Investment In Amundi Dow Jones Industrial Average UCITS ETF: Focus On Net Asset Value (NAV)

Table of Contents

A UCITS (Undertakings for Collective Investment in Transferable Securities) ETF is a type of investment fund regulated under EU law, offering investors a high degree of protection and transparency. Net Asset Value (NAV) represents the total value of an ETF's underlying assets, divided by the number of outstanding shares. Essentially, it reflects the intrinsic worth of each share. This article focuses on understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV and its significance for investors pursuing passive investing strategies and portfolio diversification. Tracking the NAV allows for informed decision-making within the context of index tracking and effective risk management.

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) is the market value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. It's calculated daily by the ETF provider, taking into account the closing prices of all the underlying assets within the ETF. The NAV provides a true reflection of the ETF's underlying asset value, independent of market fluctuations in the ETF's share price.

The NAV differs from the market price, which is the price at which the ETF shares are traded on the exchange. Discrepancies can arise due to supply and demand dynamics. Sometimes, the market price trades at a premium (above NAV) or a discount (below NAV) to the NAV.

Monitoring the NAV is critical for several reasons:

- Provides a true reflection of the ETF's value: The NAV gives you an accurate picture of the underlying asset value, irrespective of short-term market volatility.

- Helps in comparing the ETF's performance to its benchmark: By comparing the NAV changes to the benchmark index (in this case, the Dow Jones Industrial Average), you can assess the ETF's tracking efficiency.

- Facilitates better understanding of potential profits/losses: Tracking NAV changes over time allows you to accurately calculate your investment gains or losses.

- Assists in identifying undervalued or overvalued ETFs: Significant deviations between NAV and market price can signal potential buying or selling opportunities.

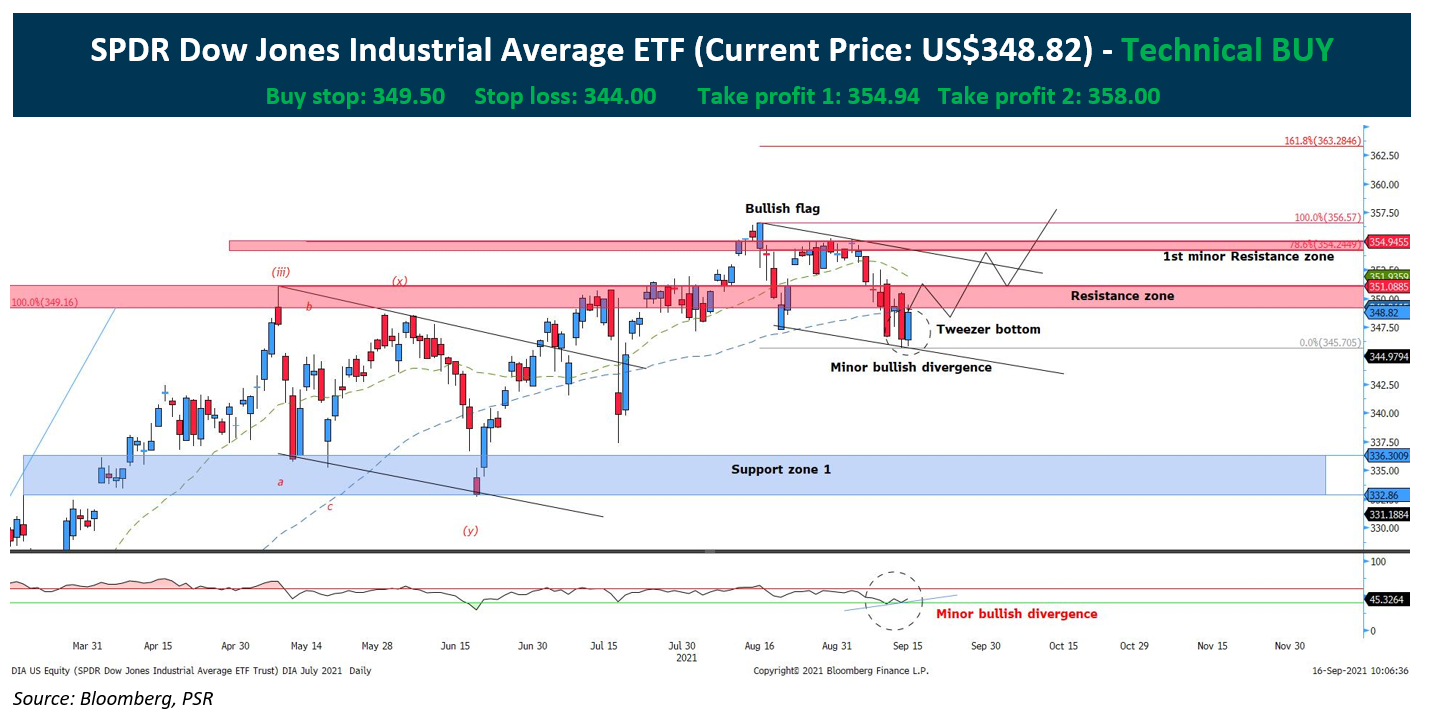

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF's NAV Performance

Accessing historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Most brokerage platforms and the ETF provider's website will provide this information, often displayed in charts and graphs. Analyzing this data reveals trends and patterns over time. (Include a chart here if possible, showing NAV trends over, say, the past year.)

