Invest In Baazar Style Retail: JM Financial's ₹400 Price Target

Table of Contents

Understanding the Bazaar Style Retail Sector

Bazaar style retail, also known as unorganized retail, is characterized by a vibrant, diverse marketplace offering a wide array of products and services. Think bustling street markets, local shops, and small-scale retailers catering to diverse customer needs with personalized attention. This sector thrives on its ability to offer affordable goods and services, fostering strong customer relationships built on trust and personalized experiences. Key growth drivers include:

- Rising Disposable Incomes: A growing middle class with increased purchasing power fuels demand for a wider range of products.

- Preference for Affordable Products: Bazaar style retail often provides more affordable options compared to organized retail, making it attractive to price-sensitive consumers.

- Untapped Market Segments: Significant growth potential remains in underserved areas and with specific consumer segments.

Key players in this sector vary geographically, but often include independent retailers, small family-owned businesses, and local market vendors. The sector's success stems from its:

- High growth potential: Vast untapped market segments ensure sustained expansion.

- Strong resilience: Its decentralized nature makes it relatively resilient to economic downturns compared to larger, organized chains.

- Opportunities for innovation: Technological advancements and evolving consumer preferences offer numerous avenues for innovation and expansion within the Bazaar style retail model.

JM Financial's ₹400 Price Target: Rationale and Analysis

JM Financial's ₹400 price target for [Company Name] is based on several key factors:

- Strong Financial Performance: The target company likely demonstrates robust revenue growth, increasing profit margins, and a healthy balance sheet. (Include specific financial data here if available, e.g., "Revenue growth exceeding 20% YoY for the last three years").

- Positive Industry Outlook: The bullish price target reflects JM Financial's confidence in the continued expansion of the Bazaar style retail sector.

- Expansion Plans and Market Penetration: The company's aggressive expansion strategies into new markets and customer segments contribute to the optimistic forecast. (Detail these expansion plans if known).

- Competitive Advantages: Unique business models, strong brand recognition, or strategic partnerships may give the company a significant competitive edge.

However, it's crucial to analyze the potential downsides:

- Valuation Concerns: Is the ₹400 price target justified based on comparable company valuations? (Include a comparison with competitor valuations if possible).

- Market Volatility: Economic fluctuations or unforeseen events could impact the company's performance and the accuracy of the price target.

- Competition: Increased competition from organized retail and e-commerce players presents a challenge.

Investment Considerations: Risks and Opportunities

Investing in Bazaar style retail presents both significant opportunities and inherent risks:

Potential Risks:

- Competition from Organized Retail: Large retail chains and e-commerce platforms pose a constant threat.

- Regulatory Changes: New government regulations or policies could impact the sector's profitability.

- Economic Fluctuations: Economic downturns can significantly affect consumer spending, impacting demand for products.

Potential Rewards:

- High Growth Potential: The sector's rapid expansion offers substantial returns on investment.

- Strong Returns: Successful investments can yield significant profits due to high growth rates.

- Diversification Benefits: Investing in Bazaar style retail offers diversification away from traditional investment options.

Suitable investor profiles for this investment include those with a higher risk tolerance and a long-term investment horizon. Risk mitigation strategies could include diversifying investments across multiple companies within the sector.

Alternative Investment Options in the Retail Sector

While Bazaar style retail offers compelling opportunities, investors should also consider alternative options within the broader retail landscape:

- Organized Retail Chains: Investing in established retail giants presents a different risk-return profile.

- E-commerce Platforms: The rapidly growing e-commerce sector provides alternative investment avenues.

A comparative table highlighting key differences between these investment options would further aid investors in making informed decisions.

Conclusion: Should You Invest in Bazaar Style Retail?

JM Financial's ₹400 price target for [Company Name] highlights the significant growth potential within the Bazaar style retail sector. While the potential for high returns is undeniable, investors must carefully consider the inherent risks associated with this sector. Conduct thorough due diligence, analyze the financial performance of the target company, and assess your own risk tolerance before making any investment decisions. Consider investing in Bazaar style retail today! Learn more about investing in this dynamic sector and its promising future.

