Investing In Palantir Before May 5th: A Detailed Look At The Potential

Table of Contents

Palantir's Recent Performance and Financial Health

Revenue Growth and Profitability

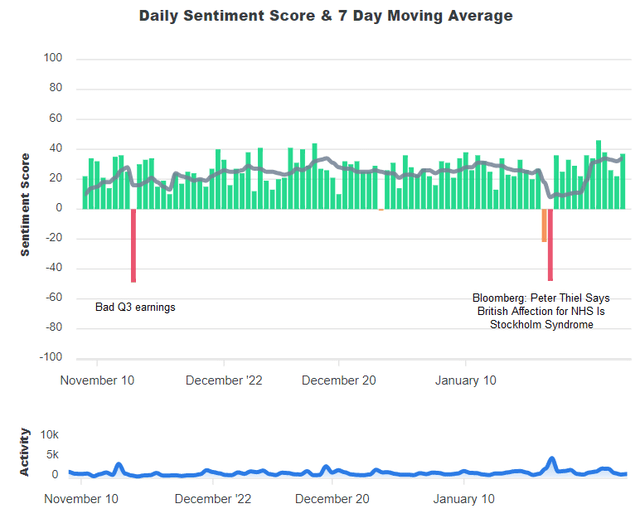

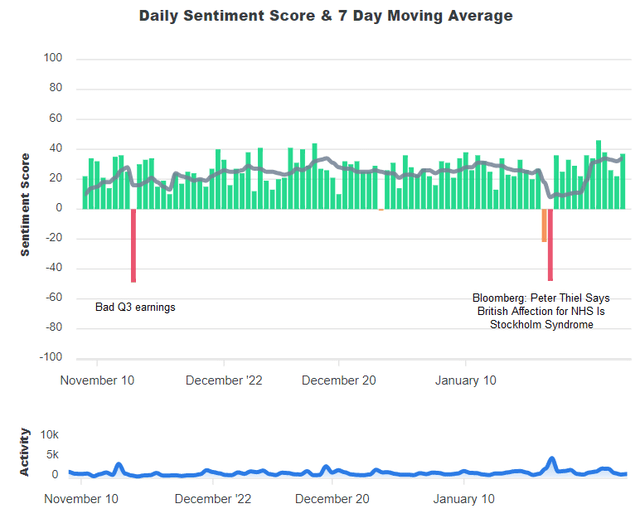

Palantir's recent financial performance offers a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus for investors. Examining recent quarterly reports reveals important trends.

- Q4 2022 Revenue: [Insert actual Q4 2022 revenue figures]. This shows a [percentage]% increase compared to Q4 2021, indicating continued growth. However, this growth rate may be [faster/slower] than previous quarters, suggesting [potential reasons].

- Profit Margins: Palantir's operating margins have [improved/declined] in recent quarters, reaching [insert percentage] in Q4 2022. This is [positive/negative] news, suggesting [reasons for the change].

- Comparison to Competitors: Compared to competitors like [mention key competitors, e.g., Snowflake, Databricks], Palantir’s revenue growth is [faster/slower], indicating [implications for market position]. Further analysis of key metrics like customer acquisition cost (CAC) and customer lifetime value (CLTV) is necessary for a complete picture.

Key Partnerships and Contracts

Palantir's strategic partnerships and contract wins are pivotal to its future growth. Securing substantial government and commercial contracts is crucial for sustained revenue.

- Significant Partnerships: Recent partnerships with [mention specific companies and their relevance to Palantir's growth] demonstrate Palantir's ability to expand its reach and offer integrated solutions.

- Government Contracts: A significant portion of Palantir's revenue stems from government contracts. While this provides stability, it also exposes the company to potential risks associated with budget cuts or shifts in government priorities. The reliance on a smaller number of large contracts should be carefully considered.

- Geographical Diversification: Palantir’s customer base is [geographically diverse/concentrated], representing [potential benefits/risks] in terms of revenue stability and exposure to geopolitical factors. Increased diversification is crucial to mitigate risk.

Assessing Palantir's Future Growth Potential

Market Opportunity and Competitive Landscape

The market for data analytics and government services is vast and expanding, presenting significant opportunities for Palantir. However, the competitive landscape is intense.

- Market Size: The global data analytics market is projected to reach [market size projection] by [year], offering a significant potential market for Palantir’s offerings.

- Market Penetration: Palantir is focusing on [mention key market segments and strategies] to increase market penetration and capture a larger share of the market.

- Competitive Analysis: Key competitors include [list key competitors], each posing unique challenges to Palantir's growth. [Analyze their strengths and weaknesses compared to Palantir].

Product Innovation and Technological Advantages

Palantir's continued investment in product innovation is crucial for maintaining a competitive edge. Its focus on AI and data analytics is key to its growth strategy.

- Recent Product Launches: The recent launch of [mention recent product launches and updates] demonstrates Palantir's commitment to innovation and addresses the evolving needs of its clients.

- Technological Advantages: Palantir's proprietary technology offers [mention key advantages] compared to its competitors, including [specific examples]. These advantages are key to securing new contracts and retaining existing clients.

- AI Integration: Palantir's increasing integration of AI and machine learning capabilities enhances its ability to provide advanced analytics and insights, further strengthening its position in the market.

Understanding the Risks Associated with Investing in Palantir

Valuation and Stock Price Volatility

Palantir's stock price has exhibited significant volatility. Understanding its valuation is crucial for potential investors.

- Valuation Metrics: Palantir's current P/E ratio is [insert current P/E ratio], which is [high/low/average] compared to industry peers. This valuation reflects investor sentiment and growth expectations.

- Stock Price Volatility: PLTR stock has experienced periods of sharp price swings, reflecting the inherent risks associated with investing in a high-growth technology company. Investors should be prepared for potential volatility.

- Future Projections: Analyzing future earnings estimates and growth projections is crucial for determining whether the current valuation is justified.

Dependence on Government Contracts and Geopolitical Risks

Palantir's significant reliance on government contracts poses specific risks.

- Government Contract Dependence: A substantial portion of Palantir's revenue is derived from government contracts. Changes in government priorities or budget cuts could significantly impact Palantir's financial performance.

- Geopolitical Risks: Palantir's operations in various geopolitical regions expose it to potential risks associated with political instability, sanctions, or changes in international relations.

- Contract Renewals: The success of contract renewals is crucial for maintaining revenue streams. Any failure to renew significant contracts could negatively impact the company's performance.

Conclusion

Investing in Palantir before May 5th requires careful consideration of its financial health, growth potential, and inherent risks. While Palantir shows promising growth, particularly in its government and commercial contracts, investors must weigh the substantial volatility against its potential rewards. This analysis provides a framework for informed decision-making; however, thorough due diligence and professional financial advice are crucial before investing in Palantir stock or any other security. Remember to always research and understand the potential risks before investing in Palantir stock. Conduct your own thorough research and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

3 000 Babysitter 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025

3 000 Babysitter 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025 -

Applauding Anchorage Local Medias Impact On The Arts Community

May 09, 2025

Applauding Anchorage Local Medias Impact On The Arts Community

May 09, 2025 -

Fox News Personality Jeanine Pirro Appointed Dc Prosecutor By Trump Examining The Controversy

May 09, 2025

Fox News Personality Jeanine Pirro Appointed Dc Prosecutor By Trump Examining The Controversy

May 09, 2025 -

Golden Knights Win Fueled By Hertls Double Hat Trick Performance

May 09, 2025

Golden Knights Win Fueled By Hertls Double Hat Trick Performance

May 09, 2025 -

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 09, 2025

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 09, 2025