Indian Stock Market Rally: Sensex, Nifty Record Significant Gains

Table of Contents

Economic Indicators Fueling the Indian Stock Market Rally

Several positive economic indicators have significantly boosted investor confidence, driving the recent Indian stock market rally. These indicators point to a healthy and growing economy, attracting both domestic and foreign investment.

Strong GDP Growth

India's robust GDP growth figures have played a pivotal role in bolstering investor sentiment. The positive economic outlook encourages increased investment and fuels the ongoing market rally.

- Recent reports indicate a [Insert Specific GDP Growth Percentage]% growth rate, exceeding expectations for the [Specify Quarter/Year].

- This represents a [Percentage]% increase compared to the same period last year, showcasing consistent economic expansion.

- Sources like the National Statistical Office (NSO) and the Reserve Bank of India (RBI) confirm this positive trend, solidifying investor confidence.

Positive Inflation Data

Positive inflation data has contributed to market stability, further fueling the Indian stock market rally. Stable prices reduce uncertainty, encouraging investment and economic activity.

- The Consumer Price Index (CPI) inflation rate has recently fallen to [Insert Specific CPI Percentage]%, nearing the Reserve Bank of India's target.

- Similarly, the Wholesale Price Index (WPI) inflation shows a [Insert Specific WPI Percentage]% decrease, indicating price stability across various sectors.

- This positive trend allows the RBI to maintain a more accommodative monetary policy, supporting continued economic growth and the stock market rally.

Foreign Institutional Investor (FII) Inflow

Significant Foreign Institutional Investor (FII) inflow has been a crucial driver of the recent Sensex and Nifty gains. This influx of foreign capital demonstrates strong international confidence in the Indian economy.

- FIIs have invested approximately [Insert Amount] in the Indian stock market during [Specify Time Period], a substantial increase compared to previous periods.

- This investment is spread across various sectors, including IT, FMCG, and financials, further contributing to the overall market rally.

- The reasons for increased FII investment include India's robust economic growth, improving regulatory environment, and attractive investment opportunities.

Sector-Specific Performances Driving the Sensex and Nifty Gains

The impressive gains in the Sensex and Nifty are not solely driven by macroeconomic factors; strong performances in specific sectors have also played a significant role.

IT Sector Boom

The IT sector has experienced a remarkable boom, significantly contributing to the overall market rally. Increased global demand for IT services has fueled the growth of Indian tech companies.

- Companies like [List Key Performing IT Companies] have shown exceptional growth, driven by increased demand for software and IT services.

- Factors driving this growth include the global digital transformation, increased outsourcing, and strong innovation within the Indian IT industry.

- The sector's positive outlook suggests continued growth and further contribution to the Indian stock market rally.

FMCG Sector Stability

The FMCG sector's consistent performance has acted as a stabilizing force, contributing to the market's resilience. Stable consumption patterns despite economic fluctuations indicate a strong underlying market foundation.

- Key FMCG players like [List Key Performing FMCG Companies] have showcased robust performance, showcasing the sector's resilience.

- Factors contributing to the sector's stability include increasing consumer spending and diverse product portfolios catering to various consumer segments.

- The FMCG sector's stable growth provides a solid base for overall market stability and further boosts the Indian stock market rally.

Financial Sector Growth

The robust growth within the financial sector has also played a crucial role in driving the Sensex and Nifty gains. Increased credit growth and improved banking sector performance are key contributors.

- Leading banks and financial institutions like [List Key Performing Financial Institutions] have reported strong earnings, demonstrating the sector's health.

- Factors such as increased credit growth, improved asset quality, and government reforms have contributed to this positive performance.

- The financial sector's strong growth provides further momentum to the Indian stock market rally, enhancing investor confidence.

Government Policies and Initiatives Supporting Market Growth

Supportive government policies and initiatives have created a favorable environment for market growth, further fueling the Indian stock market rally. These reforms are boosting investor confidence and attracting foreign investment.

Infrastructure Development

The government's focus on infrastructure development has significantly boosted investor confidence. Massive investments in infrastructure projects are generating employment and stimulating economic activity.

- Key infrastructure projects like [List Key Infrastructure Projects] are creating new opportunities and driving growth in related sectors.

- These initiatives are not only improving connectivity and logistics but also creating a positive ripple effect across the economy.

- The government's continued commitment to infrastructure development promises sustained long-term economic benefits and positive market sentiment.

Ease of Doing Business

The government's efforts to improve the ease of doing business have attracted significant foreign investment and boosted market confidence. Regulatory reforms have streamlined processes and reduced bureaucratic hurdles.

