Investing In XRP: Risks And Rewards

Table of Contents

Understanding the Potential Rewards of XRP Investment

XRP's price history demonstrates significant volatility, presenting opportunities for substantial gains. However, it's crucial to remember that past performance is not indicative of future results.

High Growth Potential

XRP has experienced periods of explosive growth, showcasing its potential for significant price appreciation. While specific past price increases should be researched independently using reliable financial data sources, several factors could drive future growth. These include:

- Increased adoption by financial institutions: Ripple's partnerships with major banks for cross-border payments are steadily increasing XRP's utility and demand.

- Technological advancements: Continuous improvements to the XRP Ledger (XRPL) could enhance its efficiency and scalability, driving further adoption.

- Growing demand for faster and cheaper cross-border payments: XRP's speed and low transaction costs offer a compelling alternative to traditional banking systems.

Utility and Real-World Applications

Unlike many cryptocurrencies that primarily exist as speculative assets, XRP boasts tangible real-world applications. Its primary function is facilitating fast and inexpensive cross-border payments through RippleNet.

- Partnerships with major banks: Ripple has collaborated with numerous global banks, integrating XRP into their payment infrastructure. This real-world usage strengthens XRP's position within the financial industry.

- Speed and low transaction costs: Compared to other cryptocurrencies like Bitcoin or Ethereum, XRP transactions are significantly faster and cheaper, making it attractive for large-scale financial transactions.

- Scalability: The XRPL is designed for high throughput, capable of handling a large volume of transactions per second.

Accessibility and Liquidity

Investing in XRP is relatively straightforward due to its accessibility on various major cryptocurrency exchanges.

- Popular exchanges: XRP is available on most major exchanges, ensuring ease of buying and selling.

- High trading volume: XRP consistently boasts high trading volume, indicating good liquidity and ease of entering or exiting positions.

- Significant market capitalization: XRP's relatively large market capitalization further contributes to its liquidity, reducing the risk of significant price swings due to limited trading volume.

Assessing the Risks Associated with XRP Investment

While the potential rewards are attractive, investing in XRP also carries considerable risks. A comprehensive understanding of these risks is crucial for informed decision-making.

Regulatory Uncertainty

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's future.

- SEC lawsuit: The SEC's claim that XRP is an unregistered security significantly impacts its price and trading.

- Uncertainty regarding future regulations: The outcome of the lawsuit will significantly influence future regulatory treatment of XRP, affecting its price and adoption.

- Geographic limitations: Some exchanges have delisted XRP due to regulatory concerns, limiting its accessibility in certain regions.

Market Volatility

The cryptocurrency market is inherently volatile, and XRP is no exception. Its price can fluctuate dramatically in short periods.

- Past price drops: XRP's price has experienced significant drops in the past, highlighting the risk of substantial losses.

- External factors: Market sentiment, news events, and broader economic conditions can all impact XRP's price.

- Importance of risk tolerance: Only invest in XRP what you can afford to lose completely.

Technological Risks

Like any technology, the XRPL faces potential vulnerabilities and limitations.

- Security risks: While the XRPL has a strong track record, potential security breaches or vulnerabilities could negatively impact its value.

- Technological limitations: The XRPL's ongoing development may face challenges related to scalability or efficiency.

- Competition: The cryptocurrency market is highly competitive, and new technologies could potentially render XRP less relevant.

Developing a Sound XRP Investment Strategy

Investing in XRP requires careful planning and risk management.

Due Diligence

Before investing, conduct thorough research to understand XRP's technology, its use cases, and the risks involved.

- Reliable sources: Consult reputable financial news sources, white papers, and independent analyses.

- Financial advisor: Consider consulting with a qualified financial advisor to discuss whether XRP aligns with your investment goals and risk tolerance.

Risk Management

Implementing sound risk management strategies is essential to mitigate potential losses.

- Diversification: Never put all your eggs in one basket. Diversify your investment portfolio to reduce risk.

- Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of price fluctuations.

- Realistic investment goals: Set realistic expectations and understand that cryptocurrency investments are inherently risky.

Long-Term vs. Short-Term Investment

Consider your personal investment timeline and risk tolerance when deciding on a long-term or short-term approach.

- Long-term investment: Suitable for investors with a higher risk tolerance and a long-term horizon who believe in XRP's long-term potential.

- Short-term investment: Higher risk, potentially higher rewards, but requires more active monitoring and a higher risk tolerance.

Conclusion: Making Informed Decisions about Investing in XRP

Investing in XRP offers the potential for significant rewards, but it's crucial to acknowledge and manage the substantial risks involved. Regulatory uncertainty, market volatility, and technological risks must be carefully considered. Conduct thorough due diligence, diversify your portfolio, and only invest what you can afford to lose. Begin your research on investing in XRP today, but always prioritize careful planning and risk assessment. Learn more about investing in XRP and how it fits into your diversified investment strategy. Remember that this information is for educational purposes and not financial advice. Conduct your own thorough research before making any investment decisions.

