Investment In Belgian Energy: A 270MWh BESS Financing Case Study

Table of Contents

The Belgian Energy Landscape and the Need for BESS

Belgium's energy transition is underway, with a strong focus on increasing the share of renewable energy sources. However, the intermittent nature of solar and wind power creates significant challenges for grid stability. This is where BESS technology plays a vital role:

- Grid stabilization: BESS can help balance supply and demand, preventing blackouts and ensuring grid reliability.

- Renewable energy integration: By storing excess energy generated during peak production periods, BESS facilitates the seamless integration of renewable energy sources, maximizing their utilization.

- Frequency regulation: BESS can provide fast-responding frequency regulation services, crucial for maintaining grid stability in a fluctuating energy system.

The Belgian government actively supports the development of energy storage projects through various incentives and policies, including:

- Investment subsidies and tax breaks for BESS projects.

- Simplified permitting processes for renewable energy storage facilities.

- Capacity remuneration mechanisms to incentivize participation in grid stabilization services.

These supportive policies create a favorable environment for Belgian energy investment in the BESS sector, specifically targeting energy storage Belgium solutions.

Project Overview: 270MWh BESS in Belgium

This case study focuses on a substantial 270MWh BESS project currently under development in [Specific Location in Belgium - replace with actual location if available, otherwise remove this sentence]. The project utilizes [Specify Technology - e.g., lithium-ion batteries] and is designed to:

- Provide grid stabilization services to Elia (the Belgian transmission system operator).

- Support the integration of a large-scale renewable energy park.

- Offer ancillary services to the Belgian electricity market.

The project developers, [Name of Developer(s)], are collaborating with [Name of Partners] to deliver this crucial infrastructure. This initiative represents a significant step towards a more sustainable and reliable energy system for Belgium, reducing reliance on fossil fuels and minimizing its carbon footprint. This energy storage project directly contributes to Belgium’s ambitious climate targets and strengthens its Belgian energy infrastructure.

Financing Strategies and Investment Analysis

The 270MWh BESS project's financing structure involves a combination of:

- Equity financing: [Percentage]% from private investors and potentially government grants.

- Debt financing: [Percentage]% secured through a combination of bank loans and green bonds.

- Potential revenue streams: Revenue will be generated from grid services provided to Elia and participation in energy markets.

The projected ROI for this BESS financing model is attractive, given the current and projected energy prices in Belgium. A detailed financial model shows a strong internal rate of return (IRR) and a positive net present value (NPV), indicating high BESS financing viability. This makes it a compelling investment opportunity with considerable growth potential in the Belgian investment opportunities space. The regulatory framework in Belgium, along with the increasing demand for grid services, mitigates many risks associated with traditional energy investments.

Risk Mitigation and Due Diligence

Investing in large-scale BESS projects involves several inherent risks, including:

- Technological risks: Battery degradation, component failures, and unforeseen technological advancements.

- Regulatory risks: Changes in government policies, permitting processes, and market regulations.

- Market risks: Fluctuations in electricity prices and demand.

To mitigate these risks, a comprehensive due diligence process was undertaken, including:

- Thorough technical assessments of the chosen BESS technology.

- Detailed analysis of the regulatory landscape and potential policy changes.

- Robust financial modeling incorporating various market scenarios.

These mitigation strategies aim to minimize potential downsides and maximize the long-term value of the investment. Understanding and managing energy investment risk is key to the success of such projects. The risk mitigation BESS approach outlined is designed to minimize such occurrences and bolster investor confidence.

Future Outlook for BESS Investment in Belgium

The BESS market Belgium is poised for substantial growth. Driven by government support, increasing renewable energy integration needs, and the declining cost of BESS technology, the demand for energy storage solutions is expected to increase significantly in the coming years.

- Future projects will likely focus on larger-scale deployments, utilizing advanced battery technologies.

- Opportunities will emerge in integrating BESS with other renewable energy technologies like green hydrogen.

Investing in sustainable energy investment in Belgium not only offers attractive financial returns but also contributes to a cleaner, more secure energy future. The Belgian energy future depends on such crucial advancements in energy storage technology, and this 270MWh BESS project exemplifies the potential for future development in this field.

