Infineon (IFX): Revised Sales Outlook And The Uncertainty Of US Trade Policies

Table of Contents

Infineon's Revised Sales Outlook: A Deeper Dive

Infineon's recent announcement regarding its sales outlook has sent ripples through the semiconductor market. Let's examine the details.

Lower than Expected Q3 Results:

The downward revision of Infineon's sales outlook stems from a confluence of factors impacting the overall semiconductor market and Infineon's specific performance.

- Weakening Demand in Automotive Sector: A slowdown in the global automotive industry, particularly in key markets like China and Europe, has dampened demand for Infineon's automotive semiconductor solutions. This contributed significantly to the lower-than-expected Q3 Infineon sales figures.

- Supply Chain Disruptions: Ongoing supply chain bottlenecks, particularly related to certain raw materials and logistics, have impacted Infineon's production capabilities and delivery timelines. This has constrained Infineon revenue and affected the overall Infineon sales performance.

- Inventory Adjustments: Customers in some sectors are reportedly adjusting their inventory levels, leading to reduced orders and further impacting Infineon sales. This is a common occurrence in cyclical industries like semiconductors, affecting IFX revenue projections.

According to the company's official report, Q3 Infineon sales fell short of projections by approximately X%, resulting in a Y% decrease in IFX revenue compared to the same period last year. This shortfall significantly impacted Infineon sales projections for the remainder of the fiscal year.

Impact on Future Projections:

The revised Q3 results have prompted Infineon to adjust its financial projections for the remaining quarters of the fiscal year.

- Revised Guidance: Infineon has lowered its revenue guidance for the full fiscal year, reflecting the challenges outlined above. The new guidance projects a Z% growth in IFX revenue, down from the previously anticipated A% growth.

- Impact on Investor Sentiment: The downward revision has understandably impacted investor sentiment, leading to fluctuations in Infineon's stock price. Many analysts have revised their price targets for IFX, reflecting the uncertainty surrounding the semiconductor market outlook.

- Market Reaction: The stock market reacted negatively to the news, with Infineon's share price experiencing a temporary decline before stabilizing. The long-term impact will depend on the company's ability to address the underlying issues impacting Infineon sales.

The Uncertainty of US Trade Policies and their Influence on Infineon

The ongoing uncertainty surrounding US trade policies poses another significant challenge for Infineon.

Tariffs and Trade Wars:

The semiconductor industry is highly sensitive to trade policies, and Infineon is no exception.

- Impact on Semiconductor Imports/Exports: Tariffs and trade disputes can significantly impact the cost of importing and exporting semiconductors, potentially affecting Infineon's profitability and competitiveness. Fluctuations in global trade tensions directly impact IFX’s operations.

- Supply Chain Disruption: Trade restrictions can disrupt Infineon's global supply chain, creating delays and increasing costs. This further contributes to the uncertainty surrounding Infineon sales and its long-term growth.

- Regional Impact: The geographic distribution of Infineon's manufacturing facilities and sales markets makes it vulnerable to trade disputes affecting specific regions. This necessitates careful risk management on the part of IFX.

Geopolitical Risks and Mitigation Strategies:

Infineon faces various geopolitical risks, including trade wars, political instability, and potential disruptions to its global supply chain.

- Diversification Efforts: To mitigate these risks, Infineon is actively diversifying its manufacturing base and supply chain. This includes establishing production facilities in various regions to reduce dependence on any single country or region.

- Investment in New Technologies: Infineon is investing heavily in research and development to develop new technologies and products that are less susceptible to geopolitical risks. This positions IFX for long-term growth and stability.

- Risk Management Strategies: Infineon has implemented robust risk management strategies to identify, assess, and mitigate potential threats to its business. This proactive approach is vital for navigating the complex geopolitical landscape impacting Infineon sales.

Investor Sentiment and Market Analysis

Understanding investor sentiment and market analysis is crucial for assessing the future prospects of Infineon.

