulatory overhaul in Saudi Arabia has introduced significant changes impacting the issuance of ABS. These changes aim to enhance market stability, transparency, and investor protection.

Changes to Capital Requirements

The Saudi Arabian Monetary Authority (SAMA) has adjusted capital adequacy ratios (CAR) for banks and other financial institutions involved in ABS issuance. This means that institutions now need to hold more capital against their ABS exposures.

- Increased capital requirements: This directly increases the cost of issuing ABS, potentially leading to a reduction in the overall supply of these securities.

- Potential reduction in ABS issuance: Smaller issuers, in particular, may find it more challenging to meet the higher capital requirements, potentially reducing their participation in the market.

- Effects on smaller issuers: The increased capital burden could disproportionately impact smaller financial institutions, potentially leading to consolidation within the sector.

The effect on the cost of capital will likely translate into higher pricing for ABS, impacting the attractiveness of the market for some investors.

Enhanced Due Diligence and Transparency Requirements

New regulations place a greater emphasis on due diligence and transparency throughout the ABS issuance process. This includes stricter scrutiny of the origination, underwriting, and securitization of the underlying assets.

- Stricter underwriting standards: Issuers are now subject to more rigorous checks on the quality and risk profile of the underlying assets. This should lead to a reduction in the risk of defaults and improve the overall credit quality of ABS.

- Improved data disclosure: Enhanced disclosure requirements mandate greater transparency regarding the underlying assets and the structure of the ABS. This improves investor understanding and reduces information asymmetry.

- Impact on investor risk assessment: Increased transparency enables investors to conduct more thorough risk assessments, fostering more informed investment decisions. This should theoretically lead to more efficient pricing of ABS.

These changes are crucial for building investor confidence and promoting market liquidity.

Revised Rating Agency Oversight

SAMA has also strengthened its oversight of rating agencies operating within the Saudi Arabian ABS market. This includes stricter regulatory requirements and increased scrutiny of rating methodologies.

- Increased scrutiny of rating agencies: Rating agencies are now subject to more rigorous reviews of their processes and ratings, aiming to improve the accuracy and reliability of credit assessments.

- Potential changes in ratings methodologies: The regulatory changes might influence rating agencies to adopt more conservative methodologies, which could impact the ratings assigned to ABS.

- Impact on investor perception: Greater oversight of rating agencies should enhance investor confidence in the integrity of credit ratings, leading to more informed investment decisions.

Impact on Investors and Market Participants

The regulatory changes have had a noticeable impact on both investor behavior and market participants.

Changes in Investor Demand and Pricing

The regulatory changes have introduced a degree of uncertainty, potentially affecting investor appetite for Saudi ABS.

- Increased risk aversion: Some investors may adopt a more cautious approach due to the stricter regulations and increased complexity.

- Potential for higher yields: To compensate for perceived increased risk or reduced supply, investors may demand higher yields on Saudi ABS.

- Shifting investor preferences: The regulatory changes could lead to a shift in investor preferences, with some investors favoring more liquid or less complex ABS structures.

Effects on Market Liquidity and Trading Volume

The regulatory changes have the potential to affect trading activity in the Saudi ABS market.

- Changes in trading volumes: The increased cost of issuance and potentially higher risk aversion might lead to a decrease in trading volumes in the short term.

- Impact on market depth: A reduction in trading volume could reduce market depth, making it harder for investors to buy or sell ABS without significantly affecting prices.

- Effects on price discovery: Reduced liquidity can also impair the price discovery mechanism, potentially leading to less efficient pricing of ABS. However, improved transparency should eventually lead to improved price discovery.

Long-Term Outlook and Future of the Saudi ABS Market

Despite the short-term challenges, the long-term outlook for the Saudi ABS market remains positive.

Potential for Growth and Development

The regulatory changes, while demanding, pave the way for sustainable growth in the long run.

- Improved market stability: The enhanced transparency and stricter regulatory oversight aim to create a more stable and resilient ABS market.

- Enhanced investor protection: Stronger regulations increase investor confidence and protection, attracting both domestic and international investors.

- Potential for increased foreign investment: A more transparent and regulated market can attract greater foreign investment, boosting the overall size and liquidity of the Saudi ABS market.

Challenges and Risks

Despite the potential benefits, challenges and risks remain:

- Implementation challenges: The effective implementation of the new regulations requires robust oversight and monitoring.

- Potential unintended consequences: Some unintended consequences might emerge from the new regulations, requiring adjustments and fine-tuning.

- Need for ongoing monitoring: Continuous monitoring and evaluation of the regulatory framework are essential to ensure its effectiveness and address any emerging challenges.

Assessing the Future of Saudi ABS Under a New Regulatory Landscape

The recent regulatory changes in Saudi Arabia have significantly impacted the ABS market, affecting both issuance and investor behavior. While the short-term effects may include reduced issuance and increased risk aversion, the long-term outlook remains positive. The improved transparency, stronger investor protection, and potential for attracting foreign investment should contribute to the growth and development of a more stable and mature Saudi ABS market. However, careful monitoring and addressing potential challenges will be crucial for realizing the full potential of these reforms. To stay abreast of the evolving landscape and make informed investment decisions regarding the impact of Saudi regulatory changes on the ABS market, stay informed about further developments and consult with financial experts.

