Indian Insurers Seek Regulatory Easing For Bond Forwards

Table of Contents

The Current Regulatory Landscape for Bond Forwards in India

The regulatory framework governing insurers' investments in bond forwards in India is currently quite restrictive. Several limitations significantly impede the growth of this crucial investment avenue. These constraints primarily stem from concerns about risk management and financial stability within the insurance sector. However, these restrictions may be overly cautious, preventing insurers from accessing valuable risk management tools and potentially limiting overall market efficiency.

The key regulatory hurdles faced by Indian insurers include:

- Stringent Capital Adequacy Requirements: The current capital requirements for bond forward positions may be disproportionately high compared to other investment classes, limiting insurers' capacity to utilize bond forwards effectively.

- Restrictive Investment Limits: Caps on the amount insurers can invest in bond forwards constrain their ability to diversify portfolios and hedge against interest rate risk effectively.

- Complex Reporting and Compliance Burdens: The current regulatory reporting requirements for bond forwards are often perceived as excessively burdensome and complex, adding operational costs and diverting resources from core business activities.

- Lack of Clarity on Regulatory Aspects: Ambiguities and lack of clarity in certain areas of the bond forward regulations create uncertainty and discourage investment.

Why Indian Insurers are Seeking Regulatory Easing

The push for regulatory easing stems from a desire to enhance risk management, improve portfolio returns, and optimize liquidity management. Bond forwards offer a powerful tool for Indian insurers to mitigate interest rate risk, a critical consideration given the significant portion of their liabilities tied to long-term obligations.

Investing in bond forwards offers several key advantages:

- Effective Hedging of Interest Rate Risk: Bond forwards allow insurers to hedge against potential losses arising from fluctuations in interest rates, protecting the value of their fixed-income assets.

- Improved Portfolio Returns: Strategic use of bond forwards can enhance overall portfolio returns by enabling insurers to exploit market opportunities and adjust their exposure to interest rate movements.

- Enhanced Liquidity Management: Bond forwards provide a flexible tool for managing cash flows and liquidity, enabling insurers to meet their short-term obligations while maintaining their long-term investment strategies.

- Meeting Long-Term Liabilities: Efficient management of interest rate risk through bond forwards helps insurers ensure they can meet their long-term liabilities to policyholders.

Potential Implications of Regulatory Easing

Relaxing regulations on bond forward investments carries both potential benefits and risks. A more flexible regulatory framework could significantly boost insurer profitability and contribute to a more liquid and efficient Indian bond market. However, it's crucial to approach regulatory easing with caution to maintain the financial stability of the insurance sector.

The impact of regulatory easing could include:

- Increased Insurer Profitability: Improved risk management and access to new investment opportunities would likely enhance profitability.

- Enhanced Financial Stability (with proper safeguards): A more efficient market could strengthen the overall financial stability of the sector, provided appropriate risk management measures are in place.

- Increased Market Depth and Liquidity: Greater participation by insurers would increase liquidity and depth in the Indian bond market, benefiting all participants.

Conversely, concerns include potential increased systemic risk if not carefully managed. A phased approach with robust oversight mechanisms is essential to mitigate these risks.

Examples of Similar Regulatory Changes in Other Countries

Several developed economies have successfully implemented regulatory changes to facilitate increased participation by insurers in the bond forward market. Examining these models can inform the development of a suitable framework for India. For instance, the UK and US have relatively flexible frameworks, though with robust oversight, allowing insurers greater freedom in using derivatives for risk management. Studying their regulatory approaches, including best practices and lessons learned from any challenges encountered, would be valuable.

The Path Forward: How Regulatory Easing Can Be Implemented

Implementing regulatory easing requires a carefully planned approach. This could include:

- Gradual Relaxation of Investment Limits: A phased approach would allow insurers to gradually increase their exposure to bond forwards, minimizing potential risks.

- Streamlining Reporting Requirements: Simplifying reporting requirements would reduce the administrative burden on insurers, freeing up resources for core business activities.

- Clarifying Ambiguous Regulations: Addressing ambiguities in existing regulations would foster greater certainty and encourage greater investment.

- Improving Market Infrastructure: Investing in robust market infrastructure is vital for the efficient functioning of the bond forward market.

Conclusion: The Need for Action on Regulatory Easing for Bond Forwards in India

The arguments presented strongly support the need for regulatory easing for bond forwards in India. This change would enable Indian insurers to better manage risks, enhance portfolio returns, and contribute to a more efficient and developed bond market. The potential benefits for both insurers and the broader Indian economy are significant. The timely implementation of regulatory easing for bond forwards is crucial for the growth of the Indian insurance sector and the broader economy. It's imperative that policymakers address the concerns of Indian insurers and create a more conducive environment for investment in this important asset class. Failure to act decisively risks stifling innovation and hindering the sector’s potential for growth and contribution to the national economy. The future of Indian insurance investment hinges on addressing the need for regulatory easing for bond forwards.

Featured Posts

-

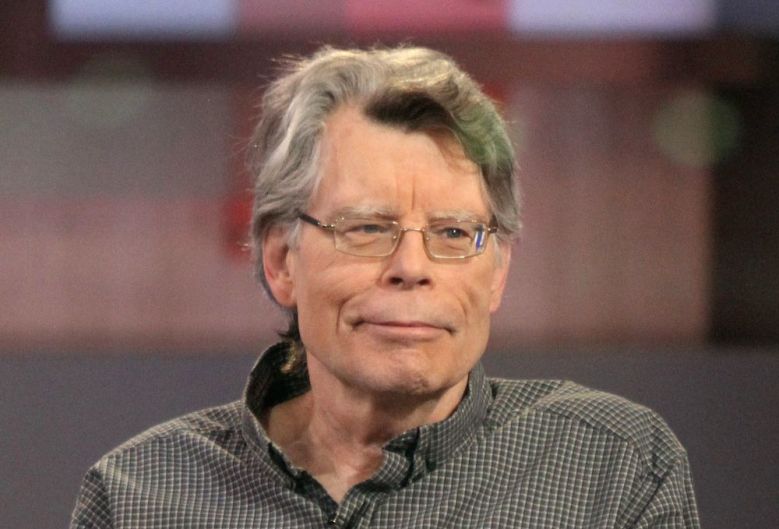

The Stranger Things It Connection What Stephen King Said

May 09, 2025

The Stranger Things It Connection What Stephen King Said

May 09, 2025 -

Bayern Munich Vs Fc St Pauli Match Preview And Prediction

May 09, 2025

Bayern Munich Vs Fc St Pauli Match Preview And Prediction

May 09, 2025 -

Celebrity Antiques Road Trip The Best Episodes And Their Hidden Gems

May 09, 2025

Celebrity Antiques Road Trip The Best Episodes And Their Hidden Gems

May 09, 2025 -

Unian Makron I Tusk Podpishut Strategicheskoe Soglashenie Mezhdu Frantsiey I Polshey

May 09, 2025

Unian Makron I Tusk Podpishut Strategicheskoe Soglashenie Mezhdu Frantsiey I Polshey

May 09, 2025 -

New Uk Visa Policy Analysis Of Potential Nationality Restrictions

May 09, 2025

New Uk Visa Policy Analysis Of Potential Nationality Restrictions

May 09, 2025