Investing In The Future: A Guide To The Country's Newest Business Hot Spots

Table of Contents

The Rise of Tech Hubs: Identifying Emerging Tech Sectors for Investment

The technology sector is constantly evolving, presenting a wealth of opportunities for investors. Identifying emerging tech sectors early can lead to significant returns. Let's examine some of the most promising areas:

Artificial Intelligence (AI) and Machine Learning:

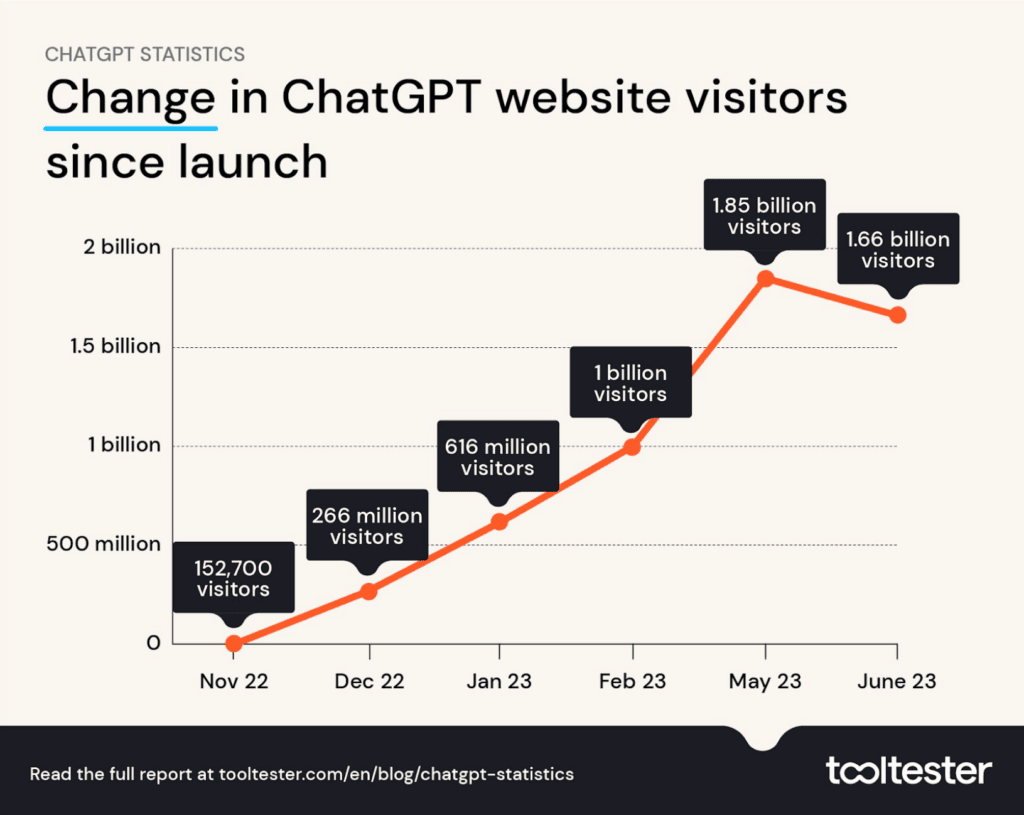

The explosive growth of AI and machine learning is transforming industries worldwide. AI investment is booming, with venture capitalists pouring billions into startups developing innovative solutions. This presents a significant opportunity for early investors.

- Examples of successful AI/ML startups: Many AI startups are achieving remarkable success, demonstrating the potential for high returns. Look for companies specializing in areas like natural language processing, computer vision, and predictive analytics.

- Potential risks: While the potential rewards are substantial, AI investment carries inherent risks. These include technological hurdles, regulatory challenges, and the high failure rate common to startups. Thorough due diligence is crucial.

- VC funding trends: Venture capital funding for AI and ML companies is at an all-time high, indicating strong investor confidence in the sector's long-term potential. This influx of capital fuels innovation and accelerates growth. Keywords: AI investment, Machine Learning startups, AI funding, artificial intelligence opportunities.

Renewable Energy and Sustainable Technologies:

The increasing demand for green energy solutions is driving substantial growth in the renewable energy sector. Government incentives and growing environmental awareness are fueling this trend, making renewable energy investment highly attractive.

- Government incentives: Many governments offer substantial tax breaks and subsidies to encourage investment in renewable energy projects, significantly boosting profitability.

- Promising renewable energy companies: Several companies are at the forefront of renewable energy innovation, developing advanced solar, wind, and geothermal technologies. Researching these companies and their growth potential is vital.

- Environmental, social, and governance (ESG) investing: ESG investing is gaining popularity, with investors increasingly prioritizing companies with strong environmental and social performance. Renewable energy companies often align perfectly with ESG principles. Keywords: Renewable energy investment, sustainable technology, green energy stocks, ESG investing.

