Investing In 2025: MicroStrategy Stock Vs. Bitcoin – A Detailed Analysis

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, a business intelligence company, has made a bold strategic move by accumulating a massive Bitcoin reserve. Understanding this strategy is crucial to evaluating its stock as an investment.

MicroStrategy's Business Model and Bitcoin Adoption

MicroStrategy's core business revolves around providing business analytics software and services. However, its CEO, Michael Saylor, has championed Bitcoin as a long-term store of value, leading the company to acquire a substantial amount of BTC.

-

Rationale for Bitcoin Purchases: MicroStrategy's Bitcoin purchases are primarily driven by:

- Inflation Hedge: Bitcoin's limited supply is seen as a hedge against inflation.

- Long-Term Investment: The company views Bitcoin as a strategic asset with significant long-term growth potential.

- Technological Innovation: They believe in the underlying technology of blockchain and Bitcoin's potential disruption of traditional financial systems.

-

Impact of Bitcoin Price Fluctuations: MicroStrategy's financial statements are directly impacted by Bitcoin's price volatility. Significant price drops result in substantial unrealized losses, affecting the company's reported value. Conversely, price increases translate into significant gains.

-

Potential Risks: The significant reliance on Bitcoin exposes MicroStrategy to considerable risk. A prolonged bear market in Bitcoin could severely impact the company's financial health and stock price.

Analyzing MicroStrategy Stock Performance

The correlation between Bitcoin's price and MicroStrategy's stock price is strong. When Bitcoin's price rises, MicroStrategy's stock generally follows suit, and vice versa.

-

Historical Stock Performance: Analyzing historical data reveals significant volatility in MicroStrategy's stock price, mirroring the volatility of Bitcoin. [Insert relevant chart/graph here showing historical stock performance correlated to Bitcoin price].

-

Factors Beyond Bitcoin: While Bitcoin is a major driver of MicroStrategy's stock performance, other factors also influence its price, including:

- The company's financial performance in its core business.

- Overall market sentiment and investor confidence.

- News and announcements related to the company's Bitcoin holdings and strategy.

Bitcoin's Potential as a Long-Term Investment

Bitcoin's potential as a long-term investment hinges on several factors, including its technological advantages and future adoption.

Bitcoin's Technological Advantages and Future Prospects

Bitcoin's underlying technology, blockchain, offers decentralized, transparent, and secure transactions. This has attracted significant interest from various sectors.

-

Potential Use Cases: Beyond investment, Bitcoin's potential applications include:

- Peer-to-peer payments.

- Decentralized finance (DeFi) applications.

- Supply chain management and tracking.

-

Factors Influencing Bitcoin's Price: Several factors can influence Bitcoin's future price, including:

- Increased adoption by institutions and individuals.

- Technological advancements within the Bitcoin ecosystem.

- Regulatory developments and governmental policies.

-

Regulatory Challenges: Regulatory uncertainty surrounding cryptocurrencies remains a significant risk factor for Bitcoin.

Assessing Bitcoin's Volatility and Risk Tolerance

Bitcoin is known for its extreme price volatility. Investing in Bitcoin requires a high risk tolerance and a long-term perspective.

-

Risk Assessment and Diversification: It's crucial to conduct thorough risk assessment and diversify your investment portfolio to mitigate potential losses.

-

Investment Approaches: Different strategies can be employed, including:

- HODLing: Holding Bitcoin for an extended period, regardless of price fluctuations.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals.

-

Past Performance and Future Scenarios: Past performance is not indicative of future results, but analyzing historical data can provide insights into potential future price movements. [Insert relevant chart/graph here showcasing Bitcoin's historical price volatility].

MicroStrategy Stock vs. Bitcoin: A Comparative Analysis

Directly comparing MicroStrategy stock and Bitcoin reveals distinct risk-reward profiles.

