Investing In AI Quantum Computing: One Compelling Reason To Buy The Dip

Table of Contents

The Untapped Potential of AI Quantum Computing

The synergistic relationship between artificial intelligence (AI) and quantum computing is revolutionary. AI algorithms, while powerful, are limited by the computational power of classical computers when tackling extremely complex problems. Quantum computing, with its ability to process vast amounts of data exponentially faster, unlocks entirely new possibilities for AI. This combination promises breakthroughs across numerous sectors. AI quantum computing applications are poised to transform industries, creating significant value for investors who recognize the potential.

- Accelerated drug discovery and development: Quantum computers can simulate molecular interactions with unprecedented accuracy, significantly speeding up the identification and development of new drugs and therapies. This translates to faster time-to-market and potentially life-saving advancements in healthcare.

- Optimization of complex financial models: AI quantum computing can analyze massive datasets and optimize complex financial models, leading to more accurate risk assessments, improved portfolio management, and potentially higher returns for investors.

- Creation of novel materials with superior properties: By simulating the behavior of materials at the atomic level, AI quantum computing can help design new materials with enhanced properties for various applications, ranging from stronger and lighter construction materials to more efficient energy storage solutions.

- Significant advancements in artificial intelligence algorithms: Quantum computing can significantly boost the capabilities of AI algorithms, enabling them to learn and adapt much faster and more efficiently, leading to more powerful and sophisticated AI systems.

Why the Current Dip Presents a Buying Opportunity

The current market correction has created a unique buying opportunity in the AI quantum computing sector. While short-term volatility is expected, the long-term growth potential of this technology far outweighs these fluctuations. Many believe this dip is temporary and presents a chance to acquire undervalued assets before the sector experiences its next period of growth.

- Market correction creating lower entry points for investors: The dip provides a chance to purchase shares at lower prices than during market highs, potentially enhancing returns in the long run.

- Increased risk tolerance among sophisticated investors: Many seasoned investors see this downturn as a chance to acquire assets in a high-growth sector at a discount.

- Government funding and initiatives boosting the sector: Governments worldwide are investing heavily in quantum computing research and development, creating a supportive environment for growth and innovation.

- Strong long-term growth potential outweighs short-term volatility: The transformative potential of AI quantum computing makes it a compelling long-term investment despite short-term market fluctuations. This is a key reason to consider buying the dip.

Mitigating Risks in AI Quantum Computing Investments

Investing in emerging technologies like AI quantum computing involves inherent risks. However, these risks can be mitigated through careful planning and diversification.

- Diversify investment across multiple AI quantum computing companies: Don't put all your eggs in one basket. Spread your investment across various companies to reduce the impact of any single company's failure.

- Conduct thorough due diligence before investing: Research individual companies, their technological capabilities, and their market position before committing your funds.

- Understand the technological hurdles and their potential impact: Be aware of the challenges facing the field and how these challenges could affect investment returns.

- Consider long-term horizons for potential returns: AI quantum computing is a long-term investment. Don't expect immediate returns; focus on the potential for substantial growth over several years.

Identifying Promising AI Quantum Computing Companies

Several companies are at the forefront of AI quantum computing development. (Disclaimer: This is not financial advice. Conduct thorough research before investing in any company.) Examples include companies focused on developing quantum computing hardware, software, and applications. Focus your research on publicly traded companies to facilitate investment.

The Future of AI Quantum Computing and its Investment Implications

The future of AI quantum computing is bright. The technology's potential to disrupt multiple industries is vast, promising exponential growth and substantial returns for early investors. The transformative power of this technology will redefine how we approach complex problems across numerous sectors.

- Potential for disruptive innovations across multiple industries: AI quantum computing will revolutionize various industries, from medicine and finance to materials science and artificial intelligence itself.

- Significant return potential compared to traditional investments: This sector offers the potential for significantly higher returns than many traditional investment options.

- Long-term value creation for early adopters: Investors who enter the market early stand to benefit most from the exponential growth predicted for this field.

Conclusion

Investing in AI quantum computing during this market dip presents a compelling opportunity. The untapped potential of this technology, coupled with the current undervaluation, makes it a strong contender for long-term growth. The potential for high returns and the transformative nature of AI quantum computing should not be overlooked.

Don't miss the opportunity to buy the dip in the exciting world of AI quantum computing! Start your research today. For further information, consult reputable financial news sources and investment research firms. Remember to conduct thorough due diligence before making any investment decisions. Explore the world of AI quantum computing investment and uncover the opportunities awaiting you. Buy the dip now and capitalize on the future of quantum computing opportunities.

Featured Posts

-

Blockbusters The Bgt Special Edition What To Expect

May 21, 2025

Blockbusters The Bgt Special Edition What To Expect

May 21, 2025 -

Wtt Press Conference A Fresh Approach To Competition

May 21, 2025

Wtt Press Conference A Fresh Approach To Competition

May 21, 2025 -

The Trans Australia Run On The Brink Of A New Record

May 21, 2025

The Trans Australia Run On The Brink Of A New Record

May 21, 2025 -

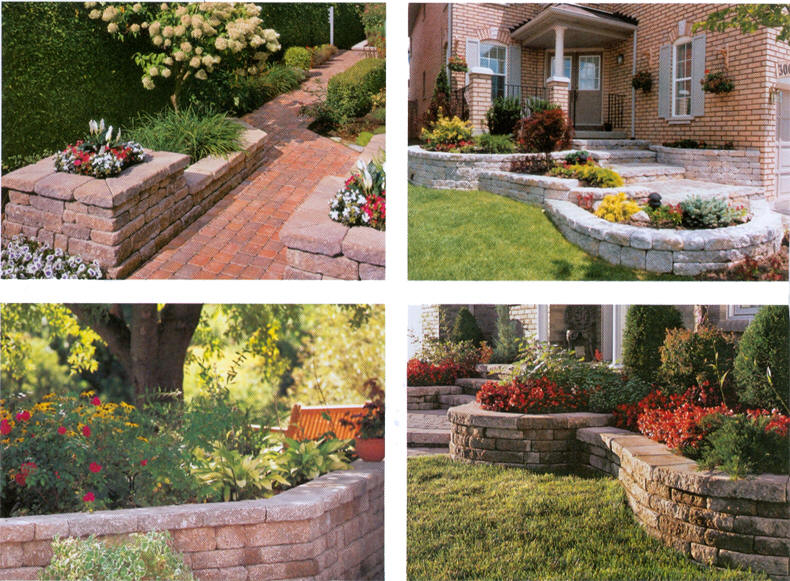

Drier Weather Ahead Tips For Your Garden And Landscape

May 21, 2025

Drier Weather Ahead Tips For Your Garden And Landscape

May 21, 2025 -

David Walliams Speaks Out Against Simon Cowell A Breakdown Of Their Rift

May 21, 2025

David Walliams Speaks Out Against Simon Cowell A Breakdown Of Their Rift

May 21, 2025