Investing In Palantir After A 30% Market Correction

Table of Contents

Understanding Palantir's 30% Market Correction

Analyzing the Causes of the Decline

Several factors contributed to Palantir's recent price drop. Understanding these is crucial for assessing the investment's current value.

-

Increased Interest Rates: The Federal Reserve's aggressive interest rate hikes have impacted growth stocks like Palantir, which are often valued based on future earnings potential. Higher rates increase borrowing costs and reduce the present value of future cash flows.

-

Broader Tech Sector Sell-Off: The recent downturn wasn't isolated to Palantir; the broader technology sector experienced significant corrections. Investor sentiment towards tech companies, particularly those with high valuations and less-established profit margins, soured.

-

Concerns About Profitability: Palantir, while showing revenue growth, hasn't consistently delivered substantial profits. Concerns about the company's path to profitability likely contributed to investor anxiety.

-

Competition Analysis: Palantir faces competition from established players like Microsoft and smaller, agile data analytics firms. Concerns about increased competition and market share erosion may have influenced the stock price.

-

Impact of Geopolitical Events: Global uncertainties, including geopolitical tensions and economic slowdowns, often negatively affect market sentiment, especially for technology companies with global operations like Palantir.

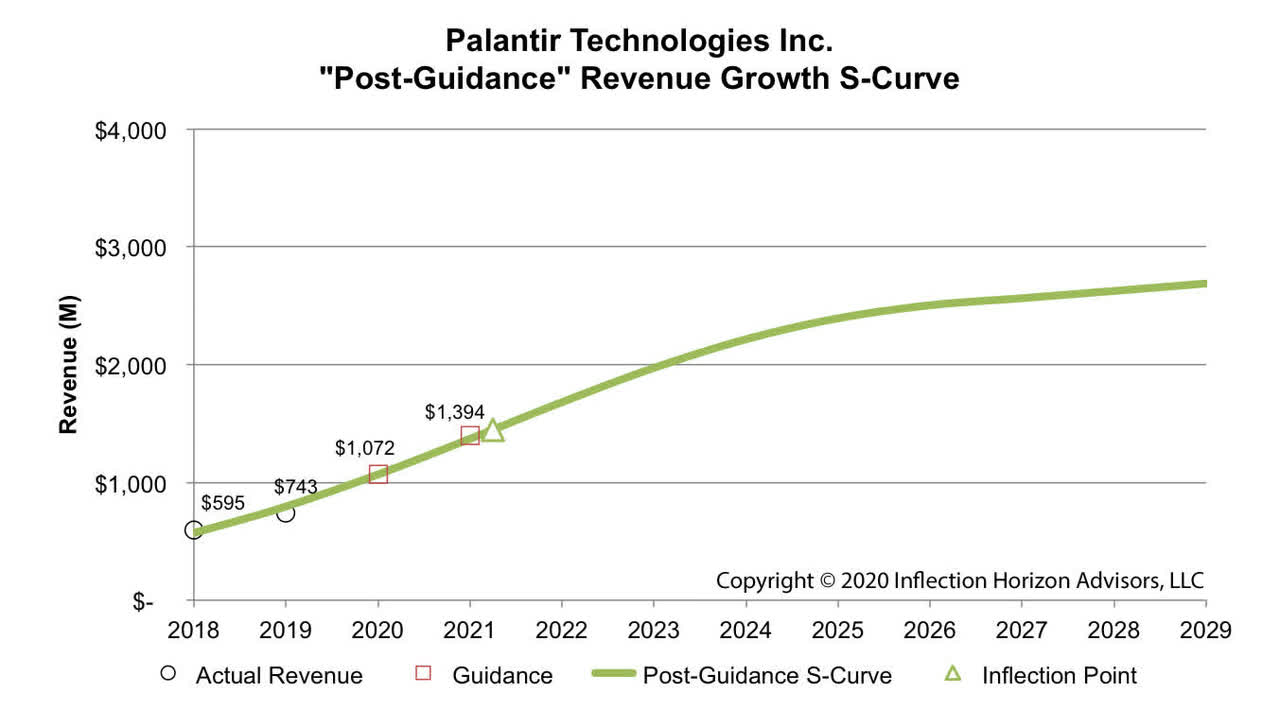

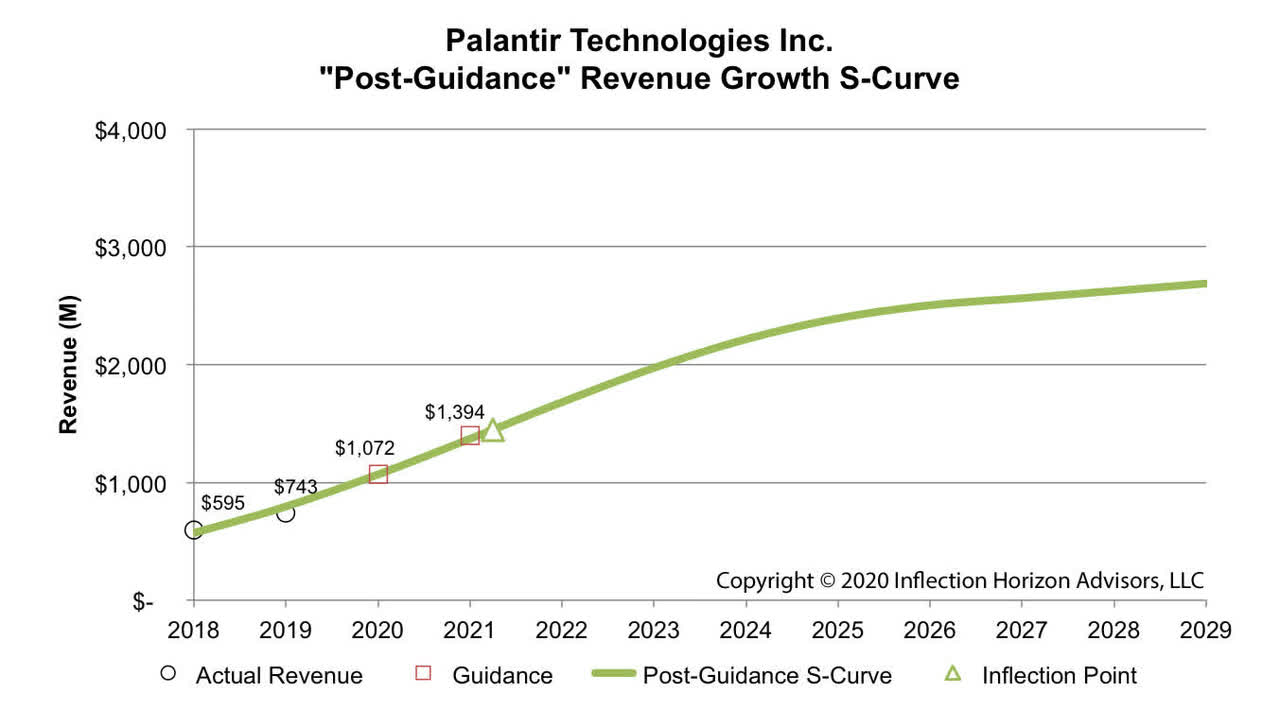

The interplay of these factors resulted in a significant decrease in Palantir's stock price. Examining historical stock price charts alongside revenue and profit margin data provides a clearer picture of the correction's magnitude and its relation to these contributing factors.

Assessing the Severity of the Correction

Comparing Palantir's current performance to its historical volatility and market trends offers crucial context. Analyzing its Price-to-Sales (P/S) ratio against competitors helps determine whether the correction is justified based on fundamental analysis.

Consulting analyst reports and ratings from reputable financial institutions provides valuable insights. While some analysts may express concern, others may view the correction as an attractive entry point, creating a divergence of opinions that highlights the inherent uncertainty of investing in growth stocks. A thorough evaluation of these aspects helps investors make informed decisions.