Direct Comparison of Risk and Reward Profiles

Both investments carry significant risk, but their risk profiles differ significantly.

| Feature | MicroStrategy Stock | Bitcoin |

|---|---|---|

| Volatility | High (correlated to Bitcoin price) | Extremely High |

| Potential Return | High (correlated to Bitcoin price and company performance) | Potentially Very High |

| Potential Loss | High (correlated to Bitcoin price and company performance) | Potentially Very High |

| Investment Type | Equity in a publicly traded company | Cryptocurrency |

- Investor Profiles: MicroStrategy stock might be suitable for investors with moderate risk tolerance who are comfortable with the volatility linked to Bitcoin’s performance. Bitcoin is best suited for risk-tolerant investors with a long-term horizon.

Diversification Strategies Incorporating Both Assets

Diversifying a portfolio by including both MicroStrategy stock and Bitcoin presents a complex scenario. While potentially offering diversification benefits, the high correlation between the two assets could limit this effect.

-

Benefits: Strategic allocation could potentially reduce overall portfolio volatility compared to holding only one asset.

-

Drawbacks: The strong correlation means that losses in one asset could be mirrored in the other, limiting the diversification benefits.

-

Asset Allocation: The appropriate asset allocation depends entirely on individual risk tolerance and investment goals. Professional financial advice is recommended.

Investing in 2025: MicroStrategy Stock vs. Bitcoin – Final Thoughts

Choosing between MicroStrategy stock and Bitcoin in 2025 requires careful consideration of risk tolerance and investment goals. Both offer substantial potential returns but also carry significant risk. MicroStrategy stock offers a leveraged play on Bitcoin's price, but it also carries the additional risk of the company's underlying business performance. Bitcoin itself remains inherently volatile.

Key Takeaways:

- MicroStrategy's stock is heavily influenced by Bitcoin's price.

- Bitcoin's volatility demands a high risk tolerance.

- Diversification is crucial when investing in either asset.

- Thorough research and understanding of your own risk profile are essential.

Call to Action: Investing in 2025: MicroStrategy stock vs. Bitcoin is a decision requiring meticulous research. Before committing any capital, conduct thorough due diligence, considering your risk tolerance and financial goals. Consult with a qualified financial advisor and explore reputable resources to deepen your understanding of both MicroStrategy stock and Bitcoin before making any investment decisions related to investing in 2025: MicroStrategy stock vs. Bitcoin.

