Increased Profits At China Life: A Result Of Robust Investments

Table of Contents

Strategic Asset Allocation: The Cornerstone of China Life's Success

China Life's remarkable success stems from a meticulously crafted approach to asset allocation, a cornerstone of their investment philosophy. Their strategy prioritizes portfolio diversification, spreading investments across a range of asset classes to mitigate risk and optimize returns. This diversified approach minimizes exposure to any single market downturn, ensuring consistent profitability even amidst market volatility.

- Percentage breakdown: While precise figures aren't publicly available for all periods, China Life's portfolio typically includes a diversified mix of equities (a significant portion), fixed-income securities (bonds), real estate investments, and alternative investments (such as private equity and infrastructure projects).

- Successful asset allocation decisions: Their strategic shift towards alternative investments in recent years, particularly in infrastructure projects within China, has yielded substantial returns. Similarly, strategic adjustments to their bond portfolio in response to fluctuating interest rates have demonstrated the effectiveness of active portfolio management.

- Risk management: Integrated risk management is paramount. China Life utilizes sophisticated models and stress testing to assess and manage potential risks associated with their diverse asset holdings. This proactive approach ensures they remain resilient against unexpected market fluctuations.

Keywords: Asset allocation, portfolio diversification, risk management, China Life investments, strategic investment

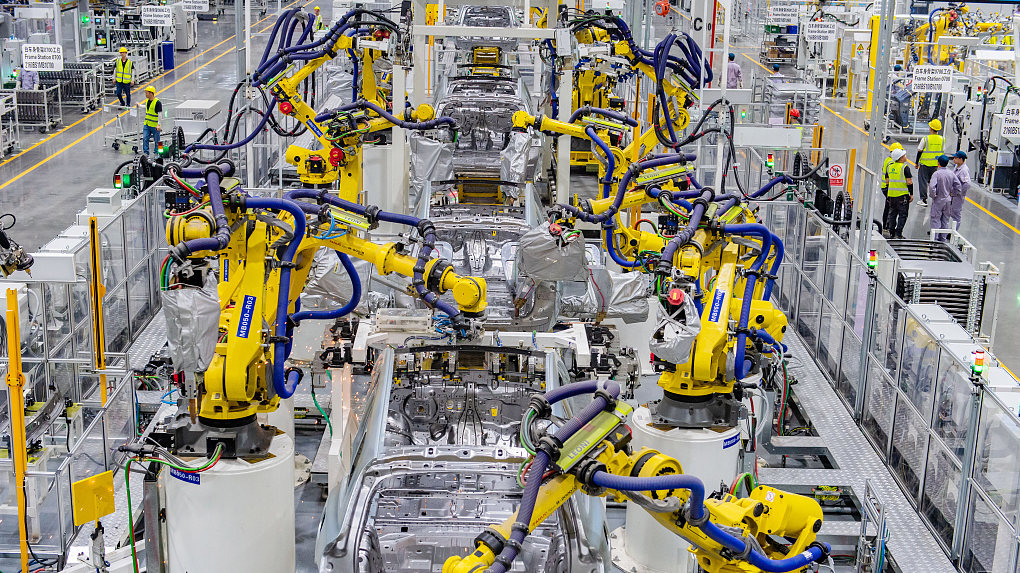

High-Yielding Equity Investments Fueling Profit Growth

China Life's equity investment performance has been a significant driver of their increased profits. Their success can be attributed to a combination of skillful stock selection and astute market timing. The company's investment team employs a rigorous research process, identifying promising companies poised for growth.

- Successful equity investments: China Life has demonstrated expertise in identifying high-growth sectors within the Chinese economy. Investments in technology companies involved in 5G infrastructure development and renewable energy firms are examples of their successful strategic choices.

- Key contributing sectors: The technology and infrastructure sectors have notably contributed to their equity returns. Their investments in these high-growth areas have been carefully chosen to align with the long-term economic growth strategy of the Chinese government.

