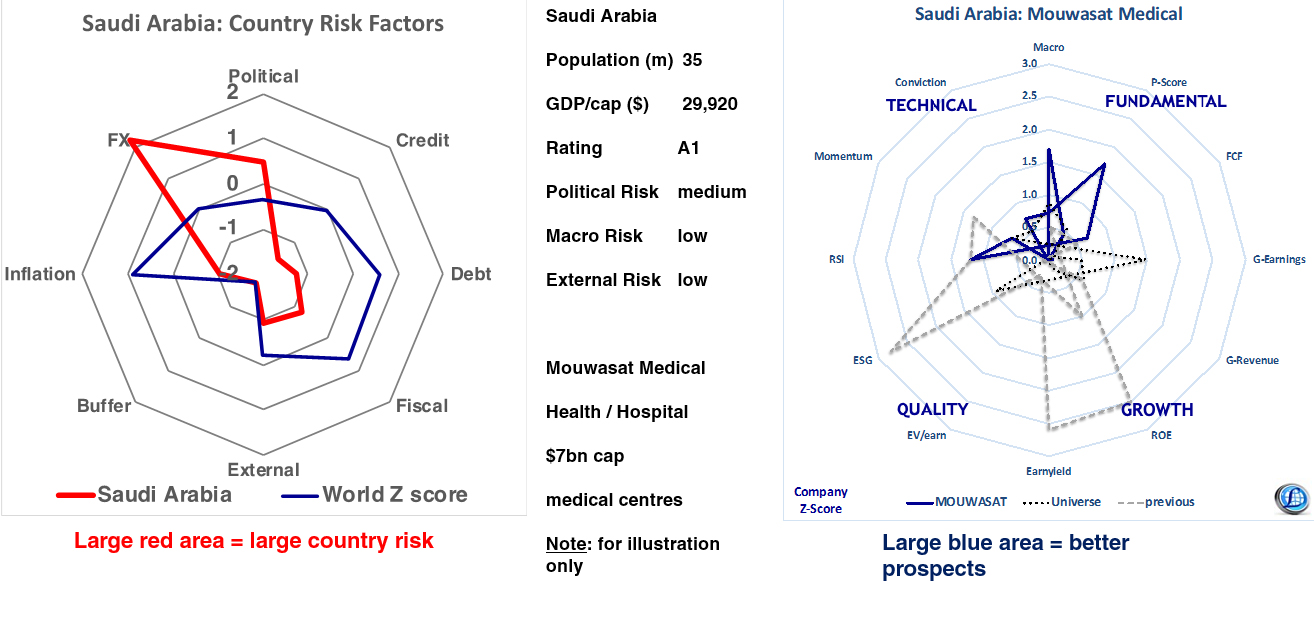

Impact Of Saudi Rule Change On ABS Market Growth

Table of Contents

Deregulation and Increased Investment in the Saudi ABS Market

The Saudi Arabian government's strategic initiatives to diversify its economy beyond oil have significantly impacted the ABS market. Key regulatory changes have created a more attractive investment climate, leading to increased domestic and foreign participation. These changes include:

- Relaxation of capital requirements for ABS issuers: Lowering the capital requirements needed to issue ABS has encouraged participation from a broader range of companies, boosting the supply of securities.

- Streamlined approval processes for ABS offerings: Simpler and faster approval processes have reduced the time and costs associated with bringing ABS to market, making it more efficient for issuers.

- Increased transparency and disclosure requirements: Enhanced transparency measures have built investor confidence, attracting both domestic and international capital.

- Government initiatives promoting the ABS market: Active government support through various programs and incentives has further stimulated market development and growth. This includes targeted financial education and outreach programs.

These regulatory adjustments have led to a substantial increase in foreign direct investment (FDI) flowing into the Saudi ABS market, signifying global confidence in the Kingdom's economic transformation.

Growth of Specific ABS Sectors in Saudi Arabia

The impact of Saudi rule change is particularly evident in the burgeoning growth of several key sectors fueled by ABS financing:

- Real estate ABS: The Kingdom's ambitious Vision 2030 plan, focusing on infrastructure development and urban renewal, has fueled a surge in real estate projects. ABS financing plays a crucial role in funding these large-scale developments, leading to significant market expansion in this segment.

