Interest Rate Cuts: Powell's Calculated Risk Amidst Trump's Pressure

Table of Contents

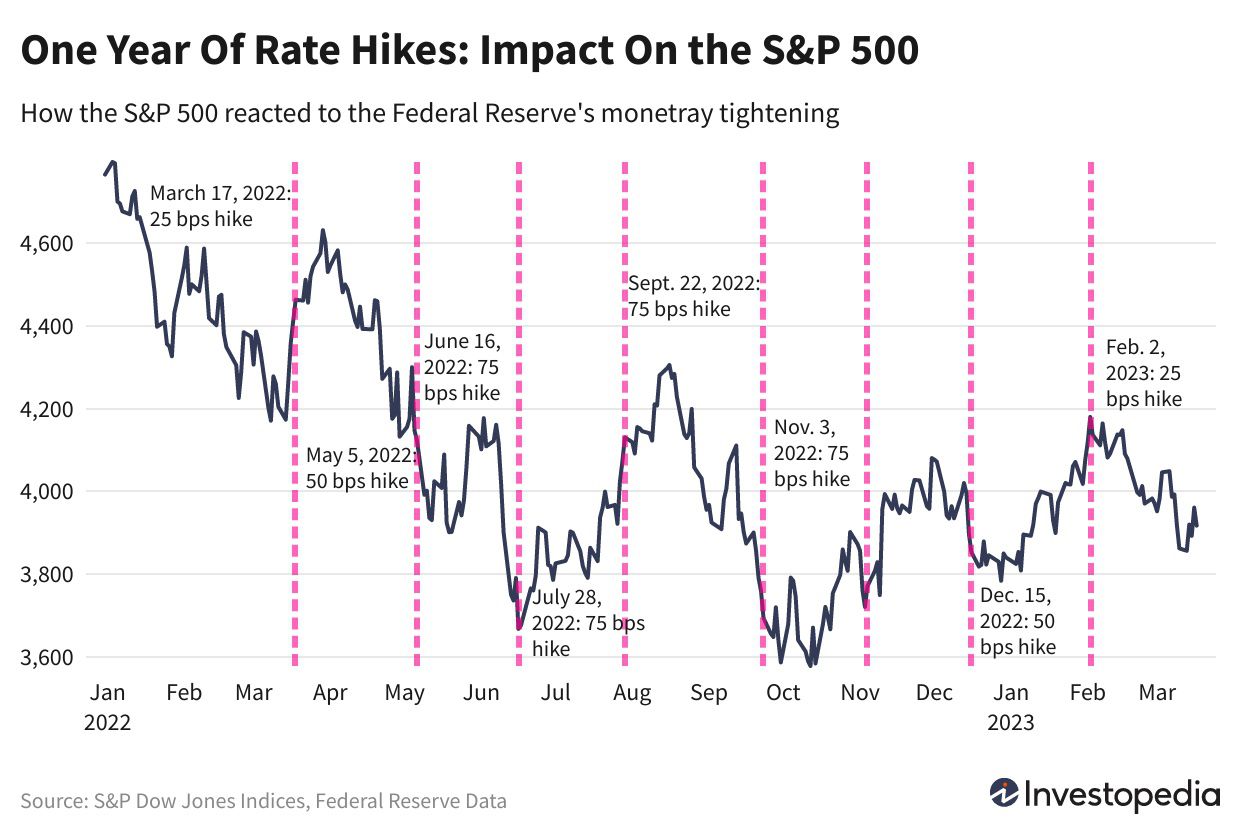

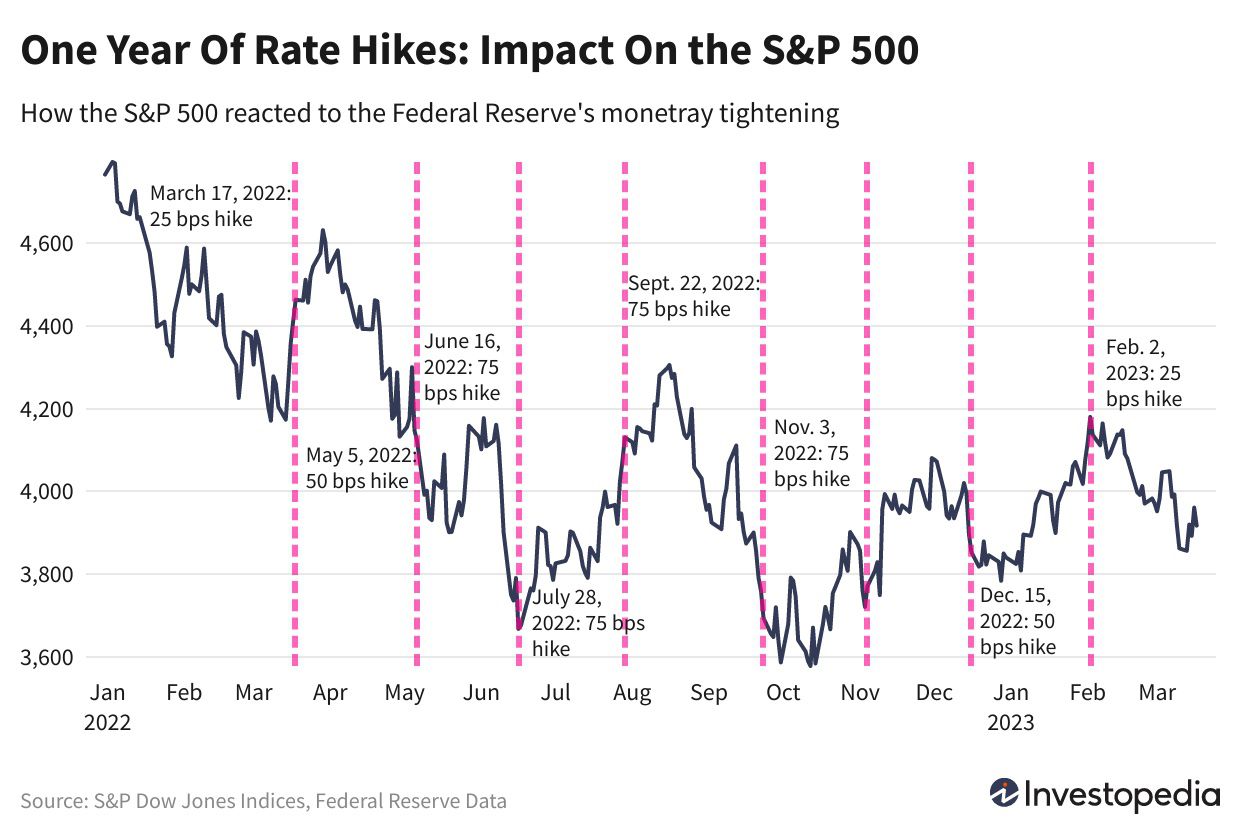

The Economic Rationale Behind Interest Rate Cuts

Interest rate cuts are a powerful tool used by central banks to stimulate economic activity. Typically, reductions are warranted when several key economic indicators point towards slowing growth or potential recession. These indicators signal a need for intervention to prevent a deeper economic downturn. During the period in question, several such indicators raised concerns:

-

Slowing GDP Growth: Economic growth, measured by Gross Domestic Product (GDP), showed signs of deceleration, signaling a weakening economy. This slowdown often triggers consideration of interest rate cuts to inject capital and boost spending.

-

Decreasing Consumer Confidence: Surveys revealed declining consumer confidence, indicating a lack of faith in the economy's future. This diminished optimism often translates into reduced consumer spending, further hampering economic growth. Interest rate cuts aim to counter this by making borrowing more attractive.

-

Concerns about a Potential Recession: The confluence of slowing GDP growth and decreasing consumer confidence fueled legitimate concerns about an impending recession. The threat of a recession is a critical factor influencing decisions regarding interest rate cuts.

-

Low Inflation Rates: Persistently low inflation rates can signal weak demand in the economy. In such circumstances, interest rate cuts aim to stimulate spending and boost inflation towards the central bank's target.

-

Inverted Yield Curve Analysis: An inverted yield curve, where short-term interest rates exceed long-term rates, is often seen as a reliable predictor of economic recessions. This indicator played a significant role in the debate surrounding interest rate cuts.

Political Pressure and the Independence of the Federal Reserve

The decision-making process surrounding interest rate cuts was significantly complicated by the intense political pressure exerted by President Trump on Chairman Powell. Trump publicly criticized Powell's monetary policy, advocating for aggressive interest rate cuts to boost the economy before the 2020 election.

-

Trump's Public Criticism of Powell's Monetary Policy: Trump's vocal criticism raised questions about the Fed's independence and its ability to make decisions based purely on economic data. This public pressure was unprecedented and potentially damaging to the Fed’s credibility.

-

Potential Consequences of Political Pressure on the Fed's Credibility: The perceived political interference threatened to undermine the Fed's reputation for impartiality and its effectiveness in managing the economy. Maintaining the Fed's independence from political influence is critical for its long-term success.

-

Historical Context of Political Influence on the Federal Reserve: While not unprecedented, the level and directness of Trump’s pressure were unusual. Examining historical instances of political influence on the Fed helps to understand the potential ramifications of this unprecedented level of intervention.

