Investing In Growth: Identifying The Country's New Business Hotspots

Table of Contents

Analyzing Economic Indicators for Promising Locations

Understanding the underlying economic health of a region is crucial for assessing its potential as a business hotspot. This involves a detailed examination of several key indicators.

GDP Growth and Sectoral Performance

Analyzing GDP growth rates provides a macro-level view of a region's overall economic performance. However, a deeper dive into sectoral performance is equally critical. Is the technology sector booming? Is manufacturing experiencing a renaissance? Is tourism flourishing?

- Accessing Data: Reliable data can be found on government websites such as the [insert relevant government statistics website here] and reports from reputable statistical agencies like [insert relevant statistical agency here].

- Key Indicators: Beyond overall GDP growth, focus on indicators like per capita income growth, which reflects the prosperity of the average citizen, and sector-specific growth rates.

- Example: The coastal region of [insert region name] has seen a remarkable 20% increase in GDP driven by a surge in the renewable energy sector, making it an attractive location for investment in solar and wind power technologies.

Infrastructure Development and Accessibility

Robust infrastructure is the backbone of any thriving business ecosystem. Efficient transportation networks, reliable communication systems, and readily available energy are essential for attracting businesses and ensuring their smooth operation.

- Supply Chain Efficiency: Well-developed transportation networks, including roads, railways, and ports, are critical for efficient supply chains and logistics.

- Government Initiatives: Look for government initiatives aimed at improving infrastructure, such as investments in high-speed rail or expansion of broadband internet access.

- Example: The recent construction of a new high-speed rail line connecting [city A] and [city B] has significantly reduced transportation times and attracted numerous logistics companies to the region.

Government Policies and Incentives

Government policies play a significant role in shaping the business environment. Favorable regulations, tax breaks, subsidies, and grants can dramatically boost business growth in specific regions.

- Tax Breaks and Subsidies: Many governments offer tax breaks and subsidies to attract businesses, especially in strategically important sectors.

- Deregulation: A streamlined regulatory environment reduces bureaucratic hurdles and makes it easier for businesses to operate.

- Government Websites: Explore government websites for details on available incentives and policies. For example, [insert link to relevant government website].

- Example: The [insert region name] government's initiative to offer significant tax breaks to tech startups has led to a rapid influx of innovative companies, creating a vibrant tech ecosystem.

Identifying Emerging Industries and Technological Trends

Focusing on emerging industries with high growth potential is crucial for identifying future business hotspots. This requires analyzing current market trends and anticipating future developments.

Sector-Specific Analysis

Several sectors are poised for significant growth in the coming years. Renewable energy, biotechnology, e-commerce, and artificial intelligence are just a few examples.

- Market Trends: Thoroughly research market trends and consumer demand within each sector. Identify areas with unmet needs or emerging opportunities.

- Technological Advancements: Analyze how technological advancements are reshaping these industries and creating new business opportunities.

- Successful Businesses: Study the success stories of businesses already operating in these sectors to understand their strategies and identify potential replicable models.

- Example: [Region name] is emerging as a global hub for renewable energy technology, benefiting from its abundant natural resources and a supportive government policy environment.

Technological Advancements and Innovation

Technological innovation is a key driver of economic growth and business success. Regions with a strong focus on R&D, access to skilled labor, and a supportive ecosystem for startups are particularly attractive to investors.

- Skilled Labor: The availability of a skilled and educated workforce is critical for innovation and technological advancement.

- Research and Development: Regions with strong research and development capabilities are more likely to attract high-tech businesses.

- Technological Infrastructure: Access to high-speed internet, advanced communication networks, and other technological infrastructure is essential.

- Example: [City name]'s thriving tech ecosystem, fueled by a strong concentration of universities and research institutions, has fostered the growth of numerous innovative startups and attracted significant foreign investment.

Assessing the Investment Climate and Risk Factors

Before committing to an investment, it's essential to thoroughly assess the investment climate and identify potential risks.