- Infrastructure ABS: Massive government investments in infrastructure projects, including transportation, energy, and utilities, require substantial financing. ABS has emerged as a preferred funding mechanism, driving considerable growth.

- Consumer finance ABS: Rising consumer spending and increased credit availability have created a robust market for consumer finance ABS. This reflects the growth of the Saudi middle class and its increasing participation in the financial sector.

The expansion in these sectors is demonstrable through various indicators, such as the increasing volume of ABS issuance, growing market capitalization, and participation from diverse institutional investors. Detailed statistics on market expansion are readily available through reports published by the Saudi Central Bank (SAMA) and other financial institutions.

Challenges and Risks Facing the Expanding Saudi ABS Market

Despite the significant progress, the rapidly expanding Saudi ABS market faces certain challenges:

- Potential for increased credit risk: Rapid expansion can sometimes lead to increased credit risk if proper due diligence and risk assessment are not implemented consistently.

- Need for robust regulatory oversight and risk management frameworks: Maintaining strong regulatory frameworks is crucial to ensure the long-term stability and health of the market.

- Concerns regarding transparency and disclosure in certain sectors: Continuous efforts to improve transparency and disclosure standards across all sectors are essential to maintain investor confidence.

- Geopolitical risks and their impact on investor confidence: Global geopolitical events can influence investor sentiment and create volatility in the market.

Mitigating these risks necessitates a proactive approach from regulatory bodies, issuers, and investors alike. This includes strengthening risk management practices, enhancing transparency, and fostering a culture of responsible investing.

Future Outlook for ABS Market Growth in Saudi Arabia

The outlook for the Saudi ABS market remains positive. Continued regulatory reforms, diversification into new asset classes, and growing investor interest are expected to drive further expansion.

- Continued growth driven by ongoing regulatory reforms: Further regulatory enhancements will create a more efficient and investor-friendly environment, boosting market growth.

- Potential for diversification into new ABS asset classes: The market is poised to expand into new sectors and asset classes, further broadening its scope and diversification.

- Increased competition among issuers and investors: Increased competition can lead to more innovative products and better returns for investors.

- Long-term implications for the Saudi financial system: The growth of the ABS market will strengthen the overall financial system of Saudi Arabia.

Predicting the exact market size and growth rate is complex, but conservative estimates indicate substantial growth in the coming years. Independent financial analysts and research firms regularly publish detailed forecasts and analyses of the Saudi ABS market.

Conclusion: Navigating the Future of ABS Market Growth in Saudi Arabia

The Impact of Saudi Rule Change on ABS Market Growth is undeniable. Regulatory reforms have unlocked significant potential, fostering a dynamic and rapidly expanding market. While challenges remain, the long-term outlook is positive, driven by continued government support, increased investor confidence, and diversification into new sectors. Learn more about how the Impact of Saudi Rule Change on ABS Market Growth is shaping investment strategies and explore the potential of Saudi ABS today!

