Investing In The Future: A Geographic Analysis Of Promising Business Hotspots

Table of Contents

North America: A Blend of Established Markets and Emerging Tech Hubs

North America boasts a dynamic mix of established markets and burgeoning tech hubs, presenting diverse investment opportunities.

Silicon Valley and the West Coast Tech Boom

Silicon Valley, the epicenter of technological innovation, continues to attract significant investment. San Francisco, Seattle, and San Diego are leading cities within this tech boom, fueled by venture capital and a constant stream of innovative startups. The region offers a strong talent pool, access to substantial funding, and established infrastructure, making it an attractive business hotspot. However, the high cost of living is a significant consideration for businesses and investors alike.

- Strong talent pool: Access to highly skilled engineers, developers, and designers.

- Access to funding: Abundant venture capital and private equity investment.

- Established infrastructure: World-class transportation, communication, and energy networks.

The Rise of Southern US Business Hotspots

While the West Coast remains dominant, the Southern US is experiencing a surge in economic activity. Texas, Florida, and Georgia are emerging as major players, driven by growth in aerospace, logistics, and renewable energy. These states offer a more affordable cost of living and doing business compared to their West Coast counterparts, attracting businesses seeking lower operational expenses.

- Lower taxes: Attractive tax policies incentivize business growth.

- Pro-business environment: Regulations are often perceived as more favorable to businesses.

- Growing population: A expanding workforce and consumer base.

Asia: Dynamic Economies and Emerging Markets

Asia presents a landscape of dynamic economies and rapidly developing markets, offering immense potential for investors.

China's Continued Economic Growth

China remains a significant global economic force, with Shanghai, Shenzhen, and Beijing leading the charge. Its massive market size and robust manufacturing capabilities continue to attract substantial foreign investment. However, investors must carefully consider potential risks associated with geopolitical uncertainties and regulatory changes.

- Large consumer market: A massive and growing population with increasing purchasing power.

- Strong manufacturing base: A highly efficient and cost-effective manufacturing sector.

- Government support: Government initiatives often aim to stimulate economic growth.

Southeast Asia's Thriving Startup Scene

Southeast Asia's burgeoning startup scene is attracting considerable attention. Singapore, Vietnam, and Indonesia, in particular, are experiencing rapid economic growth, driven by young, tech-savvy populations and a growing middle class. The ease of doing business in certain areas further enhances their attractiveness as investment destinations.

- Young workforce: A large and dynamic young population eager to embrace new technologies.

- Digital adoption: High rates of internet and mobile phone penetration.

- Growing middle class: An expanding consumer base with increasing disposable income.

Europe: Innovation and Stability in Established Markets

Europe offers a blend of established markets and innovative industries, providing a stable environment for investment.

Germany's Robust Industrial Base

Germany's strength lies in its robust industrial base, particularly in manufacturing, engineering, and the automotive sector. Its highly skilled workforce and stable political environment contribute to its attractiveness as a business hotspot.

- Skilled workforce: A highly educated and skilled labor force.

- Strong infrastructure: Well-developed transportation, communication, and energy networks.

- Stable economy: A relatively stable and predictable economic environment.

The UK's Fintech Revolution

London has established itself as a global Fintech center, attracting significant investment in financial technology companies. The concentration of innovative Fintech businesses and access to capital makes it a key business hotspot.

- Financial innovation: A hub for cutting-edge financial technology development.

- Access to capital: Easy access to venture capital and other forms of funding.

- International connectivity: A strategically important location with strong international connections.

Key Factors to Consider When Identifying Business Hotspots

Identifying the most promising business hotspots requires a comprehensive analysis. Several key factors should be carefully evaluated:

- Macroeconomic factors: GDP growth, inflation, and interest rates significantly impact investment decisions.

- Political and regulatory environments: Political stability and the ease of doing business are crucial considerations.

- Infrastructure: Adequate transportation, communication, and energy infrastructure are essential for business success.

- Human capital: Access to a skilled and educated workforce is vital for growth.

Conclusion

Identifying promising business hotspots requires a careful analysis of diverse geographic and economic factors. This article highlighted key regions in North America, Asia, and Europe, showcasing both established markets and emerging opportunities. While Silicon Valley remains a prominent example of a successful business hotspot, emerging markets in Southeast Asia and the Southern US also present compelling investment prospects. Remember to consider macroeconomic stability, the regulatory environment, and access to skilled labor when making your investment decisions. By conducting thorough research and understanding the nuances of each region, you can make informed choices and successfully invest in the future, finding the perfect business hotspots for your portfolio. Start your research today and discover the best business hotspots for your investment strategy.

