Infineon (IFX): Lower Sales Guidance Due To Trump Tariff Uncertainty

Table of Contents

Infineon's Revised Sales Forecast: A Detailed Look

Infineon's revised sales forecast paints a concerning picture for the near term. The company announced a significant reduction in its revenue projections, impacting various revenue streams.

- Percentage Decrease: The exact percentage decrease in sales guidance needs to be inserted here based on the latest official Infineon announcement. For example: "Infineon slashed its sales guidance by X%, representing a substantial drop compared to previous projections."

- Impacted Revenue Streams: Specify the affected areas of the business. For example: "The automotive sector, a key driver of Infineon's revenue, experienced a particularly sharp decline, alongside a moderate decrease in the industrial power control segment."

- Official Statement: Include a direct quote (if available) from Infineon's official press release or statement explaining the reasons behind the lowered guidance, emphasizing the role of trade uncertainties.

- Financial Data Comparison: Include a comparison of the revised forecast with previous forecasts (e.g., previous quarter, previous year). Present this data in a clear and concise manner using charts or tables if possible. This might include comparisons of key financial metrics like earnings per share (EPS) and revenue. For example: "Compared to the previous quarter's reported revenue of [insert figure], the revised forecast represents a [percentage] decrease."

This data paints a clear picture of Infineon's weakened financial performance, impacting its Infineon sales and overall revenue forecast. The next earnings report will provide a crucial update on the actual financial results and a more refined picture of Infineon's financial performance in the coming quarters.

The Impact of Trump-Era Tariffs on Infineon's Operations

The uncertainty surrounding Trump-era tariffs significantly impacted Infineon's operations. The imposition of tariffs and the threat of further trade restrictions created a volatile environment for international businesses.

- Supply Chain Disruptions: Explain how tariffs led to disruptions in Infineon's global supply chain, making it more difficult and expensive to source materials. Discuss potential bottlenecks and delays.

- Increased Costs: Detail how tariffs increased the cost of imported components and materials, squeezing profit margins. Quantify the impact whenever possible.

- Loss of Market Share: Discuss the potential for Infineon to lose market share to competitors less affected by the tariffs. Mention specific regions or product lines impacted. For instance, "The increased cost of production made it difficult for Infineon to compete effectively in price-sensitive markets, potentially leading to a loss of market share to Asian competitors."

The resulting semiconductor tariffs and import duties increased the price of their products and hurt their profitability.

Investor Response and Market Reaction to the News

The announcement of Infineon's lowered sales guidance had an immediate and significant impact on the IFX stock price.

- IFX Stock Price Impact: Describe the immediate drop (or any other reaction) in the IFX stock price following the news. Use precise figures if possible. For example, "Following the announcement, IFX stock dropped by X% in a single day."

- Analyst Ratings and Predictions: Summarize the reactions of financial analysts, including their revised ratings and predictions for the future performance of IFX stock.

- Significant Investor Actions: Mention any significant investor activity, such as increased selling or buying pressure. Discuss the trading volume. For instance, "Trading volume spiked significantly after the announcement, indicating considerable investor activity and concern."

The overall investor sentiment reflected significant uncertainty regarding the short-term outlook for Infineon.

Long-Term Implications and Future Outlook for Infineon

The lowered sales guidance raises serious questions about Infineon's long-term growth trajectory. However, the company is not without potential strategies for mitigating the negative impact.

- Long-Term Growth Challenges: Analyze the potential long-term effects on Infineon's revenue growth and profitability.

- Mitigation Strategies: Discuss strategies Infineon might employ to reduce its reliance on affected markets or diversify its product portfolio.

- Restructuring or Diversification: Examine any potential restructuring or diversification plans the company may implement.

Infineon's future depends on its ability to navigate these challenges effectively and adapt its business strategy to the changing global landscape.

Conclusion

Infineon's lowered sales guidance, primarily driven by the uncertainty surrounding Trump-era tariffs, presents a significant challenge to the company. The impact on IFX stock price, investor sentiment, and the broader semiconductor industry is undeniable. While the short-term outlook is uncertain, Infineon's long-term success hinges on its ability to navigate the complexities of global trade and implement effective mitigation strategies. The company's response to these challenges will be crucial in shaping its future trajectory. To stay informed about further developments concerning Infineon (IFX) and its response to ongoing economic and political uncertainties, it's recommended to follow reputable financial news sources and analyst reports focused on the semiconductor industry and monitor updates on Infineon sales guidance and IFX stock performance closely. Continuously monitoring the company's performance in relation to the Trump tariff implications is vital for making informed investment decisions.

Featured Posts

-

Is The Attorney Generals Fox News Presence A Distraction From Other Issues

May 09, 2025

Is The Attorney Generals Fox News Presence A Distraction From Other Issues

May 09, 2025 -

Harry Styles Reaction To His Critically Panned Snl Impression

May 09, 2025

Harry Styles Reaction To His Critically Panned Snl Impression

May 09, 2025 -

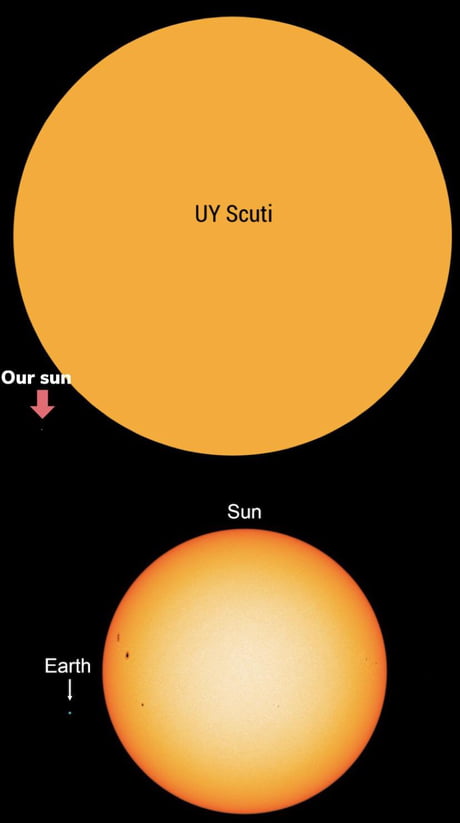

Young Thugs Uy Scuti Album When Can We Expect It

May 09, 2025

Young Thugs Uy Scuti Album When Can We Expect It

May 09, 2025 -

Lac Kir Dijon Trois Hommes Victimes D Une Agression Sauvage

May 09, 2025

Lac Kir Dijon Trois Hommes Victimes D Une Agression Sauvage

May 09, 2025 -

Analysis Of Lais Ve Day Speech The Emerging Totalitarian Threat To Taiwan

May 09, 2025

Analysis Of Lais Ve Day Speech The Emerging Totalitarian Threat To Taiwan

May 09, 2025