Featured Posts

-

Understanding The Detrimental Effects Of School Suspension On Children

May 02, 2025

Understanding The Detrimental Effects Of School Suspension On Children

May 02, 2025 -

Ekonomicheskoe Sotrudnichestvo Rf I Chekhii Itogi Peregovorov

May 02, 2025

Ekonomicheskoe Sotrudnichestvo Rf I Chekhii Itogi Peregovorov

May 02, 2025 -

Fortnite Servers Offline Update 34 40 Deployment And Return Time

May 02, 2025

Fortnite Servers Offline Update 34 40 Deployment And Return Time

May 02, 2025 -

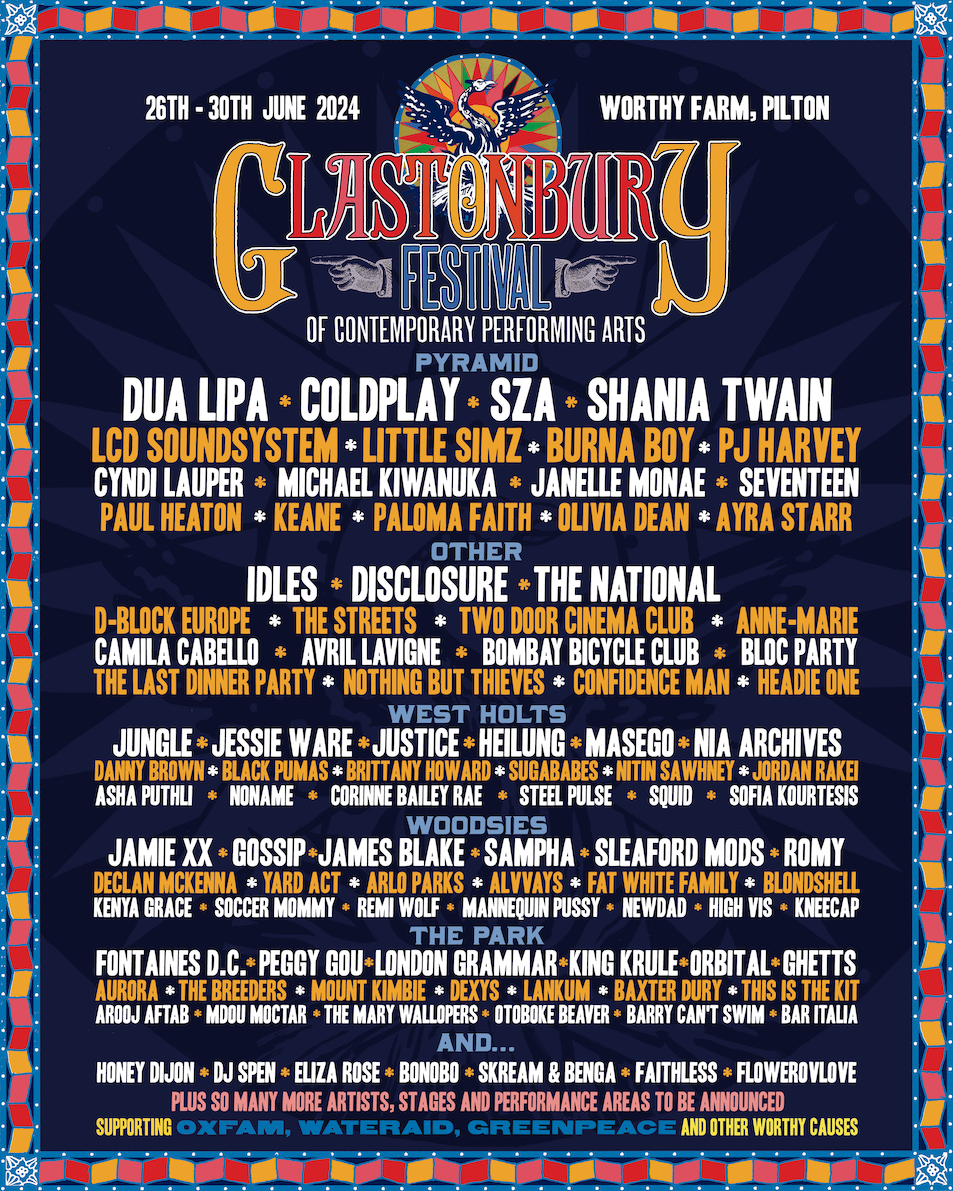

Glastonbury Stage Times 2024 A Scheduling Nightmare

May 02, 2025

Glastonbury Stage Times 2024 A Scheduling Nightmare

May 02, 2025 -

Xrp Gains Momentum Analyzing The Ripple Lawsuits Impact And Future Etf Prospects

May 02, 2025

Xrp Gains Momentum Analyzing The Ripple Lawsuits Impact And Future Etf Prospects

May 02, 2025

Latest Posts

-

Daisy May Coopers Engagement To Anthony Huggins Details Revealed

May 02, 2025

Daisy May Coopers Engagement To Anthony Huggins Details Revealed

May 02, 2025 -

Glastonbury Headliners 2024 Speculation On The 1975 And Olivia Rodrigo

May 02, 2025

Glastonbury Headliners 2024 Speculation On The 1975 And Olivia Rodrigo

May 02, 2025 -

Daisy May Cooper Engaged To Boyfriend Anthony Huggins

May 02, 2025

Daisy May Cooper Engaged To Boyfriend Anthony Huggins

May 02, 2025 -

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025 -

The 1975 And Olivia Rodrigo To Headline Glastonbury 2024

May 02, 2025

The 1975 And Olivia Rodrigo To Headline Glastonbury 2024

May 02, 2025