Investing In Riot Platforms (RIOT): Risks And Rewards

Table of Contents

Understanding Riot Platforms (RIOT) and its Business Model

Riot Platforms (RIOT) is a publicly traded company specializing in Bitcoin mining. Its core business revolves around using powerful computer hardware to solve complex cryptographic problems, thereby earning Bitcoin rewards. This process, known as Bitcoin mining, requires significant computational power and energy consumption. RIOT's success is fundamentally tied to the price of Bitcoin and its operational efficiency.

Riot Platforms boasts a substantial operational scale, continuously expanding its mining capacity across multiple facilities. Their strategy emphasizes energy-efficient mining technologies to reduce operational costs and increase profitability.

- Massive mining operations across multiple facilities: RIOT operates large-scale mining farms strategically located to leverage optimal energy costs and infrastructure.

- Focus on energy-efficient mining technologies: The company invests heavily in the latest ASIC (Application-Specific Integrated Circuit) miners and explores renewable energy sources to enhance efficiency and sustainability.

- Strategic expansion into sustainable energy sources: RIOT is actively pursuing partnerships and investments in renewable energy, aiming to reduce its carbon footprint and potentially lower energy costs.

- Long-term commitment to Bitcoin mining: RIOT demonstrates a clear, long-term vision for its Bitcoin mining operations, indicating stability and commitment to the industry.

Potential Rewards of Investing in RIOT

Investing in Riot Platforms offers several potential rewards, although these are intrinsically linked to market conditions and the company's performance.

Bitcoin Price Appreciation

RIOT's stock price is heavily correlated with the price of Bitcoin. A rise in Bitcoin's value directly translates to increased profitability for RIOT and, consequently, a higher stock price. Historically, Bitcoin's price has shown significant volatility, leading to substantial gains and losses for RIOT investors. Understanding this inherent volatility is crucial.

Growth and Expansion Opportunities

RIOT's growth potential is significant. The company's plans for future expansion, including increasing its mining capacity and adopting more energy-efficient technologies, could significantly impact profitability. Strategic acquisitions or partnerships could further accelerate growth and provide access to new resources and markets. Innovation in mining technology and operational efficiency will play a critical role.

Dividend Potential (if applicable)

While not currently paying dividends, future dividend payouts are a possibility depending on RIOT's financial performance and strategic decisions. Analyzing the company's financial statements, cash flow, and debt levels will help determine the likelihood of future dividend distributions.

Risks Associated with Investing in RIOT

Despite the potential rewards, investing in RIOT carries considerable risks. Investors must carefully consider these factors before committing capital.

Volatility of Bitcoin's Price

Bitcoin's price is notoriously volatile, subject to dramatic swings influenced by market sentiment, regulatory changes, and macroeconomic factors. A sharp decline in Bitcoin's price can severely impact RIOT's profitability and stock price, leading to significant investment losses. This volatility represents a major risk for RIOT investors.

Energy Costs and Regulation

Bitcoin mining is energy-intensive. Fluctuations in energy prices directly affect RIOT's operating costs and profitability. Moreover, increasing environmental concerns and stricter regulations on energy consumption could significantly impact the company's operations and financial performance.

Competition in the Bitcoin Mining Industry

The Bitcoin mining industry is competitive, with numerous players vying for market share. Technological advancements and the emergence of new competitors pose a constant threat. RIOT needs to maintain its competitive edge through innovation and efficiency to succeed.

Financial Risks

As with any publicly traded company, investing in RIOT involves inherent financial risks. Factors like debt levels, profitability, cash flow, and overall financial health are critical considerations. Analyzing RIOT's financial statements and understanding its financial standing is crucial before investing.

Due Diligence and Investment Strategy for RIOT

Investing in Riot Platforms (RIOT) or any publicly traded company requires thorough due diligence. Before making any investment decisions, consider these steps:

- Conduct comprehensive research: Analyze RIOT's financial statements, business model, competitive landscape, and future outlook.

- Consult a financial advisor: A professional can help assess your risk tolerance and provide personalized investment advice.

- Diversify your investment portfolio: Don't put all your eggs in one basket. Diversification mitigates risk.

- Define your investment strategy: Determine your investment timeframe (long-term or short-term) and risk tolerance to guide your decisions.