Biotechnology and Pharmaceuticals:

Advancements in biotechnology are revolutionizing healthcare, offering significant investment potential. Pharmaceutical innovation and biotech startups are at the forefront of this transformation.

- Pharmaceutical innovation: The development of novel drugs and therapies is driving substantial growth in the pharmaceutical industry. Investing in companies with promising drug pipelines can yield high returns.

- Biotech startups: Biotech startups are developing cutting-edge technologies, from gene editing to personalized medicine. Early-stage investment in these companies can be highly lucrative but also carries higher risk.

- Clinical trial funding: The funding of clinical trials is a significant component of the biotech investment landscape. Companies successfully navigating this process demonstrate strong potential. Keywords: Biotech investments, pharmaceutical stocks, biotechnology startups, clinical trial investment.

Beyond the Tech Scene: Exploring Other High-Growth Industries

While technology dominates the headlines, other sectors are experiencing remarkable growth and offer attractive investment opportunities.

E-commerce and Online Retail:

The continued growth of e-commerce presents diverse investment opportunities across various segments.

- Logistics and delivery services: The increasing demand for efficient and reliable delivery networks creates significant investment opportunities in logistics companies.

- E-commerce platforms: Investing in established e-commerce platforms or promising new entrants can yield significant returns.

- Online retail marketing: Companies specializing in online retail marketing and advertising are experiencing rapid expansion.

- Dropshipping: The dropshipping model allows entrepreneurs to start online businesses with minimal upfront investment, creating opportunities for investors. Keywords: E-commerce investment, online retail, dropshipping business, logistics investment.

Fintech and Digital Finance:

Fintech is disrupting traditional financial services, creating exciting opportunities for investors.

- Mobile payment systems: The widespread adoption of mobile payment systems is fueling growth in this sector.

- Cryptocurrency: Cryptocurrency and blockchain technology are rapidly transforming the financial landscape, although this area carries significant risks.

- Digital banking: Digital banks are gaining popularity, offering innovative services and challenging traditional banking institutions. Keywords: Fintech investment, digital finance, cryptocurrency investment, blockchain technology investment.

Agritech and Sustainable Agriculture:

Agritech is crucial for addressing global food security challenges, making it an attractive investment area.

- Precision agriculture: Technologies that optimize farming practices are boosting yields and improving efficiency.

- Vertical farming: Vertical farms are increasing food production in urban areas, using less land and water.

- Agricultural technology startups: Numerous startups are developing innovative agricultural technologies, presenting investment opportunities.

- Food tech: Companies developing new food products and processing technologies are experiencing rapid growth. Keywords: Agritech investment, sustainable agriculture, precision farming, food technology investment.

Geographical Hot Spots: Identifying the Best Locations for Investment

[Insert a map or table here visualizing key regions and their strengths. For example, this could show major cities or regions known for specific industries, like Silicon Valley for tech, or a major agricultural region for Agritech.]

Analyzing different regions within the country is crucial for identifying the best locations for investment. Factors to consider include infrastructure, talent pool, government support, and overall economic health. Specific regions might be particularly attractive due to specialized industry clusters or government initiatives supporting specific sectors. Keywords: investment locations, regional economic growth, business hot spots map.

Conclusion

Investing in the country's newest business hot spots presents exceptional opportunities for significant returns. By carefully considering the emerging tech sectors, high-growth industries beyond tech, and the geographically strategic locations highlighted in this guide, you can position yourself for success. Don't miss out on the chance to shape your financial future. Start exploring these exciting investment avenues and discover the power of investing in the future. Learn more about investing in the country's newest business hot spots today!

Featured Posts

-

Ufc Fight Night Sandhagen Vs Figueiredo Predictions Analysis And Best Bets

May 04, 2025

Ufc Fight Night Sandhagen Vs Figueiredo Predictions Analysis And Best Bets

May 04, 2025 -

Google Search Ai Data Usage And The Effectiveness Of Opt Outs

May 04, 2025

Google Search Ai Data Usage And The Effectiveness Of Opt Outs

May 04, 2025 -

Nuggets Vs Warriors How Nba Fans Reacted To Russell Westbrook

May 04, 2025

Nuggets Vs Warriors How Nba Fans Reacted To Russell Westbrook

May 04, 2025 -

Canelos Defeated Opponent Earns Knockout Seeks Rematch

May 04, 2025

Canelos Defeated Opponent Earns Knockout Seeks Rematch

May 04, 2025 -

Bianca Censoris Alleged Attempt To Divorce Kanye West

May 04, 2025

Bianca Censoris Alleged Attempt To Divorce Kanye West

May 04, 2025