Featured Posts

-

Actors And Writers Strike The Impact On Hollywood Productions

Apr 30, 2025

Actors And Writers Strike The Impact On Hollywood Productions

Apr 30, 2025 -

Alteawn Bnae Slslt Qwyt Fy Mwajht Almnafst Alshbabyt

Apr 30, 2025

Alteawn Bnae Slslt Qwyt Fy Mwajht Almnafst Alshbabyt

Apr 30, 2025 -

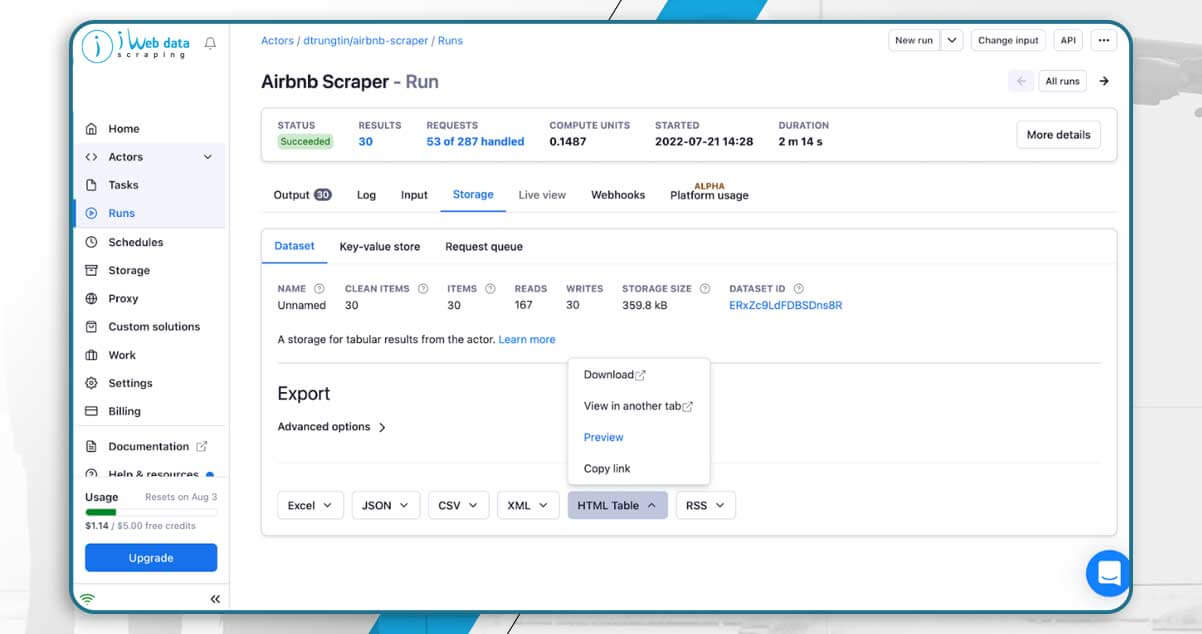

Domestic Tourism On The Rise Airbnb Data Shows 20 Increase In Canada

Apr 30, 2025

Domestic Tourism On The Rise Airbnb Data Shows 20 Increase In Canada

Apr 30, 2025 -

Schneider Electrics Early Sustainability Success 2024 Goals Surpassed

Apr 30, 2025

Schneider Electrics Early Sustainability Success 2024 Goals Surpassed

Apr 30, 2025 -

How To Watch Ru Pauls Drag Race Season 17 Episode 8 For Free No Cable

Apr 30, 2025

How To Watch Ru Pauls Drag Race Season 17 Episode 8 For Free No Cable

Apr 30, 2025

Latest Posts

-

Sjn Ryys Shbab Bn Jryr Tfasyl Alqdyt Kamlt

Apr 30, 2025

Sjn Ryys Shbab Bn Jryr Tfasyl Alqdyt Kamlt

Apr 30, 2025 -

Alastynaf Ward Ryys Shbab Bn Jryr Bed Sdwr Alhkm Ddh

Apr 30, 2025

Alastynaf Ward Ryys Shbab Bn Jryr Bed Sdwr Alhkm Ddh

Apr 30, 2025 -

Alqdae Almghrby Yhkm Ela Ryys Shbab Bn Jryr Balsjn

Apr 30, 2025

Alqdae Almghrby Yhkm Ela Ryys Shbab Bn Jryr Balsjn

Apr 30, 2025 -

Ryys Shbab Bn Jryr Ywajh Aledalt Tfasyl Alqdyt Walhkm Alsadr

Apr 30, 2025

Ryys Shbab Bn Jryr Ywajh Aledalt Tfasyl Alqdyt Walhkm Alsadr

Apr 30, 2025 -

Idant Ryys Shbab Bn Jryr Rdwd Alfel Walarae

Apr 30, 2025

Idant Ryys Shbab Bn Jryr Rdwd Alfel Walarae

Apr 30, 2025