Increased Ethereum Network Activity: Analysis Of Recent Address Interactions

Table of Contents

Analyzing Transaction Volume and Gas Fees

Understanding the relationship between transaction volume and overall Ethereum network activity is crucial. Higher transaction volume indicates increased user engagement and network usage. However, this increase often correlates with rising gas fees, the cost of executing transactions on the Ethereum blockchain. High gas fees can hinder user participation, creating network congestion and impacting the user experience.

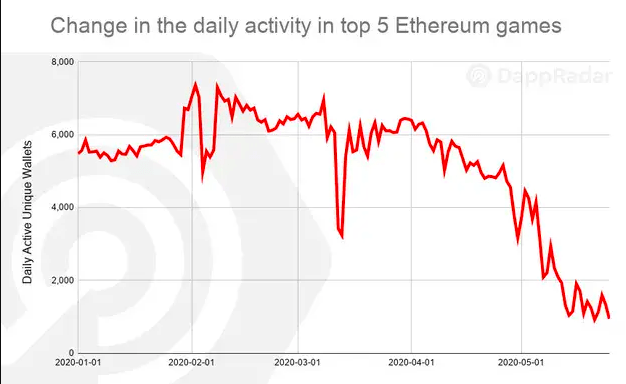

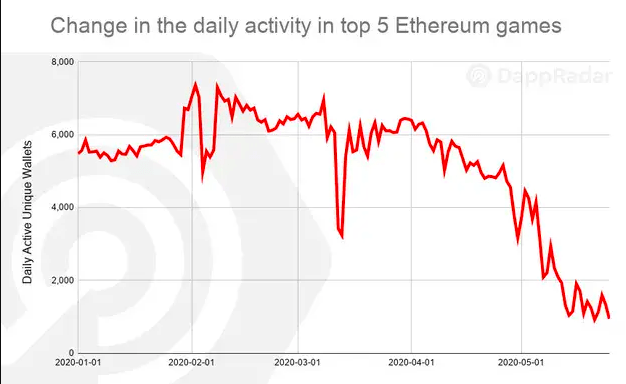

Let's look at some recent data. [Insert Chart/Graph 1: Transaction Volume over the last 3 months]. As the chart shows, we observed several notable spikes in transaction volume.

- Week of October 23rd: A significant surge driven primarily by [cite specific event, e.g., a major NFT drop].

- Week of November 12th: Another peak potentially linked to [cite specific event, e.g., a new DeFi protocol launch].

- Average Gas Fee Comparison (October - November): The average gas fee increased by approximately X% during peak periods, compared to the average for the previous month. [Insert Chart/Graph 2: Gas Fee fluctuation during these periods]. This fluctuation is often a direct result of increased demand for network resources.

Potential reasons for gas fee volatility include: increased demand, network upgrades, and the overall market sentiment towards Ethereum.

The Role of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) plays a monumental role in driving Ethereum network activity. The numerous DeFi protocols built on Ethereum facilitate a vast array of financial operations, significantly contributing to the overall transaction volume.

- Top DeFi Protocols: Protocols like Uniswap, Aave, and Compound consistently rank among the top users of the Ethereum network, processing millions of transactions daily.

- Lending, Borrowing, and Staking Activity: The increasing popularity of DeFi lending and borrowing platforms, along with staking activities for yield farming, generates a massive number of address interactions.

- Impact of DeFi Innovations: Continuous innovations in DeFi, such as automated market makers (AMMs) and decentralized exchanges (DEXs), further fuel network activity and, simultaneously, challenge Ethereum's scalability.

Non-Fungible Tokens (NFTs) and Their Influence

The explosive growth of the NFT market has significantly impacted Ethereum network activity. The minting and trading of NFTs require numerous transactions on the Ethereum blockchain, leading to substantial increases in transaction volume and gas fees.

- Major NFT Sales and Drops: High-profile NFT drops and sales events, like those on OpenSea and Rarible, often cause massive spikes in network activity.

- NFT Marketplace Transaction Data: Analysis of transaction data from major NFT marketplaces reveals a clear correlation between NFT trading volume and Ethereum network congestion.

- NFT Hype and Gas Fees: Periods of intense NFT hype are often accompanied by significantly higher gas fees, as users compete to mint and trade NFTs.

Smart Contract Interactions and their Significance

The widespread use of smart contracts is another crucial driver of Ethereum network activity. Smart contracts automate various processes, from DeFi transactions to NFT minting, generating a high volume of interactions on the network.

- Significant Smart Contract Deployments: The deployment of complex smart contracts, particularly those related to DeFi and NFTs, leads to a noticeable increase in network activity.

- Types of Smart Contract Interactions: Smart contract interactions encompass creation, execution, and function calls, all contributing to the overall transaction volume.

- Importance of Smart Contract Security: The security and proper auditing of smart contracts are crucial for maintaining the stability and reliability of the entire Ethereum network. Bugs or vulnerabilities can have severe consequences.

Conclusion: Understanding and Leveraging Increased Ethereum Network Activity

This analysis reveals that increased Ethereum network activity stems from a confluence of factors: the explosive growth of DeFi, the booming NFT market, and the ever-increasing reliance on smart contracts. Monitoring transaction volume, gas fees, and smart contract usage is essential for understanding the overall health and future trajectory of the Ethereum ecosystem. Future trends suggest continued growth, but also the need for scalability solutions to mitigate congestion and high gas fees. Stay informed about Ethereum network activity to make informed decisions regarding your investments and participation in this dynamic decentralized ecosystem. For deeper analysis, explore resources like Etherscan and various blockchain analytics platforms to track Ethereum address interactions and network metrics.

Featured Posts

-

Yevrokubki Detalniy Oglyad Matchiv Ps Zh Proti Aston Villi

May 08, 2025

Yevrokubki Detalniy Oglyad Matchiv Ps Zh Proti Aston Villi

May 08, 2025 -

Angels Outlast Dodgers Amidst Shortstop Absences

May 08, 2025

Angels Outlast Dodgers Amidst Shortstop Absences

May 08, 2025 -

Analyst Predicts 4 000 Ethereum Price Cross X Indicators Point To Institutional Accumulation

May 08, 2025

Analyst Predicts 4 000 Ethereum Price Cross X Indicators Point To Institutional Accumulation

May 08, 2025 -

V Mware Costs To Soar 1 050 At And T Details Broadcoms Extreme Price Increase

May 08, 2025

V Mware Costs To Soar 1 050 At And T Details Broadcoms Extreme Price Increase

May 08, 2025 -

Los Dodgers Y Su Asombrosa Racha Acercandose Al Record De Los Yankees

May 08, 2025

Los Dodgers Y Su Asombrosa Racha Acercandose Al Record De Los Yankees

May 08, 2025

Latest Posts

-

Altcoins 5880 Projected Rally Why Crypto Whales Are Betting Big

May 08, 2025

Altcoins 5880 Projected Rally Why Crypto Whales Are Betting Big

May 08, 2025 -

Best Krypto Stories Of All Time A Comprehensive List

May 08, 2025

Best Krypto Stories Of All Time A Comprehensive List

May 08, 2025 -

5880 Price Surge Predicted Is This New Xrp The Next Big Crypto Investment

May 08, 2025

5880 Price Surge Predicted Is This New Xrp The Next Big Crypto Investment

May 08, 2025 -

Is Supermans Dcu Debut Coming Sooner Than Expected

May 08, 2025

Is Supermans Dcu Debut Coming Sooner Than Expected

May 08, 2025 -

Unforgettable Krypto Stories A Readers Guide

May 08, 2025

Unforgettable Krypto Stories A Readers Guide

May 08, 2025