- Investment approach: While their approach blends elements of both value and growth investing, a core component is their long-term perspective. They aren't driven by short-term market trends, preferring to hold onto successful investments for extended periods to maximize returns.

Keywords: Equity investment, stock market performance, China stock market, high-yield investments, investment returns

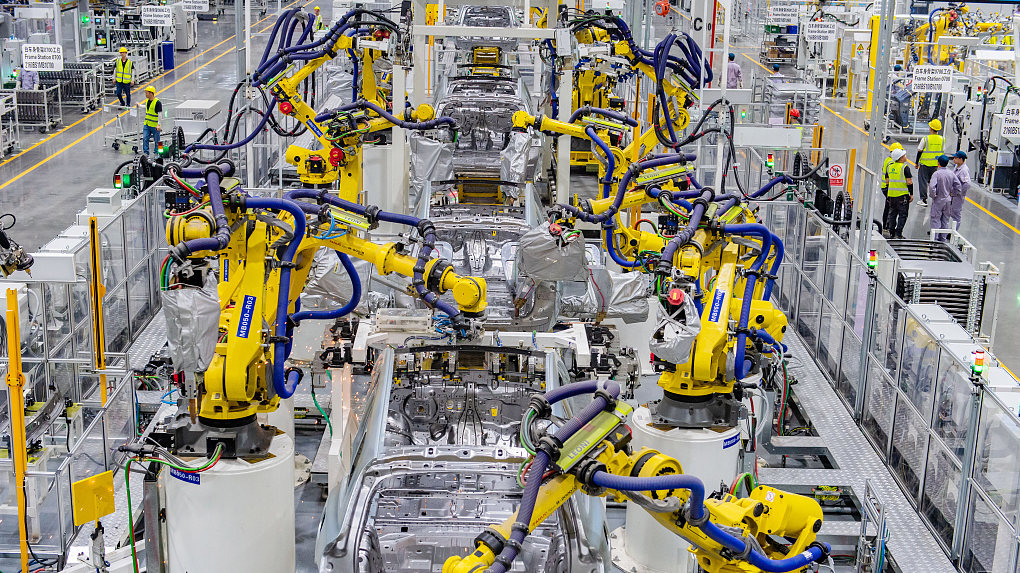

Diversification Beyond Borders: International Investment Strategies

China Life's commitment to international diversification significantly contributes to both profit growth and risk reduction. By expanding their investments beyond China's borders, they reduce their reliance on a single market's performance and gain access to opportunities unavailable domestically.

- Successful international investments: Examples include investments in established global companies with solid track records and significant exposure to international markets. They have also strategically invested in emerging markets, recognizing the potential for growth in these regions.

- Geographical diversification: Their international portfolio spans diverse geographical regions, including developed economies in North America and Europe, as well as high-growth emerging markets across Asia and beyond. This careful diversification mitigates risks associated with regional economic downturns.

- Benefits of global diversification: Global diversification is a key component in mitigating risk and tapping into opportunities in a rapidly evolving global landscape. It also provides access to new markets and investment vehicles, enhancing returns while reducing overall portfolio volatility.

Keywords: International investment, global diversification, offshore investments, foreign investment, risk mitigation

The Role of Technology and Data Analytics in Investment Decisions

China Life’s integration of technology and data analytics is transforming its investment approach. This utilization of cutting-edge tools enhances decision-making, optimizes portfolios, and improves overall investment returns.

- Technologies employed: China Life leverages advanced technologies, including Artificial Intelligence (AI) and machine learning, to analyze vast datasets, identify investment trends, and assess risk more effectively. Algorithmic trading strategies are also implemented for greater efficiency.

- Data analytics for risk assessment: Data analytics tools provide detailed risk profiles for individual assets and the portfolio as a whole, enabling proactive risk management. This allows for timely adjustments to the portfolio based on market conditions and potential threats.

