Investment In CoreWeave (CRWV): Understanding Last Week's Price Increase

Table of Contents

CoreWeave's Business Model and Recent Developments

CoreWeave (CRWV) operates in the rapidly expanding cloud computing market, providing high-performance computing infrastructure with a specific focus on artificial intelligence (AI) workloads. They differentiate themselves by leveraging repurposed NVIDIA GPUs, offering a cost-effective solution for businesses with intensive data processing needs. This business model, coupled with recent strategic moves, likely contributed significantly to last week's price jump.

Recent company news highlights several key developments:

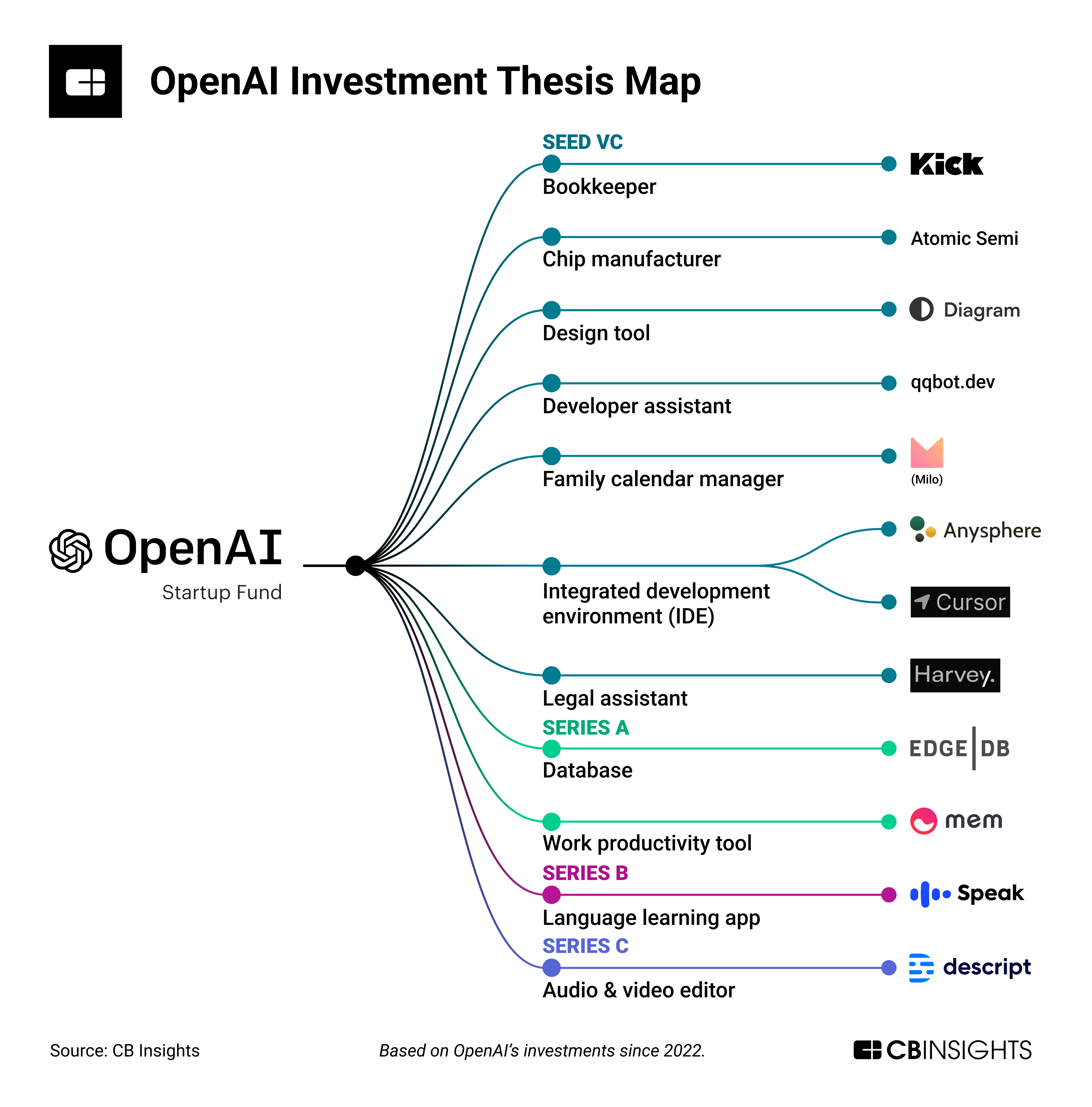

- New partnerships with major tech companies: CoreWeave has been actively forging strategic alliances with leading technology companies, securing substantial contracts and expanding their market reach. These partnerships provide access to new customer bases and further solidify their position in the industry.

