Investing In Palantir Before May 5th: A Detailed Analysis Of Current Market Sentiment

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Q4 2022 Earnings Report Analysis

Palantir's Q4 2022 earnings report revealed mixed results. While the company beat analyst expectations on revenue, its earnings per share fell short. Analyzing Palantir's earnings is crucial for understanding its current trajectory. Key figures from the report, including revenue growth, net income, and operating margins, need careful consideration when evaluating Palantir stock performance.

- Positive Aspects: Revenue exceeded expectations, demonstrating continued demand for Palantir's data analytics platform. Strong growth in the commercial sector suggests increasing market penetration.

- Negative Aspects: Earnings per share missed projections, potentially reflecting increased investments in research and development or sales and marketing. Operating margins remained under pressure.

- Competitor Comparison: Compared to competitors like Databricks and Snowflake, Palantir showed a slower revenue growth rate in Q4 2022, highlighting the competitive nature of the data analytics market. A thorough analysis of Palantir revenue growth compared to its peers is necessary.

Growth Prospects and Long-Term Potential

Despite the mixed Q4 results, Palantir's long-term growth prospects remain promising. The company's strategic initiatives, particularly expansion into new markets and continuous product development, position it for future success. Assessing Palantir future growth requires looking beyond short-term fluctuations.

- Key Growth Drivers: Government contracts continue to form a significant portion of Palantir's revenue, while increasing commercial partnerships are vital for Palantir long-term investment potential. Further expansion into the private sector will be critical for sustained growth.

- Challenges and Risks: Increased competition in the data analytics space, potential regulatory hurdles, and the need to maintain high customer satisfaction represent significant risks to Palantir strategic initiatives. Careful assessment of these challenges is crucial before investing.

