India-Pakistan Tensions Weigh On Indian Stock Market: Sensex And Nifty 50 Performance

Table of Contents

Historical Impact of India-Pakistan Tensions on the Indian Stock Market

Heightened India-Pakistan tensions have historically triggered volatility in the Indian stock market, impacting both the Sensex and Nifty 50 indices. These periods of uncertainty often lead to investor apprehension and capital flight, resulting in market corrections. Analyzing past instances helps understand potential future reactions.

-

1999 Kargil War: The Kargil conflict led to a significant sell-off, with the Sensex experiencing a considerable drop. Investor confidence plummeted due to the uncertainty surrounding the conflict's duration and potential economic consequences. The Nifty 50 mirrored this decline, reflecting the widespread concern among investors.

-

2001 Parliament Attack: The terrorist attack on the Indian Parliament triggered immediate market reactions. The Sensex and Nifty 50 saw sharp declines as investors reacted to the increased geopolitical risk. This event highlighted the vulnerability of the Indian stock market to sudden escalations in India-Pakistan tensions.

-

2008 Mumbai Attacks: Similar to previous events, the 2008 Mumbai attacks led to a considerable dip in both the Sensex and Nifty 50. Investor behavior reflected a flight to safety, with many choosing to liquidate their holdings amidst the heightened security concerns.

Analyzing investor behavior during these periods reveals a pattern: a short-term negative impact on market performance, followed by a gradual recovery as the situation stabilizes. However, the recovery speed and magnitude depend on various factors including the severity and duration of the crisis, as well as government response and global market conditions. The following chart illustrates the Sensex performance during these key periods (Illustrative chart would be placed here showing Sensex performance during mentioned years).

Current Tensions and Their Immediate Impact on Sensex and Nifty 50

The current geopolitical climate between India and Pakistan, while not experiencing large-scale conflict, still exhibits periods of heightened tension. Recent border skirmishes, political statements, and cross-border incidents contribute to market uncertainty. This uncertainty influences investor decisions, leading to fluctuations in the Sensex and Nifty 50.

-

Impact of recent border skirmishes or political statements: Even minor incidents can significantly impact investor sentiment, triggering sell-offs in certain sectors. News headlines and social media chatter often amplify these reactions.

-

Analysis of investor reaction to news headlines and social media sentiment: Rapid dissemination of information through social media platforms can accelerate market reactions, creating a self-reinforcing cycle of fear and uncertainty.

-

Specific sectors disproportionately affected: Sectors like defense experience short-term gains due to increased demand, while tourism and related sectors often suffer due to decreased travel and investor hesitancy. This highlights the varied and often contrasting impacts of India-Pakistan tensions on different parts of the Indian economy.

Analyzing the Relationship: Correlation vs. Causation

Attributing stock market fluctuations solely to India-Pakistan tensions is an oversimplification. While a correlation exists, it's crucial to distinguish this from causation. Numerous other factors influence Sensex and Nifty 50 performance, including:

-

Global market trends: Global economic downturns or uncertainties in international markets can significantly impact the Indian stock market, regardless of India-Pakistan relations.

-

Domestic economic policies: Government policies, economic reforms, and interest rate changes play a crucial role in shaping investor confidence and market performance.

-

Direct vs. Indirect Impacts: Direct impacts include immediate sell-offs following major incidents. Indirect impacts encompass longer-term effects on investor sentiment and foreign investment.

-

Role of Media Coverage and Speculation: Media reporting can significantly influence investor perception, often amplifying the impact of events.

Strategies for Investors During Periods of Heightened India-Pakistan Tensions

Navigating market volatility requires a strategic approach. Investors can mitigate risks through:

-

Long-term investment strategies: Focusing on long-term goals rather than reacting to short-term fluctuations is crucial.

-

Diversifying investments across different asset classes: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) reduces the impact of any single market downturn.

-

Staying informed about geopolitical events but avoiding emotional decision-making: Maintain awareness of geopolitical developments, but avoid making impulsive investment choices based on fear or speculation.

-

Considering hedging strategies to mitigate risk: Hedging strategies can help offset potential losses during periods of market uncertainty.