- Expansion into new geographic markets: Strategic geographic expansion helps CoreWeave access new customer pools and reduce reliance on any single region, mitigating risks and fostering growth.

- Successful product launches catering to the growing AI market: The increasing demand for AI-related services positions CoreWeave perfectly to capitalize on this burgeoning market. Their product launches reflect a focus on meeting these specific, high-demand needs.

- Announcements regarding increased capacity and infrastructure: Investing in and announcing increased capacity demonstrates CoreWeave's commitment to meeting growing demands, assuring investors of their ability to handle future growth and potentially increasing their market share.

Market Factors Influencing CRWV Stock Price

Beyond CoreWeave's internal developments, broader market trends also played a crucial role in the CRWV stock price increase. The current landscape is highly favorable for cloud computing and AI infrastructure companies.

- Increased demand for AI computing resources: The explosion of interest in generative AI and machine learning has created an unprecedented demand for powerful computing resources, directly benefitting companies like CoreWeave.

- Positive investor sentiment towards cloud infrastructure stocks: The overall positive outlook for the cloud computing industry has led to increased investor confidence and willingness to invest in companies within this sector.

- Overall market optimism affecting technology sector investments: Broader market optimism, particularly within the technology sector, has created a generally positive investing environment that favors growth stocks like CRWV.

- Competition analysis: how CoreWeave is positioned against competitors: While competition in the cloud computing market is fierce, CoreWeave's focus on AI workloads and cost-effective solutions provides a strong competitive edge. Their strategic partnerships further solidify their position.

Analyzing the Sustainability of the Price Increase

While last week's price increase is encouraging, it's crucial to analyze its sustainability. Several factors could influence CoreWeave's future performance:

- Potential future competition and market saturation: Increased competition could lead to price wars and reduced profit margins. Careful market analysis and continued innovation are crucial to maintain a competitive advantage.

- Economic factors influencing investment in the technology sector: Macroeconomic factors, such as interest rates and inflation, can significantly impact investment decisions in the technology sector.