Conclusion: Investing in the Future of Belgian Energy with BESS

This case study demonstrates the significant investment potential of large-scale BESS projects in Belgium. The 270MWh BESS project highlights the financial viability, risk mitigation strategies, and long-term benefits of investing in this crucial area of the Belgian energy investment market. BESS offers a compelling solution for grid stability, renewable energy integration, and environmental sustainability, making it an attractive option for investors seeking both financial returns and positive social impact. The future of renewable energy investment Belgium relies heavily on such projects.

To learn more about BESS financing opportunities and explore investment options in the rapidly expanding Belgian energy storage sector, please contact us using the link below: [Insert Link to Contact Form or Relevant Resource Here]. Seize the opportunity to become a part of Belgium's energy transition and secure a piece of the future of Belgian energy investment.

Featured Posts

-

Gigi Hadid Bradley Cooper And The Leonardo Di Caprio Connection

May 04, 2025

Gigi Hadid Bradley Cooper And The Leonardo Di Caprio Connection

May 04, 2025 -

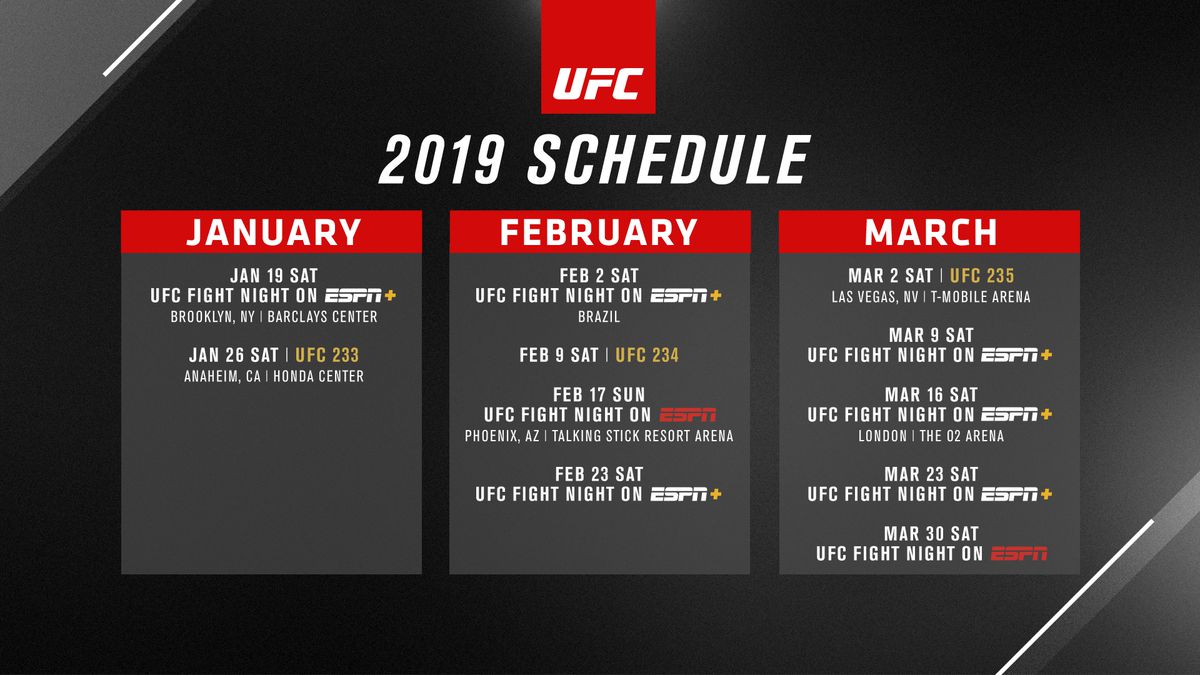

Your Guide To The Ufc Fight Schedule May 2025 Ufc 315 Included

May 04, 2025

Your Guide To The Ufc Fight Schedule May 2025 Ufc 315 Included

May 04, 2025 -

Katie Nolan Addresses Charlie Dixon Allegations

May 04, 2025

Katie Nolan Addresses Charlie Dixon Allegations

May 04, 2025 -

Eurovision 2024 Leslies Journey Continues

May 04, 2025

Eurovision 2024 Leslies Journey Continues

May 04, 2025 -

16 Year Olds Torture Death Stepfather Charged With Murder

May 04, 2025

16 Year Olds Torture Death Stepfather Charged With Murder

May 04, 2025