Increased US-China Trade Activity Ahead Of Trade Truce

Table of Contents

Rising Import and Export Volumes Indicate a Potential Breakthrough

The most compelling evidence of a potential thaw in US-China relations lies in the rapidly increasing import and export volumes. Data from various sources, including official government statistics and industry reports like those from the U.S. Census Bureau and the China Customs, reveal a notable uptick in bilateral trade volume. This growth signifies a positive shift in economic indicators, suggesting both countries are actively engaging in increased trade activity.

-

Specific Sector Growth: Significant growth is observed in several key sectors. Technology imports from China to the US, particularly in components and electronics, have shown remarkable increases. Simultaneously, agricultural exports from the US to China, including soybeans and other agricultural products, have also experienced a substantial boost.

-

Data Sources and Implications: These figures are substantiated by reports from major shipping companies and analyses of container traffic at key ports. The implications are far-reaching, indicating a potential rebalancing of the bilateral trade balance and stimulating economic growth in both nations. A sustained increase in trade volume could further strengthen the global economy.

-

Impact on Economies: The increased trade activity is injecting much-needed dynamism into both economies, supporting employment and driving economic growth. This positive momentum provides crucial momentum for further negotiations.

Easing of Trade Tensions Fuels Investor Confidence

The rising tide of US-China trade activity is directly impacting investor sentiment. The increased trade volume reflects a decrease in economic uncertainty surrounding the relationship, leading to a more positive outlook among investors. This shift is evident in stock market trends and renewed interest in foreign investment opportunities.

-

Stock Market Trends: As trade talks progress positively, stock markets, both in the US and China, have shown resilience and even experienced periods of growth, indicating investor confidence in the future of bilateral trade relations.

-

Investor Sentiment Shift: There's a noticeable improvement in investor sentiment, with a reduction in the perceived risk associated with investments in either market. This renewed optimism is encouraging new business collaborations and foreign direct investment between both countries.

-

Investment Driven by Confidence: Several major companies have announced new investments and expansion plans in both the US and China, directly fueled by this improved confidence and the expected easing of trade tensions. This positive feedback loop further strengthens the economic ties between the two nations.

Specific Examples of Increased Trade Activity

Beyond broad economic indicators, specific examples of increased US-China trade activity underscore the positive momentum. Numerous business partnerships and contract signings have solidified the trend. These real-world examples demonstrate the tangible benefits of a potential trade truce.

-

Successful Business Collaborations: For example, several technology companies have announced new joint ventures involving research, development, and manufacturing, benefiting from the complementary strengths of both nations. Similar collaborations are developing in other sectors such as manufacturing and renewable energy.

-

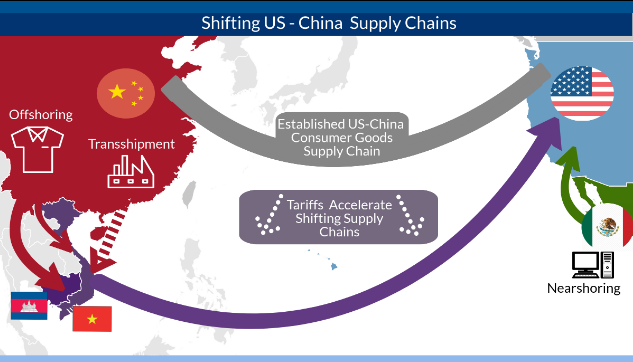

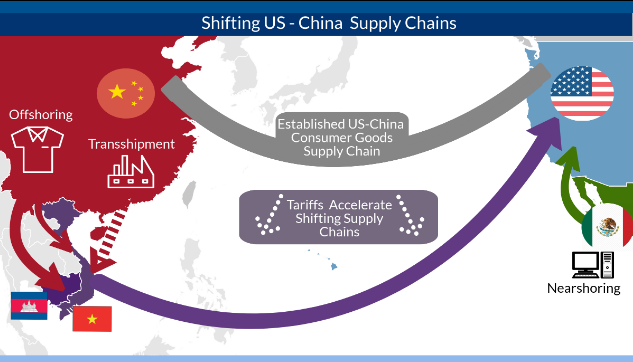

Specific Sectors: The resurgence of trade is particularly strong in areas such as consumer goods, where increased demand for Chinese-made products is met by a robust supply chain, and agriculture, as mentioned above.

-

Long-Term Implications: These collaborations are not just short-term gains; they build a foundation for a more integrated and interdependent economic relationship between the US and China, leading to long-term economic benefits for both sides.

Challenges and Uncertainties Remain

While the recent surge in US-China trade activity is encouraging, it's crucial to acknowledge the challenges and uncertainties that persist. A lasting trade truce requires continued cooperation and resolution of lingering disputes.

-

Unresolved Trade Disputes: Some trade disputes remain unresolved, and the possibility of future policy changes or unexpected geopolitical events remains. These could introduce new trade barriers or disrupt the positive momentum.

-

Potential Future Policy Changes: Both governments may introduce new policies that inadvertently impact trade. Therefore, it is crucial for businesses to closely monitor regulatory changes and adapt accordingly.

-

Importance of Continued Negotiation and Cooperation: Continued cooperation and pragmatic diplomacy are essential for maintaining and strengthening this positive trajectory in US-China trade relations.

Conclusion

Increased US-China trade activity is a strong indicator that a trade truce is nearing. The rising import and export volumes, the improved investor confidence, and the numerous examples of successful business collaborations all point toward a positive shift in bilateral economic relations. However, challenges remain, and continued vigilance and negotiation are crucial. Stay informed about the evolving situation and the potential impact of a US-China trade truce on global markets by following our updates on increased US-China trade activity. We will continue to provide insights into the ongoing developments in US-China trade relations and their impact on the global economic landscape.

Featured Posts

-

Europe First Macrons Appeal To Eu Leaders On Trade Policy

May 22, 2025

Europe First Macrons Appeal To Eu Leaders On Trade Policy

May 22, 2025 -

Real Madrid In Yeni Teknik Direktoerue Kim Olmali Ancelotti Mi Klopp Mu

May 22, 2025

Real Madrid In Yeni Teknik Direktoerue Kim Olmali Ancelotti Mi Klopp Mu

May 22, 2025 -

Wisconsin Gas Prices Increase Average Now 2 98 Per Gallon

May 22, 2025

Wisconsin Gas Prices Increase Average Now 2 98 Per Gallon

May 22, 2025 -

Love Monster Activities For Kids Creative And Educational Fun

May 22, 2025

Love Monster Activities For Kids Creative And Educational Fun

May 22, 2025 -

Controversa Fratilor Tate Bataie De Multime In Centrul Bucurestiului

May 22, 2025

Controversa Fratilor Tate Bataie De Multime In Centrul Bucurestiului

May 22, 2025