Investing In XRP (Ripple) Below $3: Risks And Rewards

Table of Contents

The Potential Rewards of Investing in XRP Below $3

Investing in XRP below $3 could offer significant rewards, depending on various factors. Let's explore the potential upsides.

XRP's Technological Advantages

RippleNet, Ripple's payment network, boasts impressive capabilities that contribute to XRP's potential. Its global reach, facilitated by its adoption by numerous banks and financial institutions worldwide, positions XRP as a potential game-changer in cross-border payments. This widespread adoption translates to real-world use and provides a solid foundation for future growth.

- Faster transaction times: XRP transactions are significantly faster than many other cryptocurrencies, making it attractive for businesses seeking efficient and cost-effective solutions.

- Lower fees: Compared to traditional banking systems and some other cryptocurrencies, XRP boasts remarkably low transaction fees. This cost-effectiveness makes it appealing to both businesses and individual users.

- Potential for wider adoption: As more financial institutions and businesses adopt RippleNet, the demand for XRP is likely to increase, potentially driving up its price.

- Integration with existing financial systems: Ripple's focus on integrating with existing financial infrastructure reduces friction and allows for smoother adoption, unlike some cryptocurrencies that require entirely new systems.

- Beyond Cross-Border Payments: While currently dominant in cross-border payments, XRP’s underlying technology shows potential applications in other areas like supply chain management and microtransactions. Future developments could significantly broaden its utility and increase demand.

The Potential for Price Appreciation

Analyzing XRP's historical price movements reveals periods of significant growth, though past performance, as always, is not indicative of future results. Several catalysts could drive future price increases:

- Regulatory Clarity: A positive resolution to the ongoing SEC lawsuit could significantly boost XRP's price, removing a major source of uncertainty for investors.

- Increased Institutional Adoption: Further adoption by banks and financial institutions would likely lead to increased demand and price appreciation.

- Positive Market Sentiment: Broader positive sentiment within the cryptocurrency market often lifts altcoins like XRP.

- Technological Advancements: Continued development and innovation within the Ripple ecosystem could also fuel investor confidence and drive price increases.

While some XRP price predictions are highly optimistic, it's crucial to approach these with a healthy dose of skepticism. Technical analysis can provide insights, but it’s not a crystal ball. The cryptocurrency market is highly speculative, and price movements can be influenced by many unpredictable factors.

The Risks Associated with Investing in XRP Below $3

Despite the potential rewards, investing in XRP below $3 involves considerable risks. Understanding these is paramount before making any investment decision.

Regulatory Uncertainty

The ongoing legal battle between Ripple and the SEC casts a long shadow over XRP's future. A negative outcome could significantly impact XRP's price and potentially lead to delisting from exchanges. Furthermore, the regulatory landscape for cryptocurrencies is constantly evolving and differs across various jurisdictions, adding another layer of complexity and uncertainty.

- SEC lawsuit: The ongoing SEC lawsuit is a major risk factor, creating considerable uncertainty surrounding XRP's legal status.

- Potential for further regulatory scrutiny: Even with a positive resolution, XRP could still face future regulatory challenges.

- Jurisdictional variations in crypto regulations: The regulatory environment varies greatly globally, impacting XRP’s accessibility and use in different markets.

Market Volatility

The cryptocurrency market is inherently volatile, meaning XRP's price can fluctuate wildly in short periods. This extreme price volatility is driven by several factors:

- High price volatility: XRP's price is subject to dramatic swings, both upward and downward, making it a high-risk investment.

- Susceptibility to market manipulation: Like other cryptocurrencies, XRP can be vulnerable to market manipulation and speculative bubbles.

- Influence of external factors: News events, broader market trends (including Bitcoin's price), and general investor sentiment can heavily influence XRP's price.

- Potential for substantial losses: Investors could experience significant losses if the price drops dramatically.

