Inflation Persists: ECB Attributes High Prices To Pandemic Relief Spending

Table of Contents

The ECB's Argument: Linking Pandemic Relief to Inflation

The ECB's official statements consistently highlight the link between the unprecedented levels of pandemic relief spending and the subsequent surge in inflation. They argue that the massive injection of liquidity into the economy fueled demand while simultaneously disrupting supply chains, creating a perfect storm for price increases.

-

Increased demand due to stimulus packages: Government stimulus packages, designed to support businesses and individuals during lockdowns, significantly boosted disposable income. This increased purchasing power led to a surge in demand for goods and services, outpacing the ability of the supply chain to meet it. [Link to relevant ECB publication on stimulus packages].

-

Supply chain disruptions exacerbated by the pandemic, leading to price increases: The pandemic itself caused major disruptions to global supply chains. Lockdowns, factory closures, and transportation bottlenecks constrained the supply of goods, further contributing to upward price pressures. This scarcity, coupled with heightened demand, resulted in significant price increases across various sectors. [Link to news article on supply chain disruptions].

-

Government spending exceeding productive capacity: The scale of pandemic relief spending, while necessary in the short-term, arguably exceeded the economy's productive capacity. This excess demand, unable to be met by supply, fuelled inflationary pressures. [Link to ECB report on economic capacity utilization].

-

Lagged effects of expansive monetary policy: The ECB's own expansive monetary policy, implemented to support the economy during the crisis, also contributed to inflation. The lagged effects of these policies, such as low interest rates and quantitative easing, continued to fuel demand even as the immediate crisis subsided. [Link to ECB's monetary policy statements].

Analyzing the Impact of Pandemic Relief Spending

The pandemic relief measures implemented across the Eurozone were diverse, ranging from direct cash payments to individuals and businesses to expanded unemployment benefits and government-backed loans.

-

Short-term benefits vs. long-term inflationary consequences: While these measures provided crucial short-term economic support, preventing a deeper recession, they inadvertently fueled long-term inflation. The trade-off between immediate economic relief and potential future inflationary pressures is a key area of debate among economists.

-

Impact on different sectors of the economy (e.g., energy, housing): The impact of increased spending varied across sectors. The energy sector, already facing supply constraints, experienced particularly sharp price increases. Similarly, the housing market saw significant price growth due to increased demand and limited supply.

-

Regional variations in inflation rates across the Eurozone: Inflation rates varied considerably across the Eurozone, reflecting differences in the structure of economies and the implementation of relief measures. [Include a chart showing regional inflation variations].

-

Comparison to inflation rates in countries with different pandemic response strategies: A comparison of inflation rates in countries with differing pandemic response strategies offers valuable insights into the relative impact of government spending on price levels. [Include a graph comparing inflation across countries with varied responses].

The ECB's Response to Persistent Inflation

Facing persistent high inflation, the ECB has implemented a series of monetary policy measures aimed at cooling down the economy.

-

Interest rate hikes and their impact on borrowing costs: The ECB has aggressively raised interest rates, increasing borrowing costs for businesses and consumers. This aims to reduce demand and curb inflationary pressures.

-

Quantitative tightening measures (reducing the ECB's balance sheet): The ECB is also undertaking quantitative tightening, reducing its balance sheet by gradually unwinding its holdings of government bonds. This reduces the money supply, further contributing to tighter monetary conditions.

-

Potential risks associated with aggressive interest rate increases: Aggressive interest rate hikes carry risks, including the potential for a sharp economic slowdown or even a recession. Balancing the need to control inflation with the risk of economic contraction is a delicate challenge.

-

Debate regarding the effectiveness of the ECB's approach: The effectiveness of the ECB's approach remains a subject of ongoing debate among economists. Some argue that the measures are insufficient to address the root causes of inflation, while others express concerns about the potential negative consequences of overly aggressive tightening. [Include expert opinions and quotes from financial analysts].

Alternative Explanations for High Inflation

While pandemic relief spending played a significant role, other factors also contributed to the current inflationary environment:

-

Global supply chain bottlenecks (beyond pandemic effects): Supply chain disruptions continue even beyond the acute phase of the pandemic, due to geopolitical factors and other logistical challenges.

-

The war in Ukraine and its impact on energy prices: The war in Ukraine significantly impacted energy prices, contributing to broad-based inflation across the Eurozone.

