Investing In Sovereign Bonds: Insights From Swissquote Bank

Table of Contents

Understanding Sovereign Bond Basics

What are Sovereign Bonds?

Sovereign bonds, also known as government bonds or treasury bonds, are debt securities issued by national governments to finance their spending. They represent a loan from an investor to the government. These bonds are considered relatively low-risk investments compared to corporate bonds or equities because they are backed by the full faith and credit of the issuing government. Various types exist, differing in maturity and features. For example, Treasury bills are short-term, while Treasury bonds have longer maturities.

- How sovereign bonds work: Investors purchase a bond at a specific price, and the government agrees to repay the principal amount (the face value) at maturity, along with periodic interest payments (coupons).

- Sovereign bonds vs. corporate bonds: Sovereign bonds are generally considered less risky than corporate bonds because governments have the power to tax and can theoretically print money to service their debt (though this is inflationary and generally avoided). Corporate bonds, however, are subject to the financial health of the issuing company.

- Risk profile: Sovereign bonds are considered a relatively low-risk asset class, particularly those issued by countries with strong credit ratings. However, they still carry risk, including interest rate risk and inflation risk. Compared to stocks and real estate, they typically offer lower potential returns but also lower volatility.

- Maturities: Sovereign bonds are available with various maturities, ranging from short-term (less than a year) to long-term (30 years or more). The maturity impacts both the risk and the yield of the bond.

Factors Influencing Sovereign Bond Yields

Interest Rates and Monetary Policy

Central bank interest rate policies significantly impact bond yields. When central banks raise interest rates, bond yields generally rise, and bond prices fall (and vice-versa). This is because higher interest rates make newly issued bonds more attractive, reducing demand for existing bonds with lower yields.

Credit Ratings and Country Risk

Credit rating agencies (like Moody's, S&P, and Fitch) assess the creditworthiness of governments. Countries with high credit ratings are perceived as less risky, leading to lower yields on their sovereign bonds. Conversely, countries with lower credit ratings or experiencing political instability often have higher yields to compensate investors for the increased risk. For example, bonds issued by the US government generally have lower yields than bonds issued by a developing nation.

- Inflation's effect: High inflation erodes the real return on bonds, leading to higher yields to compensate for the loss of purchasing power.

- Economic growth/recession: Strong economic growth can lead to higher interest rates and thus higher bond yields. Recessions often cause central banks to lower interest rates, driving bond prices up and yields down.

- Geopolitical factors: Political instability, wars, or other geopolitical events can significantly impact sovereign bond markets, increasing yields as investors demand a risk premium.

- Supply and demand: The supply and demand for sovereign bonds influence their prices and yields. High demand pushes prices up and yields down, while increased supply can push prices down and yields up.

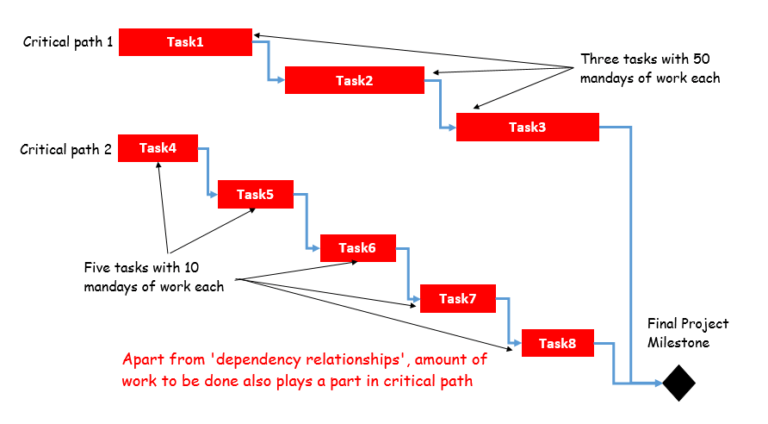

Diversification and Portfolio Construction with Sovereign Bonds

Diversifying Across Countries and Currencies

Diversifying your sovereign bond portfolio across different countries and currencies is crucial for mitigating risk. Exposure to a single country's economy can leave your investment vulnerable to that country's specific economic or political events. Investing in bonds denominated in various currencies helps hedge against currency fluctuations.

Sovereign Bonds in a Balanced Portfolio

Sovereign bonds are a valuable component of a balanced investment portfolio. Their relatively low volatility can help reduce overall portfolio risk, providing a counterbalance to the higher volatility of assets like stocks.

- Examples of diversified portfolios: A diversified portfolio might include sovereign bonds from developed countries (like the US, Germany, Japan), emerging markets (like Brazil, India, China), and bonds denominated in different currencies (like USD, EUR, GBP, JPY).

- Managing currency risk: Hedging strategies, such as using currency forwards or options, can help manage currency risk in international bond investments.

- Income generation: Sovereign bonds generate income through regular coupon payments, providing a steady stream of cash flow.

- Risk reduction: By allocating a portion of your investment portfolio to sovereign bonds, you can reduce overall portfolio volatility and protect your capital from significant losses.

Investing in Sovereign Bonds with Swissquote Bank

Swissquote's Services and Platforms

Swissquote Bank offers a comprehensive suite of services for investing in sovereign bonds, including access to a robust online trading platform, sophisticated research tools, and dedicated account management support. Their platform allows you to trade a wide range of sovereign bonds from different countries and currencies.

Advantages of Using Swissquote

Choosing Swissquote Bank for sovereign bond investments offers several advantages: competitive trading fees, a secure and user-friendly platform, access to market-leading research and analysis, and excellent customer support.

- Swissquote's trading platform: The platform offers real-time quotes, advanced charting tools, and order management capabilities.

- Research and educational resources: Swissquote provides clients with access to research reports, market analysis, and educational materials on sovereign bond investing.

- Special offers and promotions: Check Swissquote's website for any current special offers or promotions related to sovereign bond investments.

- Customer support and account management: Dedicated account managers can provide personalized support and guidance.

Conclusion

Investing in sovereign bonds presents a valuable opportunity for investors seeking stability and potential returns. Understanding the factors influencing bond yields, diversifying your portfolio strategically, and leveraging the services of a reputable bank like Swissquote Bank are crucial steps in achieving your investment goals. Swissquote Bank offers a secure and user-friendly platform for trading sovereign bonds, providing access to a wide range of investment opportunities. Start exploring the world of sovereign bond investing with Swissquote Bank today! Learn more about how to incorporate sovereign bonds into your investment strategy and discover the potential benefits.

Featured Posts

-

How Paige Bueckers Is Changing The Game For The Dallas Wings And The Wnba

May 19, 2025

How Paige Bueckers Is Changing The Game For The Dallas Wings And The Wnba

May 19, 2025 -

Royal Mail Stamp Price Hike What You Need To Know

May 19, 2025

Royal Mail Stamp Price Hike What You Need To Know

May 19, 2025 -

Final Destination Bloodlines Trailer Offers First Look At The New Horror

May 19, 2025

Final Destination Bloodlines Trailer Offers First Look At The New Horror

May 19, 2025 -

I Kyriaki Ton Myroforon Sta Ierosolyma Istoria Paradosi Kai Simasia

May 19, 2025

I Kyriaki Ton Myroforon Sta Ierosolyma Istoria Paradosi Kai Simasia

May 19, 2025 -

The Often Overlooked Value Of Middle Managers A Critical Analysis

May 19, 2025

The Often Overlooked Value Of Middle Managers A Critical Analysis

May 19, 2025