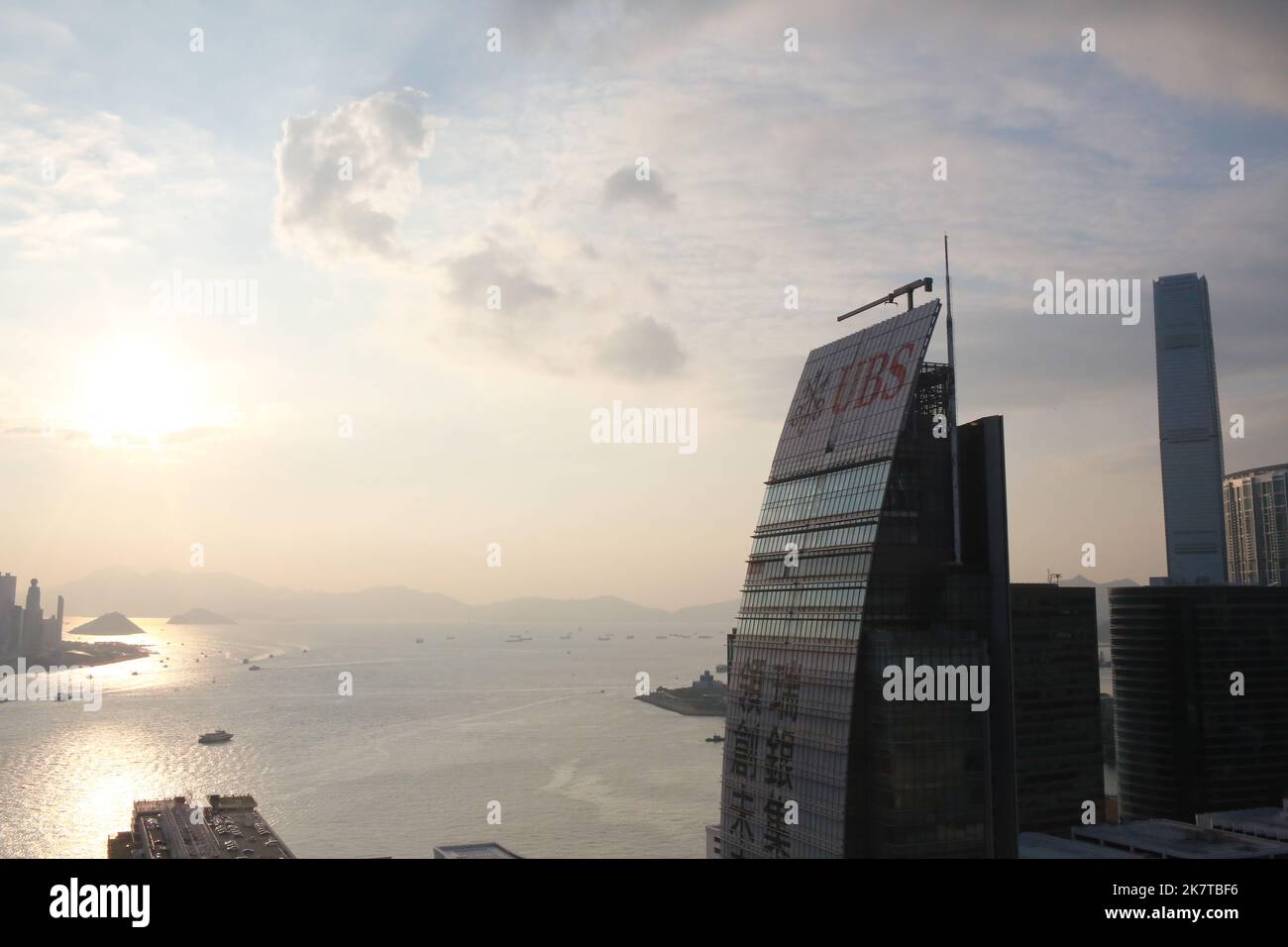

India Upgraded, Hong Kong Downgraded: UBS Investment Strategy Shift

Table of Contents

UBS's Rationale for Upgrading India

UBS's bullish stance on India stems from a confluence of factors pointing towards robust and sustained economic growth. The firm's upgrade is not simply a short-term prediction but a reflection of India's long-term potential as a global economic leader.

- Strong Economic Growth Projections: India's economy consistently outpaces many other emerging markets, with projections exceeding global averages for years to come. This sustained growth is fueled by a robust domestic market and increasing global demand for Indian goods and services.

- Demographic Dividend: India boasts a young and burgeoning population, a significant demographic advantage that fuels consumption, innovation, and workforce expansion. This "demographic dividend" is expected to propel further economic growth for decades.

- Government Reforms: The Indian government's commitment to economic reforms, including initiatives like "Make in India," aims to streamline regulations, attract foreign investment, and stimulate domestic manufacturing. These reforms are gradually improving the business environment and fostering increased economic activity.

- Infrastructure Development: Massive investments in infrastructure development—from roads and railways to digital connectivity—are modernizing the country and supporting economic expansion. This upgraded infrastructure is vital for attracting foreign investment and facilitating efficient business operations.

- Attractive Valuations: Despite strong growth, Indian equities often exhibit relatively attractive valuations compared to other established and emerging markets, presenting a potentially rewarding entry point for investors.

- Increasing Foreign Direct Investment (FDI): India is witnessing a significant influx of foreign direct investment, further bolstering economic growth and reinforcing investor confidence. This FDI fuels job creation, technological advancement, and overall economic development.

The "Make in India" initiative, for example, is actively promoting domestic manufacturing and attracting significant foreign investment, contributing directly to India's economic ascendancy. This government-led push is creating a more self-sufficient and resilient economy, less vulnerable to global economic shocks.