Stock Performance and Analyst Ratings:

Infineon's revised sales outlook and the uncertainties surrounding US trade policies have directly impacted its stock performance.

- Stock Price Volatility: The stock price has experienced volatility in response to the revised outlook and ongoing trade tensions. Investors are carefully assessing the long-term implications for Infineon's growth potential.

- Analyst Ratings: Several analysts have revised their ratings on Infineon's stock, reflecting the uncertainty in the market. Some have maintained a positive outlook while others have expressed more cautious views regarding the company's future performance.

- Market Capitalization: The changes in stock price have directly affected Infineon's market capitalization, a key indicator of investor confidence.

(Insert chart or graph illustrating Infineon stock price performance here)

Long-Term Outlook for Infineon:

Despite the current challenges, Infineon's long-term prospects remain positive.

- Growth in Key Markets: Infineon is well-positioned in several high-growth markets, including automotive, industrial automation, and power management. This offers potential for long-term growth and stability for IFX.

- Technological Leadership: Infineon's technological leadership and innovation in key semiconductor areas provide a strong competitive advantage. This will be essential for navigating future challenges and capitalizing on new opportunities.

- Strong Financial Position: Despite the recent challenges, Infineon maintains a solid financial position, providing a buffer against short-term market fluctuations. This supports the company’s long-term growth strategy.

Conclusion

Infineon's revised sales outlook underscores the complexities facing the semiconductor industry, including weakening demand in certain sectors, supply chain disruptions, and the ever-present uncertainty of US trade policies. These factors significantly influence Infineon sales and its overall financial performance. It's crucial for investors to consider these complexities when assessing Infineon's investment potential. Understanding the interplay between these issues is key to accurately evaluating IFX’s future. Stay updated on the latest news and analysis regarding Infineon (IFX) to navigate the complexities of the semiconductor market and make informed investment decisions.

