Indian Bourse BSE: Share Price Surge On Earnings

Table of Contents

Strong Q2 Earnings Drive BSE Share Price Up

The recent surge in BSE share price is directly attributable to the strong Q2 (second quarter) earnings reports released by the exchange. These results showcase impressive financial performance, significantly boosting investor sentiment.

- Revenue Growth: A remarkable X% increase in revenue compared to the same period last year demonstrates the BSE's robust growth trajectory. This substantial growth surpasses expectations and underlines the exchange's strong market position.

- Net Profit Increase: Net profit soared by Y%, significantly exceeding analyst projections. This impressive increase highlights the efficiency and profitability of the BSE's operations.

- EPS Improvement: Earnings per share (EPS) saw a Z% improvement, rewarding shareholders with higher returns. This positive trend reinforces the attractiveness of the BSE as an investment opportunity.

Compared to Q1 2024, the Q2 results indicate a substantial improvement, suggesting a positive trend that is likely to continue. Specific contributions to this success came from increased trading volumes in derivatives and equities segments.

Increased Investor Sentiment and Trading Volume on BSE

The impressive Q2 earnings have triggered a notable shift in investor sentiment, creating a bullish market for BSE shares. This positive sentiment translates directly into increased trading volume.

- Trading Volume Surge: Daily trading volumes on the BSE have experienced a significant uplift, indicating robust investor participation and confidence in the exchange's future prospects. This heightened activity underscores the market's belief in the BSE's continued growth.

- Market Capitalization Growth: The BSE's market capitalization has seen a notable increase, reflecting the higher valuation placed on the exchange by investors. This upward trajectory underscores the positive market perception of the BSE's financial health and future potential.

- Reduced Volatility: Despite broader market volatility, the BSE has demonstrated relative resilience, indicating its strong fundamental position and appeal to risk-averse investors seeking stability.

Impact of Government Policies and Economic Indicators on BSE Performance

Macroeconomic factors have also played a significant role in shaping the BSE's positive performance. Government policies and key economic indicators have contributed to the overall bullish sentiment.

- Government Initiatives: Supportive government policies aimed at boosting economic growth and fostering a favorable investment climate have contributed to increased investor confidence. These policies signal a positive outlook for the Indian economy and, by extension, the BSE.

- GDP Growth: The strong GDP growth witnessed in recent quarters has significantly contributed to positive market sentiment. This underlying economic strength fuels investor confidence in the overall market and specifically in the BSE's growth trajectory.

- Inflation Management: The government's efforts to manage inflation effectively have also positively impacted investor sentiment. Price stability is a crucial factor in fostering a stable and attractive investment environment.

Future Outlook and Predictions for BSE Share Price

While the current outlook for the BSE share price is positive, it's essential to approach future predictions with caution. Several factors could influence future performance.

- Global Economic Uncertainty: Global economic uncertainties, such as inflation and geopolitical events, could pose challenges. However, the BSE’s strong fundamentals could help mitigate these risks.

- Regulatory Changes: Any changes in regulatory frameworks could impact the BSE’s operations. However, the BSE’s established position should allow it to adapt effectively.

- Technological Advancements: The BSE's ongoing investment in technology will be crucial in maintaining its competitiveness. This commitment positions it for future growth in the increasingly digital financial landscape.

Potential scenarios for the BSE share price include continued growth driven by strong earnings and increased investor confidence. However, short-term fluctuations are possible depending on market conditions and global events.

Conclusion

The recent surge in BSE share price is a direct consequence of strong Q2 earnings, demonstrating the exchange's robust financial health and operational efficiency. This positive performance is further bolstered by increased investor sentiment and favorable macroeconomic conditions. While future uncertainties exist, the long-term outlook for the BSE remains positive, making it an attractive investment opportunity in the dynamic Indian Bourse. Stay informed about BSE share price movements and consider investing in the dynamic Indian Bourse. Learn more about the opportunities available in the BSE and explore investment strategies for the BSE by visiting the BSE's official website or reputable financial news portals.