Featured Posts

-

Donald Trump And The Calibri Tattoo Misconception Fact Or Fiction

May 03, 2025

Donald Trump And The Calibri Tattoo Misconception Fact Or Fiction

May 03, 2025 -

England Womens Squad Chloe Kelly Replaces Injured Players

May 03, 2025

England Womens Squad Chloe Kelly Replaces Injured Players

May 03, 2025 -

La Creme De La Crim L Impact De Joseph Sur Tf 1

May 03, 2025

La Creme De La Crim L Impact De Joseph Sur Tf 1

May 03, 2025 -

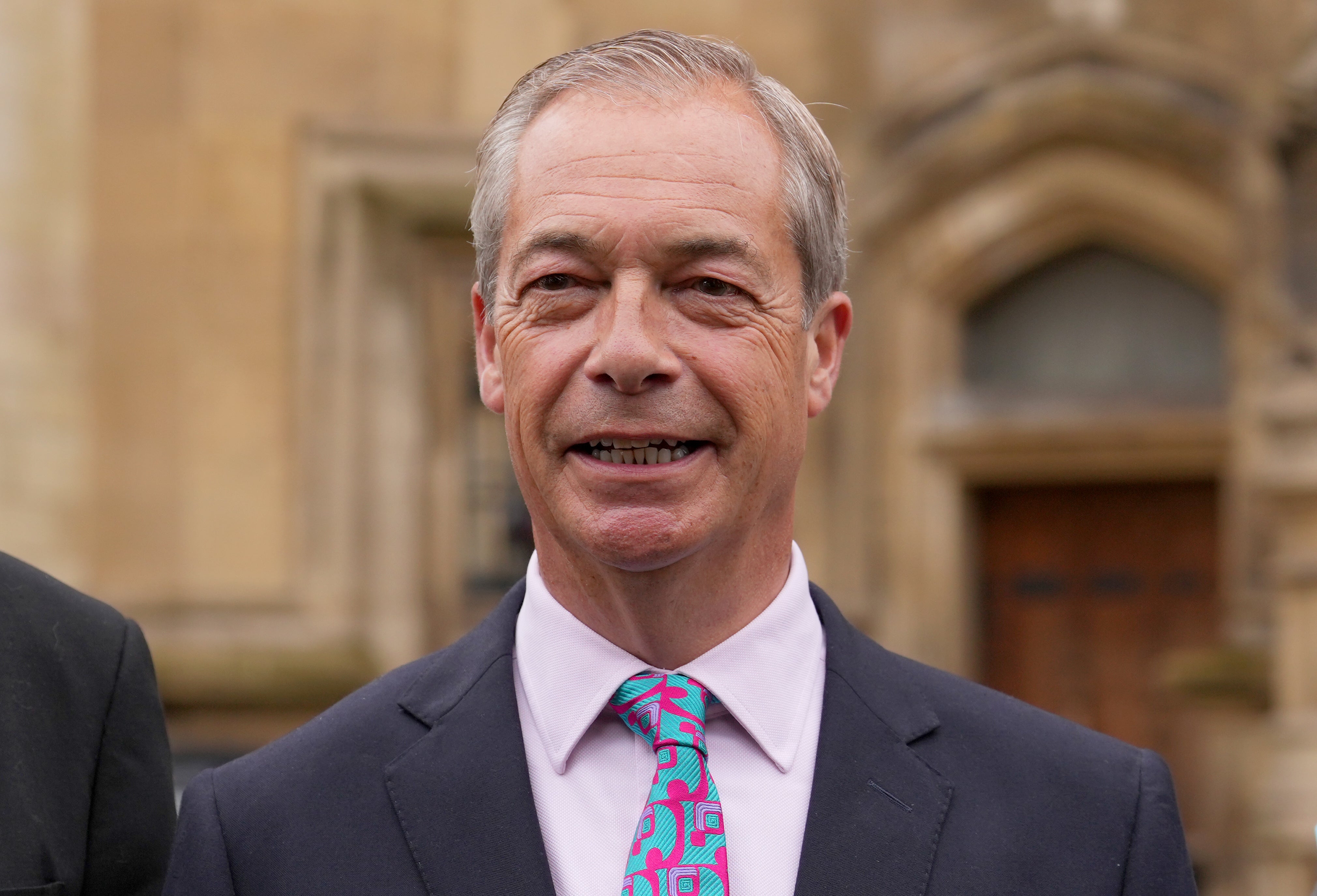

Witnessing History My Perspective From Nigel Farages Press Conference

May 03, 2025

Witnessing History My Perspective From Nigel Farages Press Conference

May 03, 2025 -

Innovative Tariff Model Dutch Utilities Harness Solar Energy

May 03, 2025

Innovative Tariff Model Dutch Utilities Harness Solar Energy

May 03, 2025

Latest Posts

-

The Ongoing Dispute Within Reform Uk An Explanation

May 03, 2025

The Ongoing Dispute Within Reform Uk An Explanation

May 03, 2025 -

Deep Divisions In Reform Uk Analysing The Current Crisis

May 03, 2025

Deep Divisions In Reform Uk Analysing The Current Crisis

May 03, 2025 -

A Fierce Row Shakes Reform Uk Understanding The Internal Divisions

May 03, 2025

A Fierce Row Shakes Reform Uk Understanding The Internal Divisions

May 03, 2025 -

Liverpools Frimpong Pursuit And Elliotts Contract Status

May 03, 2025

Liverpools Frimpong Pursuit And Elliotts Contract Status

May 03, 2025 -

Latest Liverpool Fc News Frimpong And Elliott Situation

May 03, 2025

Latest Liverpool Fc News Frimpong And Elliott Situation

May 03, 2025