Indian Stock Market Update: Sensex, Nifty Gains; UltraTech Falls

Table of Contents

Main Points:

2.1 Sensex and Nifty Performance: A Bullish Trend?

H3: Sensex Gains: The Sensex closed with a robust gain of 1.5%, reaching 66,000 points. This positive performance can be attributed to a confluence of factors, including positive global market trends driven by easing inflation concerns in the US, improving investor sentiment fueled by strong corporate earnings in certain sectors, and robust buying in IT and Banking stocks.

- Sectors driving Sensex gains:

- Information Technology (IT) sector saw significant gains due to strong quarterly results and positive global outlook.

- The Banking sector also contributed significantly, driven by positive interest rate scenarios and increased credit growth.

- Fast-Moving Consumer Goods (FMCG) showed moderate growth, indicating sustained consumer demand.

- Top performing stocks: Reliance Industries, Infosys, and HDFC Bank were among the top performers, significantly contributing to the Sensex's overall gains.

H3: Nifty 50's Positive Trajectory: The Nifty 50 index mirrored the Sensex's positive performance, closing with a 1.2% increase, reaching 19,600 points. This upward trajectory reflects a generally optimistic outlook among investors.

- Sectors driving Nifty gains: Similar to the Sensex, the IT and Banking sectors were key drivers of the Nifty's positive performance. The Nifty Bank index, in particular, saw a significant surge.

- Key Nifty performers: Tata Consultancy Services (TCS), Hindustan Unilever Limited (HUL), and ICICI Bank contributed significantly to the Nifty's overall positive trend. The Nifty IT index registered impressive gains.

- Nifty sectoral indices performance: The Nifty Bank index outperformed other sectoral indices, indicating investor confidence in the financial sector.

H3: Overall Market Sentiment: Based on today's performance and the high trading volume observed, the overall market sentiment appears to be cautiously bullish. However, this positive sentiment is tempered by the significant fall in UltraTech Cement, suggesting that certain sector-specific risks persist.

2.2 UltraTech Cement's Decline: Understanding the Fall

H3: Reasons for UltraTech's Drop: UltraTech Cement experienced a considerable decline of 3%, closing significantly below its opening price. Several factors may have contributed to this fall:

- Potential reasons for the decline:

- Concerns regarding a potential slowdown in the cement industry due to weakening real estate activity.

- Pressure on profit margins due to rising input costs.

- Investor profit-booking after recent price rallies. (This requires verification from market data)

- Impact on market sentiment: While the broader market displayed positive sentiment, UltraTech's fall served as a reminder of sector-specific risks and potential volatility.

2.3 Key Sectoral Performances:

H3: IT Sector Update: The IT sector was a star performer today, exhibiting robust growth driven by strong quarterly results and positive global outlook for the technology industry. This sector contributed substantially to both Sensex and Nifty's gains.

H3: Banking Sector Update: The Banking sector also registered significant gains, fueled by expectations of continued credit growth and favorable interest rate scenarios. Investor confidence in the sector remained high.

H3: FMCG Sector Update: The FMCG sector displayed moderate growth, suggesting sustained consumer demand despite inflationary pressures. This sector's performance demonstrated resilience in the face of economic uncertainties.

2.4 Expert Opinions and Market Forecasts:

Financial analysts remain cautiously optimistic about the Indian stock market's short-term outlook. While the Sensex and Nifty's gains signal positive investor sentiment, concerns remain about sector-specific challenges and potential global economic headwinds. Several analysts predict continued growth in the IT and Banking sectors, while others suggest caution regarding the cement and real estate sectors. Many forecasts suggest a moderate upward trend for the Sensex and Nifty in the coming weeks, contingent on global macroeconomic factors and corporate earnings.

Conclusion: Staying Informed on the Indian Stock Market

Today's Indian stock market update highlights a mixed performance, with significant gains in the Sensex and Nifty indices offset by a notable fall in UltraTech Cement. The overall market sentiment appears cautiously bullish, driven primarily by strong performances in the IT and Banking sectors. Staying informed about Indian stock market trends, analyzing Sensex and Nifty movements, and understanding sector-specific news are crucial for making informed investment decisions. To stay updated on daily Indian stock market updates and receive in-depth Indian stock market analysis, subscribe to our newsletter for daily updates and insights. Regularly checking for updates on Sensex and Nifty trends will help you navigate the dynamic landscape of the Indian stock market.