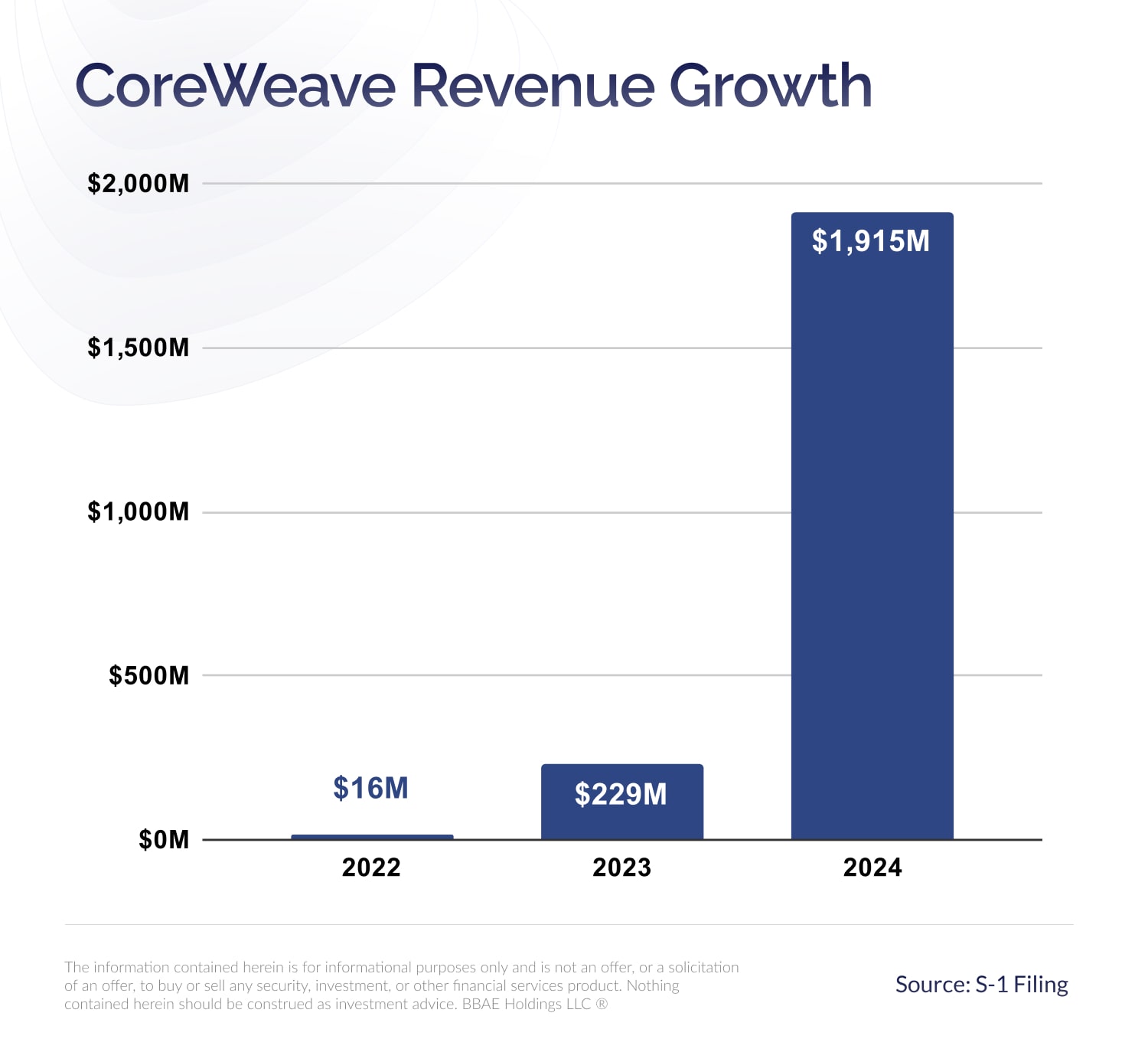

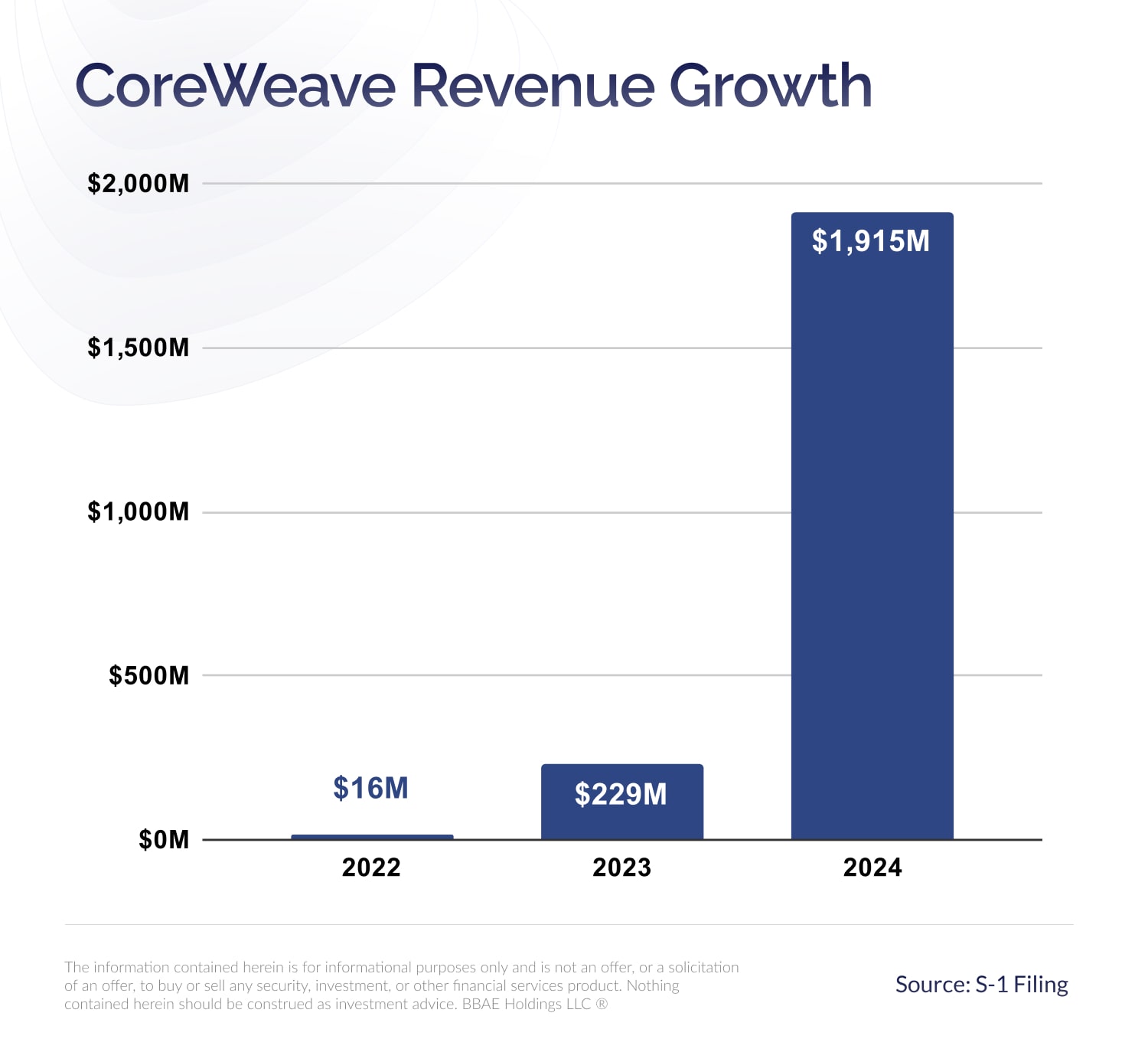

- CoreWeave's financial performance and future projections: Sustained growth requires consistent and positive financial performance. Investors will closely watch CoreWeave’s financial reports and future projections to gauge their long-term viability.

- Regulatory risks and compliance considerations: Navigating regulatory complexities in various jurisdictions is crucial for continued success and sustainable growth.

Evaluating Long-Term Investment Potential in CRWV

For investors considering a long-term investment in CRWV, a thorough assessment is vital.

- Consideration of CoreWeave's valuation compared to competitors: A comparative analysis of CoreWeave's valuation against its competitors is essential to determine if the current price reflects its true potential.

- Long-term growth projections based on market trends and company performance: Analyzing future growth prospects based on market trends and CoreWeave's past performance and strategic direction is crucial for long-term investment decisions.

- Importance of diversification in investment portfolios: Diversification is a key principle of successful investing. Investing in CRWV should be considered within the context of a well-diversified portfolio.

- Comparison of CoreWeave to other investments in the cloud computing and AI sector: Comparing CoreWeave's potential against other investment opportunities within the cloud computing and AI sectors is vital to make informed decisions.

Conclusion