Evaluating Palantir's Long-Term Growth Potential

The Strength of Palantir's Business Model

Palantir's core offering lies in its data analytics platforms, Gotham and Foundry. Gotham is tailored to government clients, addressing national security and intelligence needs, while Foundry focuses on commercial clients, offering data integration and analysis capabilities across diverse sectors. These platforms provide significant competitive advantages.

-

Key Clients and Partnerships: Palantir boasts a diverse portfolio of clients across both the government and commercial sectors, highlighting its adaptability and market penetration. Strategic partnerships further enhance its reach and capabilities.

-

Competitive Advantages: Palantir's expertise in handling extremely large and complex datasets, coupled with its robust security features, gives it a significant competitive edge in the data analytics market.

Future Growth Prospects and Market Opportunities

The market for data analytics and Artificial Intelligence (AI) is expanding exponentially. This presents significant growth opportunities for Palantir.

-

Expanding Market: The growing demand for data-driven decision-making across various industries creates a favorable landscape for Palantir's offerings.

-

Strategic Initiatives: Palantir's continued investment in research and development, coupled with its strategic expansion plans into new markets and sectors, signifies its commitment to long-term growth.

-

Future Revenue Streams: Exploring new applications for its technology, such as AI-powered solutions and expanding into adjacent markets, could create substantial future revenue streams.

Managing the Risks Associated with Investing in Palantir

Assessing the Financial Risks

Investing in Palantir carries inherent risks, primarily related to its financial health and valuation.

-

Financial Health: Analyzing Palantir's debt levels, cash flow, and profitability is vital. Understanding its financial health helps assess its resilience to market fluctuations and potential for future growth.

-

Valuation: Palantir's valuation is a significant consideration. The stock's price-to-earnings ratio (P/E) and other valuation metrics need to be assessed against its growth prospects and industry benchmarks. Further price drops remain a possibility.

-

Risk Tolerance: Investing in Palantir requires a high-risk tolerance. The company's volatile nature necessitates a clear understanding of your personal risk profile and investment goals. Diversification is crucial.

Mitigating Investment Risks

Several strategies can mitigate the risks associated with Palantir investment.

-

Dollar-Cost Averaging: Investing regularly over time, regardless of the stock price, can lessen the impact of short-term market volatility.

-

Diversification: Spreading investments across different asset classes reduces overall portfolio risk.

-

Stop-Loss Orders: Placing stop-loss orders can help limit potential losses if the stock price drops below a predetermined level.

-

Thorough Due Diligence: Before investing, comprehensive research is paramount. Understand Palantir's business model, financial health, competitive landscape, and future prospects.

Conclusion

Investing in Palantir after a 30% market correction requires careful consideration. The factors influencing the decline – interest rate hikes, broader tech sell-off, profitability concerns, competition, and geopolitical uncertainty – are significant. However, Palantir's strong business model, future growth potential in the expanding data analytics and AI markets, and strategic initiatives present a compelling case for long-term investors. The associated risks are substantial, necessitating a high-risk tolerance and a long-term investment horizon. Conduct thorough research and consider your individual risk profile before making any investment decisions. Learn more about Palantir stock and its future prospects by [link to further resources]. Is now the right time to invest in Palantir after its correction? The decision is yours.

Featured Posts

-

Nyt Strands Game 349 Solutions Saturday February 15th

May 10, 2025

Nyt Strands Game 349 Solutions Saturday February 15th

May 10, 2025 -

Seattles Smart Strategy Accepting Canadian Dollars To Attract Sports Tourism

May 10, 2025

Seattles Smart Strategy Accepting Canadian Dollars To Attract Sports Tourism

May 10, 2025 -

Show Name Season 2 A Potential Spoiler Filled Replacement Show Is Now Streaming

May 10, 2025

Show Name Season 2 A Potential Spoiler Filled Replacement Show Is Now Streaming

May 10, 2025 -

Hyatt Hotel Project To Demolish Historic Broad Street Diner

May 10, 2025

Hyatt Hotel Project To Demolish Historic Broad Street Diner

May 10, 2025 -

Indian Stock Market Sensex And Nifty Performance Todays Highlights

May 10, 2025

Indian Stock Market Sensex And Nifty Performance Todays Highlights

May 10, 2025