Featured Posts

-

Operation Sindoor Impact Kse 100 Trading Halted Amidst Market Panic

May 10, 2025

Operation Sindoor Impact Kse 100 Trading Halted Amidst Market Panic

May 10, 2025 -

Britannian Kruununperimysjaerjestys Muutokset Ja Nykyinen Jaerjestys

May 10, 2025

Britannian Kruununperimysjaerjestys Muutokset Ja Nykyinen Jaerjestys

May 10, 2025 -

The Whats App Spyware Case Metas 168 Million Loss And The Road Ahead

May 10, 2025

The Whats App Spyware Case Metas 168 Million Loss And The Road Ahead

May 10, 2025 -

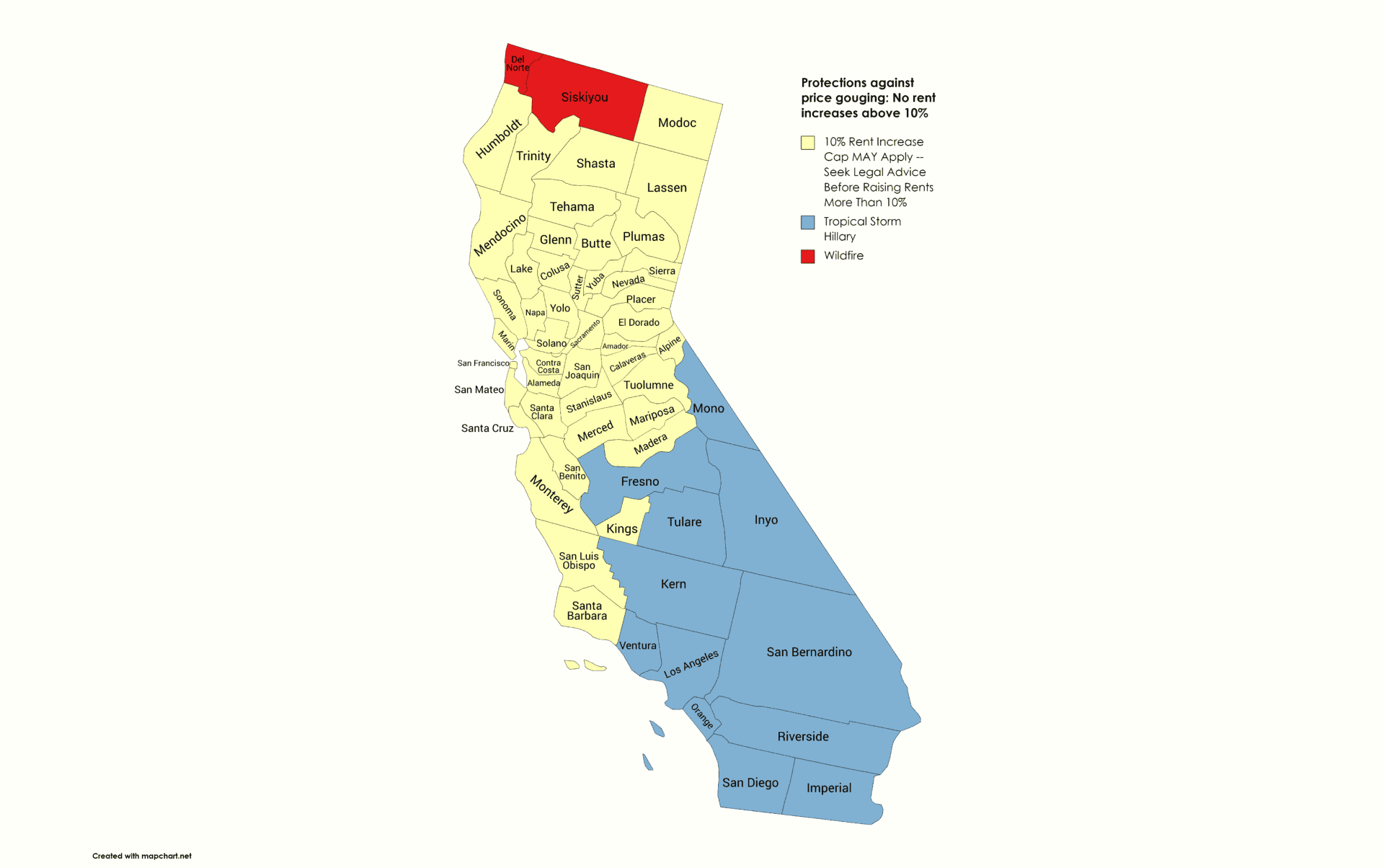

Increased Rent In La After Wildfires Are Landlords Price Gouging

May 10, 2025

Increased Rent In La After Wildfires Are Landlords Price Gouging

May 10, 2025 -

Seattle Welcomes Canadian Sports Fans Businesses Accept Canadian Dollars

May 10, 2025

Seattle Welcomes Canadian Sports Fans Businesses Accept Canadian Dollars

May 10, 2025