Featured Posts

-

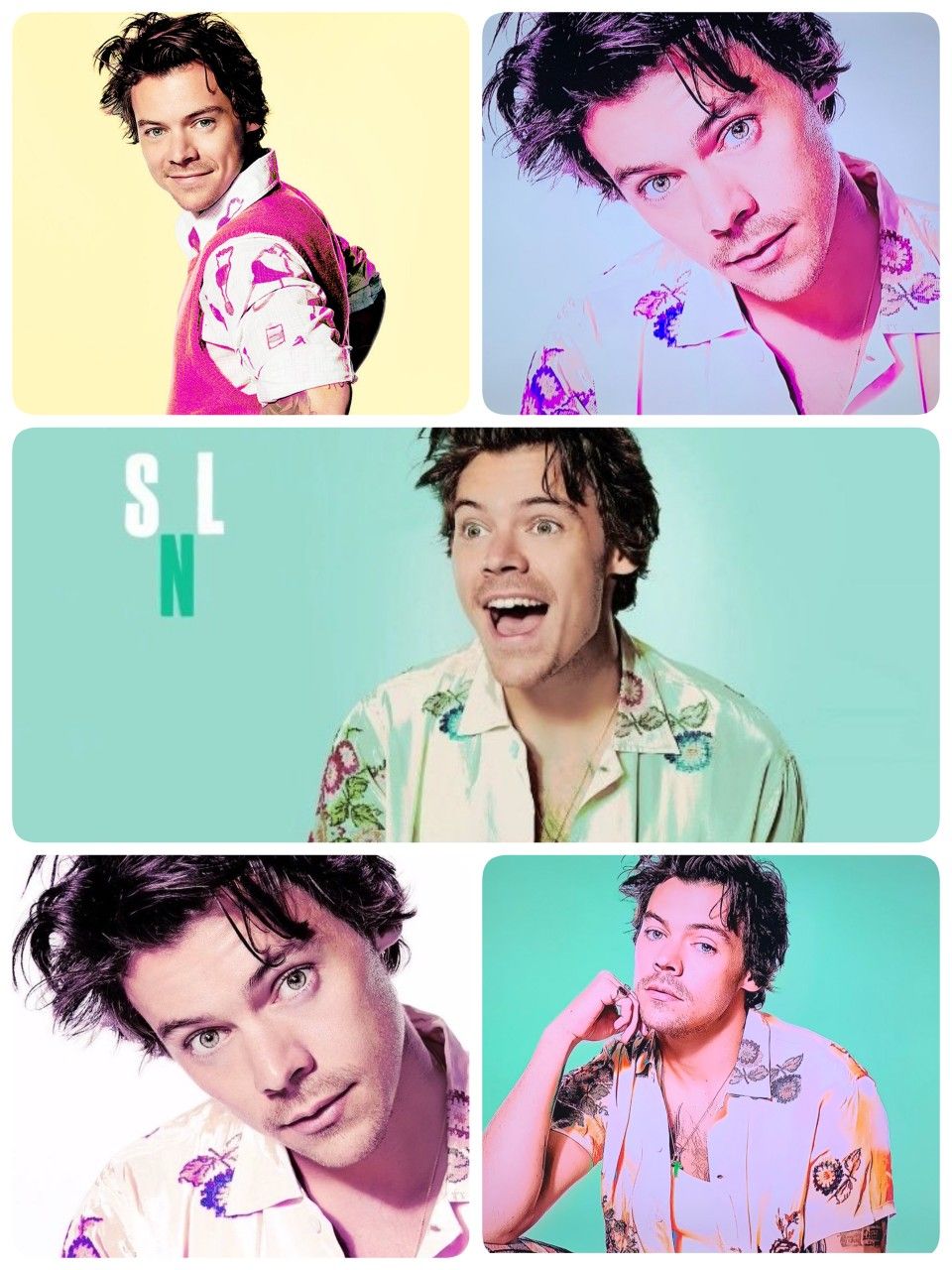

Harry Styles Honest Reaction To A Bad Snl Impression

May 10, 2025

Harry Styles Honest Reaction To A Bad Snl Impression

May 10, 2025 -

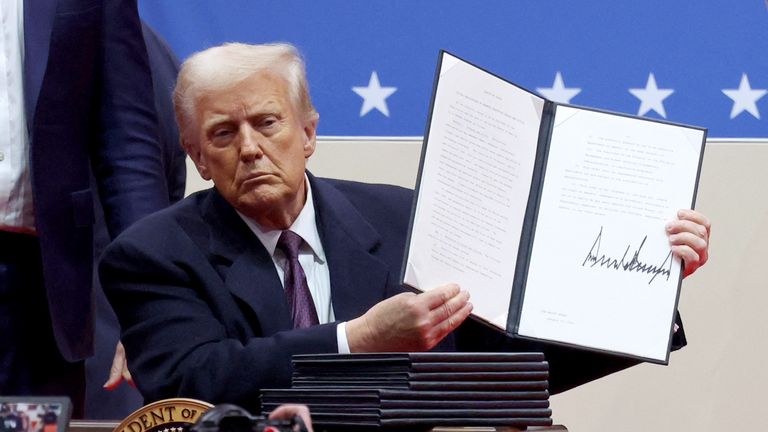

The Lived Reality Transgender People And The Legacy Of Trumps Executive Orders

May 10, 2025

The Lived Reality Transgender People And The Legacy Of Trumps Executive Orders

May 10, 2025 -

Frantsiya I Polsha Podrobnosti Oboronnogo Soglasheniya Ot 9 Maya

May 10, 2025

Frantsiya I Polsha Podrobnosti Oboronnogo Soglasheniya Ot 9 Maya

May 10, 2025 -

Letartoztattak Egy Transznemu Not Floridaban A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Egy Transznemu Not Floridaban A Noi Mosdo Hasznalataert

May 10, 2025 -

Leon Draisaitl Suffers Injury Impact On Oilers Season

May 10, 2025

Leon Draisaitl Suffers Injury Impact On Oilers Season

May 10, 2025