Featured Posts

-

Jenna Ortega Unlikely To Return To The Marvel Cinematic Universe

May 07, 2025

Jenna Ortega Unlikely To Return To The Marvel Cinematic Universe

May 07, 2025 -

The Wto And Privilege A Fast Track To Membership

May 07, 2025

The Wto And Privilege A Fast Track To Membership

May 07, 2025 -

Bancheros 24 Points Power Orlando Magic Past Cavaliers

May 07, 2025

Bancheros 24 Points Power Orlando Magic Past Cavaliers

May 07, 2025 -

The 5 Minute Song That Became A Rihanna Global Phenomenon 1 6 Billion Streams

May 07, 2025

The 5 Minute Song That Became A Rihanna Global Phenomenon 1 6 Billion Streams

May 07, 2025 -

John Wick 5 A Premature Sequel The Arguments Against

May 07, 2025

John Wick 5 A Premature Sequel The Arguments Against

May 07, 2025

Latest Posts

-

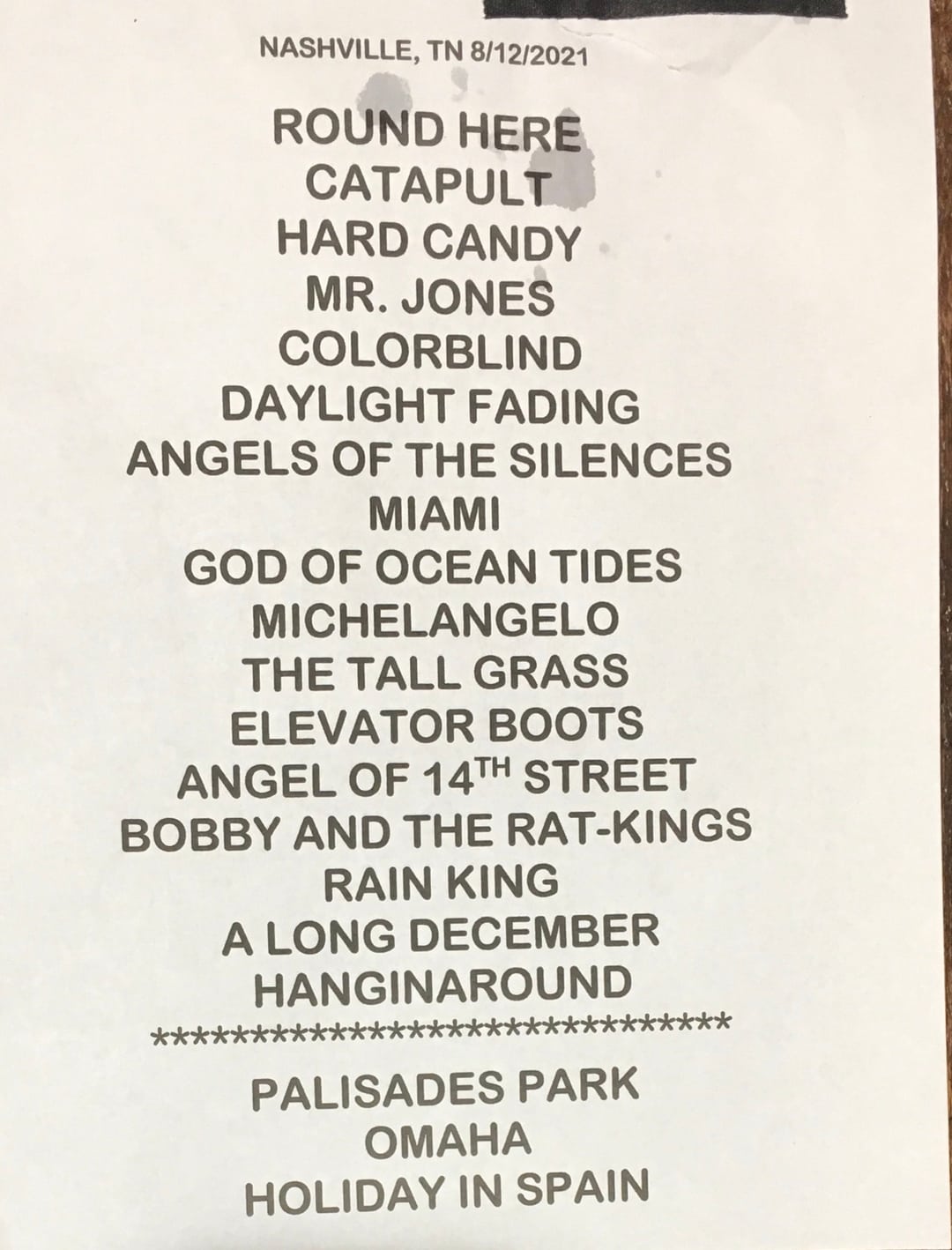

Predicted Counting Crows Setlist For 2025 Concerts

May 08, 2025

Predicted Counting Crows Setlist For 2025 Concerts

May 08, 2025 -

Counting Crows Potential 2025 Tour Setlist A Fans Speculation

May 08, 2025

Counting Crows Potential 2025 Tour Setlist A Fans Speculation

May 08, 2025 -

Counting Crows 2025 Setlist Predictions What Songs Will They Play

May 08, 2025

Counting Crows 2025 Setlist Predictions What Songs Will They Play

May 08, 2025 -

Analyzing Counting Crows Slip Into The Shadows From The Aurora Album A Track By Track Look

May 08, 2025

Analyzing Counting Crows Slip Into The Shadows From The Aurora Album A Track By Track Look

May 08, 2025 -

Nba Playoffs Triple Doubles Quiz How Many Can You Name

May 08, 2025

Nba Playoffs Triple Doubles Quiz How Many Can You Name

May 08, 2025