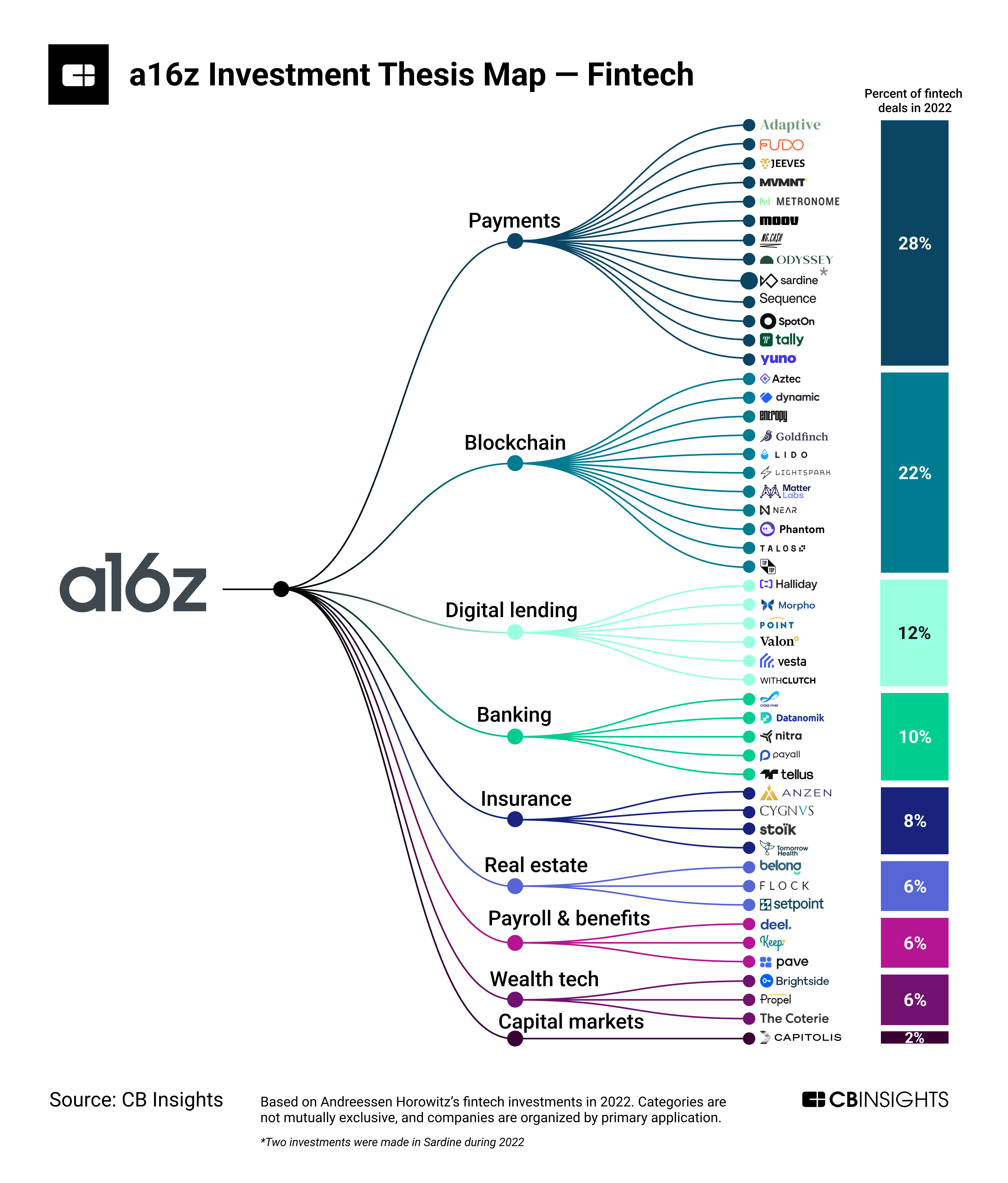

Competition in the Crypto Market

XRP faces stiff competition from other cryptocurrencies and established payment systems. Several factors contribute to this competitive landscape:

- Competition from other payment solutions: XRP competes with other cryptocurrencies and traditional payment systems aiming to facilitate cross-border payments.

- Emergence of new cryptocurrencies: The cryptocurrency market is constantly evolving, with new projects and technologies emerging that may challenge XRP's position.

- Market share dynamics: XRP needs to maintain and grow its market share to ensure its continued success and price stability.

Conclusion

Investing in XRP below $3 presents a complex scenario with both significant potential rewards and substantial risks. While XRP's technology and potential for wider adoption offer compelling reasons for investment, the regulatory uncertainty and inherent market volatility cannot be ignored. Before investing in XRP or any other cryptocurrency, it's crucial to conduct thorough research, understand your risk tolerance, and only invest what you can afford to lose. Remember that past performance is not indicative of future results. Carefully consider all the risks and rewards before making an investment decision regarding XRP. Conduct your own due diligence before investing in XRP (Ripple) below $3.

Featured Posts

-

Dragon Den Against The Odds A Surprising Investment

May 01, 2025

Dragon Den Against The Odds A Surprising Investment

May 01, 2025 -

The Future Of Luxury Cars In China Challenges And Opportunities For Bmw Porsche And Competitors

May 01, 2025

The Future Of Luxury Cars In China Challenges And Opportunities For Bmw Porsche And Competitors

May 01, 2025 -

Fouad L En De Erasmusschietpartij Waarom Levenslang Geen Tbs

May 01, 2025

Fouad L En De Erasmusschietpartij Waarom Levenslang Geen Tbs

May 01, 2025 -

Kshmyr Tnazeh Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 01, 2025

Kshmyr Tnazeh Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 01, 2025 -

Dallas And Carrie Star Passes Away Daughter Amy Irving Shares Tribute

May 01, 2025

Dallas And Carrie Star Passes Away Daughter Amy Irving Shares Tribute

May 01, 2025

Latest Posts

-

Canadian Federal Election Poilievres Seat In Question

May 01, 2025

Canadian Federal Election Poilievres Seat In Question

May 01, 2025 -

Analysis Pierre Poilievres Electoral Setback In Canada

May 01, 2025

Analysis Pierre Poilievres Electoral Setback In Canada

May 01, 2025 -

China Lifes Successful Investment Strategy Higher Profits

May 01, 2025

China Lifes Successful Investment Strategy Higher Profits

May 01, 2025 -

Canada Election Results Poilievres Unexpected Loss

May 01, 2025

Canada Election Results Poilievres Unexpected Loss

May 01, 2025 -

How Strong Investments Helped China Life Increase Profits

May 01, 2025

How Strong Investments Helped China Life Increase Profits

May 01, 2025