Important Information For BigBear.ai (BBAI) Investors Regarding Legal Action

Table of Contents

Current Legal Actions Against BigBear.ai (BBAI)

BigBear.ai is currently facing several legal challenges that could significantly impact its stock price and future performance. These actions involve allegations of serious financial misconduct, demanding careful consideration by all investors. Understanding the nature and scope of these legal battles is paramount for protecting your investment.

The allegations against BBAI primarily revolve around claims of securities fraud, misleading statements, and potential financial irregularities. These claims suggest that the company may have provided inaccurate or incomplete information to investors, leading to inflated stock valuations. This type of litigation carries substantial risks for shareholders.

Here's a summary of some key legal actions:

-

Case 1: Doe v. BigBear.ai, filed January 26, 2024, in the Southern District of New York. This class-action lawsuit alleges securities fraud related to undisclosed risks associated with a major government contract. Plaintiffs claim misleading statements inflated the BBAI stock price. Potential impact: Significant negative impact on stock price pending resolution.

-

Case 2: SEC Investigation (ongoing). The Securities and Exchange Commission is conducting an investigation into BigBear.ai's accounting practices. The scope and nature of the investigation remain undisclosed. Potential impact: Depending on findings, penalties and further stock price declines are possible.

-

Case 3: Smith et al. v. BigBear.ai, filed February 15, 2024, in the District Court of California. This lawsuit focuses on alleged material misstatements concerning the company's revenue projections and financial stability. Potential impact: Significant negative impact on the company's reputation and stock price.

Understanding Your Rights as a BigBear.ai (BBAI) Investor

As a BBAI investor facing these legal challenges, it's vital to understand your rights and the available recourse. Securities litigation offers avenues for seeking compensation for losses resulting from alleged fraud or misrepresentation.

Investors have several options:

- Joining a class-action lawsuit: This allows you to participate in collective legal action against BigBear.ai, potentially reducing individual legal costs.

- Individual litigation: You can file an individual lawsuit, but this option generally entails higher legal costs.

- Consulting a securities attorney: A qualified attorney specializing in securities law can advise you on your rights and options.

Remember these key rights:

- Right to seek compensation for losses: If the allegations prove true, you may be entitled to financial compensation for losses incurred due to the alleged wrongdoing.

- Right to participate in class-action lawsuits: Joining a class action simplifies the legal process and reduces costs.

- Right to consult with a securities attorney: Seek expert legal counsel to understand your options and protect your interests.

- Importance of preserving relevant documents: Retain all investment-related documents, including trade confirmations and account statements, as they may be crucial evidence.

Assessing the Risks Associated with Investing in BBAI

The ongoing legal actions present several significant risks for BBAI investors. The uncertainty surrounding the outcomes of these lawsuits creates a volatile investment climate.

Key risks include:

- Potential for further declines in stock price: Negative publicity and ongoing legal battles can lead to continued downward pressure on BBAI's stock price.

- Uncertainty surrounding the outcome of legal proceedings: The unpredictable nature of litigation creates significant investment risk.

- Reputational damage to the company: Negative media coverage and legal allegations can severely damage the company's reputation, affecting future business prospects.

- Potential for increased regulatory scrutiny: The SEC investigation could lead to increased regulatory oversight and potential penalties for BBAI.

Resources for BigBear.ai (BBAI) Investors

Staying informed is crucial. Access reliable sources to monitor the legal situation and potential impacts on your investment:

- SEC Filings (EDGAR): Review BigBear.ai's SEC filings for official disclosures and updates.

- Law Firm Websites: Websites of law firms handling BBAI-related litigation often provide updates and information for potential plaintiffs.

- Financial News Outlets: Reputable financial news sources provide ongoing coverage of the legal actions against BBAI.

Conclusion: Staying Informed as a BigBear.ai (BBAI) Investor

The legal actions against BigBear.ai present considerable challenges for investors. Understanding your rights, assessing the risks, and staying informed are crucial for protecting your investment. Remember to consult with legal and financial professionals for personalized advice. Proactively managing your investment in light of Important Information for BigBear.ai (BBAI) Investors Regarding Legal Action is essential. Regularly review reliable news sources and seek professional guidance to make informed decisions and protect your portfolio.

Featured Posts

-

From Ragbrai To Daily Rides Scott Savilles Love Of Biking

May 21, 2025

From Ragbrai To Daily Rides Scott Savilles Love Of Biking

May 21, 2025 -

Tigers 8 6 Win Over Rockies A Deeper Look

May 21, 2025

Tigers 8 6 Win Over Rockies A Deeper Look

May 21, 2025 -

Metagrafi Giakoymaki Endiaferon Apo Omades Tis Los Antzeles

May 21, 2025

Metagrafi Giakoymaki Endiaferon Apo Omades Tis Los Antzeles

May 21, 2025 -

Work From Home

May 21, 2025

Work From Home

May 21, 2025 -

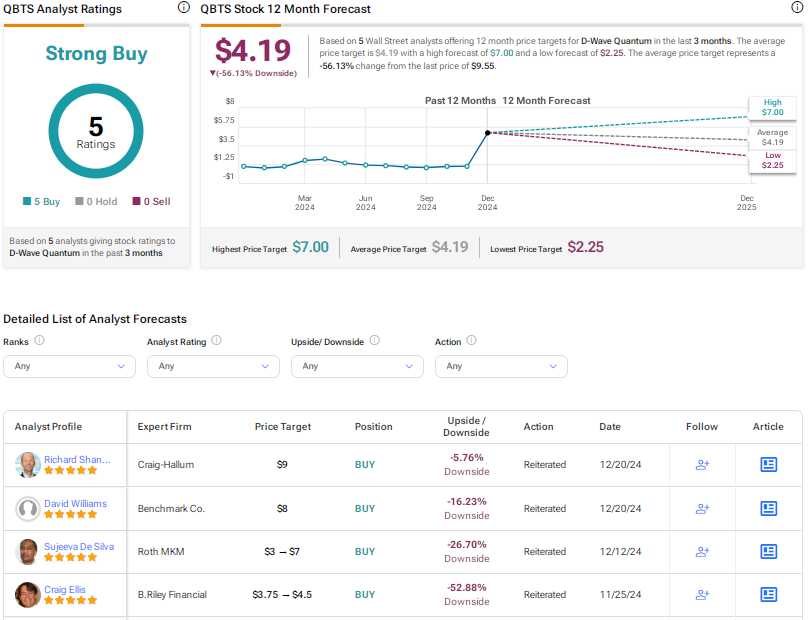

Mondays Market Activity Why Did D Wave Quantum Qbts Stock Go Up

May 21, 2025

Mondays Market Activity Why Did D Wave Quantum Qbts Stock Go Up

May 21, 2025