- Impact of technology: The integration of technology and data analytics has significantly streamlined the investment process, enabling more informed and timely decisions. This has led to improved portfolio optimization and enhanced risk management, which translates directly to increased profitability.

Keywords: Fintech, data analytics, AI in finance, investment technology, algorithmic trading

Conclusion: Understanding the Drivers of Increased Profits at China Life

China Life's significant profit increase is a direct outcome of a multi-faceted strategy encompassing robust investment strategies. Strategic asset allocation, high-yielding equity investments, international diversification, and the innovative use of technology and data analytics have all played crucial roles. Their success underscores the importance of a well-defined investment strategy that prioritizes diversification, risk management, and the application of advanced technologies. By understanding the principles behind China Life's success, businesses can learn valuable lessons about implementing robust investment strategies to achieve their own financial goals. Learn more about China Life's innovative investment approach and how it leads to increased profits.

Keywords: China Life, increased profits, robust investments, investment strategies, financial success

Featured Posts

-

Gia Tieu Hom Nay Phan Tich Thi Truong Va Tac Dong Den Nong Dan

May 01, 2025

Gia Tieu Hom Nay Phan Tich Thi Truong Va Tac Dong Den Nong Dan

May 01, 2025 -

Is Xrp A Good Investment Exploring The Potential Of Ripples Crypto

May 01, 2025

Is Xrp A Good Investment Exploring The Potential Of Ripples Crypto

May 01, 2025 -

Dragons Den Success Stories And Strategies

May 01, 2025

Dragons Den Success Stories And Strategies

May 01, 2025 -

Penn University Trump Administrations Order To Delete Transgender Swimmers Records

May 01, 2025

Penn University Trump Administrations Order To Delete Transgender Swimmers Records

May 01, 2025 -

Understanding Michael Sheens Recent 1 Million Philanthropic Act

May 01, 2025

Understanding Michael Sheens Recent 1 Million Philanthropic Act

May 01, 2025

Latest Posts

-

Soski S Ovechkinym Ot Kinopoiska Podarok Novorozhdennym

May 01, 2025

Soski S Ovechkinym Ot Kinopoiska Podarok Novorozhdennym

May 01, 2025 -

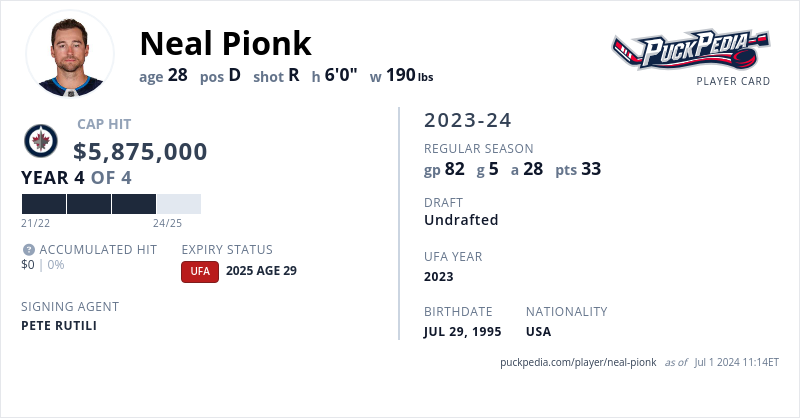

The Latest On Neal Pionk News Scores And Analysis

May 01, 2025

The Latest On Neal Pionk News Scores And Analysis

May 01, 2025 -

Celtics Beat Cavaliers 4 Key Takeaways From Derrick Whites Heroics

May 01, 2025

Celtics Beat Cavaliers 4 Key Takeaways From Derrick Whites Heroics

May 01, 2025 -

Neal Pionk Contract Status And Future Outlook

May 01, 2025

Neal Pionk Contract Status And Future Outlook

May 01, 2025 -

Neal Pionk Injury Updates And Performance Highlights

May 01, 2025

Neal Pionk Injury Updates And Performance Highlights

May 01, 2025