Indonesia's Falling Reserves: A Consequence Of Rupiah Pressure

Table of Contents

The Weakening Rupiah: A Key Driver of Falling Reserves

The weakening Indonesian Rupiah is a primary driver of the decline in Indonesia's foreign exchange reserves. Understanding this relationship is crucial to addressing the broader economic challenges.

Understanding the Relationship

A weakening Rupiah forces Bank Indonesia (BI), the central bank, to intervene more frequently in the foreign exchange market to support the currency. This intervention directly impacts Indonesia's foreign exchange reserves.

- BI's intervention involves selling US dollars to buy Rupiah, directly reducing foreign exchange reserves. This is a crucial mechanism used to maintain a degree of stability in the exchange rate. The more the Rupiah falls, the more dollars BI needs to sell.

- Increased demand for US dollars to defend the Rupiah puts upward pressure on the USD/IDR exchange rate. This creates a vicious cycle, where intervention to stabilize the Rupiah further depletes reserves and potentially weakens the currency even more.

- Import costs rise as the Rupiah weakens, impacting the trade balance and further pressuring reserves. Indonesia, as a significant importer of various goods, sees its import bill inflate when the Rupiah depreciates, leading to a wider trade deficit and further strain on foreign exchange reserves.

Factors Contributing to Rupiah Weakness

Several macroeconomic factors contribute to the weakening of the Indonesian Rupiah:

- Global economic uncertainty and the strength of the US dollar. Global economic headwinds, including potential recessions in major economies and a strong US dollar, put downward pressure on emerging market currencies, including the Rupiah.

- Inflationary pressures within Indonesia. High inflation erodes the purchasing power of the Rupiah, making it less attractive to investors and potentially leading to capital flight. Managing inflation is therefore critical for maintaining Rupiah stability.

- Capital outflows driven by investor sentiment. Negative investor sentiment, triggered by factors such as political uncertainty or economic slowdown, can lead to significant capital outflows, putting further downward pressure on the Rupiah.

- The impact of commodity prices on Indonesia’s trade balance. As a major exporter of commodities, Indonesia's trade balance is heavily influenced by global commodity prices. A decline in commodity prices can negatively impact the trade balance, putting pressure on the Rupiah and reserves.

The Implications of Diminishing Foreign Exchange Reserves

The dwindling foreign exchange reserves have significant implications for Indonesia's economic stability.

Impact on Indonesia's Economic Stability

Low foreign exchange reserves pose several risks:

- Reduced ability to service external debt. A decline in reserves reduces Indonesia's capacity to meet its external debt obligations, increasing the risk of a sovereign debt crisis.

- Vulnerability to speculative attacks on the Rupiah. Low reserves make the Rupiah more vulnerable to speculative attacks, where investors bet against the currency, potentially triggering a sharp depreciation.

- Increased difficulty in importing essential goods. A weaker Rupiah and lower reserves make it more expensive and difficult to import essential goods, potentially impacting inflation and economic activity.

- Potential for further Rupiah depreciation. The combination of low reserves and other macroeconomic challenges can create a self-fulfilling prophecy, leading to further depreciation of the Rupiah.

Government and Bank Indonesia's Response

The Indonesian government and BI have implemented several measures to address the situation:

- Monetary policy adjustments (interest rate hikes). Raising interest rates makes the Rupiah more attractive to investors, potentially attracting capital inflows and supporting the currency.

- Fiscal policy measures (budgetary adjustments). Fiscal consolidation measures aim to reduce government spending and improve the budget deficit, enhancing macroeconomic stability.

- Seeking assistance from international financial institutions. Indonesia may seek financial assistance from institutions like the IMF to bolster its reserves and support the Rupiah.

- Promoting foreign investment. Attracting foreign direct investment can help strengthen the Rupiah and increase foreign exchange reserves.

Long-Term Strategies for Strengthening the Rupiah and Reserves

Addressing the underlying weaknesses in the Indonesian economy is crucial for long-term stability.

Diversifying the Economy

Reducing reliance on commodity exports is paramount:

- Investing in higher-value-added industries. Shifting towards industries with higher value-added will improve export earnings and reduce dependence on volatile commodity prices.

- Promoting domestic consumption and reducing import dependency. Boosting domestic demand and reducing reliance on imports will strengthen the current account and support the Rupiah.

- Improving infrastructure to boost productivity. Improving infrastructure will improve the efficiency of the economy and support long-term growth.

Enhancing Macroeconomic Stability

Sound fiscal and monetary policies are essential:

- Controlling inflation. Keeping inflation under control is crucial for maintaining macroeconomic stability and strengthening the Rupiah.

- Maintaining a stable macroeconomic environment. Consistent and predictable economic policies will increase investor confidence and attract foreign investment.

- Improving governance and transparency. Improving governance and transparency will boost investor confidence and contribute to long-term economic stability.

Conclusion

The decline in Indonesia's foreign exchange reserves, directly linked to the pressure on the Indonesian Rupiah, presents a significant challenge. Understanding the interplay between these factors is crucial for developing effective strategies. Addressing the underlying issues through diversified economic growth, strengthened macroeconomic stability, and responsible policymaking is essential to bolster Indonesia's foreign exchange reserves and ensure long-term economic resilience. Staying informed about the fluctuations in Indonesia's foreign exchange reserves and the pressures on the Rupiah is vital for both investors and the Indonesian economy. Continue to monitor updates on Indonesia's foreign exchange reserves and the evolving situation surrounding the Rupiah.

Featured Posts

-

Dwry Abtal Awrwba Tmwhat Barys San Jyrman Wthdyath

May 10, 2025

Dwry Abtal Awrwba Tmwhat Barys San Jyrman Wthdyath

May 10, 2025 -

Snls Failed Harry Styles Impression The Singers Response

May 10, 2025

Snls Failed Harry Styles Impression The Singers Response

May 10, 2025 -

Woman Kills Man In Racist Stabbing Attack Unprovoked Violence

May 10, 2025

Woman Kills Man In Racist Stabbing Attack Unprovoked Violence

May 10, 2025 -

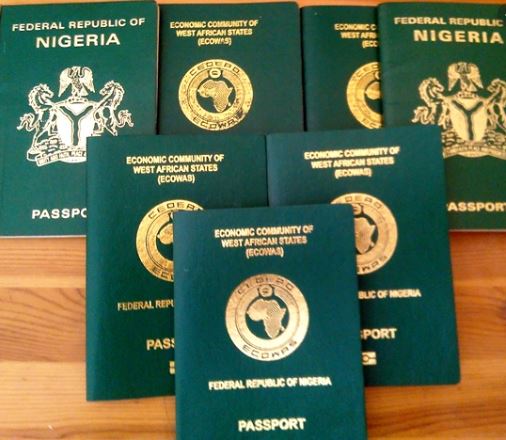

Uk Tightens Visa Rules Impact On Nigerian And Pakistani Applicants

May 10, 2025

Uk Tightens Visa Rules Impact On Nigerian And Pakistani Applicants

May 10, 2025 -

Bundesliga 2 Koeln Nach Spieltag 27 An Der Tabellenspitze

May 10, 2025

Bundesliga 2 Koeln Nach Spieltag 27 An Der Tabellenspitze

May 10, 2025