Impact Of Trump's 30% Tariffs On China: An Extended Outlook To 2025

Table of Contents

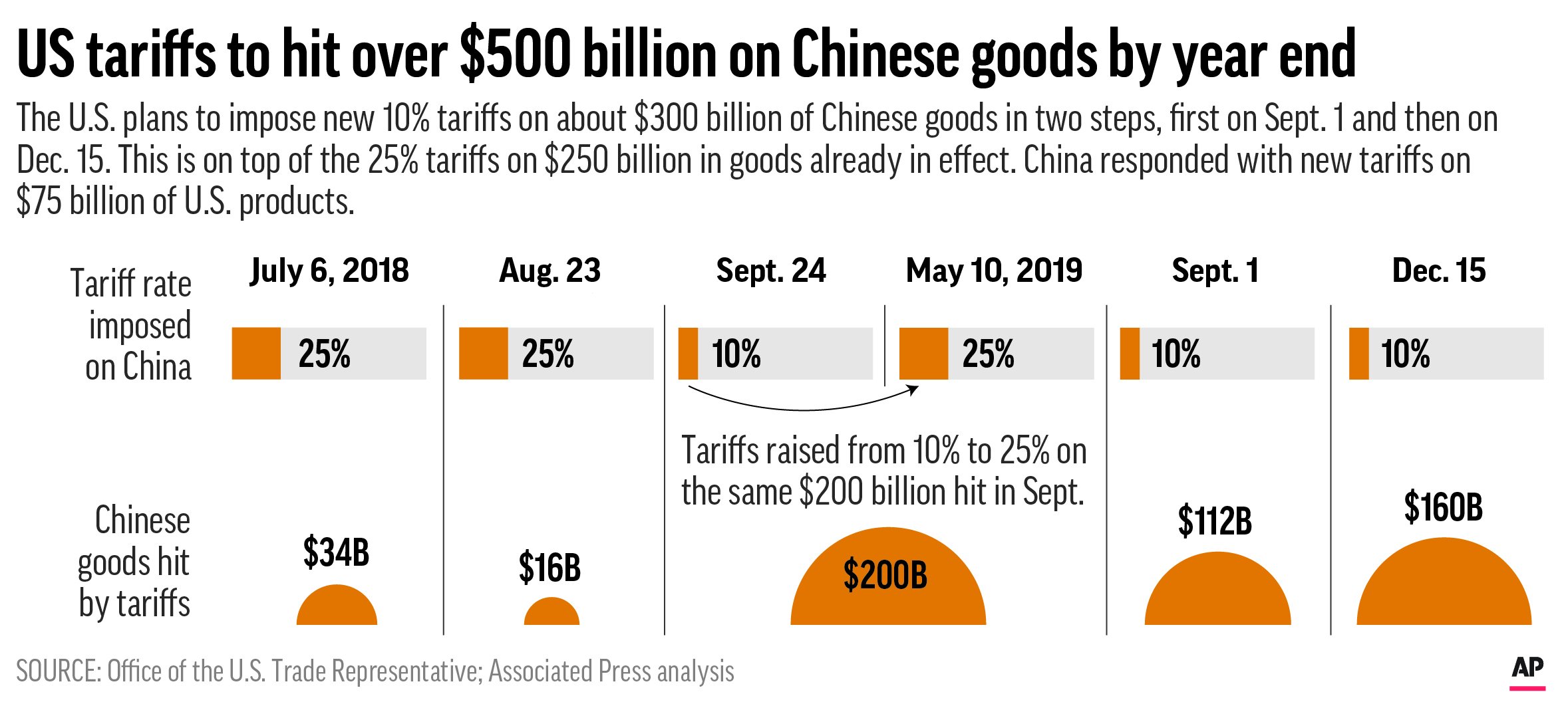

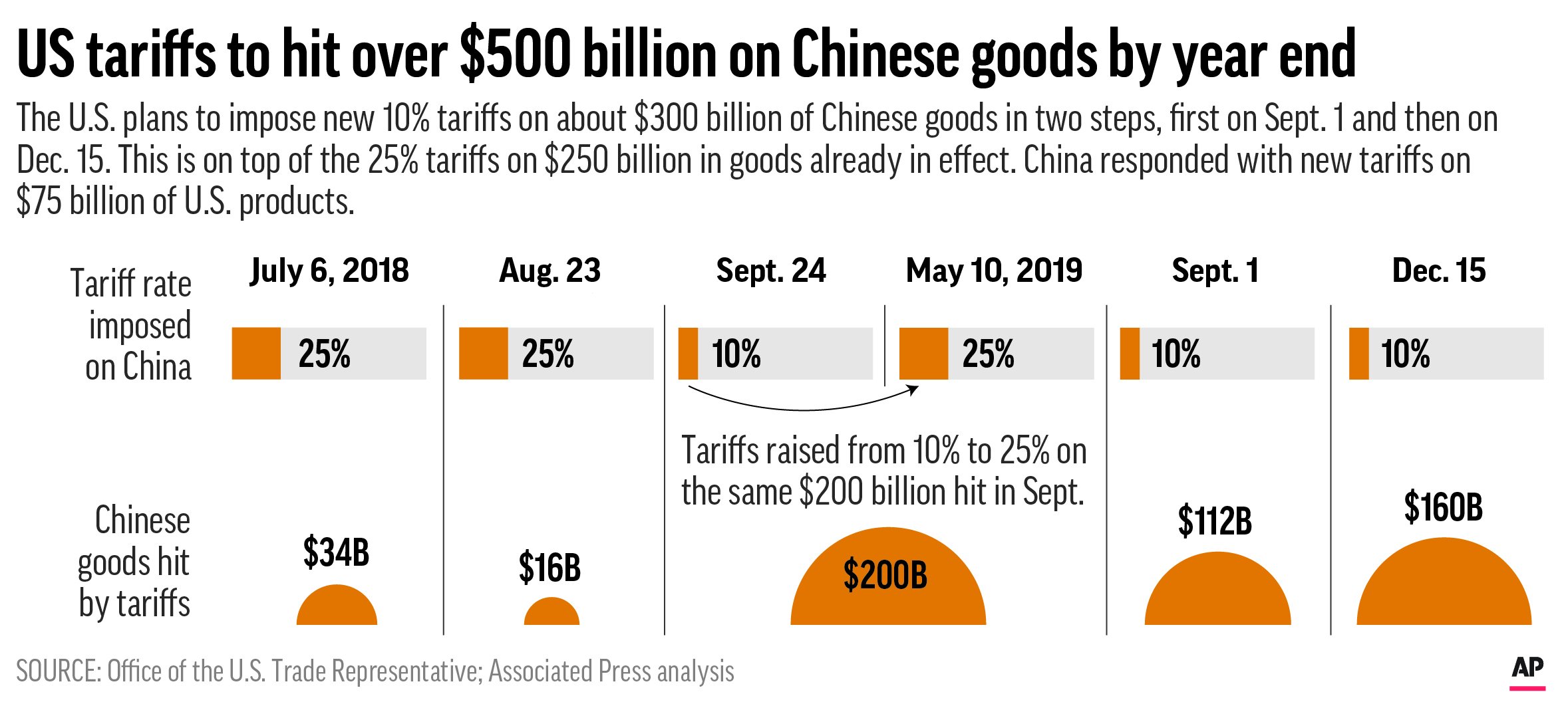

The Trump administration's imposition of 30% tariffs on billions of dollars worth of Chinese goods in 2018 sent shockwaves through the global economy. This drastic measure, a key element of the escalating China-US trade war, significantly impacted international trade and continues to shape the economic landscape today. This article analyzes the lasting consequences of "Trump's 30% Tariffs on China," exploring their impact on both the Chinese and US economies until 2025 and beyond, examining the tariff impact and its ripple effects on global trade.

H2: Short-Term Economic Shockwaves (2018-2020):

H3: Impact on Chinese Exports: The immediate consequence of the tariffs was a sharp decline in Chinese exports to the US. This tariff impact was felt across various sectors.

- Specific examples of affected industries: Steel, aluminum, consumer electronics, textiles, and agricultural products experienced significant drops in US sales.

- Data on export value decline, job losses in China: While precise figures are debated, numerous reports indicate a substantial contraction in Chinese export value to the US, leading to job losses, particularly in manufacturing hubs.

- Chinese government's response measures: The Chinese government responded with a combination of subsidies to affected industries, efforts to stimulate domestic demand, and retaliatory tariffs against US goods.

H3: Retaliatory Tariffs and Global Market Disruption: China's retaliatory tariffs on US goods further exacerbated the situation, disrupting global supply chains and increasing costs for consumers worldwide.

- Examples of affected US industries: American farmers, particularly soybean producers, were significantly impacted, along with manufacturers of various goods.

- Increased costs for consumers in both countries: The tariffs led to higher prices for consumers in both the US and China as businesses passed on increased costs.

- Shift in global trade patterns: The trade war forced businesses to reconsider their supply chains, leading to some diversification away from both the US and China.