Assessing the Risks of Interest Rate Cuts

While interest rate cuts can stimulate economic activity, they also carry significant risks. These risks include:

-

Risk of Increased Inflation: Lowering interest rates can increase the money supply, potentially leading to higher inflation. This is particularly concerning when the economy is already showing signs of recovery, as it could overheat.

-

Potential for Asset Bubbles: Lower borrowing costs can fuel speculation and the formation of asset bubbles in areas such as the stock market and real estate. These bubbles, when they burst, can have devastating economic consequences.

-

Growing National Debt and its Long-Term Implications: Persistent interest rate cuts can contribute to an increase in national debt as the government borrows more money at lower rates. This increase can have significant long-term implications for the country’s economic stability.

-

Uncertainty Surrounding the Effectiveness of Rate Cuts: The impact of monetary policy is never certain, and there's always the possibility that rate cuts may not produce the desired economic effects. This uncertainty makes such decisions high-stakes gambles.

Powell's Balancing Act: A Calculated Risk?

Jerome Powell faced an incredibly challenging situation. He had to balance the economic indicators suggesting a need for stimulus with the significant risks associated with interest rate cuts, all while navigating the unprecedented political pressure from the President. His decisions represented a calculated risk, attempting to stimulate the economy without triggering runaway inflation or creating dangerous asset bubbles.

-

Powell's Statements and Public Communications Regarding Interest Rate Policy: Powell’s public statements offered insight into his decision-making process, highlighting the complexities and trade-offs involved.

-

Analysis of the Federal Open Market Committee (FOMC) Meetings: The FOMC meetings, where interest rate decisions are made, provide a window into the internal debate and the rationale behind policy choices.

-

Comparison with Previous Instances of Fed Rate Adjustments Under Political Pressure: Analyzing historical precedents helps contextualize Powell's response to political pressure and assess whether his actions were exceptional or a reflection of established norms.

The Ongoing Debate Surrounding Interest Rate Cuts

The decision to implement interest rate cuts during this period remains a subject of intense debate. While the cuts aimed to prevent a deeper recession, they also carry potential long-term risks. The interplay between economic realities and political pressures created a volatile environment that tested the Federal Reserve’s independence and its ability to effectively manage the US economy. The independence of the Federal Reserve, and its crucial role in maintaining economic stability, remains paramount. Stay informed about future interest rate adjustments and the evolving Federal Reserve monetary policy decisions. Consult reputable sources like the Federal Reserve website and leading financial news outlets to remain updated on this critical aspect of the American economy. Understanding interest rate cuts and their implications is crucial for navigating the complexities of the financial landscape.

Featured Posts

-

John Wick 5 What Keanu Reeves Said About A Potential Sequel

May 07, 2025

John Wick 5 What Keanu Reeves Said About A Potential Sequel

May 07, 2025 -

Isabela Merced Discusses Her Experience Playing Hawkgirl And Madame Web

May 07, 2025

Isabela Merced Discusses Her Experience Playing Hawkgirl And Madame Web

May 07, 2025 -

Check Daily Lotto Results For Tuesday April 15 2025

May 07, 2025

Check Daily Lotto Results For Tuesday April 15 2025

May 07, 2025 -

Isabela Merceds Dina A High Point Of The Last Of Us Season 2 Episode 1

May 07, 2025

Isabela Merceds Dina A High Point Of The Last Of Us Season 2 Episode 1

May 07, 2025 -

San Francisco Giants Win Home Opener Thanks To Adames Walk Off Hit

May 07, 2025

San Francisco Giants Win Home Opener Thanks To Adames Walk Off Hit

May 07, 2025

Latest Posts

-

Enhancing Resilience And Sustainable Development In The Least Developed Countries

May 07, 2025

Enhancing Resilience And Sustainable Development In The Least Developed Countries

May 07, 2025 -

Stephen Currys Injury Steve Kerrs Positive Assessment And Expected Timeline

May 07, 2025

Stephen Currys Injury Steve Kerrs Positive Assessment And Expected Timeline

May 07, 2025 -

Building Resilience In Least Developed Countries A Pathway To Sustainable Transformation

May 07, 2025

Building Resilience In Least Developed Countries A Pathway To Sustainable Transformation

May 07, 2025 -

Warrior Steve Kerr Optimistic About Stephen Currys Speedy Injury Recovery

May 07, 2025

Warrior Steve Kerr Optimistic About Stephen Currys Speedy Injury Recovery

May 07, 2025 -

All Star Game 2024 Currys Victory Overshadows Format Criticism

May 07, 2025

All Star Game 2024 Currys Victory Overshadows Format Criticism

May 07, 2025