ING Group Publishes 2024 Annual Report (Form 20-F)

Table of Contents

Key Financial Highlights from ING Group's 2024 Form 20-F

This section delves into the core financial data presented in ING Group's 2024 Form 20-F. Analyzing this information provides a clear picture of the company's financial health and performance throughout the year.

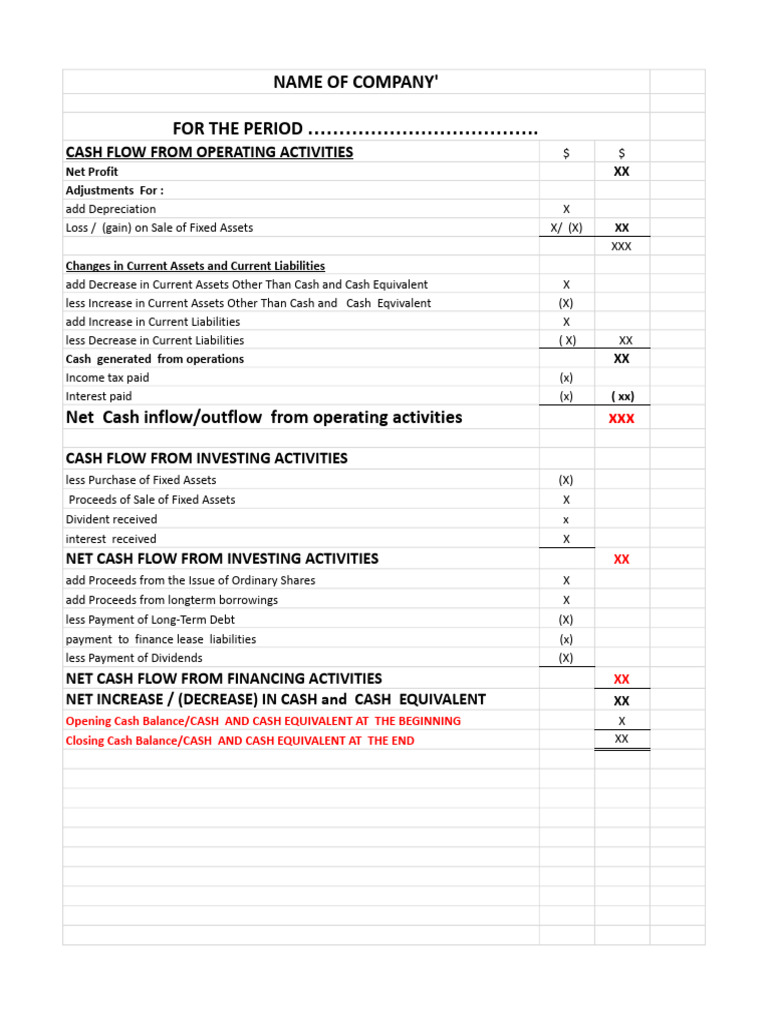

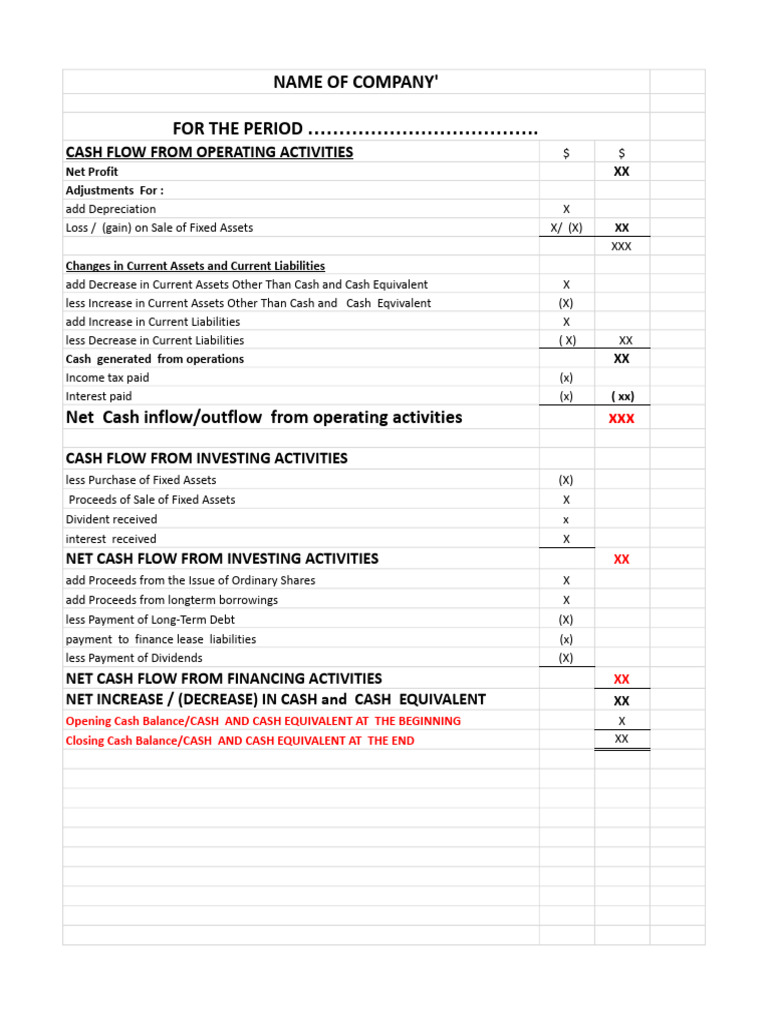

Revenue and Net Income

ING Group's 2024 financial results showcase [insert actual revenue figure] in revenue, representing a [insert percentage]% change compared to 2023. This demonstrates [positive/negative] growth in revenue, primarily driven by [mention key contributing factors, e.g., strong performance in specific business segments, increased market share, etc.]. Similarly, net income reached [insert actual net income figure], showcasing a [insert percentage]% [increase/decrease] compared to the previous year. This change can be attributed to [mention factors impacting net income, e.g., changes in operating expenses, interest rates, etc.]. This data points towards a [positive/negative] trend in ING Group's financial performance compared to industry benchmarks of [mention relevant industry benchmarks and comparisons]. Analyzing ING Group's financial performance in this context offers valuable insights into the company's overall health and competitiveness within its sector. The key takeaway regarding ING Group's revenue and net income is [Summarize the most important aspect of revenue and net income growth/decline].