H2: Long-Term Restructuring of Global Supply Chains (2020-2025):

H3: "De-globalization" and Reshoring: The tariffs accelerated a pre-existing trend: companies are actively seeking to diversify their manufacturing bases, reducing over-reliance on China as a single manufacturing hub. This "de-globalization" manifests as reshoring (returning production to the home country) and nearshoring (moving production to nearby countries).

- Examples of companies reshoring or nearshoring operations: Many companies in the apparel, electronics, and automotive industries have either begun reshoring or moved production to countries like Vietnam, Mexico, and India.

- Impact on manufacturing employment in different countries: While some manufacturing jobs have returned to the US and other countries, the impact on employment varies widely depending on industry and location.

- Increased costs associated with reshoring: Reshoring often involves higher labor costs and logistical challenges compared to manufacturing in China.

H3: Rise of Regional Trade Agreements: The disruption caused by the tariffs has spurred increased interest in regional trade agreements as a means of promoting stability and predictability in trade.

- Examples of new or strengthened regional trade pacts: The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) are examples of significant regional trade agreements gaining traction.

- Impact on international trade patterns: These agreements are reshaping global trade flows, creating new opportunities and challenges for businesses.

- Opportunities and challenges for businesses: Businesses need to adapt to these evolving regional trade dynamics, navigating the complexities of new regulations and market access.

H2: Geopolitical Implications and Future Outlook (2025 and Beyond):

H3: Strained US-China Relations: Trump's 30% tariffs significantly damaged US-China relations, extending beyond mere economic issues.

- Increased tensions in other areas: The trade war intensified tensions in areas like technology, intellectual property, and human rights.

- Potential for future trade disputes: The underlying causes of the trade conflict remain, suggesting a continued potential for future disputes.

- Impact on global stability: The strained relationship between the US and China has implications for global stability and cooperation on various international issues.

H3: Predicting the Economic Landscape Post-2025: The lingering effects of Trump's 30% tariffs will continue to shape the economic landscape for years to come.

- Potential scenarios for US-China trade relations: Scenarios range from continued tension and potential further tariffs to a gradual de-escalation and a more stable, albeit different, relationship.

- Predictions for global trade patterns: Global trade patterns will likely remain more fragmented and regionally focused, with less reliance on a single manufacturing hub.

- The lasting impact on economic growth in both countries: The long-term economic impact on both the US and China is still unfolding, with potential for both opportunities and challenges.

Conclusion:

The imposition of "Trump's 30% Tariffs on China" had immediate and profound short-term economic shockwaves, but its lasting impact is reshaping global supply chains, intensifying geopolitical tensions, and influencing trade patterns even today. Understanding the lasting impact of these tariffs is crucial for navigating the evolving global economic landscape. The shift towards regional trade agreements and the ongoing restructuring of global supply chains are key takeaways. Stay informed on the latest developments in US-China trade relations to effectively plan for the future and mitigate potential risks associated with the continued impact of these tariffs.

Featured Posts

-

Medicaid Cuts Fuel Republican Infighting

May 18, 2025

Medicaid Cuts Fuel Republican Infighting

May 18, 2025 -

A Comprehensive Look At Trumps Aerospace Deals What We Know What We Dont

May 18, 2025

A Comprehensive Look At Trumps Aerospace Deals What We Know What We Dont

May 18, 2025 -

Confortos Spring Struggles A Look At His Early Season Performance

May 18, 2025

Confortos Spring Struggles A Look At His Early Season Performance

May 18, 2025 -

Roucou Hong Kong A Cheese Lovers Omakase Experience

May 18, 2025

Roucou Hong Kong A Cheese Lovers Omakase Experience

May 18, 2025 -

Amanda Bynes A Classmates Perspective On Past Incidents

May 18, 2025

Amanda Bynes A Classmates Perspective On Past Incidents

May 18, 2025

Latest Posts

-

Amanda Bynes And Only Fans Navigating Life After Hollywood

May 18, 2025

Amanda Bynes And Only Fans Navigating Life After Hollywood

May 18, 2025 -

Amanda Bynes Seeks New Career Path On Only Fans

May 18, 2025

Amanda Bynes Seeks New Career Path On Only Fans

May 18, 2025 -

Amanda Bynes Only Fans Launch Photos And Recent Public Appearance

May 18, 2025

Amanda Bynes Only Fans Launch Photos And Recent Public Appearance

May 18, 2025 -

Post Only Fans Amanda Bynes Seen Out With A Friend

May 18, 2025

Post Only Fans Amanda Bynes Seen Out With A Friend

May 18, 2025 -

Amanda Bynes Spotted After Joining Only Fans

May 18, 2025

Amanda Bynes Spotted After Joining Only Fans

May 18, 2025