UBS's Reasons for Downgrading Hong Kong

In contrast to its positive outlook on India, UBS's downgrade of Hong Kong reflects growing concerns regarding geopolitical risks and economic uncertainty.

- Escalating Geopolitical Tensions: The escalating geopolitical tensions between China and the West have significantly impacted investor confidence in Hong Kong. This uncertainty creates a volatile investment environment, deterring long-term investments.

- Concerns about China's Economic Slowdown: China's economic slowdown, coupled with its increasingly assertive foreign policy, casts a long shadow over Hong Kong's economic prospects. Hong Kong's close economic ties with mainland China make it particularly vulnerable to these economic headwinds.

- Increased Political Uncertainty and Potential Regulatory Changes: Changes in political dynamics and the potential for further regulatory interventions in Hong Kong introduce significant uncertainty for businesses and investors. This uncertainty makes long-term planning and investment more challenging.

- Weakness in the Hong Kong Property Market: The Hong Kong property market, once a pillar of the economy, has shown signs of weakening, adding to the overall negative outlook. This weakening poses significant risks for investors heavily invested in Hong Kong real estate.

- Reduced Attractiveness Compared to Other Asian Investment Destinations: Compared to other dynamic Asian markets, Hong Kong's appeal has diminished due to the factors mentioned above. Investors are increasingly looking toward alternative investment destinations with greater stability and growth potential.

The ongoing geopolitical complexities and economic uncertainties significantly impact Hong Kong’s investment appeal. The risks associated with continued investment in Hong Kong require careful consideration by investors.

Implications for Investors and Portfolio Diversification

UBS's revised investment strategy necessitates a reassessment of existing portfolio allocations. Investors need to actively adjust their strategies to capitalize on opportunities and mitigate risks.

- Re-evaluate Current Asset Allocation Strategies: Given the shifts highlighted by UBS, investors should critically evaluate their current portfolio allocations and make necessary adjustments to align with the changing market dynamics.

- Opportunities to Increase Exposure to Indian Equities: India's upgraded outlook presents a compelling opportunity to increase exposure to Indian equities, particularly in sectors poised for significant growth.

- Diversify Investments Across Different Geographies and Asset Classes: Diversification remains a cornerstone of sound investment strategy. Spreading investments across diverse geographies and asset classes helps to mitigate risks associated with any single market's performance.

- Mitigating Risks in Emerging Markets: While emerging markets offer significant growth potential, they also come with inherent risks. Strategies like hedging against currency fluctuations and diversifying across multiple emerging markets can help mitigate these risks.

- Professional Financial Advice: Navigating the complexities of global markets requires expert guidance. Seeking professional financial advice is crucial for tailoring an investment strategy that aligns with individual risk tolerance and financial goals.

Investors can consider diversifying into various sectors within the Indian economy, such as technology, infrastructure, and consumer goods, which are expected to experience substantial growth in the coming years. Meanwhile, reducing exposure to Hong Kong may involve shifting funds to other Asian markets or more stable developed economies.

Conclusion

UBS's decision to upgrade India and downgrade Hong Kong signals a pivotal shift in the global investment landscape, reflecting fundamental economic trends and evolving geopolitical realities. Investors must carefully analyze these shifts and adapt their strategies accordingly. Understanding the implications of UBS's revised investment strategy is paramount for effective portfolio management. Don't miss out on the potential opportunities presented by India's burgeoning economy. Review your investment strategy today and consider incorporating India and other emerging markets into your portfolio for optimal diversification. Learn more about how to adapt your investment strategy to reflect the latest market trends and capitalize on these significant shifts.

Featured Posts

-

Bayern Munichs Resilience Seals Bundesliga Lead Against Stuttgart

Apr 25, 2025

Bayern Munichs Resilience Seals Bundesliga Lead Against Stuttgart

Apr 25, 2025 -

Chinas Overtures To Canada A New Era Of Strategic Cooperation

Apr 25, 2025

Chinas Overtures To Canada A New Era Of Strategic Cooperation

Apr 25, 2025 -

Los Angeles Wildfires And The Growing Market For Disaster Related Gambling

Apr 25, 2025

Los Angeles Wildfires And The Growing Market For Disaster Related Gambling

Apr 25, 2025 -

Police Cordon And Csi Activity At Blackbush Walk Thornaby

Apr 25, 2025

Police Cordon And Csi Activity At Blackbush Walk Thornaby

Apr 25, 2025 -

Sadie Sinks Age And The Likelihood Of Her Mcu And Spider Man 4 Involvement

Apr 25, 2025

Sadie Sinks Age And The Likelihood Of Her Mcu And Spider Man 4 Involvement

Apr 25, 2025

Latest Posts

-

X Files Reboot Ryan Coogler Discusses Potential Collaboration With Gillian Anderson

Apr 30, 2025

X Files Reboot Ryan Coogler Discusses Potential Collaboration With Gillian Anderson

Apr 30, 2025 -

Could Gillian Anderson Return To The X Files Ryan Coogler Weighs In

Apr 30, 2025

Could Gillian Anderson Return To The X Files Ryan Coogler Weighs In

Apr 30, 2025 -

Ryan Coogler Talks Potential X Files Reboot With Gillian Anderson

Apr 30, 2025

Ryan Coogler Talks Potential X Files Reboot With Gillian Anderson

Apr 30, 2025 -

The X Files Future Anderson And Carter On A Coogler Led Reboot

Apr 30, 2025

The X Files Future Anderson And Carter On A Coogler Led Reboot

Apr 30, 2025 -

Could Ryan Coogler Revive The X Files Anderson And Carter Weigh In

Apr 30, 2025

Could Ryan Coogler Revive The X Files Anderson And Carter Weigh In

Apr 30, 2025