The recent CoreWeave (CRWV) price increase reflects a combination of strong company performance, strategic partnerships, and favorable market trends within the burgeoning AI and cloud computing sectors. However, potential investors must consider the inherent risks involved in any investment, particularly in a rapidly evolving market. Thorough due diligence, including analyzing financial performance, competitive landscape, and broader market conditions, is essential before making any investment decision. Learn more about investing in CoreWeave (CRWV) and other promising cloud computing and AI stocks by conducting your own research and consulting with a financial advisor. Understanding the factors influencing CoreWeave's price is crucial for making informed investment decisions in this rapidly evolving market. Begin your CoreWeave (CRWV) investment research today!

Featured Posts

-

Grocery Prices Soar Inflations New High

May 22, 2025

Grocery Prices Soar Inflations New High

May 22, 2025 -

Blockbusters On Bgt A Deep Dive Into The Shows Biggest Hits

May 22, 2025

Blockbusters On Bgt A Deep Dive Into The Shows Biggest Hits

May 22, 2025 -

Vidmova Ukrayini Vid Nato Politichni Ta Ekonomichni Perspektivi

May 22, 2025

Vidmova Ukrayini Vid Nato Politichni Ta Ekonomichni Perspektivi

May 22, 2025 -

Former Tory Councillors Wife Challenges Racial Hatred Sentence

May 22, 2025

Former Tory Councillors Wife Challenges Racial Hatred Sentence

May 22, 2025 -

Googles Ai Investment Delivering Returns And Building Confidence

May 22, 2025

Googles Ai Investment Delivering Returns And Building Confidence

May 22, 2025