-

Rising commodity prices: Rising commodity prices, driven by global demand and supply constraints, further exacerbated inflationary pressures.

-

Increased demand from emerging markets: Increased demand from emerging markets contributed to global inflationary pressures.

Conclusion

The ECB attributes the persistent high inflation in the Eurozone partly to the expansive pandemic relief spending implemented in 2020 and 2021. This spending, coupled with supply chain disruptions and other global factors, created a potent inflationary cocktail. The ECB's response involves aggressive interest rate hikes and quantitative tightening, but the effectiveness and potential risks of this approach remain a subject of ongoing debate. Understanding the complexities of inflation and its multifaceted causes, including the impact of pandemic relief spending, is crucial for navigating the current economic climate. Stay informed about the ongoing developments surrounding inflation and the ECB's monetary policy response by following reputable sources for updates on ECB monetary policy and its effects on the cost of living.

Featured Posts

-

Exclusive University Group Challenges Trump Administration Policies

Apr 29, 2025

Exclusive University Group Challenges Trump Administration Policies

Apr 29, 2025 -

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025 -

Anchor Brewing Company Shuts Down Impact On The Craft Beer Industry

Apr 29, 2025

Anchor Brewing Company Shuts Down Impact On The Craft Beer Industry

Apr 29, 2025 -

Beirut Under Fire Israeli Airstrike And Urgent Evacuation Order

Apr 29, 2025

Beirut Under Fire Israeli Airstrike And Urgent Evacuation Order

Apr 29, 2025 -

Is This The New Quinoa A Rising Star In Healthy Eating

Apr 29, 2025

Is This The New Quinoa A Rising Star In Healthy Eating

Apr 29, 2025

Latest Posts

-

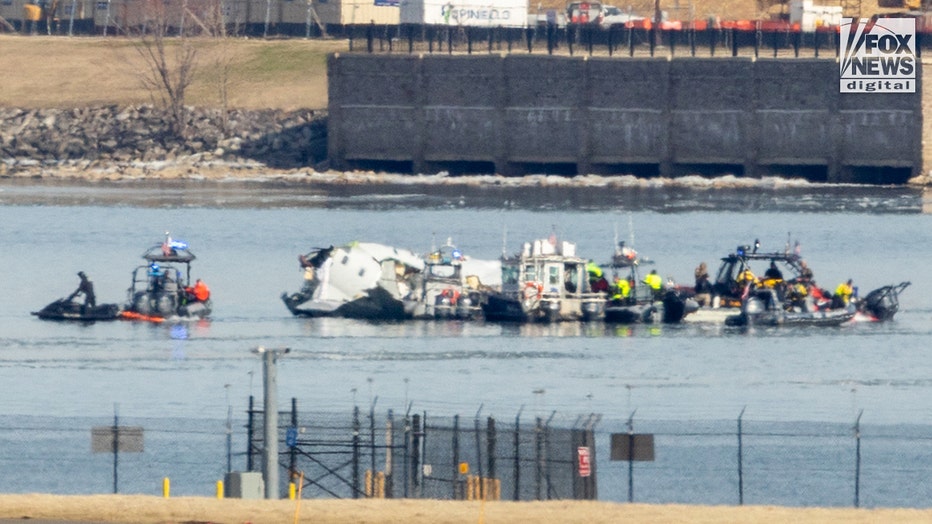

The Dangers Of Misinformation The D C Plane Crash And Social Media

Apr 29, 2025

The Dangers Of Misinformation The D C Plane Crash And Social Media

Apr 29, 2025 -

D C Mid Air Collision Separating Fact From Fiction On Social Media

Apr 29, 2025

D C Mid Air Collision Separating Fact From Fiction On Social Media

Apr 29, 2025 -

Social Medias Role In Misinformation Following D C Air Crash

Apr 29, 2025

Social Medias Role In Misinformation Following D C Air Crash

Apr 29, 2025 -

Remembering Past Tragedies Louisville Residents Under Shelter In Place

Apr 29, 2025

Remembering Past Tragedies Louisville Residents Under Shelter In Place

Apr 29, 2025 -

Louisvilles Shelter In Place A Time For Reflection And Remembrance

Apr 29, 2025

Louisvilles Shelter In Place A Time For Reflection And Remembrance

Apr 29, 2025