Political and Regulatory Stability

Political stability and a predictable regulatory environment are crucial for attracting long-term investment. Uncertainty in these areas can significantly increase investment risk.

- Transparency and Predictability: Look for regions with transparent regulations, clear legal frameworks, and strong protection of intellectual property rights.

- Ease of Doing Business: A streamlined and efficient regulatory environment makes it easier for businesses to operate and reduces administrative burdens.

- Example: [Region A] boasts a stable political climate and investor-friendly regulations, while [Region B] has experienced significant political instability in recent years, making it a riskier investment location.

Labor Market and Human Capital

Access to a skilled and productive workforce is essential for business success. The quality of human capital significantly influences a region's attractiveness to investors.

- Education Levels: Higher education levels and literacy rates often correlate with a more productive and skilled workforce.

- Specialized Skills: The availability of specialized skills relevant to specific industries is particularly important.

- Example: [Region name]'s highly skilled workforce, with a strong emphasis on STEM education, attracts high-value businesses requiring specialized technical expertise.

Risk Assessment and Mitigation

Even the most promising investment locations carry some level of risk. Economic downturns, natural disasters, and unforeseen political events can all impact investment returns.

- Due Diligence: Conduct thorough due diligence to understand the potential risks associated with an investment.

- Diversification: Diversifying investments across different regions and sectors can help mitigate risk.

- Risk Management Strategies: Implementing risk management strategies, such as insurance or hedging, can help protect against potential losses.

- Example: Investing in earthquake-resistant infrastructure in a seismically active region can mitigate the risk of damage from natural disasters.

Conclusion

Identifying the country's new business hotspots requires a comprehensive analysis of economic indicators, emerging industries, and the overall investment climate. By carefully considering factors such as GDP growth, infrastructure development, government policies, technological advancements, and risk factors, investors can significantly improve their chances of success. Remember that strategic investment in high-growth regions can generate substantial returns. Start investing in growth today by exploring the country's new business hotspots! Begin your journey of identifying promising investment opportunities by leveraging the insights shared on identifying the country's new business hotspots.