Conclusion

Investing in Riot Platforms (RIOT) presents both significant opportunities and considerable risks. The potential for substantial returns is linked directly to the price of Bitcoin and the company's operational success. However, investors must carefully consider the volatility of the cryptocurrency market, energy costs, regulatory changes, and competition within the Bitcoin mining industry. Thorough due diligence and a well-defined investment strategy are crucial for mitigating risk and maximizing potential returns from your Riot Platforms (RIOT) investment. Before making any investment decisions, consult a financial advisor and conduct your own comprehensive research on Riot Platforms (RIOT) and the cryptocurrency market. Remember, understanding the risks and rewards is key to successful investing in Riot Platforms (RIOT).

Featured Posts

-

Mental Health Literacy Education A Comprehensive Guide

May 02, 2025

Mental Health Literacy Education A Comprehensive Guide

May 02, 2025 -

Woke Criticisms Validate Doctor Who Star Argues

May 02, 2025

Woke Criticisms Validate Doctor Who Star Argues

May 02, 2025 -

Wsoc Tv Michael Sheens Generous Act Erases 1 Million In Debt

May 02, 2025

Wsoc Tv Michael Sheens Generous Act Erases 1 Million In Debt

May 02, 2025 -

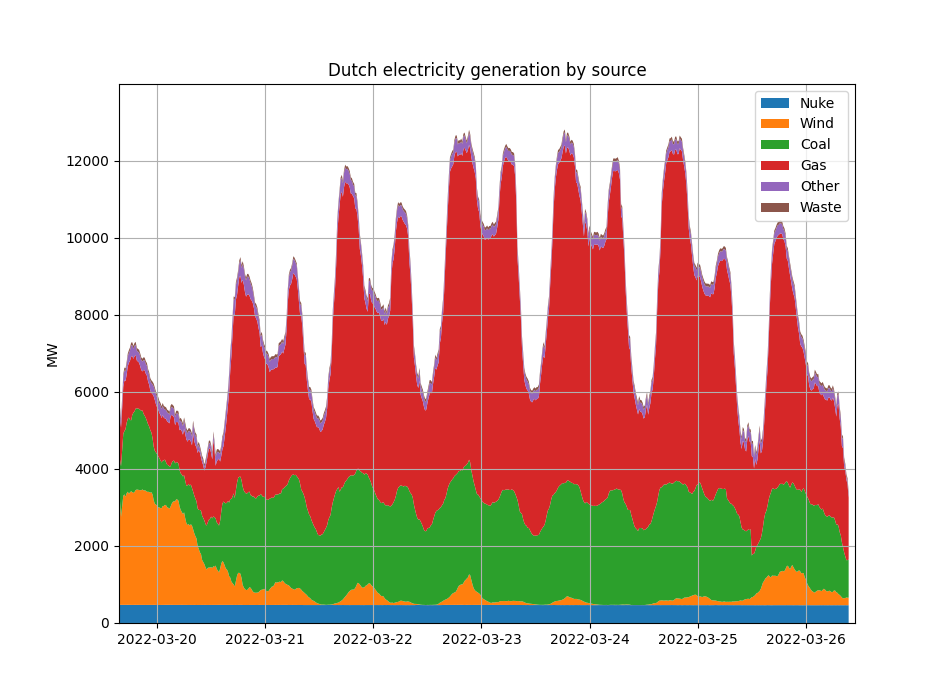

Enexis Blokkeert Duurzame School Kampen Kort Geding Gestart

May 02, 2025

Enexis Blokkeert Duurzame School Kampen Kort Geding Gestart

May 02, 2025 -

Fotos Laura Keller De Biquini Em Retiro Espiritual De Tantra Yoga

May 02, 2025

Fotos Laura Keller De Biquini Em Retiro Espiritual De Tantra Yoga

May 02, 2025

Latest Posts

-

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Facility

May 03, 2025

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Facility

May 03, 2025 -

Dutch Utilities Explore Dynamic Pricing Based On Solar Production

May 03, 2025

Dutch Utilities Explore Dynamic Pricing Based On Solar Production

May 03, 2025 -

Netherlands Largest Heat Pump Utrecht Wastewater Plant Innovation

May 03, 2025

Netherlands Largest Heat Pump Utrecht Wastewater Plant Innovation

May 03, 2025 -

Innovative Tariff Model Dutch Utilities Harness Solar Energy

May 03, 2025

Innovative Tariff Model Dutch Utilities Harness Solar Energy

May 03, 2025 -

Utrecht Wastewater Plant Installs Netherlands Largest Heat Pump

May 03, 2025

Utrecht Wastewater Plant Installs Netherlands Largest Heat Pump

May 03, 2025