- Initiatives like [List Specific Business Reforms] have simplified regulations, reducing the time and cost associated with starting and running a business.

- These reforms have improved India's ranking in global ease of doing business indices, making it a more attractive destination for foreign investors.

- The positive impact of these reforms is clearly reflected in the increased foreign investment and the overall strength of the Indian stock market rally.

Conclusion: Sustaining the Indian Stock Market Rally – A Look Ahead

The recent Indian stock market rally is a result of several converging factors: strong economic indicators, impressive sector-specific performances, and supportive government policies. While the outlook remains positive, it's crucial to acknowledge potential challenges like global economic uncertainty and geopolitical risks. However, the fundamental strength of the Indian economy and the ongoing reforms suggest a sustainable, long-term growth trajectory for the Sensex and Nifty. To stay updated on the Indian stock market, monitor the Sensex and Nifty closely, follow market news, and conduct thorough research before making any investment decisions. Learn more about the Indian stock market rally and its implications by subscribing to our updates. Stay informed and make smart investment choices!

Featured Posts

-

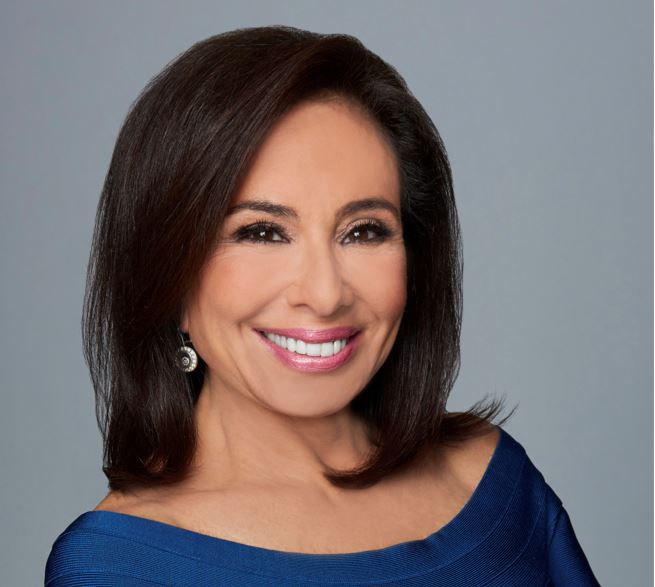

An Unfiltered Look At Judge Jeanine Pirro Behind The Scenes At Fox News

May 10, 2025

An Unfiltered Look At Judge Jeanine Pirro Behind The Scenes At Fox News

May 10, 2025 -

9 Maya V Kieve Politico O Nepolnom Prisutstvii Soyuznikov Ukrainy

May 10, 2025

9 Maya V Kieve Politico O Nepolnom Prisutstvii Soyuznikov Ukrainy

May 10, 2025 -

Leon Draisaitls Lower Body Injury Expected Return Before Nhl Playoffs

May 10, 2025

Leon Draisaitls Lower Body Injury Expected Return Before Nhl Playoffs

May 10, 2025 -

Zuckerbergs Strategies In A Post Trump World

May 10, 2025

Zuckerbergs Strategies In A Post Trump World

May 10, 2025 -

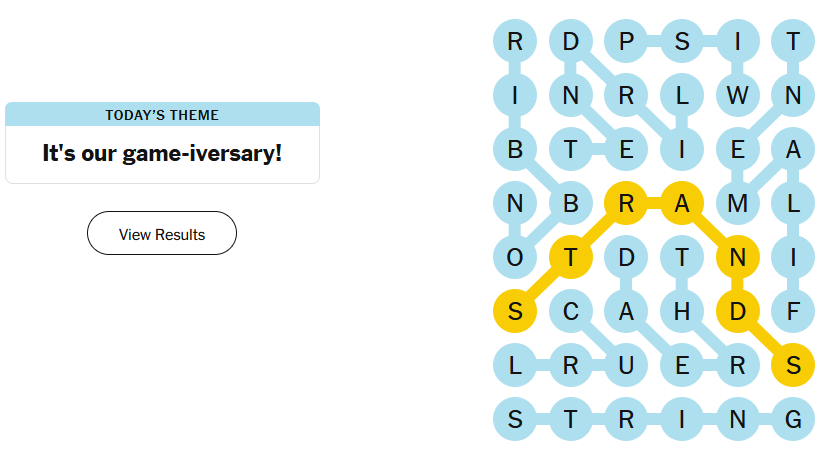

Nyt Strands Game 366 March 4th Complete Answers And Hints

May 10, 2025

Nyt Strands Game 366 March 4th Complete Answers And Hints

May 10, 2025