Featured Posts

-

Ethereum Market Crash 67 M In Liquidations And The Path Ahead

May 08, 2025

Ethereum Market Crash 67 M In Liquidations And The Path Ahead

May 08, 2025 -

Ps 5 Pro Sales Trail Ps 4 Pro A Market Analysis

May 08, 2025

Ps 5 Pro Sales Trail Ps 4 Pro A Market Analysis

May 08, 2025 -

Asias Premier Bitcoin Event Bitcoin Seoul 2025

May 08, 2025

Asias Premier Bitcoin Event Bitcoin Seoul 2025

May 08, 2025 -

Comprehensive Ethereum Price Prediction 2024 And Beyond

May 08, 2025

Comprehensive Ethereum Price Prediction 2024 And Beyond

May 08, 2025 -

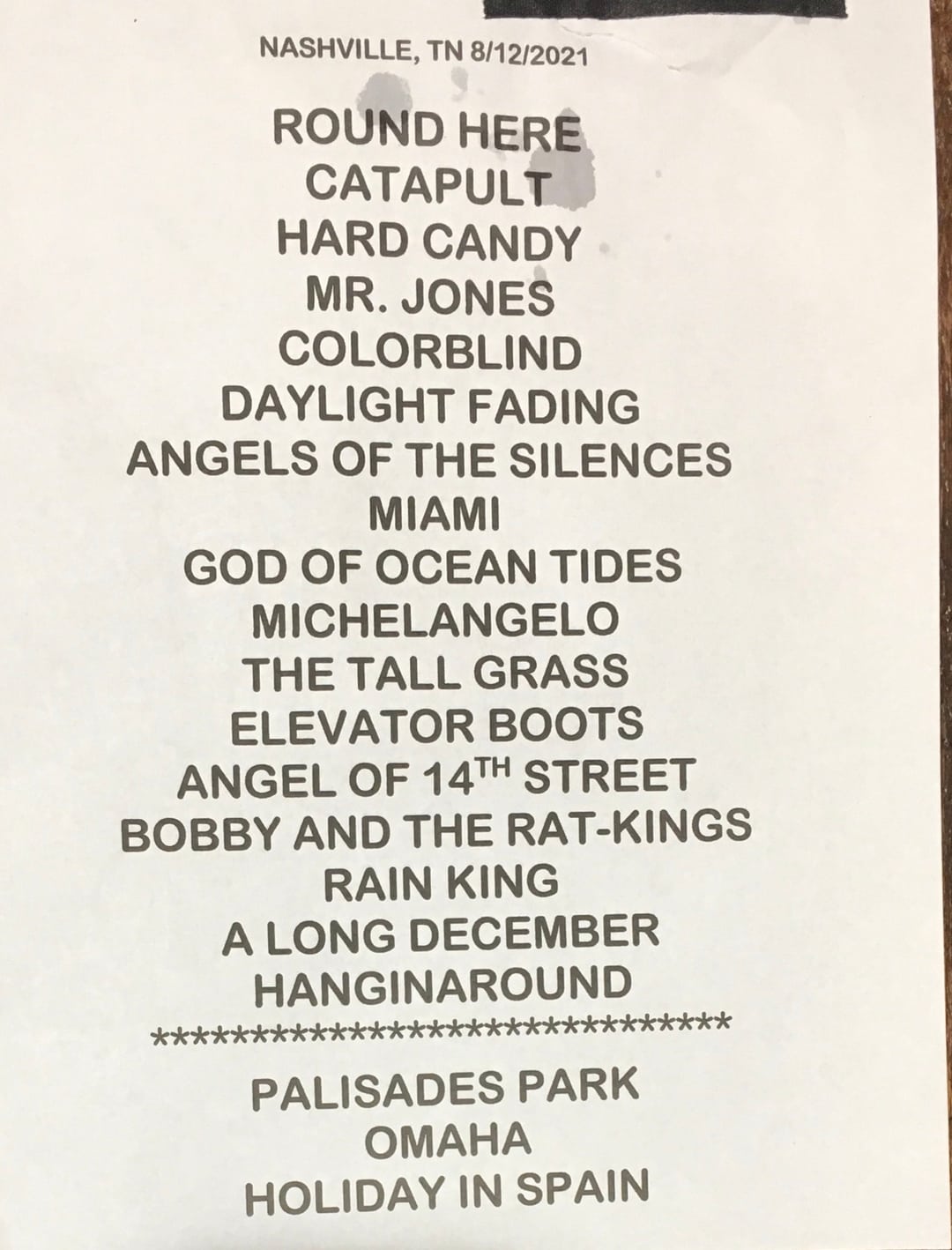

Predicted Counting Crows Setlist For 2025 Concerts

May 08, 2025

Predicted Counting Crows Setlist For 2025 Concerts

May 08, 2025

Latest Posts

-

Four More Human Smugglers Arrested By Fia Operation Update

May 08, 2025

Four More Human Smugglers Arrested By Fia Operation Update

May 08, 2025 -

Grftary Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn

May 08, 2025

Grftary Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn

May 08, 2025 -

The Colin Cowherd Jayson Tatum Debate A Deeper Look At The Criticism

May 08, 2025

The Colin Cowherd Jayson Tatum Debate A Deeper Look At The Criticism

May 08, 2025 -

Ahsan Advocates For Tech Adoption To Boost Made In Pakistan Globally

May 08, 2025

Ahsan Advocates For Tech Adoption To Boost Made In Pakistan Globally

May 08, 2025 -

Fia Arrests Four More Human Smugglers Crackdown Intensifies

May 08, 2025

Fia Arrests Four More Human Smugglers Crackdown Intensifies

May 08, 2025