Featured Posts

-

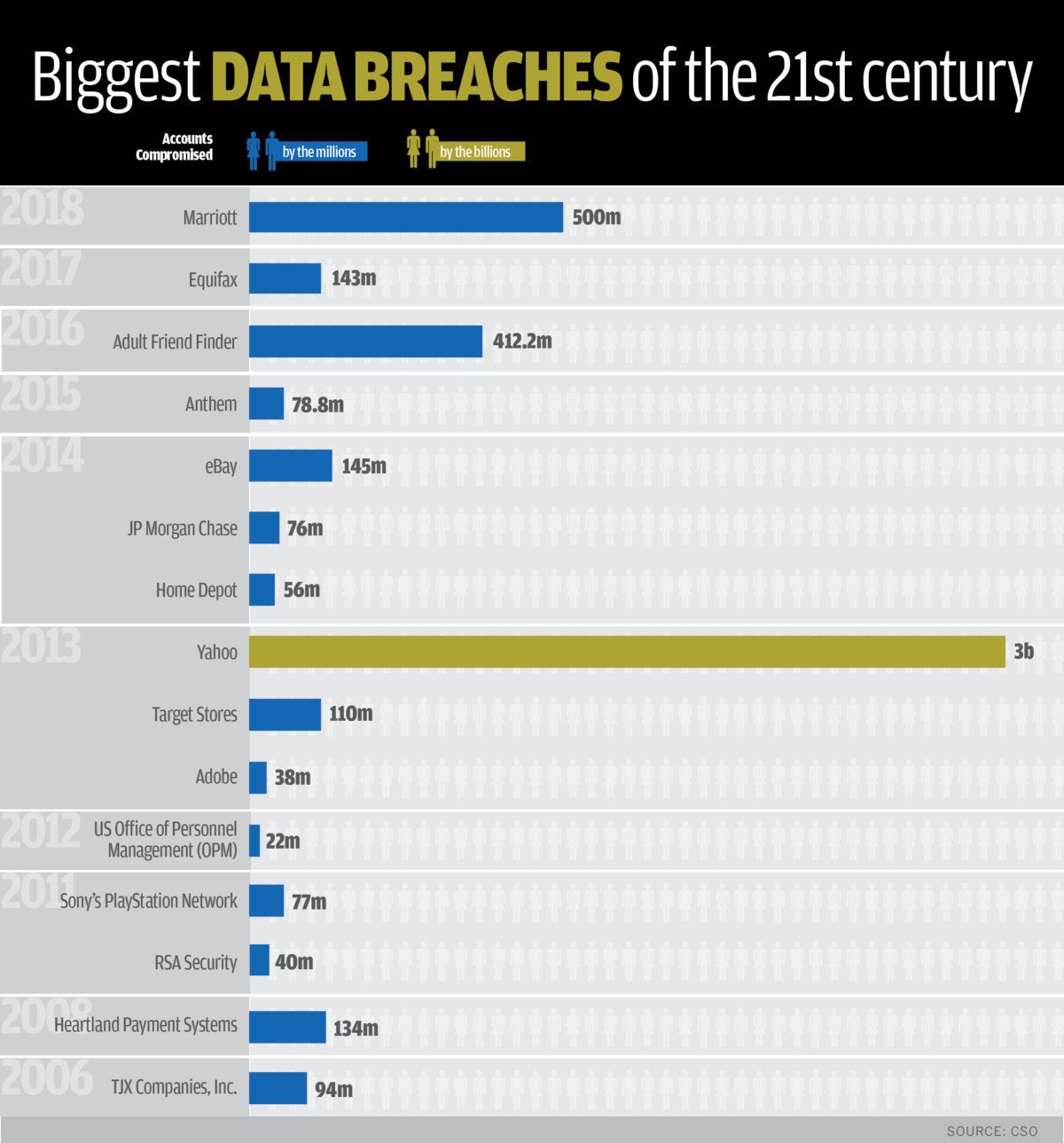

16 Million Fine For T Mobile Details On Three Years Of Data Breaches

May 15, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Breaches

May 15, 2025 -

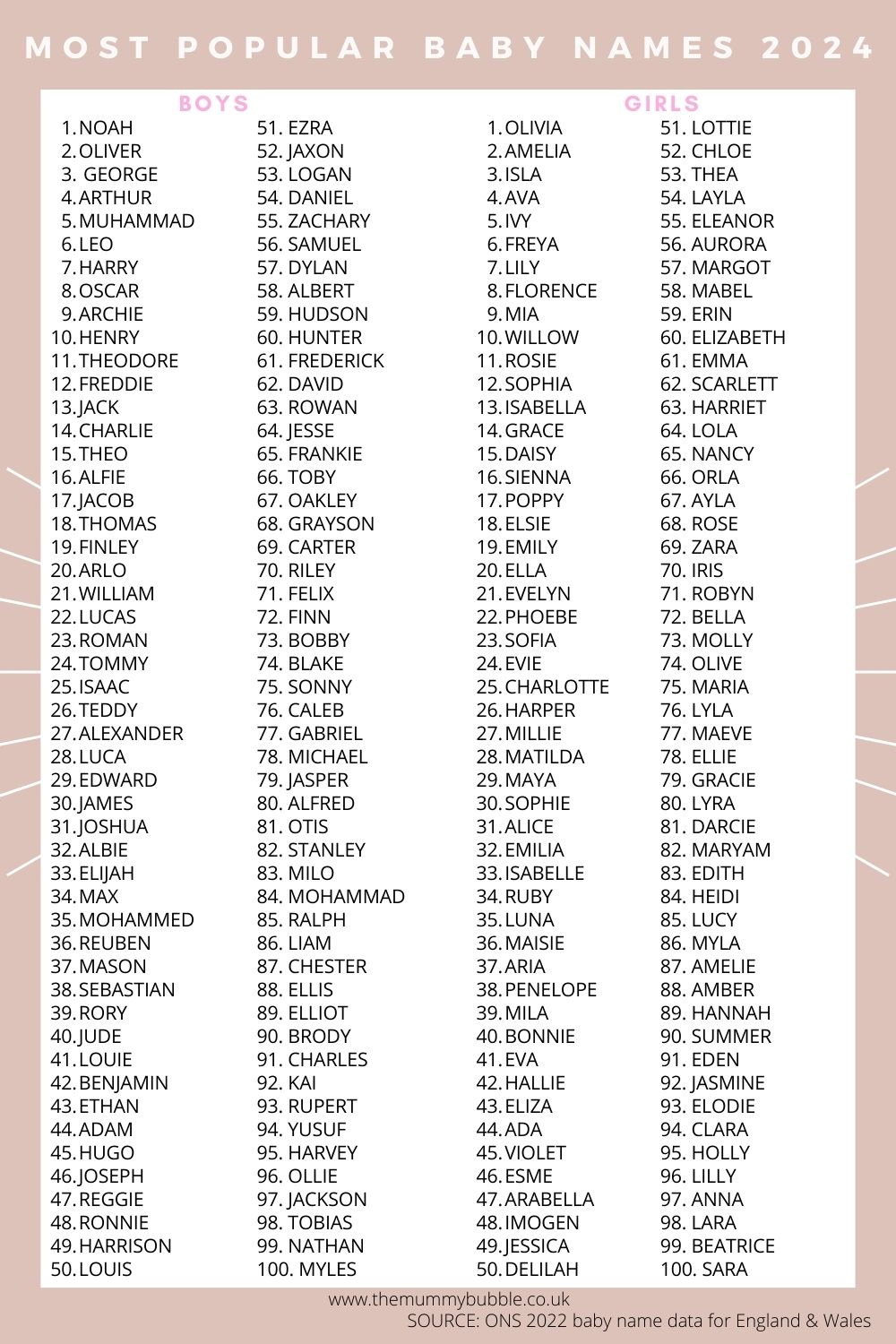

The Most Popular Baby Names Of 2024

May 15, 2025

The Most Popular Baby Names Of 2024

May 15, 2025 -

Limited Time Offer Calvin Klein Euphoria At Nordstrom Rack

May 15, 2025

Limited Time Offer Calvin Klein Euphoria At Nordstrom Rack

May 15, 2025 -

Analysts Point To Nike Turnaround In Latest Foot Locker Earnings

May 15, 2025

Analysts Point To Nike Turnaround In Latest Foot Locker Earnings

May 15, 2025 -

Finding Stability Microsoft Among Software Stocks Facing Tariff Challenges

May 15, 2025

Finding Stability Microsoft Among Software Stocks Facing Tariff Challenges

May 15, 2025