Investing In CoreWeave: What You Need To Know About The Stock

Table of Contents

Understanding CoreWeave's Business Model

CoreWeave's unique selling proposition (USP) lies in its specialized GPU-as-a-service offerings. Unlike general-purpose cloud providers like AWS, Google Cloud, and Azure, CoreWeave focuses on providing high-performance computing power tailored specifically for demanding applications like AI model training, machine learning, and high-performance computing (HPC). This niche focus allows them to offer optimized solutions and potentially higher performance than general-purpose cloud platforms.

Their target markets include:

- AI research and development companies

- Machine learning startups

- Financial institutions using advanced analytics

- Gaming companies requiring high-end rendering capabilities

CoreWeave's competitive advantages include:

- Sustainable energy usage: A commitment to environmentally friendly practices can attract environmentally conscious investors and clients.

- Focus on specific AI workloads: Specialization allows for optimized performance and efficiency for their target customer base.

- Partnerships with key players: Collaborations with leading hardware and software vendors enhance their offerings and market reach.

CoreWeave's revenue streams primarily come from its GPU cloud computing services, with potential future revenue streams from related services. While precise financial data might be limited depending on CoreWeave's public status, analyzing its year-over-year growth, market share projections, and client acquisition rates are crucial to assess its potential for future growth and profitability when considering investing in CoreWeave.

Analyzing CoreWeave's Financial Performance

Analyzing CoreWeave's financial performance is critical for determining its investment potential. If CoreWeave is a publicly traded company, readily available data like revenue growth, profit margins, debt-to-equity ratio, and cash flow will inform your decision. Key metrics to consider include:

- Revenue growth projections: How quickly is the company expanding its revenue base?

- Profitability analysis: Is CoreWeave profitable, or is it still operating at a loss? What are the projections for future profitability?

- Debt levels: High debt can create financial instability. What is CoreWeave's debt-to-equity ratio?

- Cash flow: Is the company generating sufficient cash flow to fund its operations and future growth?

If CoreWeave is a private company, information on funding rounds and valuations can provide insight into investor confidence and the company's perceived worth. Understanding its funding history and the valuations achieved in each round can help you assess its growth trajectory. Remember, even with substantial funding, profitability and sustainability remain key factors when deciding on investing in CoreWeave.

Assessing the Risks of Investing in CoreWeave

Investing in CoreWeave, like any investment in a relatively new or private company, carries inherent risks. The rapidly evolving nature of the cloud computing and AI industries magnifies these risks. Potential challenges include:

- Competition from established players: Companies like AWS, Google Cloud, and Azure possess significant resources and market share.

- Technological obsolescence: Rapid technological advancements could render CoreWeave's technology outdated.

- Regulatory uncertainty: Changes in data privacy regulations or antitrust laws could impact CoreWeave's operations.

- Market volatility: The stock market, especially for high-growth technology companies, can be highly volatile. Economic downturns can significantly impact investor sentiment and the valuation of technology stocks.

Considering CoreWeave Stock Valuation

Determining whether CoreWeave stock is fairly valued requires a thorough analysis. If CoreWeave is publicly traded, comparing its valuation metrics (like Price-to-Earnings ratio, Price-to-Sales ratio) with those of its competitors is essential. If it's a private company, comparable company analysis, examining similar companies in terms of size, growth rate, and business model, can provide a benchmark for its valuation.

Additional valuation methods include:

- Comparable company analysis: Comparing CoreWeave's key metrics to those of similar companies.

- Discounted cash flow (DCF) analysis (if applicable): Projecting future cash flows and discounting them to their present value. This is particularly useful for publicly traded companies.

Remember that both fundamental analysis (examining financial statements and business model) and technical analysis (studying price charts and trading volume) are important tools when evaluating stock prices. Understanding these will greatly help you in your decision-making process when considering investing in CoreWeave.

Conclusion: Making Informed Decisions on Investing in CoreWeave

Investing in CoreWeave presents both exciting opportunities and significant risks. Before making any investment decisions, conducting thorough due diligence is paramount. This includes understanding CoreWeave's business model, analyzing its financial performance, and carefully assessing the inherent risks associated with investing in a relatively young company in a dynamic and competitive industry. Remember to assess your personal risk tolerance and investment goals. Consult with a qualified financial advisor to discuss if investing in CoreWeave aligns with your investment strategy and risk profile. Only after comprehensive research and professional consultation should you proceed with investing in CoreWeave or any other stock.

Featured Posts

-

Zupinennya Dopomogi Ukrayini Senator Grem Zaklikaye Do Yiyi Vidnovlennya

May 22, 2025

Zupinennya Dopomogi Ukrayini Senator Grem Zaklikaye Do Yiyi Vidnovlennya

May 22, 2025 -

Music World Mourns Frontman Of Popular Rock Band Dies At 32

May 22, 2025

Music World Mourns Frontman Of Popular Rock Band Dies At 32

May 22, 2025 -

Reactia Publicului La Aparitia Fratilor Tate In Bucuresti

May 22, 2025

Reactia Publicului La Aparitia Fratilor Tate In Bucuresti

May 22, 2025 -

How To Watch Peppa Pig Online Free Streaming Guide For Cartoons

May 22, 2025

How To Watch Peppa Pig Online Free Streaming Guide For Cartoons

May 22, 2025 -

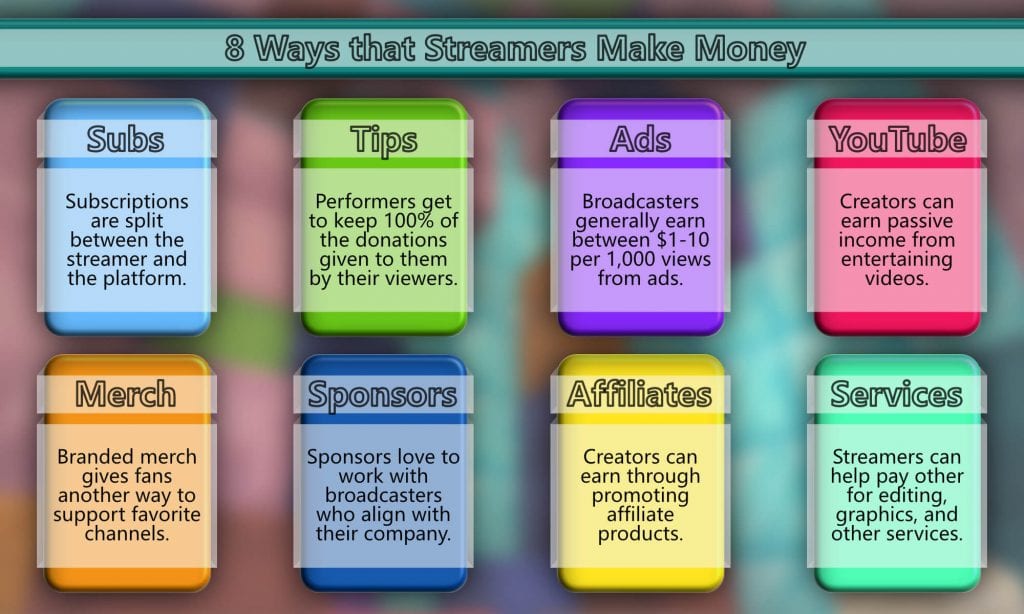

Streamers Are Making Money The Complex Reality For Viewers

May 22, 2025

Streamers Are Making Money The Complex Reality For Viewers

May 22, 2025