Featured Posts

-

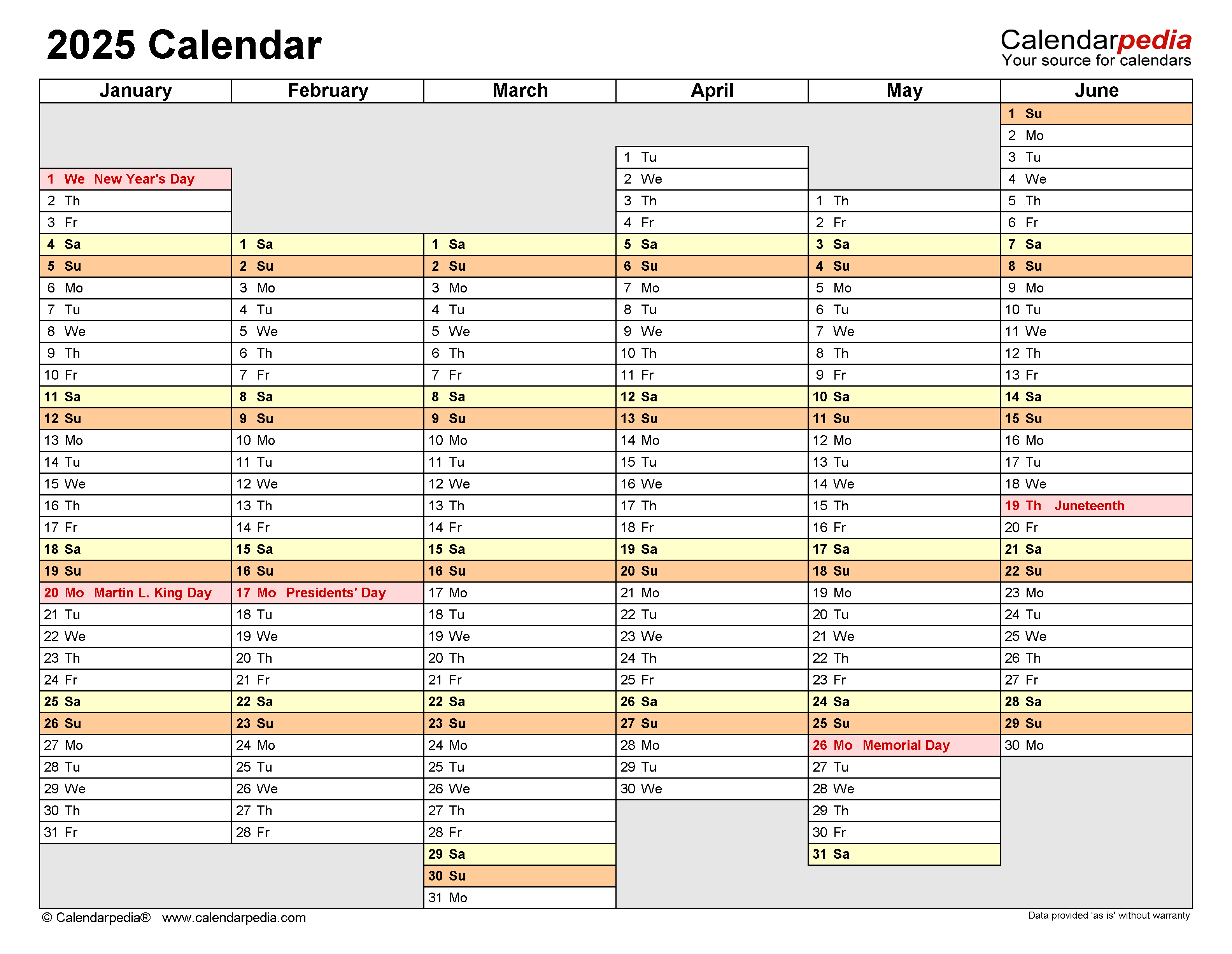

Plan Your Year A Seniors Calendar Of Trips And Events

May 12, 2025

Plan Your Year A Seniors Calendar Of Trips And Events

May 12, 2025 -

12 Conseils Pour Une Doze D Economie Efficace

May 12, 2025

12 Conseils Pour Une Doze D Economie Efficace

May 12, 2025 -

2024 Houston Astros Foundation College Classic A Preview Of The Tournament

May 12, 2025

2024 Houston Astros Foundation College Classic A Preview Of The Tournament

May 12, 2025 -

Opponent Routed Celtics Secure Division Crown

May 12, 2025

Opponent Routed Celtics Secure Division Crown

May 12, 2025 -

Bayerns Home Win A Fitting Farewell For Muller And Championship Clincher

May 12, 2025

Bayerns Home Win A Fitting Farewell For Muller And Championship Clincher

May 12, 2025

Latest Posts

-

Dodgers Vs Cubs 2 05 Ct First Pitch Lineup Cards And Viewing Details

May 13, 2025

Dodgers Vs Cubs 2 05 Ct First Pitch Lineup Cards And Viewing Details

May 13, 2025 -

Cubs Vs Dodgers 2 05 Ct Game Lineups Tv Info And Live Discussion

May 13, 2025

Cubs Vs Dodgers 2 05 Ct Game Lineups Tv Info And Live Discussion

May 13, 2025 -

Epic City Under Scrutiny Cornyns Doj Referral And Paxtons Expanding State Investigation

May 13, 2025

Epic City Under Scrutiny Cornyns Doj Referral And Paxtons Expanding State Investigation

May 13, 2025 -

Society News Texas Mosques Struggle Against Religious Restrictions

May 13, 2025

Society News Texas Mosques Struggle Against Religious Restrictions

May 13, 2025 -

Cornyn Calls For Federal Investigation Paxton Expands Texas Probe Of Epic City

May 13, 2025

Cornyn Calls For Federal Investigation Paxton Expands Texas Probe Of Epic City

May 13, 2025