Broader Market Trends Impacting QBTS

Monday's QBTS stock dip wasn't an isolated incident. A general market downturn significantly impacted many sectors. Understanding the overall market performance is crucial to assessing the extent to which broader trends contributed to QBTS's decline. Analyzing the influence of macroeconomic factors is essential for a complete picture.

- Specific market indices and their performance: The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced declines on Monday. The severity of these declines varied, but the overall negative market sentiment likely played a role in the QBTS

stock market dip.

- Significant economic releases: The release of unexpectedly high inflation data or disappointing economic growth figures could have negatively impacted investor confidence, leading to a sell-off across various sectors, including the relatively volatile

quantum computing stock market.

- Geopolitical events impacting investor confidence: Geopolitical instability or escalating international tensions can create uncertainty in the market, prompting investors to move towards safer assets and away from riskier investments like QBTS stock. This

market volatility can disproportionately affect smaller-cap companies.

Company-Specific News and Developments

Internal factors within D-Wave Quantum itself could have influenced the stock price decline. Analyzing any company-specific news or developments is crucial in understanding the Monday dip.

- D-Wave Quantum news: A careful review of any press releases, announcements, or financial reports released by D-Wave Quantum around Monday is necessary. Negative news concerning the company's technology, partnerships, or financial performance could have directly triggered the sell-off.

- Financial performance indicators: Any unexpected setbacks in financial performance, such as lower-than-expected revenue or increased losses, could have spooked investors and contributed to the

QBTS stock dip.

- Partnership delays or R&D setbacks: Delays in project timelines or setbacks in research and development could signal challenges to the company's future growth prospects, prompting investors to reassess their positions. Any negative news relating to key partnerships or collaborations would also be relevant here.

Analyst Ratings and Investor Sentiment

The overall sentiment surrounding D-Wave Quantum and the quantum computing sector played a crucial role in Monday's stock market dip. Analyzing analyst ratings and investor sentiment provides valuable insights.

- Analyst ratings and their impact: Downgrades from influential analysts could have contributed to the negative sentiment surrounding QBTS stock. A change in consensus rating from "buy" to "hold" or "sell" can significantly influence investor behavior.

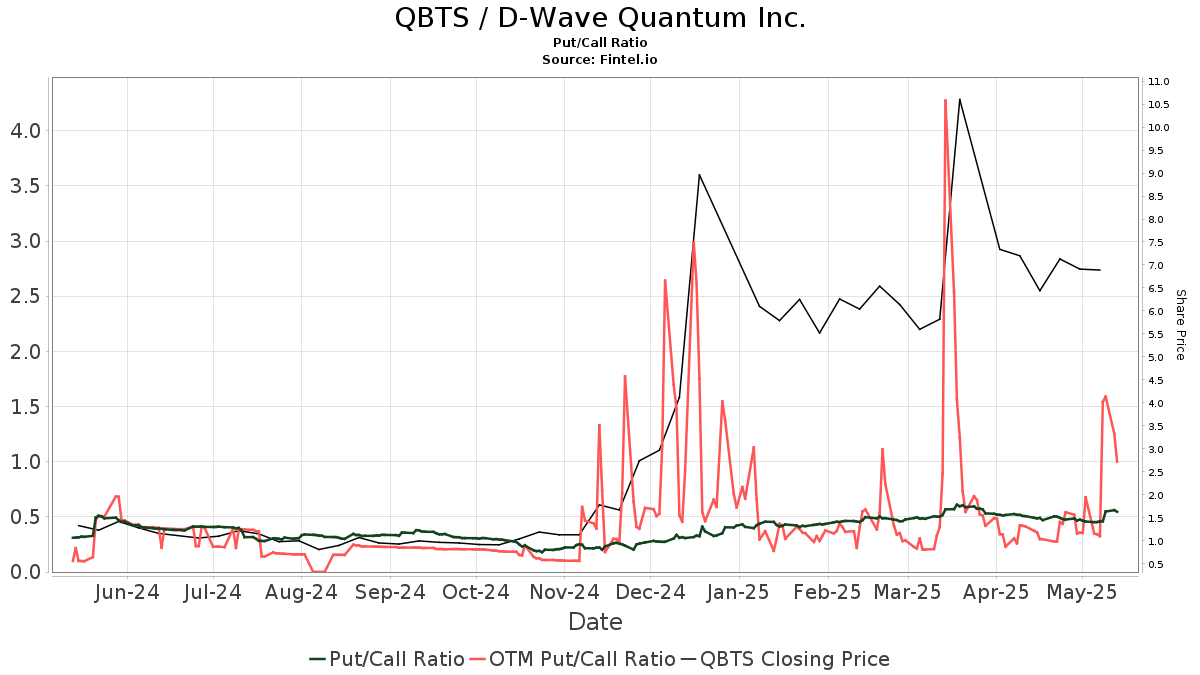

- Short interest and trading volume: A sudden increase in short interest (investors betting against the stock) or unusually high trading volume around the time of the dip suggests significant shifts in investor sentiment and potentially contributed to the price decline.

- Social media sentiment analysis: Monitoring social media sentiment can provide valuable insights into the overall narrative surrounding D-Wave Quantum. Negative sentiment expressed on platforms like Twitter or Reddit could reflect broader investor concerns.

Technical Analysis of QBTS Stock Chart

Technical analysis can provide additional context for the QBTS stock price decline. While not a definitive explanation, examining the stock chart offers supplementary insights.

- Relevant technical indicators: Analyzing key technical indicators such as moving averages and the Relative Strength Index (RSI) can reveal whether the dip was a result of an established downtrend or a temporary correction.

- Support and resistance levels: A breach of significant support levels on the QBTS stock chart could indicate a weakening trend and signal further potential declines.

- Chart patterns: Certain chart patterns, while not always predictive, may suggest a continuation of the downward trend.

Conclusion: Understanding the QBTS Stock Dip and Looking Ahead

The Monday dip in QBTS stock likely resulted from a confluence of factors, including broader market trends, company-specific news (or lack thereof), shifting analyst sentiment, and potentially technical indicators. Pinpointing a single definitive cause is challenging. It is essential to remember that investing in quantum computing stock, particularly in a relatively new and volatile sector like quantum computing, involves inherent risk. Conduct thorough research and consult with financial advisors before making any investment decisions.

Stay informed about the latest developments in D-Wave Quantum and the quantum computing sector to better understand future fluctuations in QBTS stock. Continue monitoring the D-Wave Quantum stock price and other relevant market indicators to make informed decisions about your quantum computing stock investments. Understanding the nuances of QBTS stock performance requires diligent analysis and staying abreast of industry news.

Fastest Crossing Of Australia On Foot A New Record

Fastest Crossing Of Australia On Foot A New Record

Peppa Pigs Parents Throw Gender Reveal Party A New Baby Arrives

Peppa Pigs Parents Throw Gender Reveal Party A New Baby Arrives

Abn Amro Analyse Van De Halvering Voedselexport Naar De Vs Door Heffingen

Abn Amro Analyse Van De Halvering Voedselexport Naar De Vs Door Heffingen

Out Now 2024 25 Premier League Champions Photo Gallery

Out Now 2024 25 Premier League Champions Photo Gallery

Podcast Production Revolutionized Ais Role In Processing Repetitive Scatological Data

Podcast Production Revolutionized Ais Role In Processing Repetitive Scatological Data