Several factors influence the Amundi Dow Jones Industrial Average UCITS ETF's NAV:

- Performance of Dow Jones Industrial Average components: The ETF's NAV directly correlates with the performance of the 30 companies in the Dow Jones Industrial Average. Positive performance in the underlying stocks will increase the NAV.

- Currency fluctuations: If the ETF is denominated in a currency different from your base currency, exchange rate changes will impact your NAV in your local currency.

- Expense ratio: The ETF's expense ratio (the annual fee charged to manage the fund) will slightly reduce the NAV over time.

The market price of the ETF can diverge from its NAV. This is common, particularly with actively traded ETFs.

- Premium/discount analysis: Comparing the market price to the NAV allows for identifying premiums or discounts.

- Implications for buying/selling decisions: A significant discount might present a buying opportunity, while a large premium might suggest considering selling.

- Arbitrage opportunities: Sophisticated investors may seek to exploit discrepancies between NAV and market price through arbitrage strategies.

Practical Applications of NAV in Investing in the Amundi Dow Jones Industrial Average UCITS ETF

Understanding NAV empowers investors to develop effective strategies:

-

Investment Strategies: Dollar-cost averaging (investing a fixed amount at regular intervals) becomes more effective when you consider the NAV fluctuations. Value investing, based on identifying undervalued assets, relies heavily on NAV analysis.

-

Risk Management: Monitoring NAV helps in mitigating investment risks.

- Identifying potential losses early on: A significant drop in NAV signals potential losses, allowing for timely action.

- Making timely adjustments to portfolio allocation: Based on NAV trends, you can rebalance your portfolio to manage risk effectively.

- Minimizing potential investment losses: Careful monitoring can help you limit exposure to potentially declining assets.

Choosing a broker that provides accurate and timely NAV data is essential. Compare different brokers based on their data reliability and platform features.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding and regularly monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV is paramount for successful investing. The NAV provides a clear picture of the ETF's underlying value, allowing for informed investment decisions, effective risk management, and strategic portfolio adjustments. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF NAV. Regularly check your ETF's NAV to identify potential buying and selling opportunities and to track its performance against its benchmark. Learn more about maximizing your Amundi Dow Jones Industrial Average UCITS ETF investments through NAV analysis.

For further research on ETF investing and NAV analysis, consult reputable financial websites and investment guides. Remember, this information is for educational purposes and not financial advice. Always conduct thorough research and consider seeking professional financial advice before making any investment decisions.

Featured Posts

-

Analysis West Hams Offer For Kyle Walker Peters

May 25, 2025

Analysis West Hams Offer For Kyle Walker Peters

May 25, 2025 -

Strategi Investasi Pasca Penambahan Mtel And Mbma Ke Msci Small Cap Index

May 25, 2025

Strategi Investasi Pasca Penambahan Mtel And Mbma Ke Msci Small Cap Index

May 25, 2025 -

Top 10 Fastest Production Ferraris Fiorano Track Times

May 25, 2025

Top 10 Fastest Production Ferraris Fiorano Track Times

May 25, 2025 -

Your Escape To The Country Financial Considerations And Planning

May 25, 2025

Your Escape To The Country Financial Considerations And Planning

May 25, 2025 -

Photos Lego Master Manny Garcias Visit To Veterans Memorial Elementary

May 25, 2025

Photos Lego Master Manny Garcias Visit To Veterans Memorial Elementary

May 25, 2025

Latest Posts

-

Europese En Amerikaanse Aandelen Een Vergelijking Van Recente Marktbewegingen

May 25, 2025

Europese En Amerikaanse Aandelen Een Vergelijking Van Recente Marktbewegingen

May 25, 2025 -

Voorspelling Vervolg Snelle Markt Draai Europese Aandelen

May 25, 2025

Voorspelling Vervolg Snelle Markt Draai Europese Aandelen

May 25, 2025 -

Analyse Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street

May 25, 2025

Analyse Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street

May 25, 2025 -

Brest Urban Trail Un Evenement Reuni Grace Aux Benevoles Artistes Et Partenaires

May 25, 2025

Brest Urban Trail Un Evenement Reuni Grace Aux Benevoles Artistes Et Partenaires

May 25, 2025 -

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 25, 2025

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 25, 2025