Market Sentiment and Analyst Opinions

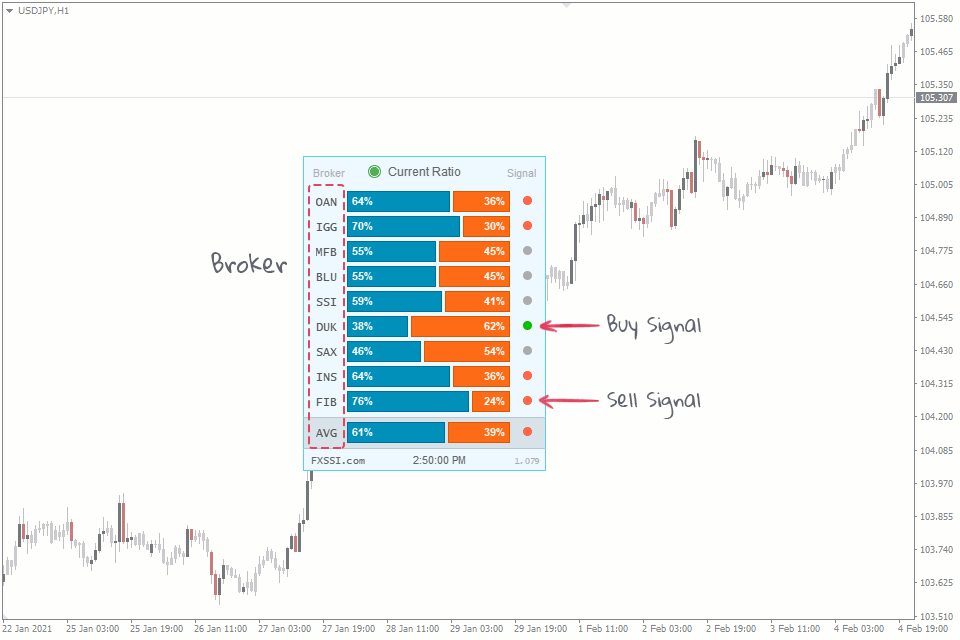

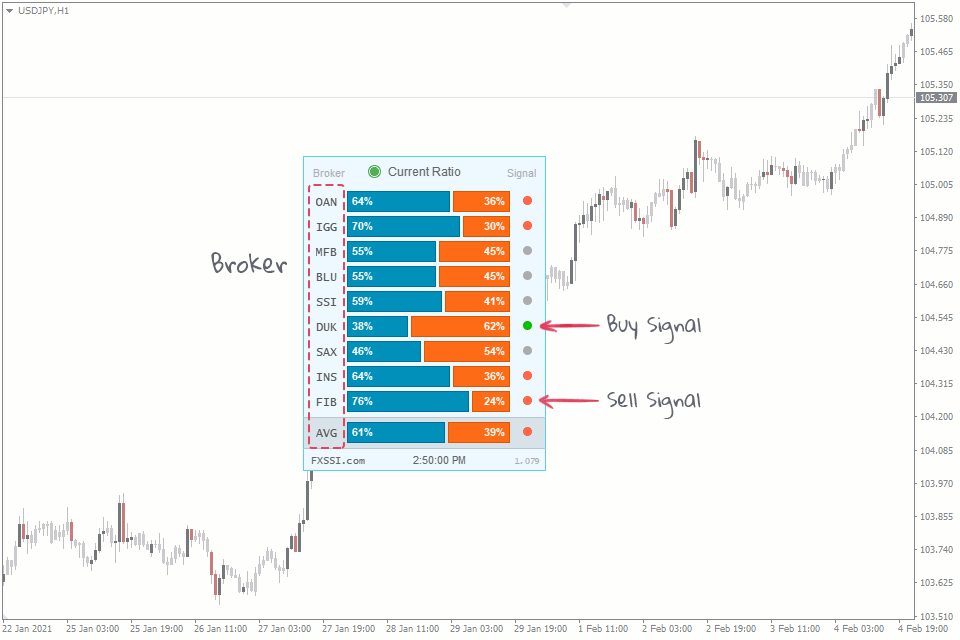

Current Investor Sentiment Towards Palantir

Current investor sentiment towards Palantir is largely mixed. While some remain bullish on the company's long-term potential, others express concerns about its profitability and valuation. Understanding Palantir stock sentiment is crucial for potential investors.

- Evidence from News and Social Media: Recent news articles highlight both the positive aspects of Palantir's technological advancements and concerns about its high valuation. Social media sentiment is also divided, with active discussions in investor forums reflecting a mixed outlook.

- Recent Changes in Sentiment: A shift towards greater optimism may be observed if the company delivers strong Q1 2023 results, but negative news or unforeseen events could quickly reverse this trend. Monitoring the evolving Palantir investor outlook is crucial.

Analyst Ratings and Price Targets

Analyst ratings on Palantir are varied, reflecting the divergence in opinions about the company's future prospects. Analyzing Palantir analyst ratings offers a valuable perspective, although it's important to remember these are just opinions.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Goldman Sachs | Buy | $20 |

| Morgan Stanley | Hold | $15 |

| JPMorgan Chase | Neutral | $18 |

- Consensus Opinion: While some analysts maintain a buy rating, others express more caution, indicating a lack of consensus regarding Palantir price target.

- Divergence of Opinions: The range of price targets reflects the uncertainty surrounding Palantir's future performance. Understanding this Palantir stock recommendation variance is critical in forming your own investment strategy.

Potential Catalysts and Risks Before May 5th

Upcoming Events and Announcements

Several potential catalysts might influence Palantir's stock price before May 5th. Monitoring these Palantir upcoming events carefully is vital for informed investment decisions.

- Q1 2023 Earnings Report: The upcoming earnings report is a major catalyst, potentially shifting market sentiment depending on the results. Strong performance could boost investor confidence.

- New Product Launches or Partnerships: Announcements of new products or strategic partnerships could create positive momentum, highlighting the significance of staying informed about Palantir catalysts.

Key Risks and Uncertainties

Despite the potential upside, several risks could negatively impact Palantir's stock price. A thorough Palantir risk assessment is crucial for any potential investor.

- Geopolitical Instability: Global events could impact government spending and commercial partnerships, posing risks to Palantir investment risks.

- Increased Competition: The highly competitive data analytics market presents a constant challenge. Palantir market challenges require constant attention.

Conclusion: Should You Invest in Palantir Before May 5th?

Investing in Palantir before May 5th presents a mixed bag of opportunities and risks. While the company's long-term potential is undeniable, short-term volatility and market sentiment remain uncertain. Our analysis suggests a careful and thorough assessment is required before committing to Investing in Palantir.

Remember to conduct your own thorough due diligence before making any investment decisions. Consider your risk tolerance and financial goals. While the potential rewards of Investing in Palantir are significant, the risks need careful consideration. Therefore, carefully weigh the potential benefits against the risks before deciding whether to invest in Palantir before May 5th.

Featured Posts

-

Projet Viticole A Dijon 2500 M De Vignes Aux Valendons

May 09, 2025

Projet Viticole A Dijon 2500 M De Vignes Aux Valendons

May 09, 2025 -

Jayson Tatum Ankle Injury Updates On Celtics Stars Condition

May 09, 2025

Jayson Tatum Ankle Injury Updates On Celtics Stars Condition

May 09, 2025 -

Le Projet De 3e Ligne De Tramway De Dijon Entre En Phase De Realisation Suite A La Concertation Metropolitaine

May 09, 2025

Le Projet De 3e Ligne De Tramway De Dijon Entre En Phase De Realisation Suite A La Concertation Metropolitaine

May 09, 2025 -

Harry Styles Honest Opinion The Snl Impression Debacle

May 09, 2025

Harry Styles Honest Opinion The Snl Impression Debacle

May 09, 2025 -

Dijon Violente Agression Au Lac Kir Trois Hommes Blesses

May 09, 2025

Dijon Violente Agression Au Lac Kir Trois Hommes Blesses

May 09, 2025