Profitability and Return on Equity (ROE)

ING Group's profitability, a key indicator of financial health, is reflected in its Return on Equity (ROE). The 2024 Form 20-F reports an ROE of [insert actual ROE figure], indicating [positive/negative] performance compared to the previous year's [insert previous year's ROE figure]. This change in ROE can be explained by [mention contributing factors like changes in net income, shareholder equity, etc.]. A detailed analysis of ING Group's profitability reveals a [positive/negative] trend, indicating [explain the overall trend and its implications]. Understanding ING Group's profitability is critical for assessing its long-term financial sustainability and investor return potential.

Key Financial Ratios

Several key financial ratios offer further insights into ING Group's financial health. The debt-to-equity ratio, for example, stands at [insert actual figure], suggesting [explain the implication of this ratio]. Liquidity ratios, which measure the company's ability to meet its short-term obligations, demonstrate [insert actual figures and interpretations]. This analysis of key financial metrics provides a comprehensive picture of ING Group's financial stability and risk profile. The overall financial analysis showcases [concise overview of financial health based on ratios].

- Revenue Growth: [Insert percentage]%

- Net Income Increase/Decrease: [Insert percentage]%

- Return on Equity (ROE): [Insert percentage]%

- Debt-to-Equity Ratio: [Insert figure]

ING Group's Strategic Initiatives and Outlook for 2025

The 2024 Form 20-F also outlines ING Group's strategic priorities and outlook for 2025. Understanding these aspects is vital for evaluating the company's future prospects.

Strategic Priorities

ING Group's strategic priorities for 2025 focus on [list key strategic priorities mentioned in the report, e.g., digital transformation, expansion into new markets, sustainability initiatives]. These initiatives aim to [explain the goals of each initiative and their expected impact]. A commitment to [mention specific commitments like environmental sustainability, customer experience improvement etc.] highlights ING Group's forward-looking approach to business. The strategic goals laid out in the 20-F suggest a [positive/negative/neutral] outlook for the company’s future. The company's business outlook reflects a confidence in its ability to [mention what the company aims to achieve].

Risk Factors and Management

The report acknowledges various risk factors, including [mention key risk factors such as macroeconomic conditions, geopolitical instability, regulatory changes, cyber security threats, etc.]. ING Group's risk management strategies include [mention specific risk mitigation strategies outlined in the report]. Addressing these risks proactively is crucial for maintaining financial stability and long-term sustainability. Understanding the identified risks and mitigation strategies is crucial for assessing ING Group's resilience and its ability to navigate potential challenges.

- Digital Transformation Initiatives: [brief description]

- Market Expansion Plans: [brief description]

- Sustainability Targets: [brief description]

Where to Access the Full ING Group 2024 Annual Report (Form 20-F)

The complete ING Group 2024 Annual Report (Form 20-F) is available on the official ING Group investor relations website: [Insert Link Here]. You can also find the report through major financial news sources and SEC filings. The report is structured to provide easy navigation through its various sections, including the Management Discussion and Analysis (MD&A) and the detailed financial statements. To find specific information, utilize the report's table of contents and search functions.

Conclusion: Understanding the Implications of ING Group's 2024 Form 20-F

The ING Group 2024 Annual Report (Form 20-F) paints a picture of [summarize overall performance - positive, negative or mixed]. Key highlights include [briefly mention key financial highlights and strategic initiatives]. This report is a critical resource for investors, analysts, and stakeholders seeking a comprehensive understanding of ING Group's financial performance and future direction. Download the ING Group 2024 Annual Report, read the complete ING Group Form 20-F, and analyze the key takeaways from ING Group's 2024 financial report to gain a thorough understanding of the company's performance and strategic plans. Understanding the details within this document is crucial for informed decision-making regarding investments and assessing the company's long-term prospects.

Featured Posts

-

The Michael Strahan Interview A Deep Dive Into Ratings And Competition

May 21, 2025

The Michael Strahan Interview A Deep Dive Into Ratings And Competition

May 21, 2025 -

The Kartels Grip On Guyanas Rum Industry Examining The Stabroek News Findings

May 21, 2025

The Kartels Grip On Guyanas Rum Industry Examining The Stabroek News Findings

May 21, 2025 -

Understanding The Friday Rise In D Wave Quantum Qbts Stock

May 21, 2025

Understanding The Friday Rise In D Wave Quantum Qbts Stock

May 21, 2025 -

De Ultieme Gids Voor Tikkie Betalen In Nederland Gemakkelijk Gemaakt

May 21, 2025

De Ultieme Gids Voor Tikkie Betalen In Nederland Gemakkelijk Gemaakt

May 21, 2025 -

Leverkusen Stalls Bayerns Bundesliga Festivities Kane To Miss The Party

May 21, 2025

Leverkusen Stalls Bayerns Bundesliga Festivities Kane To Miss The Party

May 21, 2025