Increased China-US Trade: Exporters Scramble Before Trade Deal Expiry

Table of Contents

The Pressure Mounts: Understanding the Impending Trade Deal Expiry

The current US-China trade deal, while offering periods of relative stability, is nearing its expiration date, creating significant uncertainty for businesses involved in the bilateral trade relationship. The implications of this expiry are far-reaching, impacting various industries and potentially reshaping global supply chains. The lack of clarity regarding future trade policies adds another layer of complexity.

- Increased tariffs on specific goods: The expiry could lead to the re-imposition or increase of tariffs on a wide range of goods, significantly impacting import and export costs. This is particularly concerning for businesses heavily reliant on China for sourcing or as a key export market.

- Potential disruption to established supply chains: Years of established supply chains built around the existing trade deal could face significant disruption, forcing businesses to find alternative suppliers and logistics solutions. This adds lead times and costs.

- Uncertainty regarding future trade policies: The lack of clear communication regarding the future trade relationship between the US and China creates a high level of uncertainty, making it difficult for businesses to plan effectively for the future. This uncertainty discourages investment and hinders long-term strategic planning.

- Impact on consumer prices: Increased tariffs and supply chain disruptions will likely translate to higher prices for consumers, impacting purchasing power and potentially slowing economic growth in both countries.

Exporters' Strategies: Adapting to a Changing Trade Landscape

Faced with the looming expiry of the US-China trade deal, exporters are employing various strategies to mitigate risks and navigate the changing trade landscape. Diversification is a key theme, with businesses exploring alternative markets and sourcing options to reduce reliance on a single trading partner.

- Shifting sourcing locations: Many businesses are actively seeking alternative sourcing locations, particularly in Southeast Asia, to diversify their supply chains and reduce dependence on China. This involves significant investments in establishing new relationships and logistical arrangements.

- Negotiating contracts to minimize tariff exposure: Exporters are negotiating contracts with suppliers and buyers to try to minimize their exposure to potential tariff increases. This may involve longer-term contracts with fixed pricing or other risk-mitigation clauses.

- Investing in new technologies: Investments in automation, technology, and improved efficiency are crucial to enhance competitiveness and reduce reliance on specific geographic locations for production. This includes adopting advanced manufacturing technologies and improving inventory management systems.

- Exploring alternative trade agreements and partnerships: Businesses are exploring opportunities under other trade agreements and forging new partnerships in different regions to diversify their export markets and access new opportunities. This requires significant research and understanding of different international trade regulations.

The Role of Logistics and Supply Chain Management

Efficient logistics and supply chain management play a crucial role in mitigating the risks associated with the expiring trade deal. Real-time data visibility and flexible supply chain strategies are paramount for businesses to remain competitive.

- Investment in advanced logistics technology: Businesses are investing in technologies like blockchain, AI, and IoT to enhance supply chain visibility, improve tracking, and optimize logistics operations. This ensures greater agility and resilience in responding to disruptions.

- Developing robust risk management strategies for supply chain disruptions: Proactive risk management, including scenario planning and contingency measures, is crucial for minimizing the impact of unexpected events, such as port congestion, political instability, and natural disasters.

- Improved inventory management techniques: Effective inventory management strategies, including demand forecasting and optimized stock levels, are critical to ensuring smooth operations and avoiding stockouts or excessive inventory buildup.

- Strategic partnerships with reliable logistics providers: Building strong relationships with reliable logistics providers, including freight forwarders and customs brokers, is vital for seamless cross-border shipments and efficient supply chain operations.

Economic Implications: The Wider Impact of Shifting China-US Trade

The changing China-US trade relationship has significant economic consequences, both positive and negative, impacting global economic growth and market stability. The potential ramifications are far-reaching and interconnected.

- Impact on inflation and consumer prices globally: Increased tariffs and supply chain disruptions can contribute to inflation, impacting consumer purchasing power and economic growth in many countries. This necessitates careful monitoring and mitigation strategies.

- Potential shifts in global manufacturing landscapes: The changing trade dynamics could lead to significant shifts in global manufacturing landscapes, as businesses seek alternative production locations and adjust their supply chain strategies. This presents both opportunities and challenges for various regions.

- Geopolitical implications of trade tensions: Trade tensions between the US and China have broader geopolitical implications, impacting international relations and potentially leading to increased instability in certain regions.

- Opportunities for growth in other emerging markets: While the changes present challenges, they also create opportunities for growth in other emerging markets that can offer alternative sources of supply or new export destinations.

Conclusion

The upcoming expiration of the US-China trade deal is forcing exporters to reassess their strategies and adapt to an evolving global trade environment. Successful navigation of this period requires proactive planning, diversification, and a robust understanding of the evolving geopolitical landscape. Proactive risk management, efficient logistics, and investment in new technologies are critical for mitigating potential disruptions and capitalizing on emerging opportunities.

Call to Action: Understanding the complexities of increased China-US trade is crucial for businesses. Stay informed on the latest developments and proactively adapt your strategies to minimize risk and capitalize on opportunities in this dynamic market. Don't wait for the trade deal expiry to impact your business negatively; plan for increased China-US trade now.

Featured Posts

-

James Wiltshires 10 Years At The Border Mail Reflections On A Photography Career

May 23, 2025

James Wiltshires 10 Years At The Border Mail Reflections On A Photography Career

May 23, 2025 -

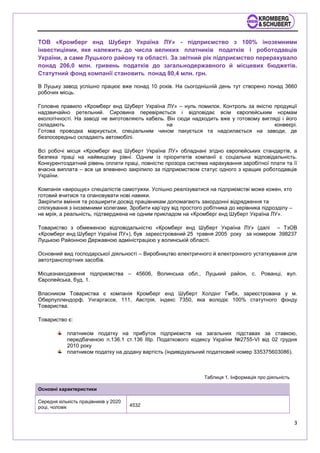

Optimizatsiya Gospodarskoyi Diyalnosti Tov Z Odnim Vlasnikom

May 23, 2025

Optimizatsiya Gospodarskoyi Diyalnosti Tov Z Odnim Vlasnikom

May 23, 2025 -

The Who The Untold Story Behind Their Iconic Name

May 23, 2025

The Who The Untold Story Behind Their Iconic Name

May 23, 2025 -

Ranking The 10 Scariest Arthouse Horror Films

May 23, 2025

Ranking The 10 Scariest Arthouse Horror Films

May 23, 2025 -

Memorial Day Weekend Nyc Forecast Rain Chances

May 23, 2025

Memorial Day Weekend Nyc Forecast Rain Chances

May 23, 2025

Latest Posts

-

Jonathan Groff Eyes Tony Award Glory With Just In Time

May 23, 2025

Jonathan Groff Eyes Tony Award Glory With Just In Time

May 23, 2025 -

Is Jonathan Groffs Just In Time Performance Tony Worthy

May 23, 2025

Is Jonathan Groffs Just In Time Performance Tony Worthy

May 23, 2025 -

Jonathan Groff Tony Award Nomination Potential For Just In Time

May 23, 2025

Jonathan Groff Tony Award Nomination Potential For Just In Time

May 23, 2025 -

Jonathan Groff And Just In Time A Tony Awards Prediction

May 23, 2025

Jonathan Groff And Just In Time A Tony Awards Prediction

May 23, 2025 -

Could Jonathan Groff Make Tony Awards History With Just In Time

May 23, 2025

Could Jonathan Groff Make Tony Awards History With Just In Time

May 23, 2025