Conclusion

The relationship between India-Pakistan tensions and the performance of the Sensex and Nifty 50 is complex and multifaceted. While heightened tensions often lead to short-term volatility, it's crucial to consider other contributing factors. Informed decision-making and strategic risk management are crucial for investors navigating this dynamic market environment. Understanding the impact of India-Pakistan tensions on the Indian stock market is crucial for informed investment decisions. Stay informed about geopolitical developments and adopt appropriate strategies to safeguard your portfolio during periods of heightened uncertainty in the Indian stock market (Sensex and Nifty 50). Regularly monitor your investments and consult with financial advisors to navigate the complexities of this ever-changing landscape.

Featured Posts

-

Frances Nuclear Deterrent A Shared European Approach

May 10, 2025

Frances Nuclear Deterrent A Shared European Approach

May 10, 2025 -

Renewed Opposition To Ev Mandates From Car Dealerships

May 10, 2025

Renewed Opposition To Ev Mandates From Car Dealerships

May 10, 2025 -

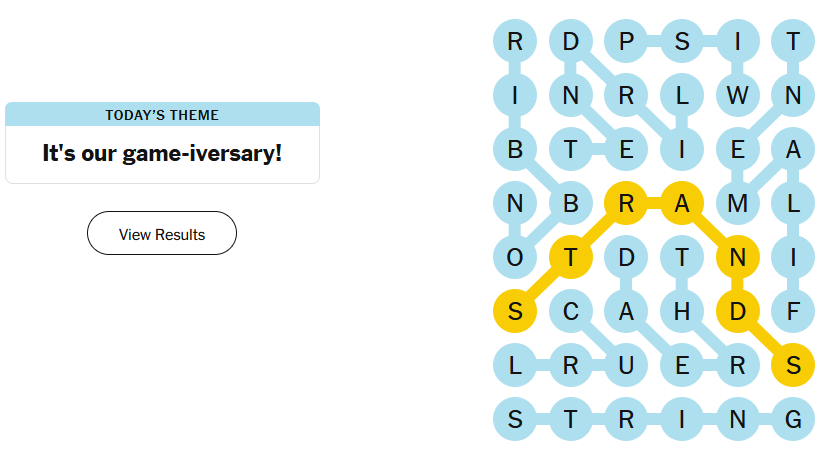

Nyt Strands Game 366 March 4th Complete Answers And Hints

May 10, 2025

Nyt Strands Game 366 March 4th Complete Answers And Hints

May 10, 2025 -

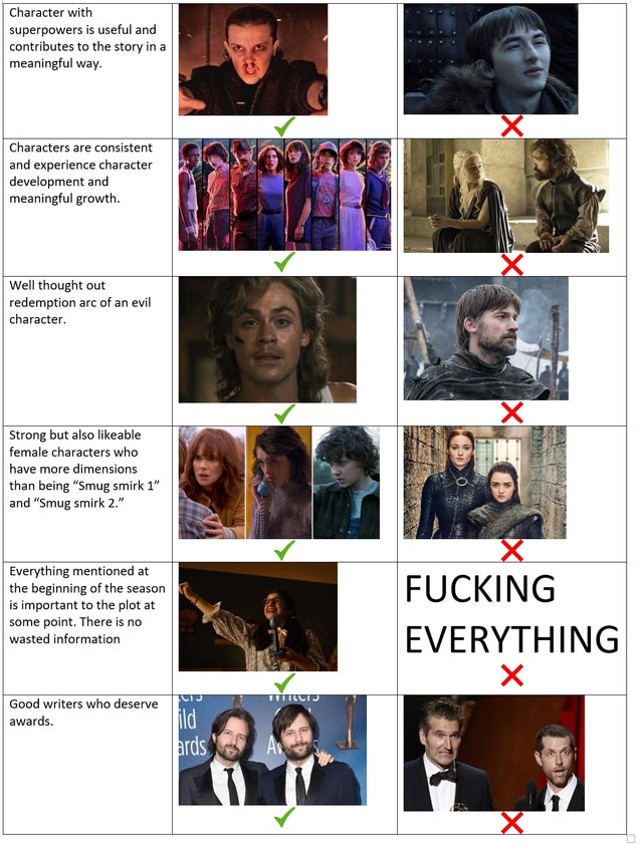

Stranger Things Vs It Stephen King Weighs In

May 10, 2025

Stranger Things Vs It Stephen King Weighs In

May 10, 2025 -

Apple At The Ai Frontier A Deep Dive Into Its Strengths And Weaknesses

May 10, 2025

Apple At The Ai Frontier A Deep Dive Into Its Strengths And Weaknesses

May 10, 2025