Inflation Report Impacts BOE Interest Rate Expectations, Boosts Pound

Table of Contents

The Inflation Report's Key Findings and Market Reaction

The latest inflation data revealed a UK inflation rate of X% (replace X with the actual figure) for [Month, Year], based on the Consumer Price Index (CPI). This figure was higher/lower (adjust based on actual report) than market expectations of Y% (replace Y with market expectation). This "inflation surprise" immediately triggered significant market volatility. Key contributing factors to this unexpected UK inflation included [mention specific factors, e.g., rising energy prices, persistent supply chain disruptions, increased demand]. The surge/dip (adjust based on actual report) in the inflation rate represents a considerable challenge/opportunity (adjust based on actual report) for the Bank of England in managing the UK economy.

Analyzing the specific "inflation data," we see that the Retail Price Index (RPI) also experienced a similar trend. The rise/fall (adjust based on actual report) in both CPI and RPI indices indicates a broader inflationary pressure/deflationary trend (adjust based on actual report) across the UK economy. The "inflation drivers" remain complex and require further investigation.

The immediate market response was dramatic. The Pound Sterling experienced a sharp [percentage]% appreciation/depreciation (adjust based on actual report) against the US dollar (USD) and a [percentage]% appreciation/depreciation (adjust based on actual report) against the Euro (EUR). This "market volatility" reflected investors' reassessment of the UK economic outlook.

- Pound's immediate percentage change: +X% against USD, +Y% against EUR (replace X and Y with actual figures)

- Changes in UK government bond yields: Increased/Decreased by Z% (replace Z with actual figure)

- Impact on the FTSE 100: Increased/Decreased by W points (replace W with actual figure)

BOE Interest Rate Expectations – A Shift in Policy?

The Bank of England's primary mandate is to maintain price stability and support sustainable economic growth. The unexpected inflation figures significantly alter the BOE's policy trajectory. The current "BOE monetary policy" is likely to be adjusted in response to the new inflation data. A key question is whether the BOE will opt for "monetary policy tightening" (interest rate hikes) or "monetary policy easing" (interest rate cuts or continued quantitative easing).

Arguments for a rate hike center on controlling the rising inflation, preventing inflationary expectations from becoming entrenched, and maintaining the credibility of the BOE's inflation target. Conversely, arguments against a rate hike focus on the potential negative impacts on economic growth, especially given existing economic uncertainties.

Several leading economists believe the BOE will [predict BOE action, e.g., likely raise interest rates by 0.25% at its next meeting]. [Insert quote from a reputable economist].

- Scenario 1: BOE hikes interest rates: This would aim to curb inflation but could potentially slow economic growth.

- Scenario 2: BOE maintains interest rates: This would risk allowing inflation to become entrenched but avoid further economic slowdown.

- Scenario 3: BOE cuts interest rates: This is less likely given the current inflationary pressure but might be considered if economic growth significantly weakens.

Long-Term Implications for the Pound and the UK Economy

The long-term consequences of the inflation report and the BOE's subsequent response will have a profound effect on the UK economy. The "UK economic outlook" depends heavily on the effectiveness of the BOE's actions. High inflation can erode consumer purchasing power, impacting "consumer spending" and potentially slowing "GDP growth." Businesses may also postpone investments due to uncertainty, leading to reduced job creation and a slowdown in employment growth.

Geopolitical factors, such as global energy prices and supply chain disruptions, will continue to influence the UK's economic trajectory.

- Potential impact on consumer confidence: A decline is likely if inflation remains high.

- Potential effects on businesses and investment: Reduced investment and hiring could occur.

- Long-term outlook for the Pound's value: The Pound's value will likely fluctuate depending on the BOE's policy response and global economic conditions.

Conclusion: Understanding the Inflation Report's Impact on BOE Rates and the Pound

The latest inflation report has profoundly impacted the BOE's interest rate expectations and the value of the Pound Sterling. The unexpected rise/fall (adjust based on actual report) in inflation figures prompted immediate market reactions, with the Pound experiencing significant appreciation/depreciation (adjust based on actual report) against major currencies. The BOE's response, whether through interest rate hikes, rate cuts, or maintaining the status quo, will have significant long-term implications for the UK economy. Understanding how the "Inflation Report Impacts BOE Interest Rate Expectations, Boosts Pound" is crucial for navigating these economic shifts. Stay informed about future inflation reports and BOE announcements by subscribing to our newsletter or following reputable financial news sources to effectively manage your finances and investments in the ever-changing UK economic landscape.

Featured Posts

-

Le Quotidien D Une Famille Nombreuse L Experience De Melanie Thierry Et Raphael

May 26, 2025

Le Quotidien D Une Famille Nombreuse L Experience De Melanie Thierry Et Raphael

May 26, 2025 -

Bundesliga Rueckkehr Hsv Aufstieg Analyse Und Reaktionen

May 26, 2025

Bundesliga Rueckkehr Hsv Aufstieg Analyse Und Reaktionen

May 26, 2025 -

Atletico Madrid 3 Maclik Galibiyetsizligi Kirildi

May 26, 2025

Atletico Madrid 3 Maclik Galibiyetsizligi Kirildi

May 26, 2025 -

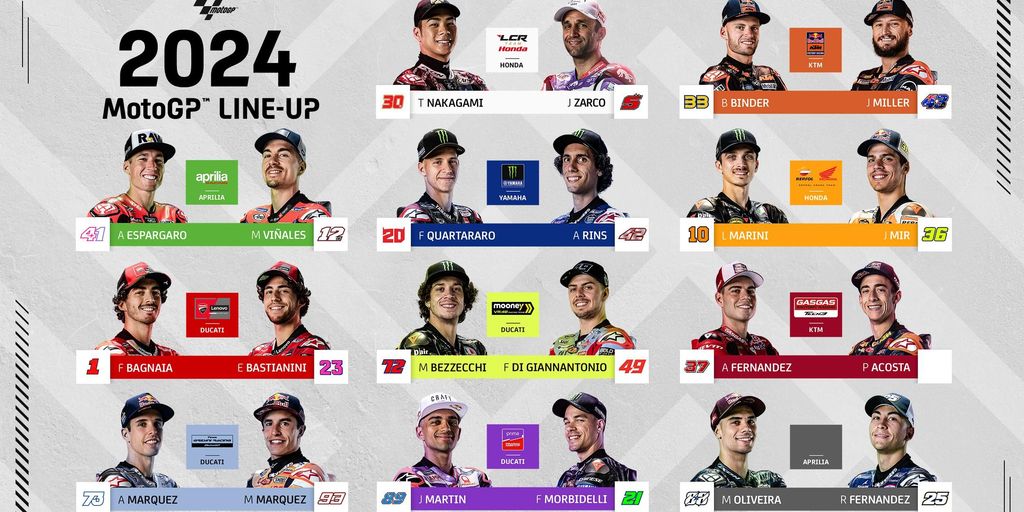

Jadwal Lengkap Moto Gp Inggris 2024 Jangan Sampai Ketinggalan

May 26, 2025

Jadwal Lengkap Moto Gp Inggris 2024 Jangan Sampai Ketinggalan

May 26, 2025 -

Jadwal Moto Gp Inggris 2024 Silverstone Klasemen And Prediksi Marquez

May 26, 2025

Jadwal Moto Gp Inggris 2024 Silverstone Klasemen And Prediksi Marquez

May 26, 2025