Infineon (IFX) Stock Dip: Tariff Uncertainty And Missed Sales Projections

Table of Contents

Tariff Uncertainty: A Major Headwind for Infineon (IFX)

Escalating trade tensions between major economies represent a significant headwind for Infineon's global operations. The semiconductor industry, including Infineon, is heavily reliant on international trade, making it particularly vulnerable to tariff fluctuations. Increased tariffs on semiconductor components and finished products directly impact Infineon's profitability, squeezing profit margins and potentially hindering future growth.

- Increased costs from tariffs reduce profit margins. Higher import and export costs eat into the bottom line, reducing the overall profitability of each unit sold. This directly impacts Infineon's earnings and could lead to lower dividend payouts for shareholders.

- Uncertainty delays investment decisions by both Infineon and its clients. The unpredictable nature of tariffs makes long-term planning difficult. Infineon may hesitate to invest in new production facilities or R&D, while its clients might postpone large orders until the trade landscape becomes clearer. This creates a ripple effect throughout the supply chain.

- Geopolitical risks associated with tariffs are hard to quantify and predict. The ongoing trade disputes are complex and involve multiple countries, making it difficult to forecast their long-term impact on Infineon's business. This uncertainty contributes to the overall risk profile of investing in IFX stock. Disruptions to the global supply chain due to trade conflicts can further exacerbate the situation, leading to production delays and increased costs. Infineon's reliance on a complex global network of suppliers and customers makes it particularly sensitive to these disruptions. The impact of tariffs extends beyond direct costs, creating uncertainty and potentially affecting the entire semiconductor industry’s supply chain.

Missed Sales Projections: A Sign of Weakness or Temporary Setback?

Infineon's recent financial report revealed a shortfall in sales projections, raising concerns amongst investors. While a single quarter's underperformance doesn't necessarily indicate a long-term trend, it warrants closer examination. Several factors could be contributing to the missed projections:

-

Weaker-than-anticipated demand in key markets. A slowdown in specific sectors, such as automotive or industrial automation, could explain lower-than-expected sales. Market analysis is crucial to identify the precise drivers of decreased demand.

-

Increased competition from other semiconductor manufacturers. The semiconductor market is highly competitive. The emergence of new players or aggressive pricing strategies from established competitors could erode Infineon's market share. Analyzing competitor activity is vital for a comprehensive understanding of the situation.

-

Specific market segments like automotive (a significant portion of Infineon's business) may be facing headwinds. The automotive industry itself is undergoing significant transformation with the rise of electric vehicles and autonomous driving technologies, creating both opportunities and challenges for Infineon's automotive semiconductor products.

-

Analysis of specific product lines showing underperformance is needed to fully understand the situation. Identifying which product categories are lagging allows for more targeted strategic responses from Infineon.

-

Competitor analysis is crucial to determining the extent of market share loss. A detailed assessment of competitors' strategies and market positioning will provide a clearer picture of the competitive landscape.

-

Long-term prospects of the automotive and industrial sectors are key factors in future sales projections. Understanding the long-term growth potential of these key markets is essential for predicting future revenue and profitability.

Analyzing the Impact on Investors and Future Outlook for IFX

The combined effect of tariff uncertainty and missed sales projections has negatively impacted investor sentiment, leading to the recent IFX stock dip. This has resulted in increased volatility in the stock price.

-

Short-term volatility is likely to continue as the market digests the recent news. Investor reactions to the financial report and ongoing trade tensions will likely continue to influence the stock price in the near term.

-

Long-term investors should carefully assess the risks and potential rewards before making any decisions. A thorough due diligence process is crucial before investing in IFX, particularly given the current uncertainties.

-

Analyzing Infineon's response strategies to address these challenges is crucial for predicting future performance. Infineon's ability to adapt to the changing market conditions and mitigate the impact of tariffs will be a key determinant of its future success.

-

Consider diversification of your investment portfolio to mitigate risk. Spreading your investments across different sectors can help reduce the impact of any single stock's underperformance.

-

Monitor industry news and Infineon's financial reports closely. Staying informed about developments in the semiconductor industry and Infineon's specific performance is essential for informed decision-making.

-

Conduct thorough due diligence before investing in IFX stock. This includes researching the company's financial statements, competitive landscape, and overall industry trends.

Conclusion:

The recent dip in Infineon (IFX) stock is a result of tariff uncertainty and missed sales projections. While these challenges present short-term headwinds, a thorough understanding of these factors and Infineon's response is vital for investors. Careful consideration of the market dynamics and the company's long-term prospects is crucial for determining whether this represents a buying opportunity or a reason for caution. Before making any investment decisions regarding Infineon (IFX) stock, conduct thorough research and consult with a financial advisor. Stay informed about Infineon and global trade to make well-informed decisions about your Infineon (IFX) stock investments.

Featured Posts

-

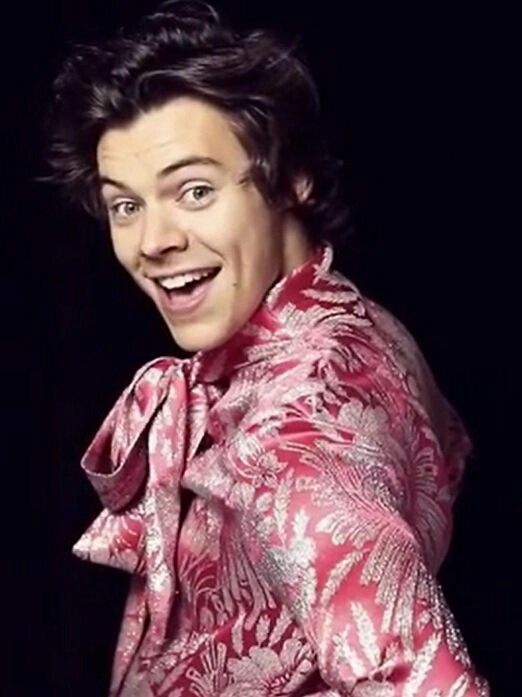

Harry Styles Response To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Response To A Hilariously Bad Snl Impression

May 10, 2025 -

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025 -

Changes To Uk Student Visas Implications For Asylum Claims

May 10, 2025

Changes To Uk Student Visas Implications For Asylum Claims

May 10, 2025 -

Seattle Businesses Accepting Canadian Dollars For Sports Fans

May 10, 2025

Seattle Businesses Accepting Canadian Dollars For Sports Fans

May 10, 2025 -

Bondi Faces Scrutiny Senate Democrats Investigate Potential Epstein Records Cover Up

May 10, 2025

Bondi Faces Scrutiny Senate Democrats Investigate Potential Epstein Records Cover Up

May 10, 2025