Featured Posts

-

Sony Play Station Christmas Voucher Glitch Free Credit Compensation

May 02, 2025

Sony Play Station Christmas Voucher Glitch Free Credit Compensation

May 02, 2025 -

Sonys New Play Station Beta Features And How To Participate

May 02, 2025

Sonys New Play Station Beta Features And How To Participate

May 02, 2025 -

Fortnite V34 30 Release Date Maintenance Schedule And New Content

May 02, 2025

Fortnite V34 30 Release Date Maintenance Schedule And New Content

May 02, 2025 -

The Roi Of Childhood Why Investing In Mental Health Pays Off

May 02, 2025

The Roi Of Childhood Why Investing In Mental Health Pays Off

May 02, 2025 -

Israil Meclisi Nde Yasanan Esir Yakinlari Guevenlik Goerevlileri Karsilasmasi Ayrintilar

May 02, 2025

Israil Meclisi Nde Yasanan Esir Yakinlari Guevenlik Goerevlileri Karsilasmasi Ayrintilar

May 02, 2025

Latest Posts

-

Kate And Lila Mosss Identical Lbds Steal The Show At London Fashion Week

May 02, 2025

Kate And Lila Mosss Identical Lbds Steal The Show At London Fashion Week

May 02, 2025 -

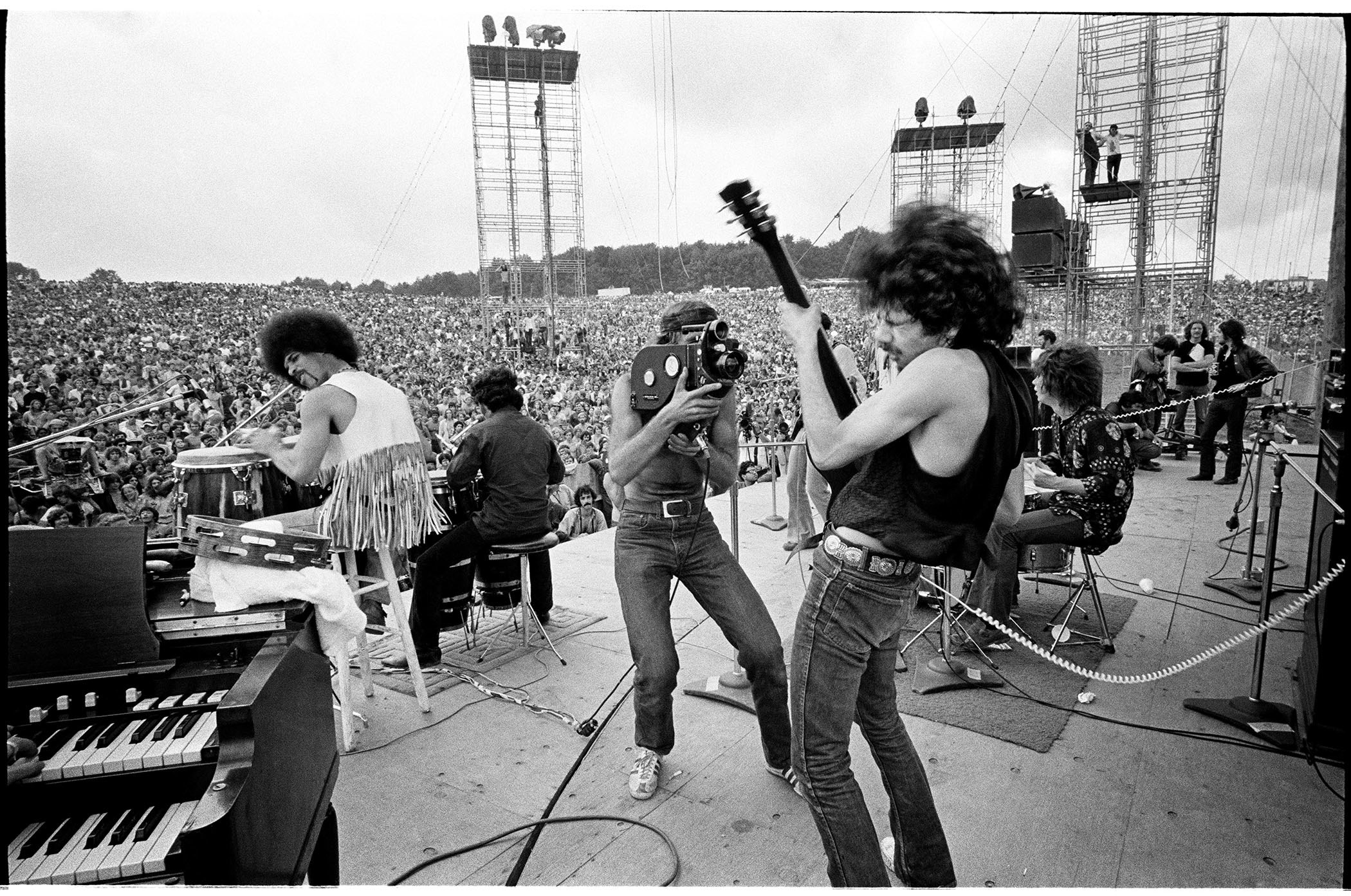

Legendary Band To Play Festival Only Under Extreme Circumstances

May 02, 2025

Legendary Band To Play Festival Only Under Extreme Circumstances

May 02, 2025 -

Matching Mothers And Daughters Kate And Lila Mosss Lbd Looks At London Fashion Week

May 02, 2025

Matching Mothers And Daughters Kate And Lila Mosss Lbd Looks At London Fashion Week

May 02, 2025 -

Iconic Bands Festival Return A Life Or Death Scenario

May 02, 2025

Iconic Bands Festival Return A Life Or Death Scenario

May 02, 2025 -

London Fashion Week Kate And Lila Moss Twin In Stylish Lbds

May 02, 2025

London Fashion Week Kate And Lila Moss Twin In Stylish Lbds

May 02, 2025